Comviva 2.0: Reboot & Conquer

Hit by regulatory uncertainties in Africa, dwindling revenue from telecom content business, and the need to cater to enterprises, Comviva made yet another attempt to enter the lucrative markets of US

This time, it was a dogged onslaught. The intent was unwavering, the mood was sombre, and the goal was unambiguous: The army can’t retreat from America. Manoranjan Mohapatra, the battle-scarred crusader, deciphers the mood within his camp. “This time, we went without a plan B, we burnt our ship and we declared there is no going back," recalls the chief executive officer of Comviva, who is alluding to the strategy embraced by the mobility solutions company when it made a decisive push to enter into the hyper-competitive markets of the US.

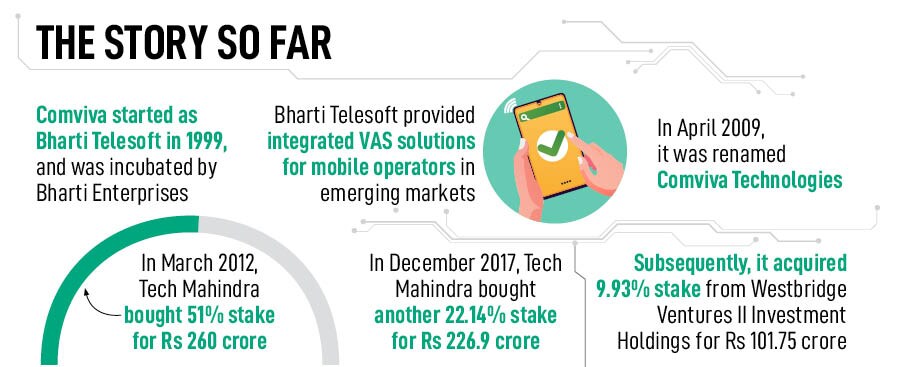

Born as Bharti Telesoft in 1999, the company was renamed Comviva after a decade in 2009, and eventually changed hands as it entered the stable of Mahindra Group when Tech Mahindra bought 51 percent stake in March 2012. For the next two decades, Mohapatra lorded over the prepaid and VAS (value added services) markets of India, Africa and Middle East. The spoils were generous, the journey remained profitable, and the empire kept growing. The CEO, who has had a 15-year stint with Aricent and was a core member of CDOT (Centre for Development of Telematics) before joining Comviva in 2007, got to helm a company which used to get 40 percent of the revenue from India in 2007. Gradually, the overseas contribution increased at a furious pace, and India’s share halved over the next decade. There was no reason to complain, though. A booming global market kept cash registers ringing.

Moons later, sometime after the onset of Covid in 2020, the veteran honcho was trying to emulate a decorated Spanish war general who set out on a voyage to conquer new frontiers. Mohapatra starts to narrate the story of Hernà¡n Cortés, who along with 600 soldiers landed in an alien geography--which is now Mexico—in 1519. The team was exhausted, the perils of fear of an unknown enemy plagued the minds of the fighters, and there was reluctance in making the decisive move to conquer the territory.

Sensing a strong wave of unease among the troops, Cortés did something unthinkable. He burnt the ship which brought them to the shore. Now the army was left with two choices: Fight and win or die. There was no room for retreat. Comviva, underlines Mohapatra, had made half-hearted attempts to enter into the American markets in the past. Plan A, though, didn’t work because there was a flourishing and successful Plan B which had been oiling the mobility services’ kingdom of Comviva across Africa, the Middle East and Southeast Asia.

The ‘Plan B,’ interestingly, had always been the ‘Plan A’. A booming overseas market, a lucrative prepaid segment which ensured a hefty 15 percent Ebitda (earnings before interest, taxes, depreciation and amortization), and a thriving telecom content business meant only one thing: There was no pressing need for Comviva to step out of its comfort zone. Consequently, the abortive attempts to do so lacked serious intent and sufficient firepower.

