She adds: “As an investment banker, I have seen companies go up and down. Only companies that create long-term sustainable value for shareholders, customers and everyone in the ecosystem survive and thrive."

It’s a philosophy Nayar draws from her innings as an entrepreneur as well. Consider that since the IPO last October, Nykaa’s market capitalisation has dropped from ₹1 lakh crore to ₹53,540.46 crore. Analysts believe this to be a result of the general market sentiment, including the tech stocks meltdown a few also feel the stock is overvalued. According to Screener.in, Nykaa was trading at a price to sales ratio of 12 and price to earnings ratio of 1,212 at the time of writing this article.

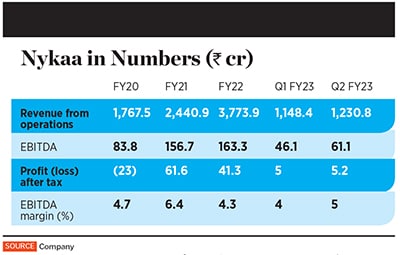

Despite market conditions, the Q2 FY23 result is an indication of Nykaa being on the growth trajectory. Nykaa’s latest quarterly results stated a 39 percent year-on-year increase in its quarterly revenue from operations to ₹1,230.8 crore, while its September quarter net profit saw a 344 percent year-on-year growth, at ₹5.2 crore.

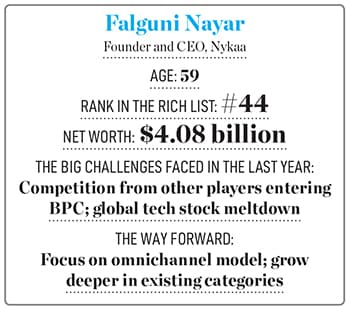

Nayar founded the company in 2012 from her father’s office, as a retailer of beauty products. Later it went on to expand into further verticals, including Nykaa Fashion, Nykaa Man, the offline vertical and many more. In November 2021, the ₹5,352-crore IPO of Nayar’s FSN E-Commerce Ventures Ltd was oversubscribed nearly 82.5 times. On the same day, the company’s market capitalisation touched the ₹1 lakh crore mark. At rank 44 with a net worth of $4.08 billion, Nayar is now a new entrant to the 2022 Forbes India Rich List.![]()

“We think of the IPO as one step along the journey," says Adwaita Nayar, Falguni’s daughter and CEO, Nykaa Fashion. “It was a growing up moment for us as a company, but we definitely feel that it’s still very much the beginning when we think of Nykaa’s trajectory. So it still feels like Day 1 and there’s a lot more to do."

In its Q2 FY23 financial reports, the company also stated that its Ebitda improved to ₹61.1 crore, as compared to ₹28.8 crore in the year-ago period. Gross margins improved to 45.3 percent versus 42.7 percent in Q2 FY22 and Ebitda margin improved to 5 percent versus 3.3 percent in Q2 FY22.

However, right before the quarterly results were announced, the shares saw a non-stop hammering for a fortnight. FSN E-Commerce Ventures share prices were down by over 20 percent, causing Nayar to lose $1 billion in 15 days. “Apart from the tech stocks meltdown globally, this could be due to the mandatory one year lock-in of pre-IPO investors that expired on November 10," explains Karan Taurani, senior vice president, Elara Capital. “Another reason for panic selling by investors," he says, “could be the quarterly results were expected to be announced soon. Given the high competition from players such Ajio and Myntra, who are now entering the beauty and personal care (BPC) space, investors probably didn’t expect the company to grow as well as it has."

![]() Now, with a stellar performance this quarter, can one assume that investors can regain their trust in Nykaa? Taurani adds, “Yes, most definitely. I am extremely bullish on the company, its profit growth is phenomenal. Even after the lock-in period, I don’t foresee a massive drop, since the promoter holding is fairly large as compared to many tech companies. Only 35 percent of its shares are expected to go through a lock-in expiry."

Now, with a stellar performance this quarter, can one assume that investors can regain their trust in Nykaa? Taurani adds, “Yes, most definitely. I am extremely bullish on the company, its profit growth is phenomenal. Even after the lock-in period, I don’t foresee a massive drop, since the promoter holding is fairly large as compared to many tech companies. Only 35 percent of its shares are expected to go through a lock-in expiry."

