True North's home advantage

How True North grew along with a nascent private equity sector over the past two decades, to now manage nearly $3 billion in assets

“Domestically, nobody understood the PE business as nobody had done this before. So we said we’ll try… if it works it works, else we will get another job.”

“Domestically, nobody understood the PE business as nobody had done this before. So we said we’ll try… if it works it works, else we will get another job.”

Vishal Nevatia, Managing Partner, True North

Image: Courtesy Pawan Manglani[br]With a capital deployment of $36.7 billion so far, 2019 is one of the record years for investments by private equity fund managers in India. In 1999, the figure stood at $320 million. While it may pale in comparison to this year’s number, it was the highest that year in fact, the most in a year that decade.

Twenty years is a long time in the Indian private equity (PE) business considering the changing economic landscape in the country. Liberalisation opened new avenues and the industry began pumping in serious capital after 1998 when overseas institutional investors started infusing money in the country. Vishal Nevatia would agree, having seen the crests and troughs of the PE business in the last two decades.

Nevatia started working for homegrown PE fund True North—previously GW Capital and then India Value Fund Advisors (IVFA)—as managing director in 1999. Prior to approaching GW Capital, he worked with accounting firm Arthur Andersen in Mumbai for 11 years of which the last six were spent in the mergers and acquisitions team.

GW Capital was founded in 1998 by ex-GE Capital’s chief executive officer Gary Wendt, who decided to start a new global fund of $2 billion. Of this, he chose to allocate nearly $1.5 billion for Japan, where he intended to stay, and the remaining equally between India, Israel, Poland and Mexico, Nevatia tells Forbes India.

Wendt decided to tie up with local partners in the countries he wanted to invest in. In India, where he looked to deploy $125 million in 1998, GW Capital partnered with HDFC Ltd and the Ashok Wadhwa-promoted Ambit Corporate Finance.The firm operated out of hotel lobbies before having an address at the World Trade Centre in Cuffe Parade, Mumbai, in January 2000. With an office and team in place, the fund was on track to raise capital and cut big cheques.

But there was a twist in the tale. One evening, Wendt called to say he won’t be able to raise the fund. He had an offer from another company to turn around their business and he didn’t want to let go of it. Wendt closed the fund. “That’s life, I guess. It happens,” quips Nevatia.

Without the money, there was no venture. After discussing the issue with HDFC Chairman Deepak Parekh, Wadhwa and the Impala team that had deep investment experience in the US and other developed markets, Nevatia decided the fund would have to raise domestic capital to survive. But it wasn’t easy as no one had raised capital from domestic investors till then. Most large financial institutions who had launched funds were either deploying capital from their balance sheet or had raised money from overseas.

“Domestically, nobody understood the PE business as nobody had done this before. So we said we’ll try… if it works it works, else we will get another job,” recalls Nevatia.

The fund decided to raise $50 million from domestic investors and HDFC committed $5 million. It quickly raised $35 million, but struggled to put together the remaining $15 million for two-and-a-half years. The dotcom bust at the time didn’t help either.

But Nevatia says there were learnings. “We realised PE is a long-term business. For limited partners (LPs) to consider an established fund, we need to deliver three full fund cycles. And three full fund cycles would effectively mean consistently performing for 15 years and the core team staying together. That’s when we will move from being an emerging manager to an established manager,” he explains.The firm decided not to cut down on resources and stick with a team of six initial partners: Rajeev Agarwal, George Thomas, Sunil Theckath, Vikram Nirula, and Sanjay Arte, who retired in 2018 and now manages the True North Foundation, the firm’s not-for-profit. The fund also created a different structure with an investing team and business management team. With the little money it had, Nevatia and team started deploying capital. Its first deal was with Mumbai-based multiplex chain-cum-film distribution house Shringar Cinemas in 2001 (it held a 33.26 percent stake). This was followed with other ones, including a pre-initial public offering investment in Kiran Mazumdar-Shaw’s Biocon Ltd, Care Hospitals and Epicentre, a BPO chain.

