ICICI Bank's accidental heir

Sandeep Bakhshi's appointment as COO may not stop the chatter against Chanda Kochhar, but it will allow ICICI Bank to focus on its core business

Sandeep Bakhshi, COO, ICICI Bank

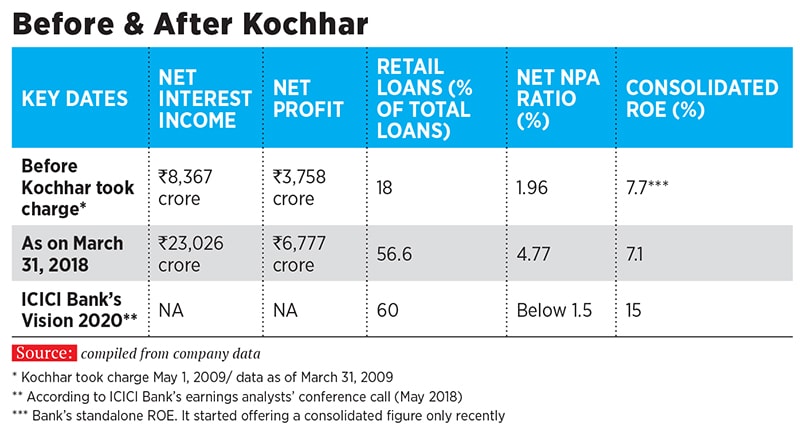

Image: Abhijit Bhatlekar / Mint Via Getty ImagesJune 18, 2018, could well become a defining date in the history of ICICI Bank. With CEO Chanda Kochhar going on leave to allow an independent investigation into charges of impropriety levelled against her, the bank’s board created a new post, appointing Sandeep Bakhshi as chief operating officer (COO). An ICICI group veteran of 32 years, Bakhshi—he was managing director and CEO of ICICI Prudential Life Insurance since August 1, 2010—is seen as Kochhar’s heir apparent.

Kochhar, 56, has been in exile since June 1, until an internal inquiry into allegations of quid pro quo against her and her family for loans made by the bank to Videocon Industries in 2012 gives its report. In May, market regulator Securities and Exchange Board of India (Sebi) issued a show cause notice against Kochhar and ICICI Bank for violating the bank’s code of conduct by not making necessary disclosures. Sebi may even initiate an adjudication process against the bank.

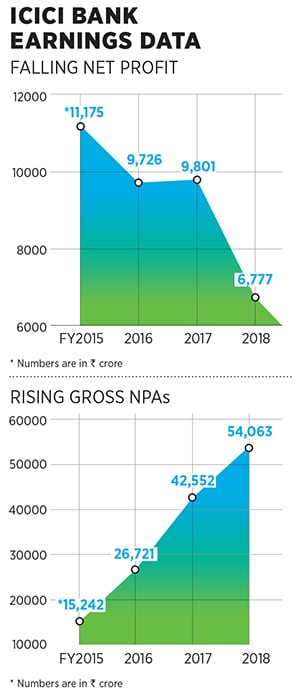

In such turbulent times—which includes corporate governance issues, questions around leadership, and rising levels of non-performing assets (NPAs)—Bakhshi’s entry may not be the panacea the bank is looking for. It has little to do with the 57-year-old himself, and is more about how the board of India’s largest private lender has dealt with the crisis the bank has lost much of its sheen and reputation.

Fence-sitting

The board chose to walk a tightrope by trying to ensure a high level of governance and transparency to shareholders, while backing its popular CEO, who had charted a new growth path for the bank since the 2008 global financial crisis.  Analysts, corporate governance experts and former bankers Forbes India spoke to say the board has failed on several fronts. They cite the lack of proper communication to shareholders and investors relating to the investigation—they have had to rely on press releases or sparse comments—and the board’s inability to arrive at a clear decision on whether to carry out a probe against Kochhar action from Sebi and media pressure prompted a turnaround.

Analysts, corporate governance experts and former bankers Forbes India spoke to say the board has failed on several fronts. They cite the lack of proper communication to shareholders and investors relating to the investigation—they have had to rely on press releases or sparse comments—and the board’s inability to arrive at a clear decision on whether to carry out a probe against Kochhar action from Sebi and media pressure prompted a turnaround.

