India is not prepared to roll out 5G due to multiple issues, the Shashi Tharoor-led Parliamentary Committee concluded in its report presented before Parliament on Monday. By the end of 2021 or early 2022, 5G will be rolled out for some specific use cases, but “4G should continue in India for at least another five to six years”, the Department of Telecommunications (DoT) informed the committee, drawing its ire.

Comparing it to the delayed deployment of 2G, 3G and 4G, the report said this delay “reflects very poorly on our planning and execution”. “India has to do a lot of catching up so far as 5G deployment is concerned,” industry body Cellular Operators Association of India (COAI) informed the committee.

“Now, when many countries are swiftly mobbing towards 5G technology, Indiais likely to witness its deployment only by the end of 2021 or early part of 2022, that too partially.” A total of 118 operators in 59 countries have deployed their 5G network. The committee wants DoT to apprise it of the reasons for delay and explain why India is still playing catch-up in 5G deployment. The government needs to take “time-bound action” on the pending recommendations by the Telecom Regulatory Authority of India (Trai).

The committee has also recommended that the DoT review all its policies related to 5G and fast track action in areas which need concerted action. It has also asked the DoT to learn the process of rolling out 5G from other countries.

However, there are apprehensions that India is set to miss the ̳5G bus “due to lack of preparedness, spectrum issues, inadequate use-case development, uncertainty around sale of radio waves for 5G, etc”.

Minimal on-ground actions

Although the policy requirements for 5G were finalised in the 5G High Level Forum Report released by DoT in August 2018, “minimal on-ground actions/implementation instructions have been issued so far”.

Spectrum bands have not been identified or made available to TSPs

Decisions have not yet been made on identifying the spectrum bands and spectrum policy. While globally 118 operators have deployed 5G network in 59 countries in three bands—lower band (700 MHz), mid band (3300-3600 MHz) and mmWave band (26 GHz Band and 28 GHz Band)—the process has not been finalised in India. The lower band was put to auction in India in 2016 but remains unsold. Trai has recommended the mid band, but it has not been auctioned yet, and the mmWave band has not yet been declared in India, the telecom authority told the committee.

Trai had made recommendations about auctioning the spectrum in 700 MHz, 800 MHz, 900 MHz, 1800 MHz, 2100 MHz, 2300 MHz, 2500 MHz, 3300-3400 MHz, and 3400-3600 MHz bands in August 2018. Despite that, the DoT has still not auctioned off the spectrum.

Opening up the mmWave band is still under deliberations. DoT said it is currently preparing a cabinet note for auctions in 700 MHz, 800 MHz, 900 MHz, and 1,800 MHz. Thus, only the mid band is available for 5G deployment, but it will be auctioned only in the next six months or so.

“The committee fail to understand as to how the TSPs (technology service providers) are going to move towards 5G technology without spectrum, the lifeline for 5G, being allocated,” the report said. The committee called it an “unconscionably long delay” by the DoT.

Shortage of spectrum for commercial services

![5g-infographics 5g-infographics]()

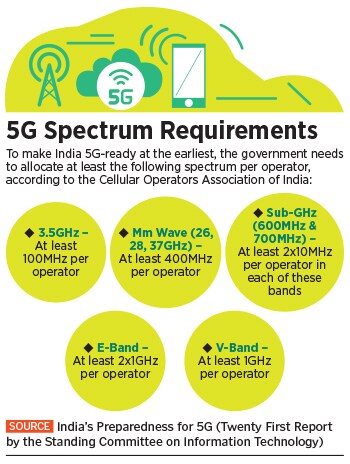

The DoT informed the committee that in mid band (3300-3600 MHz), about 25 MHz is used by the Indian Space Research Organisation (Isro) and the ministry of defence has asked DoT to allocate 3,300-3,400 MHz to them. This means that only 175 MHz is available for vendors which “may not be sufficient” for them to offer their services. The discussions between the DoT, department of space and defence ministry on the issue are still on.

- Lower per capita spectrum allocation in India than in other countries: Citing the allocation of 4G spectrum, the second unnamed TSP from above said 4G spectrum per operator is 25 percent of what other operators across the globe have. In addition to having 25 percent of the spectrum, due to India’s population, they have 3.5-4 times people per square kilometre because of which “the spectrum available to one person is 1/16”. In 5G, if compared to international standard of 100 MHz/operator, India allocates only 50 MHz/operator, Indian customers would get 1/10 spectrum of a user in other countries.

- mmWave band needs to be opened up: Airtel and an unnamed TSP both submitted that mid band is not sufficient for operations and the mmWave band (26 GHz) must be considered for allocation along with the mid band. Airtel also submitted that the spectrum “in the 600 MHz band should be identified and earmarked for 5G”. As per the COAI, each operator would need at least 100 MHz. Another unnamed TSP said that going under 80 MHz per operator would lead to severe underutilisation of equipment—equipment that will cost companies billions of dollars. The committee wants efforts to be made to earmark and allocate mmWave band for 5G in consultation with Trai.