The big break came in 2003 when Biocon went public and the fund managed a 10x return on its investment. Buoyed by the success, in 2004, it decided to launch a second fund with an objective to raise $100 million. By then Nevatia and team eyed an international fund raise and began scouting for a placement agent. But none of the global grade A placement agents were looking at anything less than $500 million. The hunt continued for six months.

With help from one of Wendt’s partners, Nevatia met placement agent Gui Eugene—who helped raise the second fund from international investors—in Boston. For a year, Nevatia and team were on the road for 25 days every month. They managed to raise $35 million from existing investors and the first close happened in September 2004.

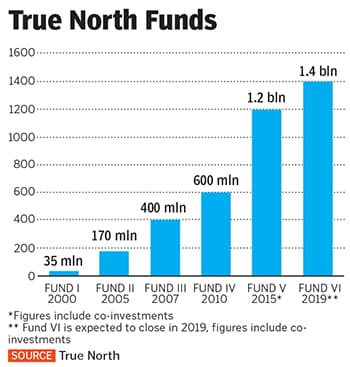

Despite the efforts, nothing came from international investors. They decided to end the chase and chose a March 31, 2005, deadline to close the fund raise. Then came the ray of hope. India started to prop up in the minds of investors and LPs. The fund eventually raised $170 million, far more than what it aimed for. “That was the time we realised we don’t have to worry about shutting the firm. We could now focus on building it,” says Nevatia.

GW Capital was rechristened India Value Fund in 2006 before becoming True North in January 2017.

In the last 20 years, it has become one of the largest homegrown PE funds in India with total assets under management of nearly $3 billion, including its co-investments. LPs, who are investors in a fund, separately commit capital for transactions known as co-investments.

True North is on the verge of raising its sixth fund. It expects the final capital base to be around $1.2 to $1.3 billion, almost equally split between the core fund and LP co-investments.The firm usually targets returns of 25 percent gross internal rate of returns (IRR) in rupee terms and 2.5-3x multiple. It aims to offer nearly 17 percent returns for its global LPs. According to Nevatia, Fund I was a blockbuster (Biocon had returned nearly 10x return on investment) and both that and Fund II exceeded on IRR and multiple terms. True North expects to completely exit Fund III—which has delivered on multiples but is slightly low on IRR—by October-end. In June, it also exited its Fund III’s entire investment of 9.15 percent in health care chain Aster DM Healthcare.

On August 31, Mahindra & Mahindra announced that it will acquire up to 55 percent stake in Meru Travel Solutions Pvt Ltd for a consideration of up to ₹103.5 crore from its existing majority shareholder True North. Mahindra also has the right of call option to acquire further shares from certain existing investors of Meru for an amount not exceeding ₹98 crore, pegging the deal at ₹201.5 crore. As of March 31, Meru’s consolidated revenue was ₹156.6 crore. According to media reports, till 2017, True North had invested $60 million in the company.

While True North is looking to exit its older investments, it is also on a buying spree. Over the last 12 months, it has invested in Max Bupa Health Insurance, Sesa Hair Care, Zydus Wellness, Fedfina and Shree Digvijay Cement.

True North started raising Fund VI in October 2017, but paused the process after four months and did a first close of $600 million. Also, its transaction with Religare Health Insurance fell through because of which it was left with $100 million to deploy from the fifth fund. Nevatia’s fundamentals are simple, “We want to raise less money in the core fund than raise a lot of money and mess up.” Hence, it has been raising its pool of co-investment capital.True North has restructured its business and investment teams in line with sectoral specialisations—financial services, consumer sector, health care, and technology products and services. Pramod Kabra, partner for consumer sector, says, “People who know the next level of details are important. That happens when you have a deep understanding and that is possible only when someone spends a considerable amount of time in a specific sector.”

Adds Kabra, who joined True North in 2007 and has overseen some of its key deals, including investment in cable firm Atria Convergence Technologies (ACT), “It had a turnover of nearly ₹30 crore… now it is ₹1,650 crore. Whichever city it has entered in, it has become number one.”

Apart from Kabra, Ashish Bhargava and Srikrishna Dwaram look after the consumer vertical.