“By getting an insider as COO, there lurks the possibility of Sandeep Bakhshi succeeding Kochhar which must be resisted by shareholders and the regulator as an outsider is required to do a thorough clean-up at the bank,” says Hemindra Hazari, an independent banking analyst who publishes his writings on Singapore-based research platform Smartkarma.

The consensus is that the board has acted late in initiating action against Kochhar. If one sees the language of its [June 18] press release, it indicates that she [Kochhar] is stepping aside the board has not asked her to do so.

The biggest challenge for Bakhshi, says a banking analyst with a foreign brokerage firm on condition of anonymity, will be to regain the trust of investors. “What was worrisome was how the board reacted when the interest of some stakeholders and investors was in question. That does not augur well for the future.”

Experts believe the bank has created an unnecessary role by making Bakhshi COO for the next five years, alongside CEO Kochhar whose term ends in March 2019. Bakhshi will report to Kochhar the bank’s executive directors will be answerable to him. He will also report directly to the board of directors till the investigation is complete.

ICICI Bank declined to speak to Forbes India for this article.

Chanda Kochhar has been in exile since June 1

Image: Vikas KhotTurbulent times

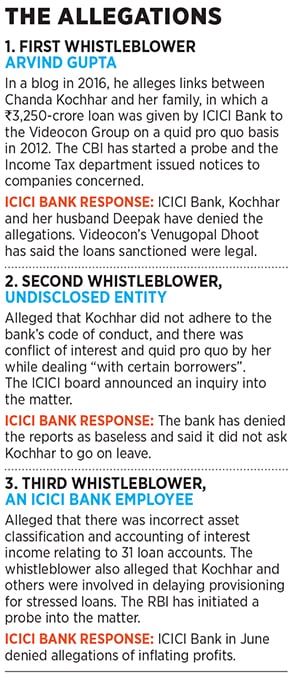

Kochhar, who became CEO in 2009, is yet to recover from the allegations from three independent whistleblowers. The first came from shareholder Arvind Gupta in his blog in 2016, in which he alleged impropriety, suggesting a case of quid pro quo against Kochhar in return for a `3,250 crore loan from the bank to the Videocon Group in 2012.

Deepak Kochhar, the CEO’s husband, is believed to have business dealings, through a firm NuPower Renewables, with Venugopal Dhoot, Videocon’s promoter. Gupta alleged that Videocon invested in NuPower an amount that is 10 percent of the loan it got from ICICI Bank. In 2017, the loan turned into an NPA.

ICICI Bank has admitted that Kochhar was part of the credit committee meeting that evaluated the loan to Videocon in 2012. She has denied any wrongdoing.

For months after the allegation, ICICI Bank backed Kochhar. In March, it even rejected the need for an internal audit to see if all processes had been followed while sanctioning the loan. In a statement to the stock exchanges in March, the bank wrote that it came “to the conclusion that there is no question of any quid pro quo/nepotism/conflict of interest as is being alleged in various rumours”.However, in April, MK Sharma, the bank’s former non-executive chairman met top mutual fund houses and institutional investors to send across a message that the institution is bigger than one individual, which seemed to indicate that the board was beginning to rethink the issue. The bank on June 29 appointed former bureaucrat Girish Chandra Chaturvedi as its non-executive part-time chairman, starting July 1.

The controversy snowballed after another allegation came from an anonymous whistleblower in May. He highlighted impropriety on Kochhar’s part, and said the bank did not adhere to its code of conduct relating to transactions with some borrowers. ICICI Bank responded by saying it would carry out an independent inquiry, separate from the one being carried out by the Central Bureau of Investigation (CBI). The CBI has, since March-end, started to gather information and material to determine if a case can be made against Kochhar.

Media reports say former Supreme Court judge BN Srikrishna will examine the allegations against Kochhar. “The bank should have constituted an independent inquiry much earlier. The time frame and the parameters of the investigation are yet to be specified,” says Shriram Subramanian, founder and MD of InGovern Research, a proxy advisory firm. Subramanian points out that ICICI Bank has not clarified their course of action if Kochhar’s term ends before the probe is completed.

