Profitability improves for banks, but deeper concerns remain

The numbers show that several issues should worry banks ahead of the festive season, which raises hopes for revival in consumer demand and demand for loans

Illustration: Chaitanya Dinesh Surpur[br]It was believed that in 2019 banks would break out from the vice-type grip of non-performing assets (NPAs). All Indian banks, particularly state-owned ones, had been struggling to get out of it for the past five years. In pure NPA terms, the June-ended FY20 earnings seem to indicate this has happened.

Illustration: Chaitanya Dinesh Surpur[br]It was believed that in 2019 banks would break out from the vice-type grip of non-performing assets (NPAs). All Indian banks, particularly state-owned ones, had been struggling to get out of it for the past five years. In pure NPA terms, the June-ended FY20 earnings seem to indicate this has happened.

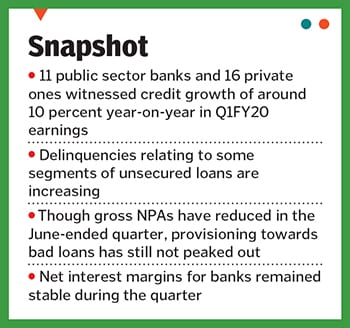

While this spells good news, a deeper look at the numbers shows that there are several issues that banks need to be worried about. This is crucial as the economy gears up for the festive season, which raises hopes for revival in consumer demand and demand for loans.

Banks in India are focusing on retail lending since corporate lending activity has struggled. Reserve Bank of India (RBI) data shows that household debt is surging. Personal loans and credit cards outstanding rose by 58 percent to ₹720.5 crore as of June 21 compared to ₹454 crore two years ago, according to RBI data.

“Some pockets of unsecured lending could see a rise in delinquencies,” says Rakesh Kumar, senior vice president and BFSI analyst at Elara Capital. Borrowing which could get delinquent for 30-90 days has gone up by 50 basis points since March 2019. Overall retail lending delinquency for 91-180 days has gone up by 8 basis points to 0.91 percent, according to Parijat Garg, senior vice president, CRIF High Mark, a credit information bureau.

Banks, however, are likely to focus on unsecured lending, considering that industrial capex is likely to remain moderate given weak demand. Also private sector capex towards brownfield and green field projects is unlikely to pick up during this fiscal, says Kumar.

Another concern is that provisioning for bad loans is unlikely to have peaked out. For public sector units, the provisioning coverage ratio is about 55 percent in some cases and 70 percent for some private banks. In Q1FY20, public sector banks grew by around 5 percent year-on-year.

First Published: Aug 13, 2019, 09:28

Subscribe Now