The young entrepreneur, though, was not dazzled either by a glittering bottom line or a glowing report card. He was frustrated with the fact that it took him seven years to open the second store in Coimbatore in 2007. “There was no pace. There was no scale. I wanted to expand," recalls Sacheti, who was not a diamond in the rough but was also not shining the way he wanted to. “I thought the internet is a great place as it can flip the problem of scale," he underlines. Though well aware of the flip side of venturing out of the family business, Sacheti mustered courage and shared his desire with the patriarch. “Who leaves the family business?" asked a bewildered father, who started a jewellery store, Jaipur Gems, in Mumbai in 1974. “You have done exceedingly well," he underlined. “And you are the best performer in the family," he lavishly praised his son.

Sacheti, though, had made up his mind. “Please give me Rs 75 lakh and four years," he made a passionate plea to his father. “If I don’t succeed, I will come back and join the family business," he promised. His dad displayed a heart of gold, Sacheti got Rs 74 lakh, his co-founder Srinivasa Gopalan chipped in with Rs 26 lakh, and the duo started CaratLane in 2008.

The diamond, though, was turning out to be a lump of coal. “We made the website, but there was no sale for 15 days," recalls Sacheti. Over the next few months, the business started trudging. But what made the journey exceedingly aggravating was loads of scepticism from a large tribe of cynics. “It’s a terrible idea. Band kar do [shut it down]," was how a top businessman in Chennai reacted. There were naysayers everywhere. During his frequent visits to Mumbai to attend trade events, Sacheti would shy away from introducing his company. “Hanste they sab mere upar, kaun khareedega online [Everyone laughed at me who will buy online]," he recounts.

Nigerian scam & a flop TV show

The venture capitalists (VCs) too joined the ever-expanding community of disbelievers. For two years, from 2009 to 2011, Sacheti tirelessly reached out to almost every VC fund in India. Everybody gave him a patient hearing. And everybody gave him the same reply: Nice progress. Come after a few months. “There were no takers," he rues.

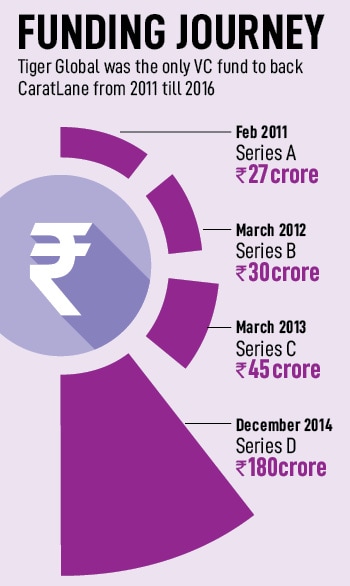

Then one fine day in 2011, the ‘Nigerian scam’ popped on Linkedin. Well, the message did sound surreal. “Hi, I am Lee Fixel. I am a partner at Tiger Global…" was how the ‘self-proclaimed’ funder introduced himself to Sacheti, who thought somebody was playing a prank. “I am interested in investing in your company." Fixel expressed his intention. Sacheti was still stunned. And his reaction was natural. For two long years, he faced countless rejections, and nobody gave him a dime. “And now, this guy says he wanted to invest! Definitely, has to be a scam," wondered the founder who was under tremendous pressure. He was about to run out of his money, his four-year period of ‘either making it big or coming back home’ was about to end, and all that CaratLane had managed since 2008 was a Rs 12 crore loss-making business! “I left my family business in Chennai which was Rs 70 crore, and had Rs 10-crore profit. Imagine," recalls Sacheti, who was fast slipping into the vortex of self doubt.

Two years later, in 2013, Sacheti was again reeling under immense pressure. This time, again, he was battling another set of mental demons. Tiger Global pumped in Rs 30 crore in March 2012. The Series B round of funding came a year after the marquee US investor had backed Sacheti in February 2011. Buoyed by the confidence shown by the investor and flattered by the promising growth of the business since the maiden funding, the founder pressed on the advertising and marketing pedal. “We went on TV and spent Rs 4-5 crore on the campaign in 2013," he says.

![]()

The move bombed. The web traffic shot up like a rocket for the first four days, and then it crashed. “Nothing moved. It was such a waste," says the founder, who was feeling devastated. There was one more setback around the corner. CaratLane opened its first outlet at GK 1 market in New Delhi. First day, women thronged in hundreds, and declared it to be a flop show. Reason: There was no jewellery in the outlet. “We had built a digital showroom, and the women wanted to ‘touch and feel’ jewellery," lamented Sacheti. Five years into the journey and two years after Tiger came on board, the growth pangs were still pronounced. In all likelihood, Sacheti was about to crack under pressure. He flew to the US to meet Lee Fixel.

