How Kolkata's Senco Gold struck gold

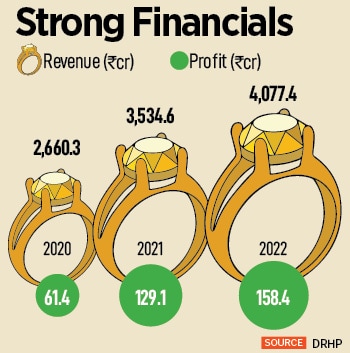

The jewellery retailer is in the midst of raising Rs405 crore from the bourses and its IPO has been fully subscribed on Day 2 of the bidding process. It plans to use the proceeds to ramp up its store

If it weren’t for fugitive diamantaire Nirav Modi, the Sen family’s moment of reckoning would have come five years ago. And, most importantly, its patron would have been around to see it.

The family had carefully planned a public listing of their company, Senco Gold & Diamonds, to raise Rs600 crore on the back of their strong reputation as a jeweller of stature in eastern India for many decades. The Sen family, comprising the company’s then-chairman Shaankar Sen and his son Suvankar, wanted to mop up some Rs600 crore from the bourses in their attempt to build a pan-India presence.

“The sentiment in the market is dull due to Nirav Modi and the apprehension about jewellers," Sen, former chairman and managing director of Senco Gold, told Forbes India in 2019. “We also saw the tanking of PC Jewellers on the stock exchanges. That’s why we have pushed the IPO." After Sen passed away in 2020, his son Suvankar has been running the day-to-day affairs as Senco Gold’s managing director.

The jewellery retailer is now in the midst of raising Rs405 crore from the bourses, and its IPO has already been fully subscribed on Day 2 of the bidding process. On Day 1, the company attracted a 69 percent subscription, and by the next day, the IPO was subscribed 2.68 times. The portion for retail individual investors (RIIs) received 3.67 times subscription, while the category for non-institutional investors was subscribed 3.58 times. The qualified Institutional Buyers (QIBs) quota was subscribed 27 percent. In the grey market, Senco Gold’s shares are reportedly valued at a 35 percent premium to the upper end of the price band.

Senco’s IPO comprises a fresh issue of equity shares worth Rs270 crore and an offer-for-sale (OFS) of equity shares worth Rs135 crore by SAIF Partners India IV Ltd. SAIF Partners has a 19.23 percent stake in the jewellery retail chain that it picked up in 2014 for Rs80 crore.

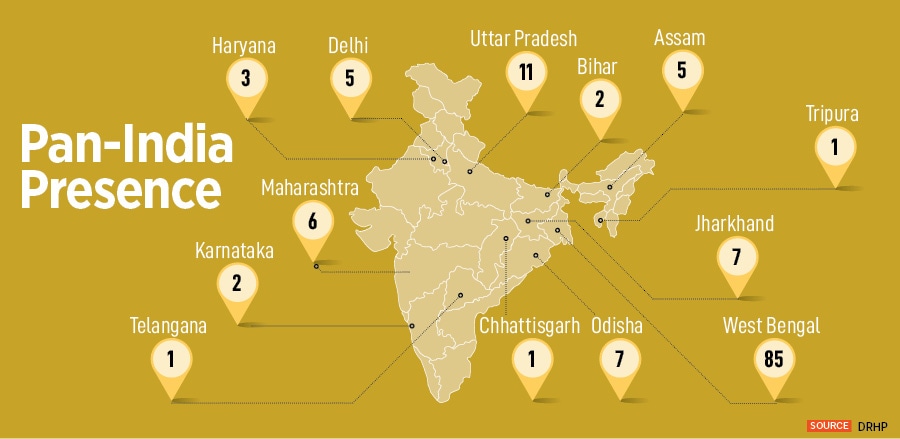

In all, the Kolkata-headquartered jeweller, whose brand ambassadors include the likes of former Indian cricket captain Sourav Ganguly, and actors Vidya Balan and Kiara Advani, currently has 136 showrooms across India. Of this,70 are company-operated showrooms and the rest as franchises across 96 cities and towns in 13 states. Last year, as much as 82 percent of the company’s revenue came from West Bengal and Eastern India, with the former alone contributing to 70 percent of the revenue.

