Why Adidas is betting big on Indian cricket

The German sportswear behemoth is looking to build a jersey culture and capture the merchandising market on the cusp of explosive growth

Every time a sea of blue wraps a cricket stadium in India, Neelendra Singh, the general manager (GM) of Adidas India, does a little jig in his corner office at the headquarters in Gurugram. For, Singh hopes that every speck of blue in the stands will usher in a ‘jersey culture’, a key aspect of fandom that has been missing from the Indian sports landscape. And with it, the German sportswear behemoth would have made a lasting foray in India.

Last May, five months before the ODI World Cup commenced in India, Adidas struck a five-year deal with the Board of Control for Cricket in India (BCCI) to exclusively manufacture the match, practice and travel kits of the Indian men’s, women’s and the under-19 teams. The national cricket jersey, sporting Adidas’s signature three stripes, debuted in the World Test Championships final played in the UK in June.

“Merchandising of sports teams has never been a great thing in India. Usually for sports teams, about 5 percent of their business is through merchandising," says Singh. “We want to change that and create a jersey culture in India."

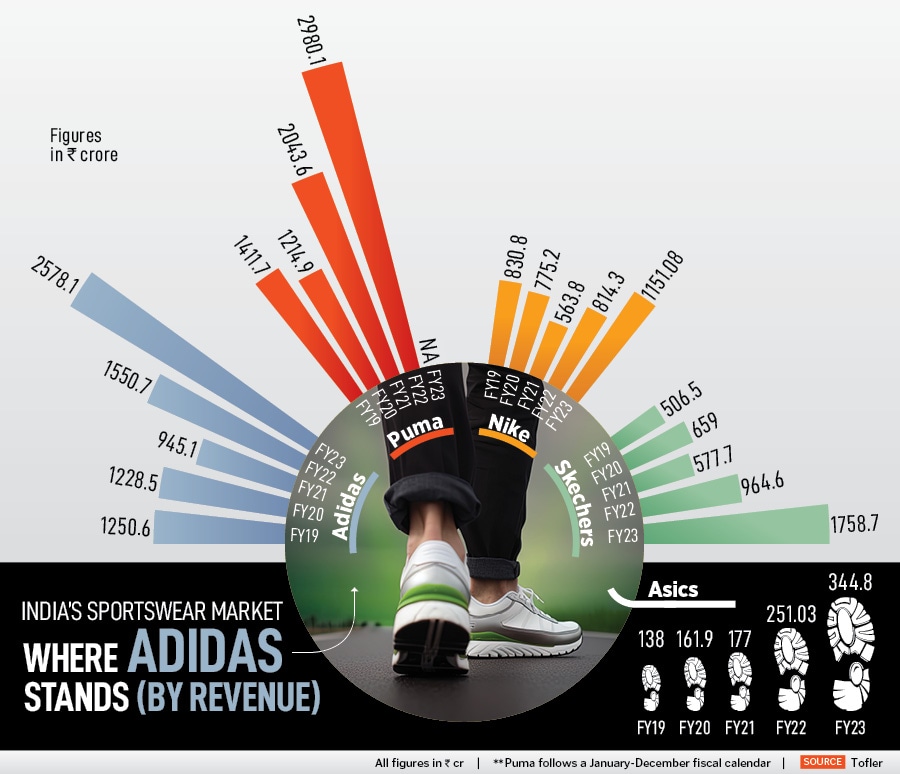

If you look at the history of merchandising in India, this might look like a tricky bet, especially by a company that lags market leader Puma by quite a few thousand crores in topline—in FY22, Puma mopped up a revenue of Rs 2,980.1 crore (fiscal closing December 2022, as Puma follows a January-December calendar), nearly 2x to Adidas’s Rs 1,550.7 crore.

Sports merchandising by top-end global behemoths, typically priced at a few thousands, made them unaffordable to the vast Indian middle class, losing out to the counterfeits and fakes being sold on pavements and outside stadiums for only a few hundreds. Only recently, a number of platforms selling team jerseys, especially of IPL franchises, at an affordable rate have started to catch the fancy of fans. These platforms have also contributed to the growth potential of merchandising—according to Maximize Research, the Indian sports apparel market, which was valued at $673.34 million in 2022, is expected to reach $1,926.10 million by 2029 at a CAGR of 16.2 percent. How will Adidas, known for its premium positioning, play out in a market that’s being driven by casualisation?

