Can Papa Johns take on big daddy Domino's?

A slow start, a cheesy first innings and an abrupt ending. Can Papa Johns be second-time lucky and get a bigger slice as it gets ready to reopen its Indian account with a new partner and a revamped st

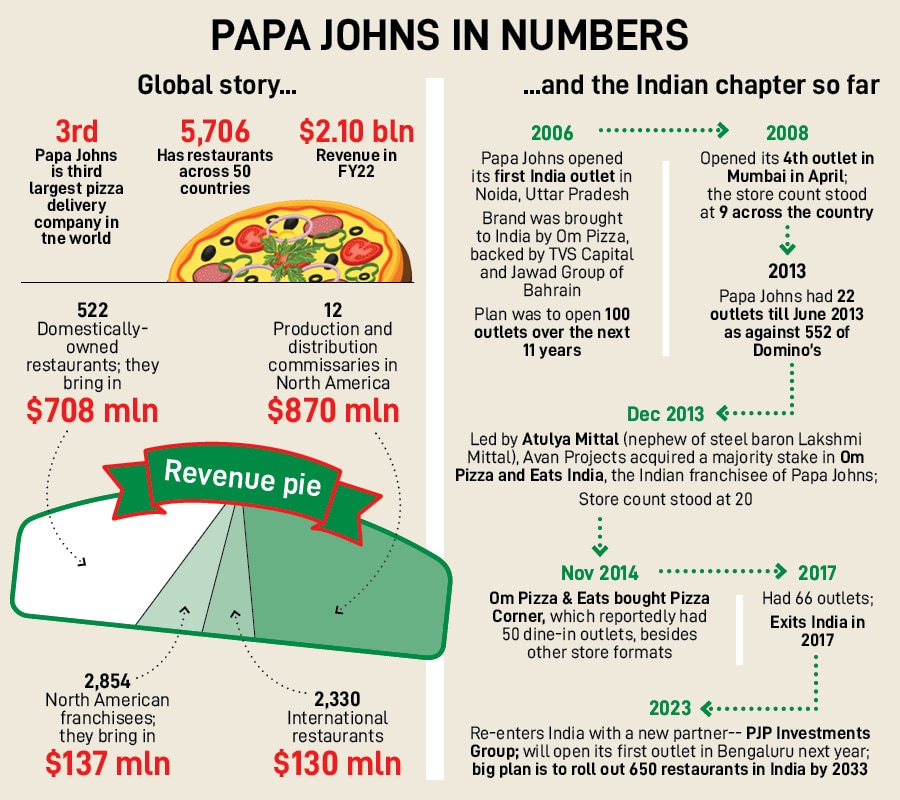

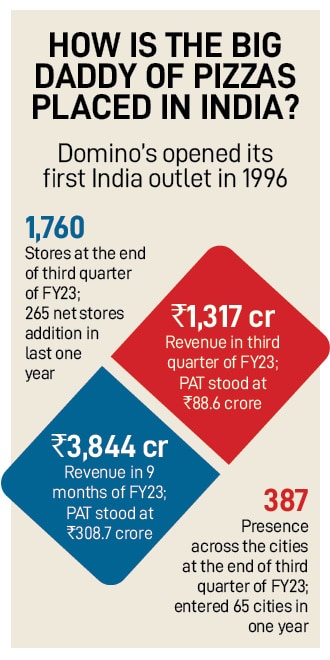

June 2006, Noida, Uttar Pradesh. Let’s look at four easy-peasy steps to make a pizza. First, place each dough ball on a heavily floured surface. Second, use fingers to stretch it. Third, use your hands to shape it into a square, round or whatever shape you want. And last, top and bake it. Simple. Isn’t it? It is indeed for the rookies. But for experts like Papa Johns—the third-biggest pizza player in the world, which has a brand topping aka tagline of ‘Better ingredients, better pizza’—making a debut in India was not all that simple. It was 2006, the American pizza giant was a decade late in opening its account, and rival Domino’s had a massive head start by rolling out its first store in New Delhi way back in 1996. The odds were heavily stacked against the challenger brand, which trailed Domino’s and Pizza Hut.

The late comer, though, was confident of making a dent. "The middle-class here is growing at a fast rate, and this is the right time for us to enter the Indian market," the then chief executive Nigel Travis reportedly remarked in 2006. The brand was brought to India by Om Pizza & Eats, backed by TVS Capital and Jawad Group of Bahrain, and the idea was to scale up at a feverish pace. The ambition, in fact, was to open 100 stores in a decade.

A year later, Domino’s had become the biggest pizza player in the country and had close to 160 outlets. In 2008, in contrast, Papa Johns opened its fourth outlet in Mumbai in June, taking the overall Indian store count to nine. Though the pizza maker was painfully slow in kneading the dough, it remained hyper bullish in its intent, and planned to open 100 stores over the next four years.

Fast forward five years. Papa Johns was getting a new shape in India. In December 2013, Om Pizza & Eats—the Indian master franchisee of Papa Johns—sold a majority stake to Atulya Mittal-led Avan Projects. Back then, globally Papa Johns had 4,296 restaurants across 35 countries. In India, though, the brand managed to open just 20 outlets in seven years! Compare this with Domino’s, which had 576 stores by the end of March 2013, had expanded its footprint across 123 cities, and sold over 66 lakh pizzas per month in FY13! It had become clear that Papa Johns could not even master easy-peasy steps: There were not many dough balls on a heavily floured surface it failed to use fingers to stretch it forget round, the brand was badly out of shape and it just couldn’t top and bake it.