“Improving economic growth, rising urbanisation, increasing disposable income levels, and mandatory hallmarking is positive for the organised players," brokerage firm Geojit said in a report about Senco Gold. “A strong brand name and a legacy of over five decades, strong company-operated showrooms, and an established asset-light ‘franchise’ model are expected to benefit Senco Gold."

Senco Gold and Diamonds traces its roots to erstwhile East Bengal.

Sen’s ancestors had set up a jewellery business in 1938 in Dhaka, but had to leave that behind during the Partition when East Bengal became a part of Pakistan.

Overnight, Sen’s father and his brothers migrated to Kolkata (then Calcutta). There, the family engaged in bulk sales of gold before moving to retail, and between 1950 and 1960, set up nearly 10 stores across the city. By 1962, however, as India and China fought a war over border disputes, the government decided to introduce the Gold Control Act, which recalled gold loans given by banks, and banned forward trading in the yellow metal.

By 1968, Sens’s father split from the family to go independent, and in the process, received a store in the busy Bowbazar area of Kolkata. “At that time, if you wanted to set up one jewellery store, you had to take a licence from the central excise department," he told Forbes India in 2019. “A licence was issued after three years of persuasion."

Thanks to the goodwill and public relations—the only capital his father managed to earn, according to Sen—Senco opened two more stores between 1968 and 1972. By 1978, as his father’s health began to deteriorate, Sen dropped out of his postgraduate studies to help his father run the business. The big break for Senco came in 1990, when the government repealed the Gold Control Act, and opened up the market, allowing for imports.

By 1994, since other members of the family also ran their gold business under the Senco brand, Sen knew it was time to build a separate identity, and named his arm, Senco Gold and Jewellery Pvt Limited.

With Suvankar now firmly in control of the business, the family is looking to use the proceeds to ramp up its store count and its working capital requirements, in addition to building up a national presence.

To do that, the company is banking on its tried-and-tested franchise model. “We focus on attaining an optimal balance between our operated showrooms and expanding our asset-light franchisee model," the company says in its DRHP. “We use a ‘hub and spoke’ approach to enter new geographies and optimise our inventory management, which means that we typically foray into large or new cities by way of our company-operated showrooms, and then leverage our ‘franchise’ model to expand into Tier-II and III locations."

The domestic gems and jewellery market was roughly around Rs4.7 lakh crore in FY23 with gold jewellery dominating the overall market with a 66 percent share. “Consumption of jewellery studded with diamond, pearls and other precious and semi-precious stones has also been rising over the past five years, but remains significantly lower than that of gold jewellery," Senco said in its DRHP.

India has recently overtaken China as the largest consumer of gold jewellery with annual consumption of 600 tonnes of gold China’s demand stood at 571 tonnes of gold jewellery in 2022. Together, India and China account for more than half of the global gold consumer demand. Now, with pent-up demand after Covid-19, alongside a fast-growing economy has meant that the demand for gold and jewellery is only expected to rise in the coming years.

“Senco intends to continue to increase its gross margins by focusing on product categories which yield higher margins," brokerage firm Axis Securities said in a report. “It intends to prioritise diamond jewellery, as the consumer demand for diamond jewellery in India has increased at relatively higher rates compared to the demand for gold jewellery."

All that means is that for Suvankar and Senco, the IPO is only a start. The real work starts now in its attempt to build a pan-India presence.

First Published: Jul 06, 2023, 10:55

Subscribe Now In 2008, Suvankar—who had a postgraduate diploma in business management from the Institute of Management Technology (IMT) in Ghaziabad—joined the family business and by 2010, Senco had expanded to 15 stores, all within the eastern region. “It is an evolving business," Suvankar told Forbes India. “[Technology] is still nascent and investments are higher. But at some point, it is going to work. Even with franchising, no other family jeweller had thought of it. We are a firm believer in technology."

In 2008, Suvankar—who had a postgraduate diploma in business management from the Institute of Management Technology (IMT) in Ghaziabad—joined the family business and by 2010, Senco had expanded to 15 stores, all within the eastern region. “It is an evolving business," Suvankar told Forbes India. “[Technology] is still nascent and investments are higher. But at some point, it is going to work. Even with franchising, no other family jeweller had thought of it. We are a firm believer in technology."