The bank was hit by allegations from a third whistleblower—an ICICI Bank employee—in March 2018, but it was disclosed only in June. The charges were of incorrect accounting of interest income in 31 loan accounts, which the bank has termed “false”. The whistleblower also raised more serious charges that the bank inflated profits by $1.3 billion over eight years by delaying provisioning for bad loans, and that Kochhar and executive director Vijay Chandok breached rules to classify these loans as bad. The bank has denied this as well.

ICICI Bank’s stock is down by 12.27 percent year-to-date, but surprisingly, it has risen each time news or events viewed as negative for Kochhar emerged. For instance, when news broke on May 30 that the ICICI Bank board will probe the Videocon deal, the bank’s stock rose to `289.5 at the BSE on June 1 from `285.25 the previous day.

Ray of hope

The appointment of Bakhshi as COO, say experts, will help the bank focus on banking issues. Tarun Chugh, managing director and CEO of Bajaj Allianz Life Insurance, who knows Bakhshi since 2001, is full of praise for him. “There were so many instances when he would be the first at meetings, completely calm and composed, armed with MIS, data which no one else had, relating to performance of peers, market share, products and fee structures,” says Chugh, who worked under Bakhshi at ICICI Prudential Life Insurance. “He never gets ruffled and does not lose sight of the wood for the trees.” Bakhshi’s approach is also likely to be different from Kochhar’s. “He is more customer-centric he breaks down complex problems and is focussed on strengthening technology,” adds Chugh.

Bakhshi’s approach is also likely to be different from Kochhar’s. “He is more customer-centric he breaks down complex problems and is focussed on strengthening technology,” adds Chugh.

Kochhar was seen as providing the vision for the bank, first in the 1990s, when she was involved in building the infrastructure industry group of the bank, surrounding lending to power and telecom businesses. In the 2000s, she focussed on building the retail business, besides technology and innovation and distribution channels across India and overseas.

The banking circle seems enthused with Bakhshi’s choice. “He is outstanding and would have been my top pick anyway. The speculation surrounding Kochhar’s role at the bank will subside… she will exit,” says a former ICICI Bank chairman, who has mentored both Kochhar and Axis Bank CEO Shikha Sharma in previous decades. “Bakhshi will take care of the bank, but I am disappointed with the board… it is lacklustre and needs to be strengthened.”

The veteran banker adds that he is “disappointed” with Kochhar, without elaborating further. “But I will still wait for the probe to be complete before making an assessment,” he says, adding that she did the right thing by not resigning. “If she had left, it would have meant admission of guilt.”

InGovern’s Subramanian says if the investigations clear the CEO of any wrongdoing, it would be fine if she came back to lead the bank. However, even if Kochhar were to be exonerated and her term comes up for renewal in March-end 2019, it may not be easy for her to stage a comeback. The Reserve Bank of India (RBI) has been unbending in its approach to ensure improved corporate governance at banks, in view of massive irregularities seen across several banks.

After the Axis Bank board cleared the way for Sharma’s fourth term, the RBI asked it to reconsider its decision. Sharma has told the bank that her tenure will be curtailed to December 31, 2018, from May 2021. Though no allegations have been made against Sharma, the bank has, since late 2016, been hit by reports of illegal practices by some branch staff during demonetisation, divergence in the assessment and reportage of bad loans against that of the RBI, and weakening asset quality.

This is where Bakhshi, who has had a strong and unsoiled career, could emerge winner. ICICI Bank’s board will hopefully revert to a two-tier system, where the executive directors report to Bakhshi, instead of the current three-tier system.

Nilanjan Karfa, analyst at Jefferies India Private Limited, is confident about the bank’s medium-term outlook, “given gradual improvement in the operating environment coupled with the arrest of fresh non-performing liabilities formation, and cheaper valuations”.

India’s economic growth is yet to pick up, with GDP at 6.7 percent in FY18. Factors such as rising oil prices and inflation, and the slow pace of private sector investments could mean that growth is unlikely to jump in FY19. With corporate lending not picking up, ICICI Bank will have to depend on its strength, retail banking, to boost earnings growth. The bank has indicated that retail loans will continue to grow and form a greater portion of the total loan book by 2020.

Bakhshi has his work cut out, but the board needs to support him. If ever there was a learning from the entire Kochhar-Videocon controversy, it is that the priority of the board, in every case, should be towards shareholders, and not the CEO.

First Published: Jul 02, 2018, 11:14

Subscribe Now