Big investors say they use ESG to reduce risk (but mostly focus on the E and G)

A new survey offers a rare window into how the world's largest institutional investors think about environmental, social, and governance priorities

You probably know that ESG stands for “environmental, social, and governance." Yet as far as most big institutional investors are concerned, the acronym should probably be changed to GCS, or “governance, climate, and social."

That’s one of several striking findings from a recent survey that Stanford Graduate School of Business researchers David Larcker, Amit Seru, and Brian Tayan, MBA ’03, conducted with assistance from the MSCI Sustainability Instituteopen in new window.

The trio previously investigated how individual investors viewed ESG priorities. This time, the researchers explored how large institutional investors such as asset managers, pension funds, and insurance companies think about ESG factors when making investment decisions. Most of the 47 survey respondents are based in North America and Europe. Nearly half hold more than $250 billion in assets.

“These are not mom-and-pop investment shops," says Larcker, a professor emeritus of accounting, co-director of the the Corporate Governance Research Initiative, and distinguished visiting fellow at the Hoover Institutionopen in new window. “They have serious money."

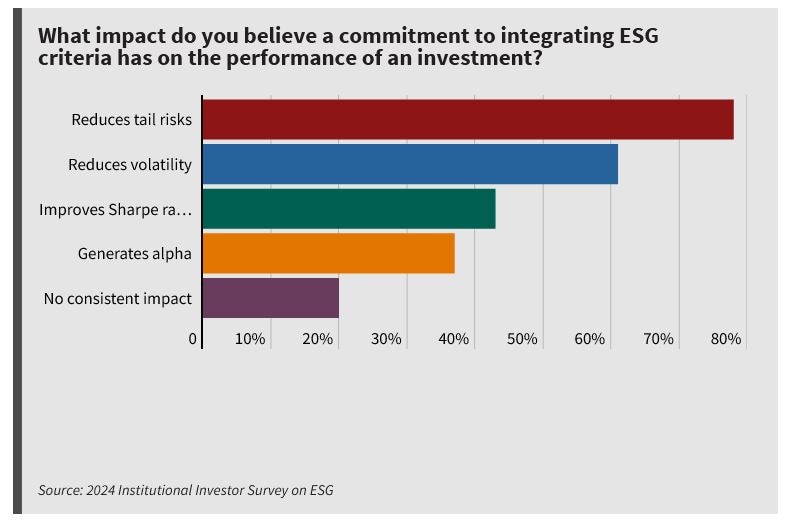

Although European respondents are nearly three times more likely to operate under ESG mandates than their North American counterparts, there is a surprising degree of agreement between investors on both sides of the pond — along with some intriguing differences. Nearly half of all respondents say that ESG criteria play a very important role in their investment decision process. Most see ESG primarily as a way of reducing volatility and risk in their portfolios — especially tail risk, the probability that a rare but catastrophic event could tank a company’s performance.

“If you’ve got a portfolio of 50 or 100 companies and a couple go to zero, your return is really going to be affected," Larcker says. “So as a portfolio manager, you’d like to screen these things out — or at least be aware that you have to get a huge return from these companies to compensate for the potential risk that you’re bearing."

In comparison, less than half of respondents see ESG as a means of producing outsized returns — though Europeans are somewhat more inclined than North Americans to view ESG as a tool for generating alpha.

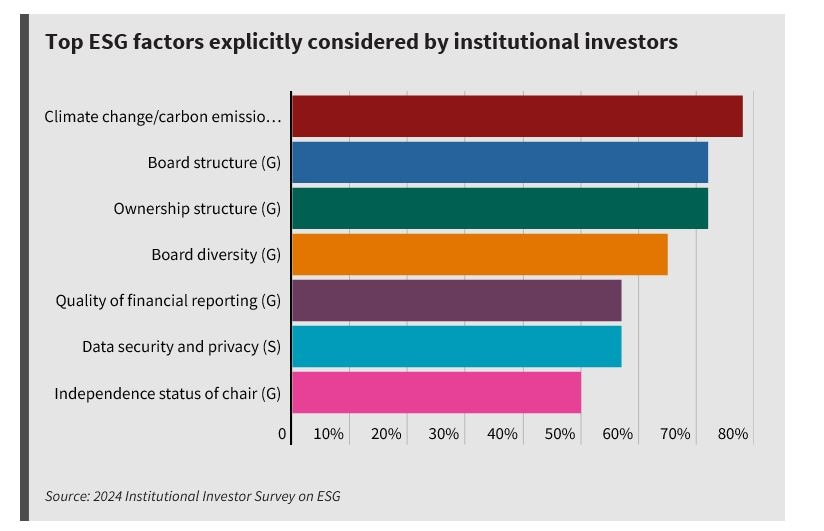

Yet European and North American investors are pretty much on the same page when it comes to ranking the relative importance of E, S, and G in their investment decisions. More than two-thirds of all respondents put governance factors at the top of the list, with environmental factors coming next and social factors barely registering at all. The only exceptions in the social category were data security and privacy, which are of particular concern to European investors.

