Rothschild & Co: Tapping into India's dealmaking opportunity

By focusing on the mid-market M&A segment in India, Rothschild & Co has won significant deal mandates on behalf of Indian entrepreneurs hungry for growth capital

The rise of Indian entrepreneurship has been accompanied by a concomitant increase in deal making and fundraising. Nowhere is this trend clearer than in the mid-market segment where companies are on the lookout for Rs500-2,500 crore deals.

Take the case of Bengaluru based agro-chemical company Cropnosys. In December 2023, it was in the market for raising funds. Its businesses that straddled herbicides and fungicides to insecticides and micronutrients, had seen rapid growth with revenues at Rs672 crores in FY23. Profitability and margins were healthy at Rs109 crore, or 20.9 percent.

While it had managed to double capacity in 2022 through internal accruals, it now needed to scale rapidly and reduce its dependence on imports for manufacturing key agri chemicals. Its new plan: A fivefold increase in capacity at its Vapi facility.

Enter Rothschild & Co, which had till then done two deals in the agro chemcials space. While the banker was confident it could sell the story to investors, the size of the fund rise surprised many in the industry.

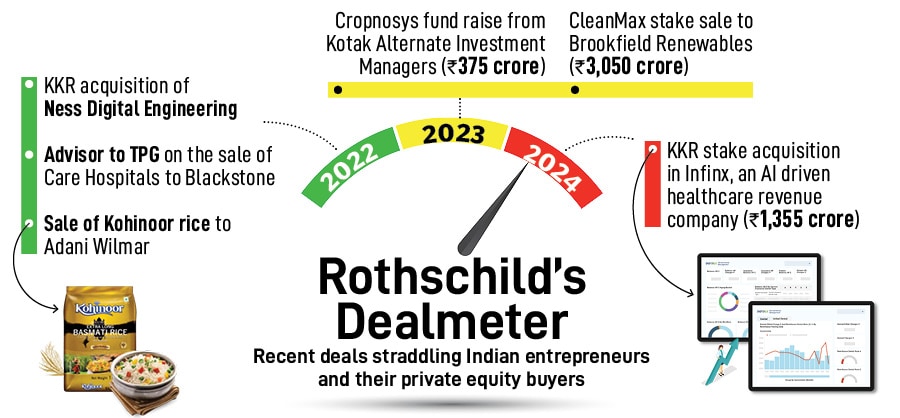

Kotak Strategic Situations Fund invested Rs375 crore (or 55 percent of its FY23 revenue) in December 2023 making this the largest deal in the agri chemical space. And it further cemented Rothschild’s position as a mid-market (defined as transaction sizes of between $100-500 million) deal maker.

Its deals like Cropnosys or the CleanMax fundraise (in 2021 and 2023) that have allowed Indian entrepreneurs and provided Rothschild with an avenue for deal making. They are able to market Indian business to investors both within India and outside—from private equity funds to pension funds and infrastructure funds to sovereign wealth funds.

According to data from Dealogic between 2007-23, Rothschild stood at number three with 151 deals concluded in India, behind Citi and Morgan Stanley that had 165 and 179 deals to their credit respectively.

Its ranking is partly on account of its mid-market positioning in the deals space. That’s where the maximum volume gets generated. “Our view is that we need to be in the flow of things. The more assets we are selling the more value add we can do to the client as we are having many more conversations with industry participants," Subhakanta Bal, managing director, Rothschild. Globally deal volume is something Rothschild takes seriously. It advised on 379 deals totalling $109.7 billion in 2023.

Rothschild’s 24 years in India provide a ringside view of the changing nature of corporate India. They have seen a greater willingness among promoters to adapt as well as the changing appetite for sectors among deal participants. “There is an openness to ask whether I can take this to the next level or whether it would be better to exit? And if it is better to be an owner or to have someone else manage it," says Chandresh Ruparel, managing director and head of India at Rothschild. While earlier, it was about being a big fish in a small pond, they are now benchmarking themselves against global peers.

It is this willingness on the part of promoters to look at other options for their businesses has led to a broadening of the M&A market in India. Case in point is deal making in the 2000s that was mainly among corporates, say the Air Deccan fundraise or the Tata Corus deal, both advised by Rothschild, a lot of activity now (both fundraising and disposals) has moved to private equity, which is willing to write the big cheques needed to fuel growth.

Private equity firms are now also more willing to take operational control if things go wrong as compared to the first round of M&A between 2005-12 when they were chasing few investable opportunities and bidding up valuations.

Often the speed of growth catches entrepreneurs by surprise leading to more business for investment bankers. CleanMax, a renewable energy company had done one round of fund raising in 2021 giving Warburg Pincus an exit. Soon the company realised it needed more capital as growth had taken off faster than anticipated. “That is why we had to go back in the market in just about a years’ time because so much happened so quickly in that period," says Aalok Shah, managing director and co-head India, Rothschild. The next deal in 2023 would be the largest in the commercial and industrial renewable space at $360 million (Rs3050 crore).

A larger sized deal meant that Rothschild cast its net wider reading out to private equity funds, infrastructure funds, pension funds and sovereign wealth funds with a teaser sent out to 35 investors. This resulted in 23 non-disclosure agreements signed and five non-binding offers that were received.

First Published: Dec 02, 2024, 17:37

Subscribe Now