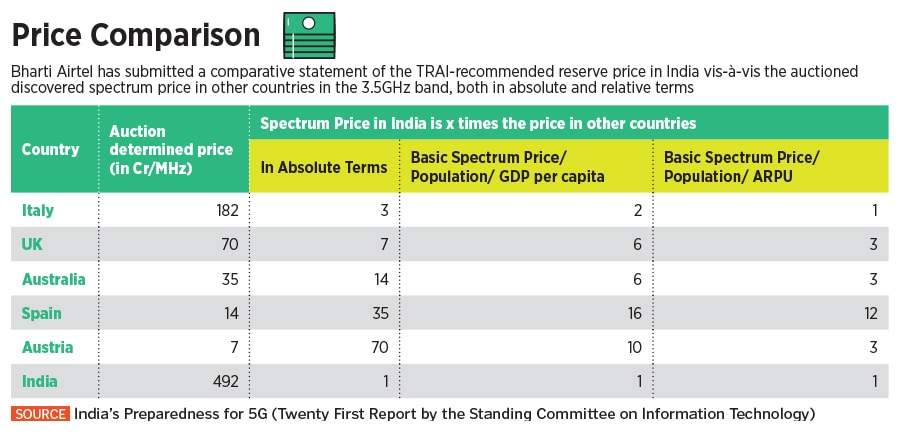

Spectrum Prices Are Too HighThe COAI submitted that the Trai-recommended reserve price of ₹492 crore/MHz for mid band is higher than the auctioner spectrum price in other countries. TSPs have to purchase in blocks of 20 MHz (₹9,840 crore) and at least 100 MHz (₹39,360 crore) to be operational. Airtel also submitted that the Trai-recommended price is 3-70 times the market-determined price in other countries in absolute terms and 16 times the price in relative terms. Airtel also said that with the minimum requirement of 100 MHz, ₹50,000 crore is “too costly a proposition for the TSPs” and paired with the low ARPU (average revenue per user), it will stifle the telecom sector.

However, Trai submitted that if a comparison is made in terms of population and geographical size, India’s spectrum price is one of the lowest.

![5g-infographic-2 5g-infographic-2]()

The DoT, however, told the committee that in line with the recommendations of the inter-ministerial Group on “Stressed Assets in Telecom Sector”, the TSPs have been given a one-time opportunity to opt for 16 instalments instead of 10 for spectrum auction deferred payment, and have been given an option to defer payment of the spectrum auction instalments due for 2020-21 and 2021-22, either for one or both years. All operational TSPs have “generally opted for moratorium of two years”. The committee also asked if the AGR issues would have an impact on the TSPs’ ability to bid for 5G. The COAI said in addition to AGR issues, there is a need to rationalise other levies and duties on the telecom sector to ease its financial stress. The committee recommended the matter should be looked into.

Considering conflicting accounts from Trai/DoT and TSPs/COAI, the committee recommended that the issue of high spectrum prices must be looked into and that DoT/TRAI should come up with “a convincing spectrum pricing policy that is sustainable, affordable and acceptable to all”.

‘Why hasn’t the allocated spectrum been audited?’

In 2015, Trai had recommended that all allocated spectrum—to both commercial operators and PSUs/government—must be urgently audited but the government’s decision is still awaited on the recommendation. Calling the lack of action by DoT on this “deplorable”, the committee has said that audit of the spectrum is essential to ensure that the spectrum is not underutilised. It has recommended that an early decision on spectrum audit should be taken on a priority basis.

Streamline issues related to licensing, allocating spectrum to attract manufacturers

The committee took the suggestion of Telecom Equipment Manufacturers Association (Tema) on board and recommended that Trai should conduct a public consultation on spectrum needs and issues for captive users. Furthermore, another group should be formed to formulate a policy for spectrum allocation for 4.0 industrial uses. Tema Chairperson NK Goyal clarified to Forbes India that this group should be within the DoT or a cross-sectoral body such as Niti Aayog.

India will learn from use case trials within the country: DoT to Committee

Following IIT-Kanpur Director Professor Abhay Karandikar’s written submission about close to 100 commercial launches of 5G technology in the world that cover seven percent of the world population, the committee asked the DoT whether “any effort has been made by the department to study the experience gained by them”.

The DoT replied that in India, it has planned specific use case trials through licensed TSPs. It has shortlisted 100 use cases for further development. Thirty of these will be demonstrated along with TSPs “to learn 5G use cases and rollout challenges”.

