Air India: Arvind Jadhav took charge of Air India in 2009. But the airlines woes

Arvind Jadhav took charge as the national carrier's chief in 2009 and set in motion a turnaround plan, but there was no end to the airline's woes

He seemed to have a magic bullet. Or at least that’s what the then-Indian government thought shortly after he made a presentation to them.

Why else was there a desperate attempt by the government to appoint Arvind Jadhav as the head of National Aviation Company of India Limited, the company that owned Air India, at a time when the Election Commission’s Code of Conduct had kicked in, and the Manmohan Singh government’s first tenure was coming to a close.

Jadhav, a sharpshooting bureaucrat from the Karnataka cadre, had already built up a reputation as a hard taskmaster and took charge as Air India’s chief on May 4, 2009. He quickly set in motion a plan to turn around the troubled fortunes of Air India in 36 months, which would see the airline rationalise routes, capacities and even rethink purchasing new aircraft. Air India’s low-cost arm, Air India Express, was also set to start domestic operations in a market that had gravitated towards low-cost airlines.

While the plan to offer low-cost operations in the domestic market materialised, and the airline began to see some turnaround within a year, Jadhav’s term was riddled with run-ins with the staff, leading to three major strikes, including a 10-day strike by the pilots seeking Jadhav’s ouster. By the time he was sacked in 2011, Air India’s debt grew to ₹43,000 crore, from ₹16,000 crore in 2009.

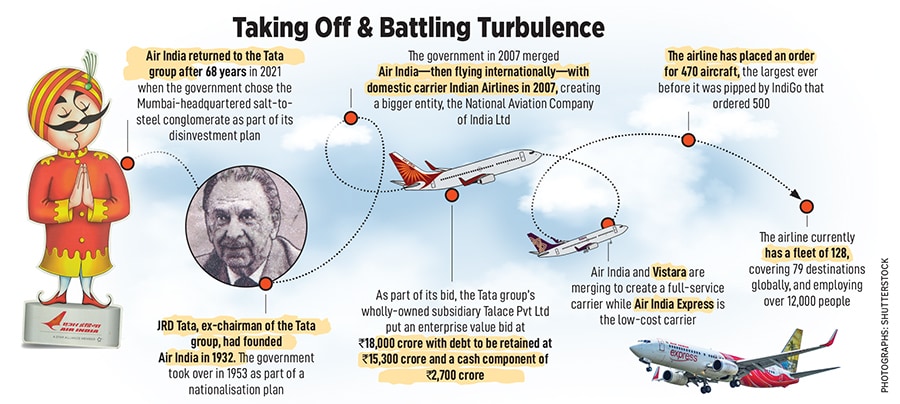

Of course, the blame for the crisis isn’t entirely Jadhav’s alone. Much of that is largely due to an ill-timed move by the government in 2007 when it merged Air India—then flying internationally—with domestic carrier Indian Airlines, creating a bigger entity, the National Aviation Company of India Ltd. Both Air India and Indian Airlines were making losses at that time, bleeding ₹541 crore and ₹240 crore, respectively, in 2007.

The merged company had more than 30,000 employees—256 per plane—in 2007, twice the global norm. That meant the company was spending almost one-fifth of its revenue on employee pay and benefits while other airlines traditionally spend only about one-tenth. Besides, the 2008 global economic collapse threw operational expenses out of gear as oil prices skyrocketed. As more private airlines took to flying on routes that once belonged to Air India, business plummeted. That meant, over time, the airline racked up debt, which stood at ₹60,000 crore by August 2021 and was steadily losing money on operations. In effect, it had become a white elephant.

Since coming to power in 2014, the Narendra Modi government has made multiple attempts to sell the airline to private companies, before managing to complete the process in October 2021. The Tata group, which had ceded control half a century ago, was quick to throw in its towel, and its wholly-owned subsidiary Talace Pvt Ltd put an enterprise value (EV) bid at ₹18,000 crore with debt to be retained at ₹15,300 crore and a cash component of ₹2,700 crore. Tata’s bid was higher than the Ajay Singh-led consortia’s EV bid at ₹15,100 crore. The Tatas took 100 percent control of Air India, the low-cost carrier AI Express, and Air India’s 50 percent stake in ground handling firm AI-SATS.

A plan to transform was brought in quickly, with the Tatas appointing Singapore Airlines veteran Campbell Wilson, who referred to the turnaround as a Test match in an era of T20 matches. The airline has a five-year plan titled Vihaan.ai, which translates to the dawn of a new era in Sanskrit. The airline has set itself clear milestones focussed on growing its network and fleet, developing a revamped customer proposition, improving reliability and on-time performance, and taking a leadership position in technology, sustainability and innovation, while aggressively hiring industry talent. It is close to cornering 30 percent of the domestic market, a target it had set to complete by 2026.

Now, since the acquisition, the Tata group is busy merging another group-owned airline, Vistara with Air India, while AirAsia India, which it owned, has been merged with Air India Express to create two airlines, a low-cost and a full-service one. It has also placed orders for 470 aircraft, which is expected to help the airline fly back into its once-lost glory.

First Published: May 31, 2024, 12:07

Subscribe Now