Fintechs in India started as payment processors and payment gateways and the natural evolution was the credit space—direct to consumer or SME lending.

The Unified Payments Interface (UPI) continues to be a game changer for India. Payments, be it consumer or B2B-focussed, is the foundation, and many more products and solutions are built on top. “India’s payment ecosystem is really far ahead of almost every country you can think of in payments. We currently have more than 300 million users of UPI irrespective of income class, location and mobile software they use," says Anuvrat Jain, vice president at venture capital firm Lightspeed, who works in the growth investment team.

While market share, topline growth and consumer visibility was what entrepreneurs swore by, profitability is the mantra they cannot ignore now. FY23 data shows that only 10 out of 24 fintech unicorns were profitable. The list of loss-making heavyweights includes Slice, Yubi, Acko, PhonePe and Groww.

The dreadful truth that all fintechs saw over the past 15 years is that the engines of growth—payment gateways, wallets and last-mile inclusion—were critical to the business but technology expansion caused them to bleed and UPI’s success has meant that fintechs cannot generate revenue while assisting the transaction.

In terms of products, fintechs often offered plain vanilla products, like travel, term insurance, small-ticket loans and health insurance. If profitability and monetisation of business is a given, the existing business models need to be tweaked. That will mean fintechs will need to continue to lend more aggressively, with or without banks.

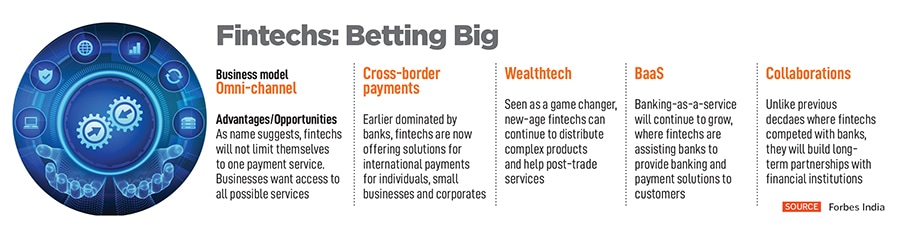

Omni-channel: Those who have adopted omi-channel payments platforms hold the chance to emerge winners in coming years. Some fintechs such a Phi Commerce, an Indian SaaS-based company, took its omni-channel model international. The fintech is likely to finalise its first deal with a large payment processor outside of India, having opened office in Singapore. “Payment channels have often operated in silos. An integrated platform is what businesses want. Also one does not get a complete 360° view of the consumer payment behaviour," Jose Thattil, CEO and co-founder of Phi Commerce, tells Forbes India.

Phi Commerce is on course to achieve $20 million revenue this year and is currently pursuing business in India, ASEAN and Middle East markets.

Innoviti Technologies is a fintech that has collaborated with RBL Bank to create an omni-channel payments platform called Omnium. Innoviti is one of India’s largest payments-based SaaS tools company for enterprises and their SME channel partners. Omnium will help retailers to integrate their business processes across HR, ERP and marketing platforms with payments to enable a precise measurement of their impact.

Ankur Saxena, senior director and head of sales at US-listed ACI Worldwide, a real-time payments software firm which works with banks across the globe, is betting big on wealthtech and cross-border payments as models for growth. ACI Worldwide’s CEO Thomas Warsop has expressed bullishness on the scope for making cross-border payments easier in India. “Fintechs are also on the right route while choosing being omni-channel. You cannot have just one payment service," says Saxena.

![]()

Banking-as-a-Service (BaaS): Some BaaS providers offer services like card issuing, personal financing, easy lending and pay-outs, while others would be involved with opening of a new fixed deposit, change in addresses. “It enhances customer acquisition and touchpoint for the fintech," says Bhavik Hathi, managing director of Alvarez & Marsal’s global transaction advisory group.

Razorpay, one of the biggest and the best functioning payment fintechs in India, has started to build sophisticated tools to assist better business. “RazorpayX provides other banking and ancillary solutions on top, which help generate a substantial amount of transaction volume," says Lightspeed’s Jain. Razorpay’s business model is like office of the CFO kind of suite. Many D2C brands, SMBs, mid-market companies and even enterprises, use Razorpay for their payroll, collections, paying taxes and payments.

