Budget 2024: Fiscal prudence or loosening the purse strings?

With a reduced mandate, the government would have to keep its allies happy. How it does that will be keenly watched

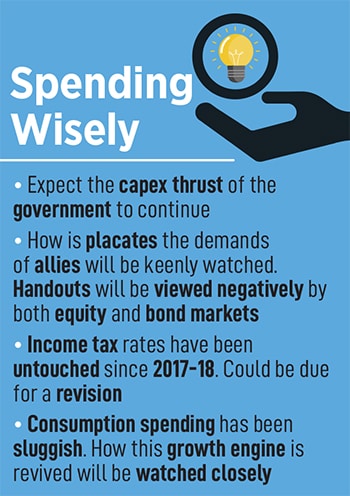

As Nirmala Sitharaman rises to present the Budget, she’d be keenly watched on two counts—the government’s stated objective of maintaining fiscal prudence and balancing that with demands for tax benefits and social welfare sops from both the allies as well as the common man. How her ministry balances these would set the tone of the next five years.

Sitharaman’s task has been helped by robust tax collections that resulted in the fiscal deficit for FY24 coming in at a lower-than-expected 5.6 percent of GDP. This was even better than the deficit number of 5.8 percent presented in the revised estimates in February 2024. Total tax collections stood at Rs 23.26 lakh crore, or 101 percent of the revised estimates.

In the past, the government has chosen to channelise this excess on infrastructure investments—an allocation of Rs 11.11 lakh crore was made in the interim Budget—as well as targeted social welfare schemes, like the PM Awas Yojana and the Pradhan Mantri Garib Kalyan Yojana.

But that was before the general election that saw the BJP fall to 240 seats and form a government in a coalition with its NDA allies. Of this, the Telugu Desam Party (TDP) and the Janta Dal United (JDU) are the largest constituents and have been demanding special category status for their states. Giving them a special package would mean spending cuts elsewhere and is being keenly analysed by political as well as market watchers.

A key factor in understanding how much the government would have to bend is in looking at the composition of the government. As things stand, it is heavily dependent on the TDP as well as the JD(U) with 16 and 12 MPs respectively. “These two are skilled at coalition politics and some provisions will have to be made for demands for special packages for Bihar and Andhra Pradesh," says Pronab Sen, former chief statistician of India. “How it plays out is difficult to say, but the government has some headroom with the RBI dividend it recently received," he adds. If either of them walks out, the reliance and demands of smaller parties in the NDA coalition would rise.

“This government does realise the importance of keeping capex spending going," says Dipti Deshpande, principal economist at Crisil. As Deshpande explains, spends on rural roads, housing and MNREGA are seen as less-inflationary. These also have a multiplier effect on employment and hence consumption spending, which has been weak in FY24.

“This government does realise the importance of keeping capex spending going," says Dipti Deshpande, principal economist at Crisil. As Deshpande explains, spends on rural roads, housing and MNREGA are seen as less-inflationary. These also have a multiplier effect on employment and hence consumption spending, which has been weak in FY24.

Take, for instance, news reports of a Rs 60,000 crore oil refinery for Andhra Pradesh. There is a chance this could be announced in the Budget. This would be seen as positive—ally kept happy while not being seen as a giveaway.

The fiscal glide path it proposed promised a fiscal deficit of 4.5 percent of GDP by 2025-26. Any slippage from this number at a time when interest rates are high globally would be likely punished by the bond markets.

While giving allies their due, Sitharaman would also have to think about the middle class that has seen no change in tax slabs since 2017-18. (A new tax regime was introduced in 2021-22 with lower rates but no deductions.) In effect, citizens are paying a lot more as tax as inflation has eaten into the value of their earnings. A rejig here is due and could set the tone for some more money in the hands of the common man. There are plans to rationalise capital gains across asset classes. Both these will be keenly watched by the middle classes.

One area where tinkering is not expected is on defence and subsidies. In the interim Budget, Rs 6.21 lakh crore was allocated for defence and Rs 4.14 lakh crore for subsidies. With fertiliser and oil prices falling, there could be some savings here leaving room for spending the revised estimates.

First Published: Jul 17, 2024, 16:08

Subscribe Now