A sustained recovery for India's economic growth is far away

The noise of a recession is starting to get louder, and the government's recent announcements have been mere sentiment boosters. Will things get worse? Most likely, yes.

Illustration: Chaitanya Dinesh Surpur [br]In September, data on India’s pace of growth at 5 percent for the three months ended June, was not only lower than what was projected by all economists and ratings agencies, it was the slowest India has grown in a quarter since March 2013.

What is more worrisome is that the government, including the Finance Minister Nirmala Sitharaman, are not willing to talk about the fact that India is in the midst of a “cyclical downturn” as stated by the Reserve Bank of India (RBI).

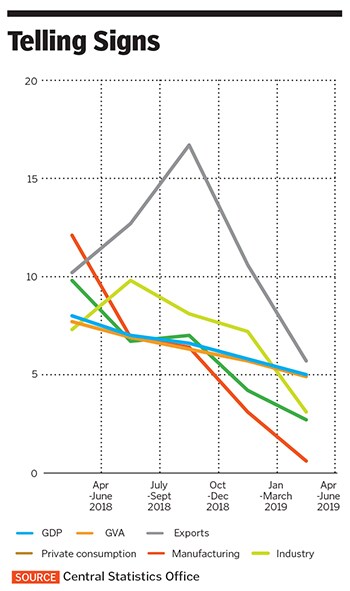

The noise of a recession is starting to get louder. Private consumption, manufacturing activity and industry have all slowed sharply from the previous quarter (see table). Will things get worse? Most likely, yes.

The government—and possibly even the media—might find temporary comfort in better numbers in H2FY20 (October 2019 to March 2020). But this could be only due to last year’s base effect.

“We have been seeing slackening of demand since the past two years, and there has been a state of denial of this,” says Madan Sabnavis, chief economist at CARE Ratings. The RBI, since December 2018, has tried to kick start growth by lowering interest rates, and will continue to do so at coming policy meetings.

“But the problem is to boost demand. Until more jobs are created and income increased, spending and demand will not pick up,” Sabnavis says.

Rural demand, including tractor sales and consumer products, might improve a bit in the ongoing festive season. But it is not likely to get India back to the 7.0 percent growth.

“Even if we factor in a 100 basis points growth acceleration in the September-ended quarter and 7.5 percent growth in H2FY20, yearly growth would come at 6.5 percent,” says Sujan Hajra, chief economist at Anand Rathi Securities.FY20, then, is as good as gone.

Sitharaman’s recent announcements to revive growth are, at best, sentiment boosters. The government has decided to withdraw the controversial tax surcharge on the Foreign Portfolio Investment (FPIs) remove the enhanced surcharge levied on long-term and short-term capital gains and relaxed norms for single brand retailers, allowing them to sell goods through online stores before opening brick-and-mortar stores within two years.

SBI’s Group chief economic advisor Soumya Kanti Ghosh says it will be difficult for India to get back to the 7 percent growth rate. “Considering the present macro-environment, it will be difficult to achieve the target in this fiscal. We are now estimating GDP growth at 6.1 percent in FY20, with downward bias.”

This is much lower than the RBI’s projection of 6.9 percent. India’s economy grew by 6.8 percent in FY19. Fitch Ratings had, prior to the release of India’s June GDP data, lowered the forecast for India’s GDP to 6.6 percent for FY20, from 6.8 percent earlier. Further downward revisions are not ruled out. It’s time to start believing in FY21.

First Published: Sep 05, 2019, 14:01

Subscribe Now