BaaS forms part of the fintech infrastructure which companies are starting to build. Lentra is one such firm, which has hooked up with several banks and NBFCs in India—HDFC Bank, Federal Bank, IDFC First Bank, Standard Chartered Bank among others —from KYC and compliance to small-ticket lending, onboarding of customers, servicing and collections.

But Lentra, which raised $27 million through a Series B funding in 2023 led by MUFG Bank and Dhanara Capital has started to layoff people, as part of its restructuring.

We could, however, continue to see consolidation in the fintech lending space. In January, DMI Finance acquired buy now pay later (BNPL)-focussed startup ZestMoney. It is believed to have an outstanding loan book of around Rs. 400 crore, according to media reports.

Wealthtech: This is emerging as the next big business model for fintechs and possibly one which holds the strongest hope to monetise. The optimism is backed by the wealth management data for India. Julius Baer, the largest foreign private bank in India, is bullish, maintaining India as one of its main core markets. Julius Baer’s India CEO Umang Papneja, on the company website says 50 percent of India’s resident wealth is concentrated in five cities 10-15 percent in the next five and another 15-20 percent in the next 20 cities. “The newly created wealth is expected to grow particularly in the small centres rebalancing the overall distribution," Papneja says.

Wealthtech will mean distribution, post-trade and back office services for the wealthy. “Wealthtech is creating value for customers, but it is at a nascent stage in India. It is only a matter of time before complex products will be sold," Alvarez’s Hathi says.

In earlier decades, wealthtech in its rawest form had expanded in India with players such as ICICI Securities, followed by IIFL Wealth, Kotak Private, Anand Rathi and others. Now Zerodha and Groww are offering new-age financial wealth solutions to the tech-savvy.

Cross-border payments: “There has to be a massive cross collaboration between banks, regulator and big forex houses for this segment to be a success," says Jain. Every transaction in the cross border has this aspect of FX (foreign exchange/forex) across multiple currencies. The more volume you generate the better forex rate you can offer to a customer. And the better forex you offer to a customer, it improves the firm’s propensity to make better margin.

This is again a segment where the RBI is likely to actively regulate payment aggregators-cross border. It would bring fintechs such as Razorpay, Cashfree, Google Pay and Amazon Pay India under supervision for this activity.

Flipkart’s Fintech Design

Ecommerce giant Flipkart, backed by the muscle of Walmart, has in recent years started to bet big on fintech expansion in India and investment opportunities in other startups, through its investment arm.

Flipkart, which has a 500 million+ customer base, is currently building its in-house credit marketplace called Super.Money. This is the focussed mission to offer personal loans, insurance and other financial products. In 2023, media reports said experienced hires included Flipkart’s senior vice president Prakash Sikaria and Premanshu Singh from insurtech Coverfox, with which it has already partnered with in 2023.

![]()

“Our suite of credit products, such as Pay Later, personal loans, co-branded credit cards, and insurance offerings, are aimed at democratising ecommerce and making it available to aspiring shoppers. Further, through the UPI offering, we are enabling access to seamless payment options.

The high-frequency traction for payments is also aimed at driving more velocity for commerce," a Flipkart spokesperson tells Forbes India.

Flipkart has partnered with Axis Bank for its own UPI handle for all customers for their online and offline transactions. It has its successful partnership with Axis, through a co-branded credit card.

More Compliance Needed

Even as fintechs continue to grow, the big challenge will be ensuring self-regulation and compliance. “There has to be proper diligence by people at the time of getting into the company.

They have to create behaviour standards and make sure that in certain cases where calls are aggressive or incorrect, SROs can communicate to its members that this is not correct way of doing things or it will need to take membership back," says Sanjay Khan Nagra, partner (corporate and commercial practice group) at Khaitan & Co.

One of the jobs for the SROs will be to make sure that regulatory requirements are not violated pursuant to a convoluted interpretation and set internal standards of compliance which will impact membership.

“Every fintech should follow compliance and regulatory norms. Following this, it is important to create partnerships. A lot of fintech historically have tried to say we can replace banks, or outcompete banks. But partnership is a win-win for everyone," Jain says. “Fintechs also have to understand, both as a challenge and an opportunity, that one model won’t work. Lastly, they have to explore and find diversified revenue streams to create an impact outcome."