“True North is instrumental in getting the best talent and making sure the business takes a long-term perspective without compromising on care, compassion and value addition to all stakeholders,” says Bala Malladi, chief executive officer, ACT.

Another investment that yielded significant returns for the firm was its investment in Ranjan Pai-owned Manipal Hospitals. In 2012, IVFA had invested ₹1,000 crore in the company to expand its hospital network. It exited in 2017 with nearly three-fold returns by selling its stake to Singapore’s Temasek Holding. “Vishal and his team had in-depth knowledge on health care and always wanted to do the right thing, a value we both could match on. And it is not just the initial investment… over the years they participated actively on the board, even in monthly meetings,” says Pai of Manipal. “Advisors are known to do things that can hurt the company, but they advised us not to do wrong acquisitions. I still reach out to him and we hope to do more transactions.”

The firm also has external advisors who guide them with transactions. For example, 18 months ago, True North was trying to find a solution for Binani Cement even before the company was sent to the National Company Law Tribunal as part of the Insolvency and Bankruptcy Code process. While the deal didn’t go through, the team did enormous research in the cement sector, especially studying the Gujrat-Rajasthan market in depth. It realised it is one of the best markets to invest in.

Anil Singhvi, who previously headed Ambuja Cement, is one of the fund’s external advisors and has been associated with it for four years. In fact, he brought the Binani Cement deal and the Shree Digvijay Cement one that the fund lapped up this year.

Other advisors include Shekhar Natarajan, non-executive chairman of Monsanto, for his inputs in the agriculture sector. He helped the firm during its controlled investment in Seedworks in July 2016.

“Having an advisor does not mean we need to close a deal… these are long-nurtured relationships. If something comes along, it helps us quickly move along on a transaction,” says Dwaram.

The financial services sector—a key focus for the fund—is led by Divya Sehgal and Maninder Singh Juneja. “Here you have a clear, defined role as an operating partner… when you work with CEOs, you are a sounding board to them,” says Juneja.

The PE fund market in India has become bigger, but how are funds differentiating themselves, as almost everyone is gunning for the same deals. “The first point in our head is that the fact that we are not global is not a disadvantage. We’ve said we will build ourselves so that we have a genuine value proposition for our clients,” says Sehgal.

True North owns 30 to 80 percent stake in various businesses and employs a management team where it has majority control. Sehgal explains, “There are a lot of businesses we are able to attract and build, and because of that a lot of CEOs respect us. They know we are not just Excel spreadsheet pushers… that becomes a huge competitive advantage.”

Usually funds tend to exit their investments in four-five years. But there have been cases where True North has stayed invested for longer. “It is a little bit of a core of what defines us on how we create admired businesses and nurture a business… so we don’t think two years, three years, we are building a business with a 5-10-year horizon, as if we are permanent shareholders,” explains Nevatia.

True North does most transactions in its core sectors, but it is now eyeing a piece of the technology market. As a first step, the fund is working closely with Prasad Thrikutam, who had senior leadership roles at Infosys and Dell, among others. “Prasad and the True North team will work for 1-2 years and get to know each other. If both of us are happy, Prasad would join as full-time partner at True North,” explains Nevatia.

The fund now plans to change the way it raises funds, at least domestically. True North’s domestic investor pool stands at around 10 percent.

It aims to build one-third of its fund from India and the remaining from foreign relationships. “We are far away from there, but have started making an effort. We believe Indian investors understand the asset class and there is demand for it,” adds Nevatia.

Apart from adding new core areas, the firm wants to grow into a multi-asset management platform. Over the next three to five years, it plans to launch other products. “Initially, our plan is to launch an Impact Fund and follow that up with a Structured Credit Fund,” says Nevatia.

“Our dream is when we sell the business, we can sell it right. That we are a company that’s so well built… we disclose everything in such a transparent manner that when I show you those numbers, you believe them and buy the company… that’s the journey and the brand name we are working towards. That’s the aim,” says Sehgal.

First Published: Oct 15, 2019, 10:05

Subscribe Now