“One of the reasons the merchandising culture doesn’t go through is because getting the functionality right in the product is not easy," says Singh. “And, more importantly, the product has to be accessible—if it isn’t available at the right price point and distribution, it fails to be accessible to all fans."

Singh believes the last factor is critical in creating market penetration in India. So, when Adidas launched the national cricket jersey for consumers, it offered three price points—Rs 4,999 for the match jersey, the replica jersey at Rs 2,999 and the watered-down fan jersey for Rs 999. “We understand consumers, we know how democratic cricket is. So, taking the price point to a level where it is accessible to a vast consumer base was an important part of the strategy, even though the margins in Rs 999 were vastly different from that of Rs 4,999. It"s not about the margins, it"s about us reaching out to consumers," says Singh.

In nine months, Singh says, his conviction was vindicated as the company sold upwards of half a million jerseys—75 percent of those were the fan jerseys, priced at the lowest rung. And that’s where Adidas India might have hit the bulls-eye.

“The overall opportunity in this market is growing on the strength of massification. This market has democratised, and that’s where a lot of brands have entered the space. The entire premise of premiumisation has come under question. The prospect of Adidas in India lies in how Adidas sees India, not so much as whether the India opportunity exists. The opportunity exists, as is demonstrated by many brands," says Ankur Bisen, senior partner and head–consumer, food and retail, Technopak, a business management consulting firm.

One of Adidas’ global rivals, Nike, was the BCCI’s long-standing kit partner. The US-headquartered sportswear makers had a 14-year deal with the cricket board valued at Rs 88 lakh per match in the last tranche, but the company did not renew its deal or re-bid when its term ended in 2020. According to media reports, Nike suffered in an adverse business climate during the lockdown and had asked the BCCI for lost time at a discount—a number of tours comprising 12 international matches were called off during the Covid-induced shutdown—but the board refused to play ball. Fantasy gaming company MPL and apparel makers Killer Jeans followed Nike as the BCCI’s kit partner, but Adidas was the first sportswear maker after Nike to ink the jersey deal with the BCCI in 2023—while Singh refused to divulge the numbers, media reports peg the value at Rs 75 lakh per match, with the total somewhere around Rs 250 crore in five years.

What makes Singh confident that Adidas would get bang for the buck when others couldn’t? He believes it’s their strategy of keeping the fan at the front and centre—not just by offering price points that are economical but also fanning out their distribution channels far and wide. “The jersey was available everywhere—our websites, own stores, franchise stores, digital partners like Myntra, Ajio etc," he says. Still, if the mountain wouldn’t come to Muhammad, Adidas decided to go where the consumers would be—hotel lobbies, standalone mall kiosks, mobile vans, kiosks at airports. And finally, they listed them on quick commerce platforms like Blinkit, Swiggy, Big Basket and Zepto. “While I can’t give out the numbers, let’s just say we’ve sold thousands of jerseys through these channels," says Singh. “The reason why we’ll succeed [where some others haven’t] is because we are building an ecosystem of the right product at the right price point with the right distribution."

“Adidas’ moves signal a shift in the sponsorship narrative. This partnership is more than a sponsorship deal, it’s a strategic gamble to redefine the jersey-wearing culture and capture a market on the cusp of explosive growth," says Divya MS, business director of ITW Universe, a sports consulting agency. “For Adidas, this is a sixer in the sense that their strategic intent reflects a broader brand play, a response to their current lag behind competitors like Puma in the Indian market. With the Indian sports market poised to grow at an impressive aggregate rate of 14 percent over the next five years, Adidas is positioning itself for a strategic leap."