(left)Amanda Clark, Chief International and Development Officer, Papa Johns and Tapan Vaidya, Group CEO of PJP Investments

(left)Amanda Clark, Chief International and Development Officer, Papa Johns and Tapan Vaidya, Group CEO of PJP Investments

In fact, the summer of 2018 threatened to bake ‘papa’—John Schnatter—and the brand. In May, the founder reportedly used the ‘N’ word in a conference call, and a month later, the racial slur took a toll and the founder had to resign. Over the next two years, the brand and the ousted founder got mired in a public slugfest, and sales dipped alarmingly. It was not until March 2019 that the peace pipe was smoked. Though operations in the home country managed to grow, the brand stayed orphaned in India and didn’t have a presence for at least five years.

Cut to April 2023. Papa Johns decides to try its luck for the second time by joining hands with a new partner: PJP Investments Group. Owned by Dubai-based private equity investment firm Levant Capital, PJP operates over 100 Papa Johns restaurants across the United Arab Emirates, Saudi Arabia and Jordan. In an exclusive interview to Forbes India, Tapan Vaidya, Group CEO of PJP Investments, reckons why Papa Johns stands a good chance of making a comeback. “This time the brand will do what India needs rather than what it does in the US," he underlines, alluding to the unanimous diagnosis by the marketing, branding and QSR experts about the failure of the brand in its first innings. The brand, they point out, was too purist in its approach, didn’t do much to Indianise and appeal to the local palate like a Domino’s or a McDonald’s, and was too premium in its appeal and positioning. “Now we are entering pretty much with a clean slate, and it’s a fresh start," says Vaidya, adding that the brand will roll out its first outlet in Bengaluru in 2024.

Cut to April 2023. Papa Johns decides to try its luck for the second time by joining hands with a new partner: PJP Investments Group. Owned by Dubai-based private equity investment firm Levant Capital, PJP operates over 100 Papa Johns restaurants across the United Arab Emirates, Saudi Arabia and Jordan. In an exclusive interview to Forbes India, Tapan Vaidya, Group CEO of PJP Investments, reckons why Papa Johns stands a good chance of making a comeback. “This time the brand will do what India needs rather than what it does in the US," he underlines, alluding to the unanimous diagnosis by the marketing, branding and QSR experts about the failure of the brand in its first innings. The brand, they point out, was too purist in its approach, didn’t do much to Indianise and appeal to the local palate like a Domino’s or a McDonald’s, and was too premium in its appeal and positioning. “Now we are entering pretty much with a clean slate, and it’s a fresh start," says Vaidya, adding that the brand will roll out its first outlet in Bengaluru in 2024.

Papa Johns’ second innings comes with a new play. Vaidya explains. While the brand promise of better ingredients and better pizza remains, what has changed is the approach in sourcing the raw materials from the country. “We are going to appeal to the Indian palate as well as the Indian pocket," he says. The second learning, and strategy, is around positioning. “We will not overprice ourselves," he says, adding that the brand will exclude red meat from its menu. “We will have white meat," he says. Ask him if the brand can take on the might of Domino’s, and the CEO dishes out a confident byte. “One would think that their size might be intimidating but we have a strategy," he beams.

Agrees Amanda Clark, chief International and development Officer at Papa Johns. She starts the conversation by underlining what the brand won’t do in India. “We are not going to think about the product from a US point of view, which I think perhaps could have been a mistake in the past," she confesses. When American brands, she reckons, go into different countries, they can make the mistake of thinking that the product has to be the same in every country. “This can sometimes lead to failure," she says. “McDonald’s India is certainly not the same as McDonald"s in the US, but it is very successful here," she says. The products, she lets on, have to be made for local consumers and taste.

But is the task, and the ambitious target of opening 650 outlets by 2033, going to be a cakewalk? Experts are sceptical. “The markets, and the pizza category, have evolved in India," says KS Narayanan, a food and beverage expert. Today there is much more competition across the mass and the premium ends. “The markets are far more segmented and consumers more discerning," he reckons, adding that for any new player, which already is making a late entry into India, making it to the top three would be extremely challenging. “This will require sustained management effort and focus to build the brand," he says.

But is the task, and the ambitious target of opening 650 outlets by 2033, going to be a cakewalk? Experts are sceptical. “The markets, and the pizza category, have evolved in India," says KS Narayanan, a food and beverage expert. Today there is much more competition across the mass and the premium ends. “The markets are far more segmented and consumers more discerning," he reckons, adding that for any new player, which already is making a late entry into India, making it to the top three would be extremely challenging. “This will require sustained management effort and focus to build the brand," he says.

The branding gurus too contend that Papa Johns would face the heat. “They must learn from the past but also need to strike a balance between being aggressive and conservative," says Ashita Aggarwal, marketing professor at SP Jain Institute of Management and Research. While being too slow did the damage in the past, taking an extreme approach of going too fast to make up for lost time can be counter-productive. “The best way to approach India is to play one’s own game," she says. The moment Papa Johns tries to take on Domino’s, it would be playing into the hands of the much bigger and the biggest player. “There is enough space for Papa. But it must not try to become Daddy," she says.

Vaidya, for his part, is up for the challenge. “It"s challenging, but it"s doable," he says, commenting on the target to open 650 outlets in India. “If we focus on execution and customers then we will win the battle," he says.

First Published: Apr 11, 2023, 15:49

Subscribe Now