However, the debut of the new kid-on-the-block Raymond Lifestyle on the exchanges on Thursday does not seem to have won the confidence of stock market investors. The shares of Raymond Lifestyle were listed at Rs3,000 on the BSE. Soon after, its shares were locked at 5 percent lower circuit at Rs2,850, while its parent Raymond lost 4 percent during the day.

The company had announced a share exchange ratio of 4:5, which means four shares of Raymond Lifestyle would be allotted to shareholders for every five shares of Raymond that they held.

Shares of Raymond have been galloping in the last few weeks, hitting a high of Rs3,493 apiece in July. Raymond shares were trading ex-lifestyle business from July 11.

“It is a proud achievement for me personally. At the time of Covid everyone had written us off, stating ‘these guys will never come back’… never is a word that doesn"t exist for me. I am very happy and proud to see this moment of demerger. Next year you will see the demerger of the real estate business. At the core of these is real shareholder value creation," Gautam Singhania, chairman and managing director, Raymond Group, said in a media address.

Singhania reiterated that the demerger aims at unlocking shareholder value by creating a focussed lifestyle business entity. “Raymond Lifestyle will sharpen its strategic focus in this fast-growing sector to become among the top three global fabric suppliers by the end of this year. The global scenario presents significant opportunities, particularly the challenges in China and Bangladesh and trade agreements with the UK, EU and Australia," he said.

What does it hold for shareholders?

According to Tanmay Gupta, analyst at Motilal Oswal Financial Services, the three separate businesses of Raymond may create shareholder value led by professional management, net cash and optimisation of costs. The ‘complete man’ maker aims to streamline businesses with a core focus area and list all the three entities separately. It has sold off its FMCG business, demerged the lifestyle business and will split the real estate business into another listed company by 2025. The parent Raymond will concentrate on the engineering business as it has acquired Maini Precision (MPPL).

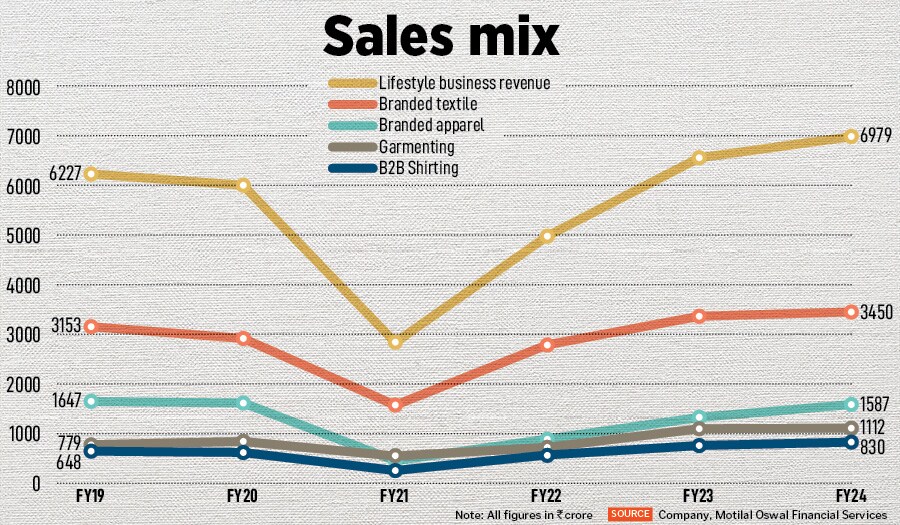

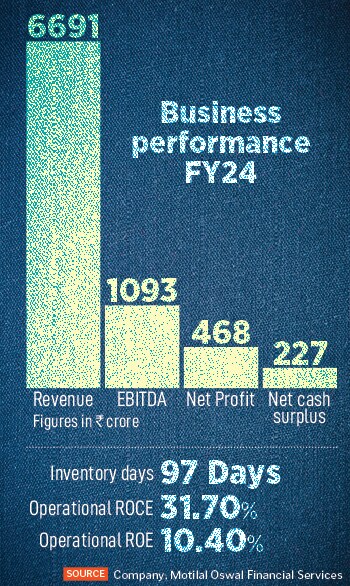

![]() Gupta estimates 6 percent revenue and Ebitda growth for FY24-26 of Raymond Lifestyle, led by branded apparel and garmenting segments, and cash flow supported by branded textiles. “We ascribe EV/Ebitda of 15 times on FY26 to arrive at a valuation of Rs15,900 crore (per share price of Rs2,610)," he adds.

Gupta estimates 6 percent revenue and Ebitda growth for FY24-26 of Raymond Lifestyle, led by branded apparel and garmenting segments, and cash flow supported by branded textiles. “We ascribe EV/Ebitda of 15 times on FY26 to arrive at a valuation of Rs15,900 crore (per share price of Rs2,610)," he adds.

Raymond Lifestyle has a legacy collection of well-established brands such as Park Avenue, Raymond, Parx, Ethnics by Raymond and ColorPlus. Raymond has been a dominant player in the men’s wedding apparel industry for the last 100 years, driven by its strong position in the suiting business. Out of the Rs75,000 crore men’s wedding wear market, Raymond Lifestyle has a 5 percent share, as per company estimates.

The company is targeting a 12 to 15 percent sales CAGR over FY24-FY28 to achieve a 6 to 7 percent market share, which would be led by high-teen growth from branded apparel, high single-digit growth from branded textiles and 18 to 20 percent growth from the garmenting business.

The company’s core business is in branded textiles, branded apparel and garmenting business, while it is foraying into new categories. The new categories of business that Raymond Lifestyle has introduced are sleepwear brand SleepZ and Park Avenue innerwear for men.