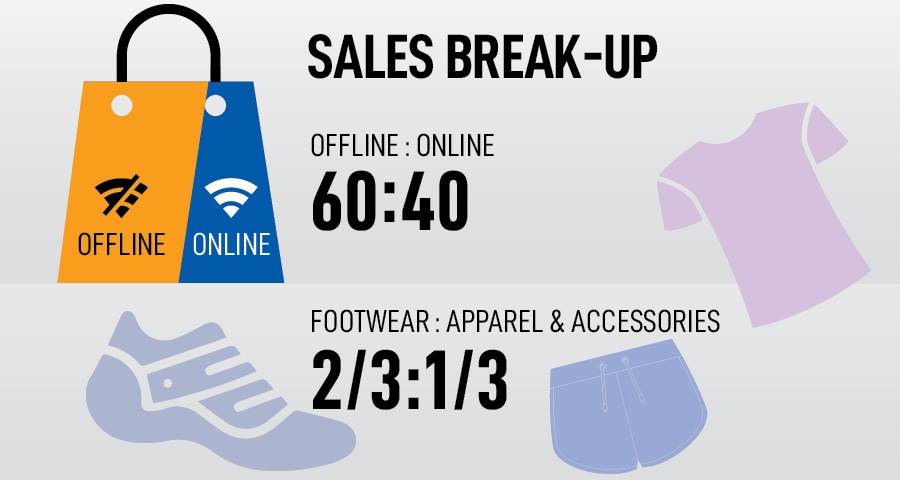

Adidas India’s jersey play—of broadening retail and distribution channels—is in keeping with the company’s policy of accelerating the digital business, which includes developing their own website adidas.co.in in 2021, as well as ramping up its own brick-and-mortar stores. Over 40 percent of the company’s business is digital, while the rest remains physical, operated through 75+ own stores across 12 cities and 370+ franchise stores. This is a paradigm shift from 2010, when Singh, an Adidas employee since 2005, left India to take up an assignment in South Korea. “Back then, online commerce was as good as zero and single-brand FDI wasn’t allowed, so we had to operate only through franchises," he says.

From South Korea, Singh moved to the company’s global headquarters in Germany for a five-and-a-half-year stint before returning to India in 2019 for his second innings. “By then, digital had taken off, 100 percent FDI in single-brand retail was allowed (in 2017) and the consumers’ tastes had evolved as well," he says. But he had barely settled in when Covid struck. And ensuring continuity became his primary objective, instead of driving growth, as was his mandate.

Once the initial Covid waves ebbed and the business jitters calmed, Singh realised Covid had shaped new categories in the sports/athletics wear market pegged to health and fitness. “Walking wasn’t a category even a few years ago, but Indians are now walking more than ever," he says. While this new habit has inspired a range of products in athleisure, the evolved tastes of the Indian customer and their exposure to global ranges, not only through travel but also through channels like TikTok and Instagram, have made their choices more sophisticated. “Buying running shoes for running and football shoes for playing football are well understood now. Unlike most of us, who, while growing up, had only one pair for every activity," adds Singh.

Says Bisen of Technopak: “What was earlier the sportswear or the sneakers market, has now evolved into the athleisure market to include footwear, surely, but also apparel, accessories, sports equipment. This market is growing at a good 13-15 percent per annum." The growth of the market is reflected in Adidas India’s revenues as well, which have gone nearly 2.5x, from Rs 945.1 crore in FY21 to Rs 2,578.1 crore in FY23. While Puma India’s FY23 numbers (fiscal closing December 2023) aren’t available yet, Adidas’s FY23 topline is more than double of Nike’s at Rs 1,151.08 crore.

This growth has been propelled by a two-tiered brick-and-mortar retail strategy that was launched 2020 onwards—at the top, flagship stores in key cities and AAA locations, followed by franchise stores with partners that have a better understanding of local consumers and trade zones. In addition to mono-branded retail stores, Adidas also has tie-ups with wholesale partners like Shoppers Stop, Lifestyle, Reliance Brands etc.

“Underlining this is the fact that we’ve been aggressively developing products in India and also making in India. Almost 60 percent of what we sell in India is made in India," says Singh. It means that Adidas doesn’t only dip into the global line of products and bring them to India, but also develops footwear and apparel in India suited to local tastes. “That helps us penetrate deeper into India and stay relevant to the Tier 2 and 3 consumers," says Singh.

Over the last couple of years, Adidas has invested in a global engineering tech hub in Delhi, and also has a global back office based in Chennai. All these initiatives show what the Indian market means for the global office, says Singh. “We’re not only making commercial investments in India with the BCCI or partnering with celebrities like Olympic athletes or Ranveer Singh and Deepika Padukone, but we are also willing to bring our global capabilities housed in India," he says. “If there has ever been a time to look at India, it is now."

First Published: Apr 12, 2024, 10:42

Subscribe Now