The rules of the game, though, changed dramatically in the years leading to the pandemic. Mohapatra starts with the first big blow. In 2007, the telecom content business contributed around 60 percent of the total revenues of the company. Over the next decade, it started to dwindle, and, by the end of 2019, it slipped to around 15 percent. The onset of the pandemic, though, accelerated the decline. The second—and a more serious and immediate one—blow emerged around regulatory uncertainties in the overseas market, especially Africa, where it was becoming increasingly difficult to expatriate forex.

The rules of the game, though, changed dramatically in the years leading to the pandemic. Mohapatra starts with the first big blow. In 2007, the telecom content business contributed around 60 percent of the total revenues of the company. Over the next decade, it started to dwindle, and, by the end of 2019, it slipped to around 15 percent. The onset of the pandemic, though, accelerated the decline. The second—and a more serious and immediate one—blow emerged around regulatory uncertainties in the overseas market, especially Africa, where it was becoming increasingly difficult to expatriate forex.

The CEO shares a freaky example of regulatory uncertainty from Nigeria. Recently, Mohapatra was informed that Comviva would take a hit of around a million dollars in free cash. Reason? The Central Bank decided to devalue Naira (the local currency) overnight. “It was increasingly difficult to do business in emerging markets," rues Mohapatra, who was forced to devise a new strategy and look at the matured markets of American and Europe. The opportunity was indeed massive. Look at the prepaid ARPU (average revenue per user). While in Africa, it’s $2.5, in the Western markets of the US and Europe, the equivalent number is $40-50.

The task, though, was not easy. First, in spite of a decent prepaid segment—an estimated 70 million prepaid sim users out of 450 million--the US happens to be an overwhelmingly post-paid market. Second, the user expectation, experience and behaviour were different from the Indian and the African markets where Comviva was born and achieved its adulthood. Third, the Indian warrior was also altering its approach and moving aggressively towards catering to enterprises. This also needed a fresh perspective and differentiated game-plan. And last, there was a strong possibility of a previous debacle in the US playing on the minds.

Mohapatra baked his US strategy by beginning to tackle the last impediment: Past failure. The idea was simple. Unless one knows what went wrong, one would never be able to get it right. The CEO decodes another crucial ingredient which led to a bitter experience in the past. “We went to the US with a little bit of arrogance of success," he confesses. Establishing a foothold in a new market needs time, energy, investment and a realisation that the new venture might impact the Ebitda in the formative years. “We did not think about the complete ecosystem which was required to succeed," he says. The naive thinking was maybe half-a-million investment and hiring a few guys—two or so—was good enough. Sadly, it was not. So this time, Mohapatra covered all chinks. “This time, we made a plan of $4-5 million investment, and looked at support, presales, technical, sales and the overall big picture," he says.

Mohapatra baked his US strategy by beginning to tackle the last impediment: Past failure. The idea was simple. Unless one knows what went wrong, one would never be able to get it right. The CEO decodes another crucial ingredient which led to a bitter experience in the past. “We went to the US with a little bit of arrogance of success," he confesses. Establishing a foothold in a new market needs time, energy, investment and a realisation that the new venture might impact the Ebitda in the formative years. “We did not think about the complete ecosystem which was required to succeed," he says. The naive thinking was maybe half-a-million investment and hiring a few guys—two or so—was good enough. Sadly, it was not. So this time, Mohapatra covered all chinks. “This time, we made a plan of $4-5 million investment, and looked at support, presales, technical, sales and the overall big picture," he says.

The second element of the ‘Westernisation’ plan was to look for the silver lining. Though a dominant postpaid market, the prepaid market in the US and Europe has been growing at 3 percent CAGR. Prepaid, Mohapatra explains, has been growing largely on the back of a few reasons. First, it doesn’t have the binding contract element strapped to it. “People want flexibility and options," he says. Second, the KYC process for postpaid is cumbersome. “Prepaid is simple," he says. Third, there has been a growing realisation among the telecom operators that there’s not much scope for growth in the post-paid. So, they now follow a strategy of acquiring a prepaid user, and then converting her to a postpaid consumer. What is aiding the process is a huge difference in ARPU of postpaid and prepaid. While the prepaid ARPU is $35-$40, post-paid stands at $50-$60.