Meanwhile, back in 2011, Sacheti was about to meet Fixel. The founder got to know from one of his friends that Fixel was the guy who had backed Flipkart. The founder realised his folly, he went back to the LinkedIn message, replied, and Fixel called him for a meeting in Delhi. Sacheti was upbeat about the prospects of getting funded. And all he wanted was $1-2 million. The meeting lasted for 50 minutes, Fixel stumped the founder by displaying meticulous knowledge about Sacheti’s business, data and numbers, and then suddenly he offered a term sheet. “What is your ask?" the investor asked a routine question before cutting the cheque.

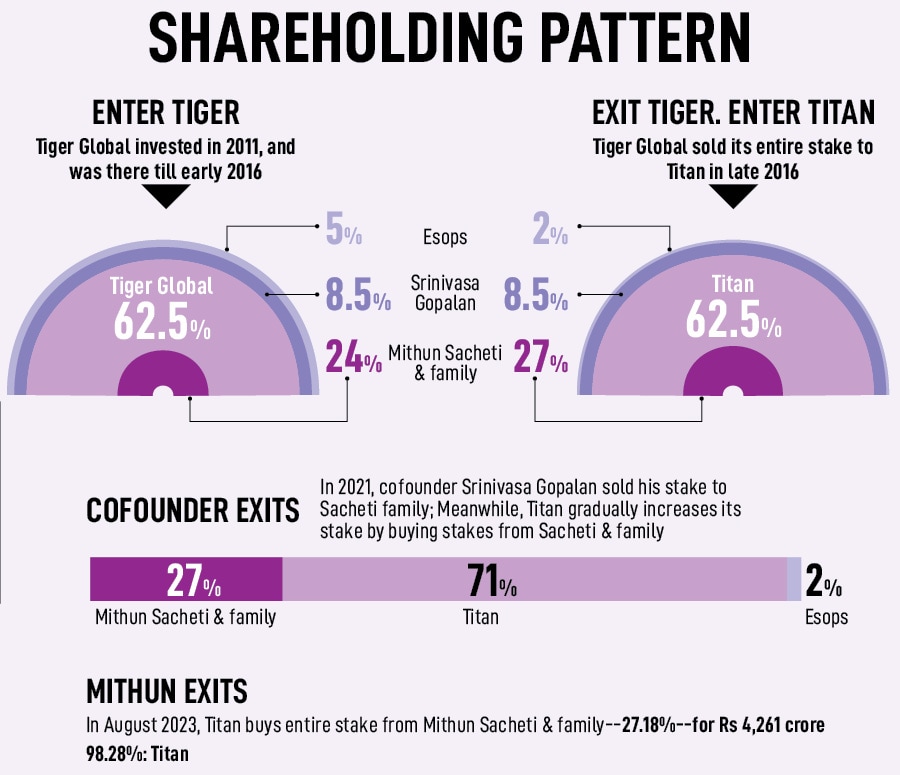

The Marwari businessman, though, was smart enough to keep his cards close to his chest. “How much do you think an online business would need," he replied by asking a question. “$5 million and a 25 percent stake," retorted Fixel. “$6 million," Sacheti upped the ante. The heady negotiation was underway, and the founder was delighted with his clever move. He, though, forgot that he had met his match. Sacheti was 32, Fixel was 30. Sacheti was a Marwari from Mumbai, Fixel was a Jewish CFA from Florida. It was a diamond cut diamond. “Okay. It’s $6 million and 33 percent," the US investor gave the final offer. Sacheti was elated. “I didn’t have a penny in my pocket, and I managed to get Rs 27 crore," he recalls. “That’s how the first funding of CaratLane happened in 2011," he adds.

Titan & change of universe

Five years later, in 2016, Tiger Global exited. From Rs 12 crore—when Tiger invested—the business grew to Rs 140 crore when Titan bought the 62 percent stake of Tiger and became the largest shareholder. More than just a new investor, CaratLane hit the jackpot. “Tata is a gold standard in trust," says Sacheti, who was keen to have a tagline along the brand name of CaratLane: A Tata product. Bhaskar Bhat, who became managing director of Titan in 2002, proposed a better idea. “Tanishq is a gold standard in trusted jewellery," he underlined. CaratLane, subsequently, started its journey as a ‘Tanishq partnership’.