DoT informed the committee that India has not “signed any agreements specifically for cooperation in 5G technology with other countries”. However, cooperation in 5G technology is one of the areas of cooperation in India’s memoranda of understanding (MoUs) on communications signed with Cambodia, Myanmar, South Korea and Vietnam.

How will 5G roll out in India?

DoT Secretary Anshu Prakash had informed the committee that 5G will be rolled out “by the end of 2021”. The launch of 5G services will depend on the availability of network equipment and device ecosystem, as per the DoT.

“The 5G technology will initially ride on the 4G technology,” Prakash told the committee. In the first few years, the core will be 4G while the radio access network will be 5G.

5G will not be rolled out pan-India, but in select areas “where the demand would justify the capex”, Prakash said. While the earliest applications will be in large metros on the bases of eMBB which will give users better speeds and reliability, he said that a user will not be able to distinguish between 4G and 5G speeds. The difference will be felt in other use cases, he said.

The next step will be to auction the mid band (3300-3600 MHz) “in the next six months or so” to make spectrum available.

Uses of 5G

Karandikar submitted to the committee that there are three key use cases of 5G—enhanced Mobile Broadband (eMBB), Ultra-high Reliable Low Latency (URLLC) and Massive Machine Type Communications (mMTC). eMBB refers to mobile broadband with very high throughput of up to 20 Gbps. URLLC means that networks can be optimised to process large amounts of data with minimal delay, that is, latency, thus being useful for factory automation, autonomous driving, smart grid, robotic surgeries, etc. mMTC refers to connections between large number of devices which intermittently transmit small amounts of traffic. 5G will thus be useful in Internet of Things (IoT) application.

‘Deadline for End-to-End 5G Test Bed project must not be extended’

The Centre’s Building an End-to-End 5G Test Bed project, under which ₹224.01 crore were awarded to IIT-Madras, IIT-Hyderabad, IIT-Delhi, IIT-Kanpur, Centre of Excellence in Wireless Technology, Society for Applied Microwave Electronics Engineering and Research and the Indian Institute of Science, Bangalore, is expected to be ready by October 2021. The aim of the Test Bed is to develop a 5G test bed through which academia and industry can collaborate to understand how 5G technologies work along with their security aspects.

The Test Bed will be realised in stages over four versions—version 0 (V0) to version 3 (V3). The first two stages are complete and the next version, V2, is being designed and is expected to be completed by March 2021. The Covid-19 pandemic and the subsequent lockdown have adversely affected the hardware development and testing but software development is on track. The committee wants DoT to ensure that the deadline for operationalisation of the Test Bed is not extended.

‘Where are specific use cases for India to enable deployment?’

Thus far, only one 5G Use Case Lab—in Banking and Financial Services and Insurance (BFSI)—has been approved by the DoT. It was proposed by the RBI’s Institute of Development of and Research in Banking Technology (IDRBT) in collaboration with the Department of Financial Services. Its ₹22.1 crore investments includes ₹17.5 crore funding by DoT.

The DoT is currently working with the Food Safety and Standards Authority of India (FSSAI) to set up a use case lab for food safety certification, and with the ministry of health, AIIMS, and ministry of housing and urban development for setting up similar labs in their respective domains. The committee rued that no sufficient use cases have been developed so far to enable successful implementation of 5G in India. It wants the DoT to focus on developing use cases by providing incentives and support, and expedite the development of use case labs that are under development.

The DoT is also currently engaging with states and Union Territories to finalise the Broadband Readiness Index report for 2019-20. In line with submission by Tema, the committee wants a cross-sectoral entity like Niti Aayog to monitor the Digital Readiness Index of various sectors.

‘Why have 5G field trials not been permitted yet?’

The government also plans to allow 5G trials in limited area and for limited time to test the potential use cases of 5G in India based on eMBB, uRLLC and mMTC. These will be done in isolation on a non-commercial basis subject to safeguards wherein participation by any vendor will not be linked to deployment of their network in India. DoT has thus far received 16 applications for the trials using imported and indigenous technology. The trials are likely to start in two to three months. DoT’s guidelines for participation include a nominal fee of ₹5,000. Indian entities involved in the field trials for the purpose of research and development, and experimentation can get a licence for up to two years which is further renewable on a case-by-case basis.

While experimental licence for 5G Test Best was issued to IIT-Delhi in April 2018 with three months’ validity, 5G field trials have not been permitted yet. Similarly, TSPs had submitted their 5G trial applications in January 2020, but so far, neither the guidelines for trials nor a date for their commencement have been set. The committee found this lack of field trials completely unacceptable, and asked why that is the case when the DoT has categorically said there are no major issues confronting trials in the country.

