How Razorpay is making online payments a breeze

Razorpay Software has grown into an indispensable bridge between banks and millions of merchants, small businesses and many of India's large enterprises and their customers

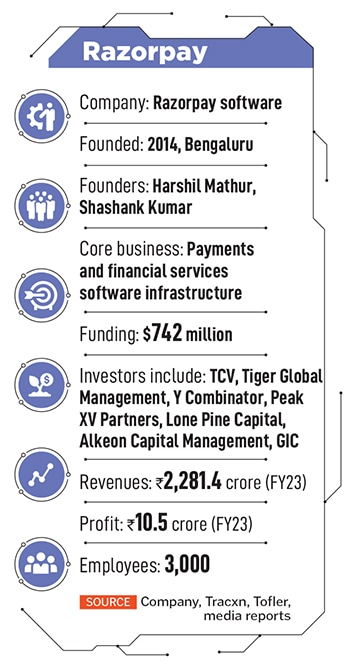

There was a time when banks gave Harshil Mathur and Shashank Kumar the runaround as the two young IIT-Roorkee graduates tried to convince them about a better, tech-driven way for small businesses and startups to accept payments. By their own account, the duo was rejected by over 100 banks.

Fast forward more than a decade of persistence, and their company Razorpay Software is an indispensable bridge between those very banks and millions of merchants, small businesses, and many of India’s large enterprises and their customers.

In February, Razorpay announced it had touched $150 billion in total annualised transaction value on its platform—a 30x increase since a year before Covid hit, and roughly 60 percent growth in FY24 over FY23.

In February, Razorpay announced it had touched $150 billion in total annualised transaction value on its platform—a 30x increase since a year before Covid hit, and roughly 60 percent growth in FY24 over FY23.

That made Razorpay one of a small number of payment gateway vendors “globally and not just in India" that operates at such scale, Mathur tells Forbes India. And it’s made its first overseas move as well, winning permits in Malaysia to process payments in that market.

“The ability to build from India for the world is a vision we are truly chasing," Mathur says, adding that the company aims to expand to more overseas markets. Mathur and Kumar haven’t been shy about making acquisitions either. The most recent was of BillMe last year that helped them expand into customer engagement and management of physical bills with digital tech.

The core payments business itself has tremendous scope to expand, Mathur points out, as India goes from an estimated 250 million online shoppers to a projected 600 million over the next five to six years. There are also many more industries where companies are digitalising their payments.

Then there’s a plethora of payments-related problems to solve. Razorpay is also expanding its “UPI switch" business, for India’s traditional banking sector to manage large volumes of payments.

Offline payments that have surged back in FY24 is another area Razorpay is ramping up investments. It’s a new entrant with about half a million devices in the market that happened on the back of the acquisition of Ezetap, a point-of-sale device company in 2022.

The company is also building a marketing stack that will include loyalty management, for customers such as Swiggy and Decathlon, for example.

The big picture is, if India’s economy grows the way it’s expected to in the coming years, at 7-8 percent, the online payments industry that is directly relevant to Razorpay is expected to grow at as much as 20 percent, says Ishaan Mittal, a managing director at Peak XV Partners.

Mittal believes that Razorpay will gain market share because of its strong tech and products. “For 5-10 years this could be a 20-plus percent compounder, which is rare as a category," he says.

Mittal believes that Razorpay will gain market share because of its strong tech and products. “For 5-10 years this could be a 20-plus percent compounder, which is rare as a category," he says.

Peak XV, previously the India and Southeast Asia portion of the US-based VC firm Sequoia Capital, has invested upwards of $150 million in Razorpay starting with its series C round in 2019. “It’s one of our most important investments. We have a high conviction in the company and we’ve invested across multiple rounds," he adds.

In December 2023, Razorpay, alongside Google Pay and a few other Indian startups, won permits to operate as payments aggregators.

First Published: May 16, 2024, 11:09

Subscribe Now