“The most surprising finding is the near-collapse of social factors within the ESG framework," says Tayan, a researcher at the Corporate Governance Research Initiative. “The all-encompassing nature of ESG is falling in on itself, and investors are retreating to focus on a shorter list of concepts that drive the bottom line: Prominent social issues like workplace diversity and internal pay equity are considered secondary to governance and the environment, and rank even lower than more pedestrian factors like data safety."

Seru, a professor of finance, co-director of the Corporate Governance Research Initiative, and senior fellow at the Hoover Institution, agrees. “All in all, it appears investors are retreating to more traditional concepts of shareholder value creation and relying less on the stakeholder concepts that have come to epitomize ESG," he says. “ESG is likely to be quite different going forward from what it has been in the past, with investors focusing on the one or two main drivers of risk that have the potential to really drive stock price and influence outcomes."

The upshot, Larcker explains, is that governance quality, in particular, has come to represent “table stakes" for companies that wish to be widely held by institutional investors. “If you’re a really bad actor, then it’s sort of over," he says.

When it comes to the E part of the ESG equation, respondents care mostly about climate: 78% rank climate change or carbon emissions as the most important environmental factors they explicitly consider when making investment decisions most say that they are analyzing the emissions associated with their investments, putting money into renewable energy and transition technologies, and quantifying the possible financial impacts of climate-related risk. Yet barely a quarter say they pay attention to other environmental issues such as pollution or packaging waste.

Climate change and carbon emissions were the top-ranked ESG factors overall, followed by a slew of governance issues such as board structure, ownership structure, and board diversity. However, investors appear to think that governance and climate-related factors operate over different timescales, with more than 75% believing that governance issues are most likely to affect an investment’s performance in the next 24 months and more than 90% believing that climate issues are most likely to affect performance over the next two to five years.

“What they’re saying is, ‘We kind of understand these governance things, and if they’re bad, we expect it to manifest over the next two years,’" Larcker says. Climate change, on the other hand, is like watching a pot boil: It’s slow, but if the predictions are right, the consequences will be devastating.

Respondents also think that environmental, social, and governance risks are unevenly reflected in asset prices. Almost all say that governance risks such as board oversight and financial reporting quality are already baked into prices, and more than three-quarters think climate risk is, too. Yet fewer than half think that social risks, such as labor practices of supply chains, are reflected in the pricing of assets — perhaps because social risks are more difficult to measure and cannot easily be integrated into the quantitative analyses that investors rely on when making decisions. “The social thing is very important but very slippery," Larcker says.

If a particular kind of ESG risk is already reflected in asset prices, asset owners and managers are unlikely to squeeze out higher risk-adjusted returns than other market participants — unless they can get their hands on superior ESG metrics that provide information their competitors lack.

They can, however, still use ESG factors to avoid companies that represent especially bad bets. And that is exactly what big institutional investors appear to be doing: While respondents are unlikely to give a company with poor financials a break because it has strong ESG characteristics, they are more likely to drop a company with poor ones. “Companies are going to remain under pressure to disclose more information for investors to get a better handle on these risks, particularly climate change, even though many companies are already disclosing massive amounts of information," Seru says.

Investors also prefer to rate a company’s ESG performance relative to its peers rather than by scoring its ESG performance on an absolute basis, regardless of industry. For instance, while respondents are divided over the question of whether a company in a “bad" industry like coal or tobacco could nonetheless merit a high ESG score because of the positive way it manages other ESG factors, most think that a company in a “good" industry could still earn a poor ESG score because of the negative way it manages such factors.

This propensity toward relativism is significant if major institutional investors were to embrace absolute standards, they would have to exclude large swaths of the market from their portfolios. By going the relativistic route, however, they can simply weed out the worst offenders. “You go absolute, you’re going to lock yourself out of whole industries," Larcker says. “And most funds don’t want to do that."

Overall, the survey offers a rare window into how the world’s largest institutional investors think about ESG. The Stanford GSB researchers hope to collaborate with other industry partners like MSCI — an investment research firm led by GSB alumnus Henry Fernandez, MBA ’83 — to advance our understanding of how major asset owners and managers make investment decisions.

“It’s hard to do a survey like this without some support from a big player," says Larcker, who credits the MSCI Sustainability Institute with providing valuable knowledge and contacts and helping to phrase the survey questions in language that respondents could understand. “I think that’s the way the research ought to go: It’s grounded in institutional facts and the insights of people who do it day to day."

First Published: Sep 02, 2024, 16:10

Subscribe Now