![]() A year later, things, though, didn’t move the way Sacheti imagined. He was feeling suffocated. He explains why. “I was getting drowned by my own noise, my own expectations," he says. Having Tata as the Big Brother, Sacheti hoped for a faster and aggressive growth. “The frustration was from my expectations, and not from what Titan was doing," he maintains. The founder was mulling about his future, his co-founder too was uncertain about the prospects, and CaratLane seemed to have lost its way in the perpetual loss-making bylanes.

A year later, things, though, didn’t move the way Sacheti imagined. He was feeling suffocated. He explains why. “I was getting drowned by my own noise, my own expectations," he says. Having Tata as the Big Brother, Sacheti hoped for a faster and aggressive growth. “The frustration was from my expectations, and not from what Titan was doing," he maintains. The founder was mulling about his future, his co-founder too was uncertain about the prospects, and CaratLane seemed to have lost its way in the perpetual loss-making bylanes.

Then one fine day, in 2017, something dazzling happened. “Bhat sahab introduced me to Rakesh Jhunjhunwala, and asked me to discuss my problems," recalls Sacheti. For the founder, it was a sense of déjà vu. Back in 2013, he had made a quick trip to the US to discuss his problems of lacklustre growth with Fixel. “I think you should hire a CEO to run the business," he suggested to the investor. The venture, Sacheti underlines, is not panning out the way it should have. “It lacks pace, and I don’t know if I am the right guy to run it," he argued. Fixel, for his part, knew that he had backed a rough diamond. “You are the right guy to run the show," he explained. The self-doubts, he underlined, were due to a mismatch between input and output. “Don’t worry. Stick to your guns, the growth will happen one day," he reassured the founder and put him at ease. " He patiently heard me out," says Sacheti.

Meanwhile in Mumbai, in 2017, Sacheti was finding it tough to put across his issues. Reason: Jhunjhunwala was getting ready to slip into his afternoon siesta. It was one of the weekdays, the market had closed, and the legendary investor was getting restless. “What are you doing? You have been running a loss-making business," he said bluntly. Sacheti assured him that there was a method in the madness. “Aacha, chal samjha [Okay, explain it to me]," Jhunjhunwala said.

The founder started but there was no audience. Jhunjhunwala dozed off. When he woke up after a few minutes, Sacheti again started. The result was the same. A pack of cigarettes lying on the table looked like a silver lining. “Do you smoke, sir?" he asked. Jhunjhunwala nodded, he lit a stick and handed over a fresh one to Sacheti. For the next 10 minutes, the founder kept talking and the investor was wide awake, listening to every word of the conversation. Then Jhunjhunwala spotted something odd. Sacheti had not lit up his cigarette. “You asked for it and you are just holding it," he asked. Sacheti smiled. “I don’t smoke. I just wanted you to stay awake," he added.

The big bull, and big learning

There was an instant bonding between the master and the disciple, and Jhunjhunwala became his biggest mentor. “He taught me the power of compounding, the value of cash flow, and the importance of staying invested," underlines Sacheti, adding how the legendary investor encouraged him to buy out the stake of his co-founder who wanted to exit. “Imagine, I went to discuss my blues and uncertainty, and he ended up making me borrow money and buy more," smiles Sacheti. “Any big advice from the Big Bull that you remember," I ask. The founder shares one of his favourites: Don’t ask for an unfair price, but stick to your price. "He taught me to be firm on one’s price," he says.

Fast forward to August 2023. Titan buys a 27.18 percent stake held by Sacheti and his family in a Rs 4,261-crore cash deal, which happens to be the second largest exit for an ecommerce founder in India after the Flipkart founders sold their stakes to Walmart. The deal valued CaratLane at Rs 17,000 crore! “Apart from Noel Tata and Bhaskar Bhat," points out Sacheti, “if there is one man who is responsible for me getting this kind of valuation, it is Rakesh Jhunjhunwala."

![]()