Some good news: Indian use case for 5G in rural areas accepted by ITU

The Department and Telecom Standards Development Society of India (TSDSI), in collaboration with IITs, got their Low Mobility Large Cell (LMLC) use case accepted by the International Telecommunications Union (ITU) as a 5G requirement for rural area. These towers will be located where the BharatNet fibre ends, in approximately 2.5 lakh gram panchayats. Sixty-seven percent of these villages are within three kilometres and the rest are within a range of two to six kilometres. Through LMLC, distance between two base stations can be increased to six kilometres compared to 1.73 kilometres by other technology. LMLC has also made its way into the IMT-2020 global standard for 5G.

‘Adopt global, interoperable standards’

IIT-Madras has developed a variant of the global 3GPP standard called TSDSI RIT which lays special emphasis on enhanced rural coverage. An unnamed Indian TSP also supports this standard. However, COAI submitted that if India does not adopt the globally harmonised 3GPP standards, it would disconnect India from the globally harmonised and standard device and network ecosystem. Airtel, GSMA and GSA submitted that the proposed TSDSI RIT standards are not globally harmonised and could lead to failures, as was the case with China and South Korea.

Calling TSDSI RIT’s objective to enhance rural coverage “a worthy initiative”, the Committee cautioned against adopting country-specific standards and instead advised adopting only those standards that are “globally harmonised to ensure interoperability, economies of scale, and help build a conducive device & network ecosystem”.

Since India is a price-sensitive market, globally harmonised standards for 5G will also allow for development of common smartphones and infrastructure, thereby driving the price. The local standards approach would make devices more expensive and delay the rollout of 5G.

Make in India: ‘Set up an R&D fund to develop indigenous equipment’

The committee agreed with Trai’s August 2018 recommendation that a Telecom Research and Development Fund (TRDF) be created. It has recommended an initial corpus of ₹1,000 crore to promote research, innovation and manufacturing of indigenous telecommunications equipment.

Jio submitted that it has developed its own 5G technology using 100 percent homegrown technologies and plans to offer it to other companies. During former US President Donald Trump’s visit to India in February 2020, Reliance Chairperson and MD Mukesh Ambani had proclaimed before him that Jio is the only network in the world to have no Chinese components. In June, former US Secretary of State had also called Jio a “clean telco”.

The DoT informed the committee that 5G Test Bed is coming up with its own technology and the DoT is also encouraging C-DOT (Centre for Development of Telematics) to do so as well. IIT has also tied up with companies like Tech Mahindra and TCS to consider 4G solutions that can be upgraded to 5G.

‘Harmonise Right of Way Rules to make fibre laying easier’

TSPs face problems while laying down fibre cables since Right of Way (RoW) rules in different states, cities and localities differ. Even though the DoT had issued RoW guidelines in 2016, only 16 states have aligned their policies with them. The committee reiterated Trai’s suggestions include time-bound issue of RoW permissions, suitable amendment of Municipal or Panchayat Acts, building bylaws, fixing of uniform RoW rates across the country, etc.

Also, the committee sided with the TSPs and said that fibre should be shared across companies to improve economies of scale and to avoid duplication of networks.

‘Don’t forget MTNL and BSNL’

The committee expressed its displeasure that 4G spectrum has still not been allocated to BSNL and MTNL even though the cabinet had approved administrative allotment through capital infusion in October 2019. TEMA also submitted that only PSUs are placing orders for Indian-manufactured foods. The committee has recommended that measures be taken to ensure that 5G spectrum is allocated to BSNL and MTNL at the same time as private TSPs so that they remain competitive and relevant.

‘Ensuring national security is a must’

The committee recommended that the Indian Telecom Security Assurance Requirement needs to be finalised at the earliest. Also, the DoT plans to implement security requirements for 5G trials and implementation through a scheme titled “Communication Security Certification Scheme” or ComSeC whose implementation will be the responsibility of the National Centre for Communication Security (NCCS).

The extra emphasis on national security also stems from the US’ standoff against Chinese telcos such as Huawei and ZTE under the Trump regime. The Sino-US trade war has dominated much of the 5G discourse across the world with a number of countries, including the US, the UK, Sweden and Australia, banning Huawei from being used in their 5G infrastructure. The European Union, on the other hand, has cautioned its members about maintaining secure networks but has not outright banned any companies.

As such, the Indian government has not banned any company, including Huawei and ZTE, from participating in the 5G trials but the committee has cautioned the DoT that “adequate precautions” must be taken before installing Chinese telecom equipment in the Indian network.

‘Promote Open RAN’

Currently in India, TSPs follow a single RAN (radio access network) model wherein the software and hardware are provided by one telecom vendor. Open RAN would disaggregate hardware and software to provide more choices and interoperability. To that end, the committee recommends that the DoT should provide financial incentives for research, development and production of Open RAN solutions.

In addition to all the problems, the committee also highlighted that there is a need to augment reliable power supply, especially in rural areas, as that acts as “one of the largest bottlenecks in upgrading the network”.

Graphics by Sameer Pawar

Image:

Image: