The Slice-NE SFB merger shakes up banking landscape

The merger could chart the course for other fintechs who seek to become banks. The small finance banking model has worked, and RBI could ill afford to see a weak SFB fail

This month fintech unicorn Slice surprised the banking and fintech landscape by announcing a merger of the Guwahati-based, loss-making North East Small Finance Bank (NE SFB) with itself, marking its entry in the banking ecosystem.

Fintech experts see this merger— to which the Reserve Bank of India (RBI) has given an NOC —as one that could “chart the course" for other fintechs seeking to explore banking opportunities and for regional banks, lagging in size, reach and digital expertise, to scale up.

There has been a bit of a precedent here already. Two years ago, in October 2021, the RBI gave a banking licence to Unity Small Finance Bank, formed out of the consortium of fintech BharatPe’s parent Resilient Innovations and Centrum Financial Services. BharatPe holds a 49 percent stake in Unity SFB and Centrum the majority balance 51 percent after the two partners created a rescue plan for the troubled Punjab and Maharashtra Co-operative (PMC) Bank.

Both Slice and NE SFB stand to gain equally from the merger. Slice had already picked up a 10 percent stake in NE SFB in two separate and equal tranches in 2022 and 2023. Founded by former Flipkart staffer Rajan Bajaj in 2016, Slice is backed by 82 investors, which include 64 institutional investors including Tiger Global, Insight Partners, Moore Ventures, Gunosy, Das Capital and Blume Ventures.

Slice had been growing rapidly in its first five years of operations, providing credit lines through the ‘buy now pay later’ (BNPL) type of products to India’s youth who are usually not eligible to get credit cards from banks, to meet their purchase requirements.

But its business model was jolted in 2022 when the RBI disallowed non-banks from loading credit lines on prepaid payment instruments (PPI) such as wallets and cards. The fintech later obtained its own PPI licence and has since pivoted to issuing term and unsecured loans, through its existing NBFC subsidiary Quadrillion Finance.

Slice was, then, always looking to expand into the lending space.

Bajaj declined to participate in this story. “We see this as an opportunity to build a highly inclusive and responsible bank, offering an unparalleled experience, underpinned by robust risk management and strong governance," Bajaj has said in the press statement.

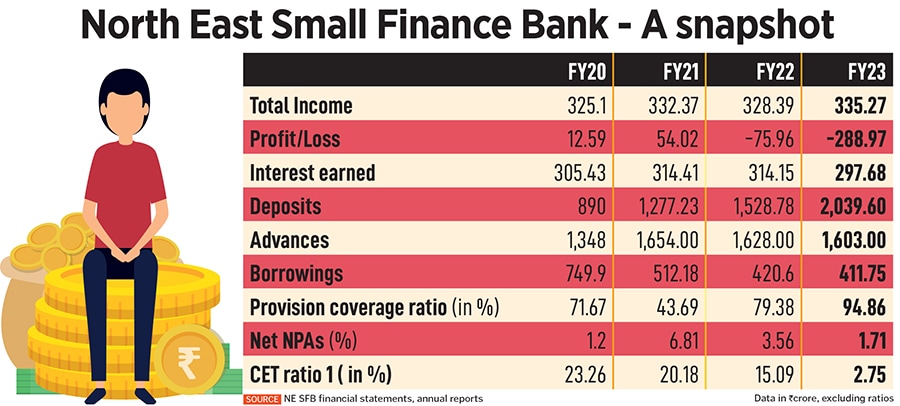

For NE SFB, the pre-merger business outlook appeared more unclear. NE SFB, the only one of its kind in the Northeast region, has seen a significant decline in its tier 1 capital ratio, to just 2.75 percent in March 2023 from 23.26 percent in March 2020 (see table). Despite some capital infusion from a section of its investors in 2022, this has not been enough. An SFB needs to maintain a minimum tier I capital of at least 7.5 percent of risk weighted assets (RWAs), according to the RBI.

NE SFB has also seen a widening of losses over the past two years, after being forced to increase provisions on loans during this time, which hurt profitability. Borrowers had been unable to repay loans due to floods in Assam, which hurt their livelihoods. NE SFB, thus, needs re-capitalisation at the earliest, which is coming in the form of Slice.

NE SFB has seen nine rounds of funding since 2011, including debt, series A and B (four rounds) totaling $43.2 million. It has 31 investors, including Dia Vikas, Nordic Microfinance Initiative, PI Ventures, SIDBI Venture Capital and Oiko Credit which are partner investors, along with RGVN (North East). NE SFB is a subsidiary of RGVN (North East) Microfinance.

Experts see this merger as a huge positive for the entire ecosystem. “It charts the course for other fintechs to explore as they seek to scale up and for small regional banks, which have been unable to scale," Anirudh A Damani, managing partner at Artha Venture Fund (AVF), tells Forbes India. AVF, which has over 114 companies in its portfolio (including exits) manages assets in excess of Rs 1,000 crore.

Besides the business synergies, there are some tough realities that have emerged in India’s banking ecosystem due to the presence and strength of fintechs, which the regulator and companies need to understand.

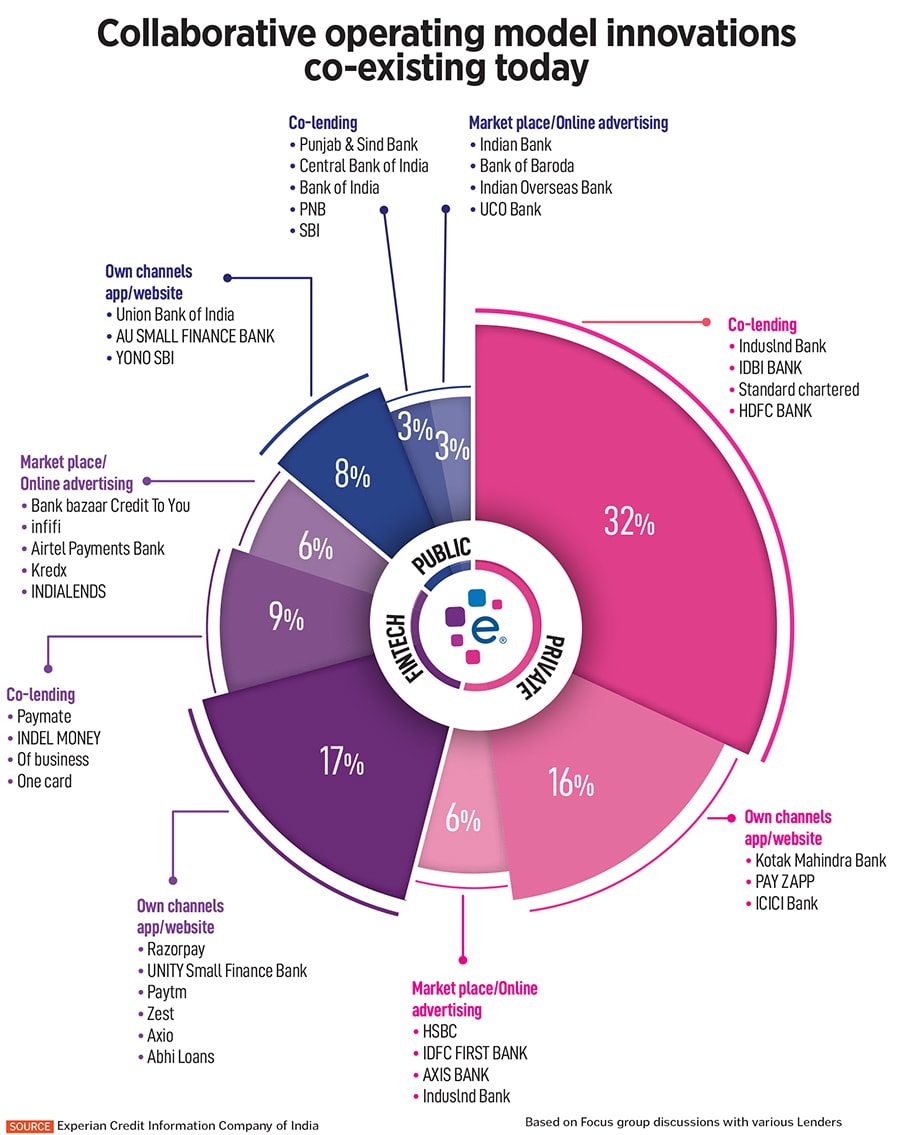

According to Saikrishnan Srinivasan, managing director of Experian Credit Information Company of India, in a white paper titled ‘Building a sustainable fintech portfolio’ says “Fintechs have had a strong growth so far in the unsecured small ticket space. Their growth outpaced that of other lender categories like private and public sector banks. Not only this, fintechs also enabled other lenders on digital acquisition."

The white paper, released in October, highlights the fact that fintechs have been able to create greater stickiness despite the absence of physical touchpoints in the onboarding journey of customers.

The white paper, released in October, highlights the fact that fintechs have been able to create greater stickiness despite the absence of physical touchpoints in the onboarding journey of customers.

One of the reasons why Slice emerged as an acquirer is that while customer acquisition by banks has been the focus, several banks have been laggards in providing state-of-the-art technology to customers who seek it. “This is where fintechs have scored over banks in recent years. The Slice NE SFB’s merger also has its roots in the fact that not all banks were willing and ready to lend to the unbanked, which is what fintechs and neo-banks have capitalised on," says Damani.

The impact of fintech-NBFCs on digital lending continues to grow rapidly. People under the age of 40 account for 80 percent of the loans disbursed, according to FY23 data from credit information firm Equifax and industry lobby group Fintech Association for Consumer Empowerment. Around 7.1 crore loans were disbursed in FY23, worth Rs 92,267 crore. Personal loans accounted for a majority of the loans (72 percent) and the average ticket size for the loans was Rs 12,989, the study shows.

The need to boost profitability has meant that fintechs would need to look at amalgamations with NBFCs or buyout small, capital-starved regional banks. US-based Lending Club, a digital fintech which in 2021 had completed its acquisition of Radius Bancorp and its digital bank subsidiary, Radius Bank, continued to show stable growth. In the UK, a different type of acquisition occurred when the peer-to-peer lender turned digital bank Zopa in 2023 acquired a fintech DivideBuy to offer BNPL.

Another factor crucial to the SFB merger in India was that it was a bank struggling to survive. “For the RBI it was important to ensure that nobody fails," says an executive at a private bank, on condition of anonymity. SFBs were introduced to the ecosystem with much fanfare, with the purpose to further financial inclusion and provide savings tools and credit lines to the unserved and underserved segments of the population.

The RBI had gone a long way in assisting PMC Bank because it was a multi-state, co-operative bank with a legacy that went back over 40 years. “The same is the case for a small finance bank serving an important role in a credit-starved region. The regulator needed to show that it has served a purpose and that all is well now [with the merger]," the banker says.

The exact contour of the merger and the equity shareholding among all investors is yet to be known and disclosed. Slice was last valued at around $ 1.8 billion (nearly Rs 15,000 crore) during its fundraising last year. In March 2023, NE SFB’s post money valuation was at $72.4 million (Rs 600 crore) as of September 2022.

Back-of-the-envelope calculations suggest that Slice and its investor group could get a majority 95 percent stake in the new entity, while NE SFB would get the balance 5 percent stake, analysts say. Slice may need to also raise more capital, to fund the businesses, besides focusing on garnering deposits and issuing credit cards directly.

Ajit Kabi, banking analyst at LKP Securities, expects NE SFB’s business to become profitable in FY24. “We are factoring lower stress and lower credit costs for the SFB. The bank had seen losses due to the high provision made. It is unlikely that they would make huge losses in the next year," he tells Forbes India.

Unity SFB stands well capitalised, with a net worth of Rs 1,744 crore as on March 31, 2023 and has reported tier 1 capital ratio of 27.2 percent, as of FY22.

Crisil Ratings notes that Unity SFB’s net loan book (excluding PMC loans) grew to Rs 4,204 crore in FY23, closing from Rs 1,835 crore a year earlier. It has a diversified loan book across microfinance, MSME loans and supply chains. While it has emerged profitable in Q1FY24, the SFB will need to boost collection efficiencies and lower its gross and net NPA levels in the coming quarters.

“As Unity SFB scales up its portfolio, it is expected to benefit from various dispensations granted by the RBI on amalgamating with PMC Bank. These include, inter alia, an additional timeline of three years to comply with priority sector lending targets, adherence to criteria for small finance banks wherein 50 percent of the loan portfolio comprises ticket sizes up to Rs 25 lakh," the Crisil ratings note in August says.

Some of the other SFBs, including AU Small Finance Bank and Capital SFB, are in better financial health, as they do not have exposure to microfinance lending, which has been a cause of anxiety for several other SFBs in previous years. Most of the SFBs have been focussed on diversifying their loan book beyond microfinance towards mortgage loans, small business and SME loans and vehicle financing.

Capital SFB has built its strategy as a “middle-income specialist", according to its CFO Munish Jain. This bank, once a local area bank in Punjab, has now expanded to neighbouring states including Haryana, Rajasthan, Himachal Pradesh and Delhi. Its June-ended earnings were strong, with year-on-year improvement in interest income, profitability, bad loans and capital adequacy.

With the 97.9 percent retail-centric deposit franchise, 99.8 percent secured lending loan book and a Casa (current and savings account) ratio of 42 percent in FY23, it is better placed than several mid-sized regional banks. Similarly, Fincare SFB has shifted its strategy towards secured lending from a microfinance-focussed one. Jana SFB has refiled its draft papers with the Securities and Exchange Board of India (Sebi) for raising funds through a public offer.

Nitin Aggarwal, banking analyst at Motilal Oswal Securities, says that the SFB concept “has done well". Interest income has risen for AU SFB (27 percent), Equitas (34 percent) and Ujjivan (42 percent) in the June-ended quarter, compared to levels a year earlier. “The SFBs have created value for the system and have been able to report their growth and profitability despite mandatory priority sector lending norms."

Much of the focus will now stay on how soon Slice can revamp the loss-making SFB business. Its performance and strategy will give confidence to several large fintechs to build for a banking dream.

First Published: Oct 10, 2023, 11:10

Subscribe Now