As compared to many tech stocks such as Zomato and Paytm that listed around the same time, Nykaa has been faring well. “Nykaa is one of the few profitable new-age companies. It has also built a sustainable moat—driven by pillars of AAE: Authenticity that it guarantees via an inventory model assortment, with the largest collection across platforms engagement from significant content investment, which has transformed it into a lifestyle platform too," says Abneesh Roy, head of research committee, Nuvama Research.

Right on track

In 2015, Nykaa launched its beauty brand, with products in areas where it saw certain market gaps in terms of price points. First came nail enamels, and then some bath and body products. After launching a few products, the company roped in Reena Chhabra, then COO at Colorbar, to head Nykaa’s private label for beauty.

![]() The company has expanded to several verticals: Nykaa Beauty—ecommerce, physical retail stores and private labels Nykaa Fashion the eB2B platform SuperStore by Nykaa and Nykaa Man. In October, Nykaa entered into a strategic alliance with Middle East-based Apparel Group to expand into the Gulf countries to build multi-brand omnichannel beauty retail operations.

The company has expanded to several verticals: Nykaa Beauty—ecommerce, physical retail stores and private labels Nykaa Fashion the eB2B platform SuperStore by Nykaa and Nykaa Man. In October, Nykaa entered into a strategic alliance with Middle East-based Apparel Group to expand into the Gulf countries to build multi-brand omnichannel beauty retail operations.

Within Beauty and Fashion, in-house brands have risen to 10 and 11, respectively. Acquired brands such as Dot & Key, Earth Rhythm, Kica, LBB, Nudge Wellness and many more have played a key role in driving the company’s growth. BPC and Fashion are highly competitive segments, making it key for Nykaa to hedge its bets.

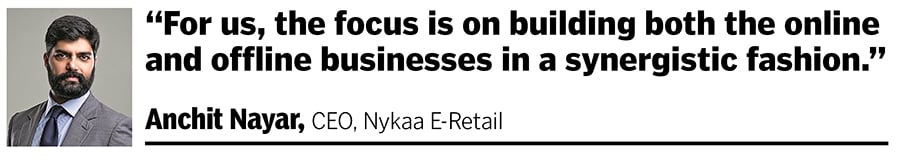

“We have a good understanding of what the consumer is looking for in India," says Anchit Nayar, Nayar’s son and CEO of Nykaa E-Retail. “It allows us to identify certain brands that are young and early on in their journey and where we think Nykaa can really add value in scaling these brands. We look for passionate and innovative founders with high quality products."

Private labels are a way for the Nykaa team, both Beauty and Fashion, to address gaps in the market. These also help Nykaa stand out from other players in the market, including the likes of Ajio and Tata Cliq, who are also moving into the BPC segment. Nykaa has brought some of the largest international brands to India, including The Ordinary, Anomaly, Huda Beauty and Charlotte Tilbury, that sell exclusively on Nykaa.

In 2019, Nykaa, along with Bollywood actor Katrina Kaif, launched Kay Beauty. Kaif, who has now worked closely with Nayar and her team, says, “It was really surprising to see that the team is constantly searching for the latest trends in the beauty industry. It allows Nykaa to stay ahead of the trends, the team is already working on the trends of the future." Currently, Kay Beauty is trending at the annualised GMV (gross merchandise value) run rate of more than ₹100 crore within a short span of three years.

“This company has beautifully transformed towards personal care. Pre-Covid, they had a huge share in terms of beauty and coloured cosmetics. The shift to personal care also helped increase frequency of customers and a higher conversion ratio," says Taurani. Monthly average unique visitors increased from 13.5 million in FY21 to 20.8 million in FY22 and number of orders increased from 17.1 million in FY21 to 27 million in FY22 for beauty and personal care, even though average order value has dropped by 5 percent to ₹1,864 in FY22.