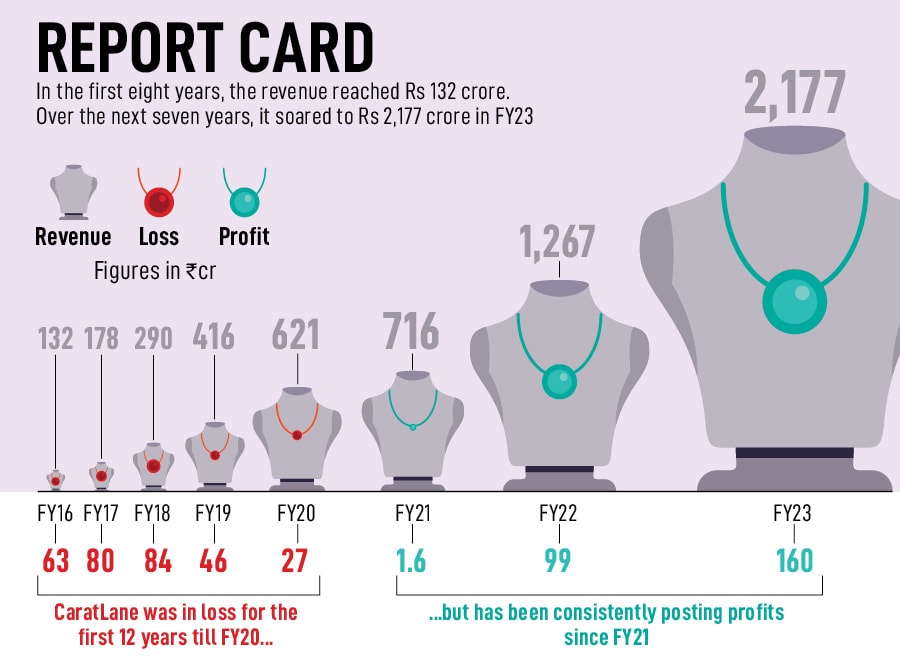

Now compare this to Rs 99-crore equity infusion in 2019 by Titan, which valued the company at Rs 900 crore. Sacheti explains why the huge difference. Till FY20, CaratLane had been consistently posting losses. “They [Tatas] understand profitable businesses and not loss-making businesses," says the founder. “I vowed not to ever take money from them, and turn the venture profitable," he says.

Sacheti lived up to his promise. CaratLane has been profitable since FY21, it closed FY23 at a heady revenue of Rs 2,177 crore, and is now striking a run rate of over Rs 3,000 crore for FY24. Now the diamond merchant has turned his focus to gold. Sacheti owns around 25 percent and is the largest shareholder in Oro Money, a gold loan platform started by Parth Shah, Sreekesh Krishnan and Rakesh Mani. In February last year, Oro raised Rs 36 crore in a Series A round led by 021 Capital, with participation of Premji Invest and individuals such as Yash Amit Nanavati, Rathna Girish Mathrubootham, Prerna and Mridual Sahuwala, according to Entrackr. “We are likely to get an NBFC licence," says Sacheti.

Sacheti’s friends and well-wishers are not surprised with the resilience of the founder. “Tiger Global is our common connection," says Girish Mathrubootham, CEO and founder of Freshworks. Fixel, he underlines, first invested in CaratLane, and then in Freshworks. The US investor came to Chennai in January 2012 to meet Sacheti and his team. “I met Fixel for the first time there, and pitched him," says Mathrubootham who was on the board of CaratLane, and stepped down ahead of the IPO of Freshworks. Since 2012, Sacheti and Mathrubootham have been good friends. “I still remember our early days’ chat when we used to talk about CEO compensation and all," recalls the CEO. “He is a phenomenal human being, always ready to help, and quite modest," he adds.

Meanwhile, Sacheti reveals another facet of his modesty. A huge cash exit, and the question on how he looks at money is a natural one to ask. “Money is only a score of fairness in my life," he says, adding that now he can take more bets and try out new things. And is there any takeaway from his long entrepreneurial stint? From 2000, when he made the odd bet to set up Jaipur Gems in Chennai, to 2008, when he started CaratLane against all odds, to 2023, when he made a successful exit, how does he look at his journey? Sacheti doesn’t take a second to reflect and points out two big themes. First is the realisation of chasing profitable growth. Second is the need to solve for business and customers. “If you do that, then there is enough money," he signs off.

A year later, things, though, didn’t move the way Sacheti imagined. He was feeling suffocated. He explains why. “I was getting drowned by my own noise, my own expectations," he says. Having Tata as the Big Brother, Sacheti hoped for a faster and aggressive growth. “The frustration was from my expectations, and not from what Titan was doing," he maintains. The founder was mulling about his future, his co-founder too was uncertain about the prospects, and CaratLane seemed to have lost its way in the perpetual loss-making bylanes.

A year later, things, though, didn’t move the way Sacheti imagined. He was feeling suffocated. He explains why. “I was getting drowned by my own noise, my own expectations," he says. Having Tata as the Big Brother, Sacheti hoped for a faster and aggressive growth. “The frustration was from my expectations, and not from what Titan was doing," he maintains. The founder was mulling about his future, his co-founder too was uncertain about the prospects, and CaratLane seemed to have lost its way in the perpetual loss-making bylanes.