Lastly, operators are willing to co-invest and co-create. Most of the biggies, underlines Mohapatra, are cutting capex. “What is hurting them is the fact that investment cycles have been shrinking," he says. While they got 8-10 years to recover money on 2G, it was just 3-4 years for 4G as 5G has started kicking in. “So, they"re looking more at revenue upliftment than operational efficiency and cost," he avers, adding that the mood has worked in the favour of Comviva which has mastered the art of ‘gain-share’ business model over the decades. “We know how to manage processes, people, and systems. Everything is geared towards the gain share model," he says, adding that around 45 percent of the revenue of the company today comes from gain share.

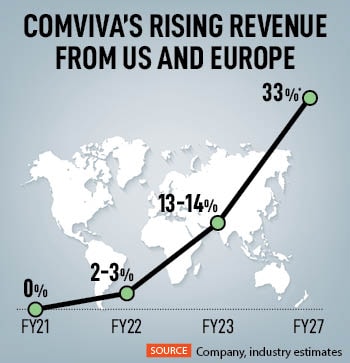

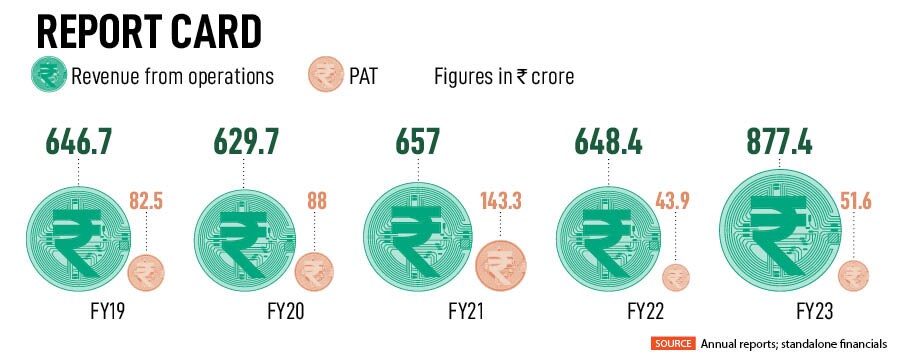

Just two years into Comviva 2.0, the results are encouraging. The percent of revenue from the US and Europe has jumped from 2-3 percent in FY22 to 13-14 percent in FY23. The target over the next five years is to take it to 33 percent. “We have been Westernising our portfolio and the pace will gather steam," says the CEO. The magic of the business, though, is not in data that reflects operating revenue. After staying in the zone of Rs 600 crore over the last few fiscals, it leapfrogged to Rs 877.4 crore in FY23. Though the venture stays profitable, the magic, Mohapatra underlines, is in free cash flow. “When I came here, our free cash was 10 percent of Ebitda, and it remained so till a few years ago as well," he says. “Now, it is at 40 percent of Ebitda and the target is to take it to 60 percent," he adds.

Though 2.0 looks promising, challenges remain. One big one is low PAT (profit after tax). It was just Rs 51.6 crore in FY23. When asked to spell out long-term goals about the plans to shore up the bottomline, Mohapatra turns philosophical. He talks about the discourse of one of the spiritual gurus which his mother was watching on television. “I saw this and fell in love," he says, sharing the insight. On a pitch-dark night, the guru started his sermon, when one starts a car, the headlight can only show visibility up to 100 or 150 meters. “But do you stop moving because you can"t see the destination or you keep your foot firmly on the pedal," she asked. You move because you believe in the system, the car and the support system. “Clarity for 100 meters is sufficient," she underlined. Comviva, reckons Mohapatra, has enough clarity. “It’s an exciting journey," he signs off.

First Published: Nov 01, 2023, 16:13

Subscribe Now