![]()

Focus on sustainability

From the very beginning, Nayar put together a business model that was sustainable and scalable. Back in 2012, Amazon was seen as its biggest competitor, yet the company chose to go with an inventory-based model over a marketplace, which helped it with superior delivery timelines and customer experience. The second was brand-funded sales—only if the brand partner wishes to offer discounts is it passed on to consumers. “At every point, we were not afraid to take decisions that were different," says Nayar.

![]() The company’s revenue model works mostly on the margins it earns by selling every product. Once brands are launched on Nykaa, they get access to millions of customers from day one. End-to-end marketing, including digital ads, influencer marketing, educational content creation, is taken care of by Nykaa. In FY22, Nykaa spent ₹478.1 crore for marketing and advertising and ₹14 crore was paid to influencers and bloggers, as per the annual report. Though brand building and customer acquisition is a focus for the management, Adwaita says, “Marketing cost tends to go down as repeat behaviour goes up." For fashion and beauty, the repeat customer rate has been going up.

The company’s revenue model works mostly on the margins it earns by selling every product. Once brands are launched on Nykaa, they get access to millions of customers from day one. End-to-end marketing, including digital ads, influencer marketing, educational content creation, is taken care of by Nykaa. In FY22, Nykaa spent ₹478.1 crore for marketing and advertising and ₹14 crore was paid to influencers and bloggers, as per the annual report. Though brand building and customer acquisition is a focus for the management, Adwaita says, “Marketing cost tends to go down as repeat behaviour goes up." For fashion and beauty, the repeat customer rate has been going up.

Nayar’s focus was never driven by achieving a certain GMV or valuation. “If you’re focussed on giving the best [product and experience] to your consumer and you are driven by passion, I don’t think you need to look anywhere. Your customers will take you way ahead of the competition," she says.

After the pandemic, omni-channel has been the way forward. Nykaa BPC has expanded its store footprint by opening nine new stores in Q2 FY23, taking the total count to 121 in 53 cities—as Nykaa Luxe, Nykaa On Trend and Nykaa Kiosks. It is targeting close to 300 stores in the next two years over 100 cities. “Post-Covid, our accelerated investments in new store rollouts as well as store upgradation have resulted in improved footfalls and higher same-store sales," said Nayar. Even Nykaa Fashion has launched one new physical multi-brand store and has also opened one store for its lingerie brand Nykd by Nykaa, and will be opening more.

Anchit believes that Nykaa has been a true omnichannel retailer for a few years now. He says, “Ninety percent of retail in India is still offline, and we don’t see it as an online versus offline equation. For us, the focus is on building both the online and offline businesses in a synergistic fashion. Our ambition is to be in 100 cities for physical stores through the next couple of years."

Fashion, game on

Nykaa Fashion was launched in 2018 in an extremely competitive market. But thanks to its premium customers and private labels, the vertical has differentiated itself with over 1,500 brands on its platform. Nykaa Fashion now has a global store, which features over 400 brands. In a few months since the launch, it accounts for almost 13 percent of the western wear business. Unlike beauty, Nykaa Fashion runs as a marketplace model.

![]() A Nykaa Fashion store at Ambience Mall, Gurugram

A Nykaa Fashion store at Ambience Mall, Gurugram

After the drop in demand during the pandemic, the fashion market in India is projected to recover strongly and grow at 18 percent CAGR over the next five years to reach ₹870.2 crore by 2025. Adwaita is confident, “We think fashion could be 5-6x the size of the beauty market and we feel that in any mature consumption economy, multiple platforms can exist. We do feel there are gaps, so we’ve identified a positioning that works for us and the consumer—which is to be a premium, curated, trend and fashion-focussed platform." The plan is to chase the price sweet spot of ₹3,000-4,000 in average order value.

“Our focus on curation and discovery in Fashion is evident, as new season merchandise accounted for 24 percent of Nykaa Fashion GMV international brands are at 13 percent of western wear category GMV in Q2 FY23. Repeat buyers in fashion now contribute 66 percent of Q2 FY23 GMV, giving us confidence in our product proposition," said Nayar.