SleepZ has a price range of Rs500-999, while Park Avenue innerwear is Rs250-600 apiece. The company is targeting the semi-premium and premium category consumers. The management expects SleepZ to contribute Rs500-700 billion of revenue by FY27.

Its topline growth is likely to be led by a CAGR of 18 to 20 percent in its apparel/garmenting businesses (40 percent revenue mix) and of 7 to 8 percent in high ROCE textiles business, says Devanshu Bansal, analyst, Emkay Global Financial Services.

![]() Bansal explains that Raymond Lifestyle holds high aspirations—of 10 times scale in ‘Ethnix’ with 400 stores versus Rs100 crore from 114 stores in FY24. “Given a Rs200 crore capex toward garmenting, Raymond Lifestyle would stand among the global top three in our view, with a 10 million capacity. Garmenting enjoys macro tailwinds backed by diversification of global supply chains and potential free trade agreements. Despite faster growth in the relatively lower-margin non-textile businesses, Raymod Lifestyle sees steady margin gain, with branded apparel/garmenting scale-up," he adds.

Bansal explains that Raymond Lifestyle holds high aspirations—of 10 times scale in ‘Ethnix’ with 400 stores versus Rs100 crore from 114 stores in FY24. “Given a Rs200 crore capex toward garmenting, Raymond Lifestyle would stand among the global top three in our view, with a 10 million capacity. Garmenting enjoys macro tailwinds backed by diversification of global supply chains and potential free trade agreements. Despite faster growth in the relatively lower-margin non-textile businesses, Raymod Lifestyle sees steady margin gain, with branded apparel/garmenting scale-up," he adds.

In the past, the Raymond group has been largely viewed as a textile/apparel player. However, the new business strategy of Raymond Lifestyle Business is to focus on the wedding wear segment with aggressive targets, implying a sizeable business going ahead. “Considering that Vedant Fashions gets a 16 times FY26 EV/sales valuation for its wedding business, Raymond Lifestyle valuation has the potential for an upside, above our/Street estimates going ahead," says Rohan Kalle, Incred Research.

Kolkata-based Vedant Fashions, owner of popular wedding and celebration wear Manyavar for men, and Mohey for women, went public in 2022. The stock listed at 8 percent premium over its issue price of Rs866 apiece and made a stellar performance on the exchanges since then. Currently, its shares have gained about 48 percent from the issue price. However, higher dependency of revenue on the wedding season in India is risky.

For instance, Vedant Fashions made weak business in the first quarter of FY25 with revenues contracting 23 percent year-on-year due to fewer wedding dates in the three months. Typically, April to June is seasonally strong, but this year, wedding dates are bunched up towards the second half of the year.

New Businesses

“We have delivered strong performance in the last 12 quarters and sold off the FMCG business. We had committed to be debt free by 2025, but achieved that by 2023. We are now demerging the lifestyle business. We have announced a demerger of the real estate business as well. We have built a very strong real estate business in the last five years," Singhania said.

![]()

In 2023, Raymond sold off its subsidiary dealing with the consumer product business of Raymond Consumer Care to Godrej Consumer Products in an all-cash deal of Rs2,825 crore. The deal included a sell-off of Raymond’s marquee brands such as Park Avenue (for consumer products category), KS (deodorants), KamaSutra and Premium.

In the same year, Raymond Group acquired a 59.25 percent stake in Maini Precision Products for Rs682 crore funded by a mix of debt and internal accruals. The acquisition is done by Raymond to strengthen its engineering business—automotive, electric vehicle, aerospace and defence components.

Raymond Realty has around 100 acres of land in Thane with approximately 11.4 million sq ft RERA-approved carpet area of which about 40 acres is currently under development.

There are five ongoing projects worth Rs9,000 crore on its Thane land, with an additional potential to generate more than Rs16,000 crore.

Gupta estimates 6 percent revenue and Ebitda growth for FY24-26 of Raymond Lifestyle, led by branded apparel and garmenting segments, and cash flow supported by branded textiles. “We ascribe EV/Ebitda of 15 times on FY26 to arrive at a valuation of Rs15,900 crore (per share price of Rs2,610)," he adds.

Gupta estimates 6 percent revenue and Ebitda growth for FY24-26 of Raymond Lifestyle, led by branded apparel and garmenting segments, and cash flow supported by branded textiles. “We ascribe EV/Ebitda of 15 times on FY26 to arrive at a valuation of Rs15,900 crore (per share price of Rs2,610)," he adds. Bansal explains that Raymond Lifestyle holds high aspirations—of 10 times scale in ‘Ethnix’ with 400 stores versus Rs100 crore from 114 stores in FY24. “Given a Rs200 crore capex toward garmenting, Raymond Lifestyle would stand among the global top three in our view, with a 10 million capacity. Garmenting enjoys macro tailwinds backed by diversification of global supply chains and potential free trade agreements. Despite faster growth in the relatively lower-margin non-textile businesses, Raymod Lifestyle sees steady margin gain, with branded apparel/garmenting scale-up," he adds.

Bansal explains that Raymond Lifestyle holds high aspirations—of 10 times scale in ‘Ethnix’ with 400 stores versus Rs100 crore from 114 stores in FY24. “Given a Rs200 crore capex toward garmenting, Raymond Lifestyle would stand among the global top three in our view, with a 10 million capacity. Garmenting enjoys macro tailwinds backed by diversification of global supply chains and potential free trade agreements. Despite faster growth in the relatively lower-margin non-textile businesses, Raymod Lifestyle sees steady margin gain, with branded apparel/garmenting scale-up," he adds.