Though this was a quarter that saw the festive season, the fashion vertical of the business is yet to turn profitable. But the management is in no rush. During the analyst conference call, Adwaita addressed concerns on low net sales volume (NSV) growth year-over-year. She said, “It’s easy to grow a lot faster, but we are taking a more measured and thoughtful approach. Even though fashion is a large market, we want a particular figure that makes sense to the Nykaa DNA and the Nykaa strategy—which is to build sustainable businesses, with a clear path to profitability." Nykaa Fashion has seen an increase of 25 percent in average order value from ₹2,739 in FY21 to ₹3,420 in FY22. Number of orders grew from 2.4 million to 5.2 million in FY22 and revenue also grew by 126 percent to ₹325.4 crore.

“Unlike the BPC segment, fashion has a curation-focussed niche positioning. Though it might achieve limited scale, it does offer a potential path to profitability, which might be a significant value driver," believes Roy. Monthly visitors stayed flat at 16 million since Q2 FY22, but orders dipped by 2 percent quarter-over-quarter.

Check out the complete lndia"s 100 Richest 2022 list

Other segments

The e-B2B Superstore was launched in April 2021 to reduce dependence on the physical retail format. “I’m not sure of the prospects of the B2B business, but going forward, it should not be making exorbitant losses, else it will hurt the overall valuation," adds Taurani.

Analysts believe that keeping the BPC segment at its core, Nykaa needs to continue expanding its physical stores. “While competition remains intense and increasing, Nykaa’s focus, via an exclusive vertical platform along with scale, has created a virtuous cycle to help sustain market share," says Roy. Sustainability and doing better every day remain at the core of the company.

When it comes to vision, Adwaita says, “We would love to create a household lifestyle brand that resonates with Indian consumers in the long run." The team hopes to continue delivering both in terms of financials and quality.

Now, with a stellar performance this quarter, can one assume that investors can regain their trust in Nykaa? Taurani adds, “Yes, most definitely. I am extremely bullish on the company, its profit growth is phenomenal. Even after the lock-in period, I don’t foresee a massive drop, since the promoter holding is fairly large as compared to many tech companies. Only 35 percent of its shares are expected to go through a lock-in expiry."

Now, with a stellar performance this quarter, can one assume that investors can regain their trust in Nykaa? Taurani adds, “Yes, most definitely. I am extremely bullish on the company, its profit growth is phenomenal. Even after the lock-in period, I don’t foresee a massive drop, since the promoter holding is fairly large as compared to many tech companies. Only 35 percent of its shares are expected to go through a lock-in expiry." The company has expanded to several verticals: Nykaa Beauty—ecommerce, physical retail stores and private labels Nykaa Fashion the eB2B platform SuperStore by Nykaa and Nykaa Man. In October, Nykaa entered into a strategic alliance with Middle East-based Apparel Group to expand into the Gulf countries to build multi-brand omnichannel beauty retail operations.

The company has expanded to several verticals: Nykaa Beauty—ecommerce, physical retail stores and private labels Nykaa Fashion the eB2B platform SuperStore by Nykaa and Nykaa Man. In October, Nykaa entered into a strategic alliance with Middle East-based Apparel Group to expand into the Gulf countries to build multi-brand omnichannel beauty retail operations.

The company’s revenue model works mostly on the margins it earns by selling every product. Once brands are launched on Nykaa, they get access to millions of customers from day one. End-to-end marketing, including digital ads, influencer marketing, educational content creation, is taken care of by Nykaa. In FY22, Nykaa spent ₹478.1 crore for marketing and advertising and ₹14 crore was paid to influencers and bloggers, as per the annual report. Though brand building and customer acquisition is a focus for the management, Adwaita says, “Marketing cost tends to go down as repeat behaviour goes up." For fashion and beauty, the repeat customer rate has been going up.

The company’s revenue model works mostly on the margins it earns by selling every product. Once brands are launched on Nykaa, they get access to millions of customers from day one. End-to-end marketing, including digital ads, influencer marketing, educational content creation, is taken care of by Nykaa. In FY22, Nykaa spent ₹478.1 crore for marketing and advertising and ₹14 crore was paid to influencers and bloggers, as per the annual report. Though brand building and customer acquisition is a focus for the management, Adwaita says, “Marketing cost tends to go down as repeat behaviour goes up." For fashion and beauty, the repeat customer rate has been going up.