Over the past two decades, banks and financial institutions in India have continued to outsource activities—from onboarding customers to cross-selling products—to business correspondents and direct selling agents (DSAs). Now fintechs are playing a more meaningful role as agents for banks. But the fact remains that banks are responsible for the activities of their agents.

“RBI has a well-defined framework of holding their regulated entities [banks/NBFCs] responsible for all partnerships and monitoring their agents, with adequate quality controls and risk management in place," says former banker and regulator Shinjini Kumar, now co-founder of SALT, a financial planning and investment venture.

In recent months, fintechs have come under more scrutiny, as the regulator has sought to curb breach of data security, fraud and money laundering.

In the case of Paytm (parent One97 Communications), RBI had concerns over the functioning of its subsidiary bank, Paytm Payments India Ltd (PPBL), which, in February this year, it accused of persistent non-compliances and continued material supervisory concerns in the bank, warranting further supervisory action.

After well over five years of regulatory warnings, PPBL has several business restrictions—including onboarding any new customers for any of its services—since March 11, 2022. PPBL has 300 million wallets, 30 million bank accounts and 1.8 million merchants in its ecosystem.

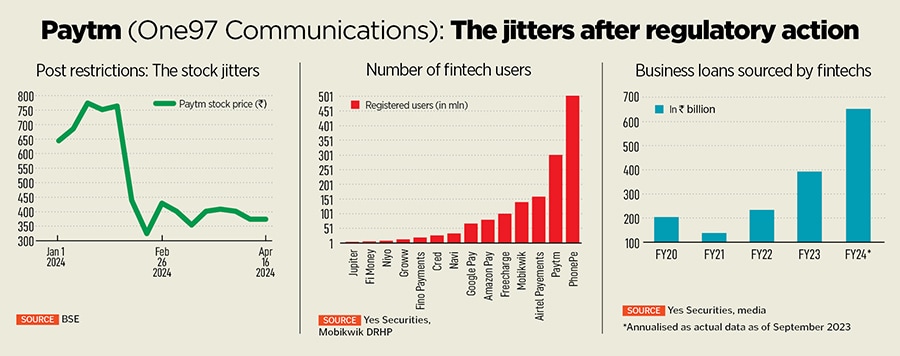

The restrictions and concerns over future growth have seen the parent firm lose 58 percent of its market value in the past six months and 80 percent since its listing debut high of `1,955 on November 18, 2021.

Analysts warn that the current restrictions will see a further impact on its growth trajectory and a decline in UPI transaction volumes/value data in March 2024. In February, Paytm’s UPI volume market share fell to 10.8 percent from 12.7 percent in January.

Paytm bullish after TPAP licence

One97 Communications has, since, been given permission by NPCI to operate as a third party application provider (TPAP) and migrate its UPI-based payments business to other banks (now Axis Bank, HDFC Bank, SBI and Yes Bank) from PPBL.

This will mean that individuals can make UPI payments, send or receive money through UPI, or make offline QR code payments on their Paytm app. It will give Paytm the flexibility to work like its peers, Google Pay and PhonePe.

Google Pay and PhonePe operate nearly as a duopoly, commanding nearly 86 percent of UPI transactions by volume. PhonePe has a near 48 percent market share and Google Pay 37 percent share. Paytm holds a 9 percent market share.

“We are collaborating with our banking partners to facilitate the migration of both merchants and consumers, which is progressing steadily," a Paytm spokesperson told Forbes India.

“We continue to offer personal and merchant loans through our lending partners, and we are taking proactive steps to expand the services. As pioneers of mobile payments, QR, and soundbox, our focus remains on customer engagement and ongoing innovation. These efforts are central to strengthening our brand and enhancing the convenience we provide to our users across India," he said, in an emailed response.

Kumar resigned from the board of PPBL in December last year, and declined to comment on any matter relating to Paytm.

![]()

Payment aggregator BharatPe—whose investors include Peak XV, Tiger Global, Beenext Capital and Dragoneer Investment Group—has also been hurt by controversies in recent months. One of its founders and former managing director Ashneer Grover—an ex-Shark Tank India judge—has accused former banker and current BharatPe chairman Rajnish Kumar of misconduct. In a letter to the RBI, Grover had accused Kumar of allocating equity shares worth a fortune to himself after joining the BharatPe board, according to media reports.

The BharatPe management has rubbished the allegations and filed a case for damages from the Grover family, for alleged embezzlement of funds.

The recent events which these fintechs have faced have raised the need for governance, which RBI has addressed in its draft framework for self-regulatory structures in fintechs in January this year.

Pangs of growing up

“By pivoting towards a culture of self-governance, fintechs could proactively set and adhere to industry standards and best practices. This approach could empower the sector to demonstrate its commitment to responsible conduct and innovation even in the absence of formal regulation.

Through collaboration, the industry could collectively identify and address challenges, foster an environment where innovation flourishes, and guide shared commitment to ethical business practices," the RBI has said in its note.

There is no escaping the fact that fintechs will continue to have a much larger role to play in the financial services ecosystem in coming years.

“These recent events are merely pangs of growing up for the fintech ecosystem in India. We advise new startup entrepreneurs to not make compliance an afterthought," says Jose Thattil, CEO of omnichannel payments solution provider PhiCommerce.

A consultant with an investment advisory firm says, “Paytm may have done things which were not approved or in the principles of arguing. But it is not limited to Paytm. It’s a problem for every economy as it evolves."

“People are, I think, unnecessarily blaming one fintech company a lot, probably because of the erosion of share price [see Paytm stock price]. Some of India’s largest banks, including HDFC Bank and Kotak Mahindra Bank, have faced regulatory hurdles and scrutiny in recent times," he adds.

These are teething problems that India and in fact most other economies have been facing. “One can recount regulatory concerns starting with multi-brand retail and ecommerce trade, when they started out in India," the consultant said, on condition of anonymity.

Short-term pain, medium-term hope

Analysts expect pain over the short-term for Paytm—which could mean the risk of losing some customers and merchants to competition. But over the medium-to-longer term hope that reputational damage will be contained. The TPAT licence will mean that Paytm’s UPI business will be intact.

“Following the recent RBI restrictions, Paytm has witnessed a significant decline in its gross merchandise value [GMV] in February, and this trend is likely to persist into March," Nitin Aggarwal, head-BFSI (institutional equities) at Motilal Oswal Financial Services, said in a March 21 note to clients.

“While some of this decline can be attributed to the absence of new user additions, there is also a looming risk of losing customers and merchants to competitors," he added. It could lose up to 15-20 percent of its merchant base, but will retain the majority.

Aggarwal estimates Paytm’s FY25E payment revenues to decline by 27 percent, attributed to the decline in GMV, impact on wallet transactions, and loss in merchant and customer base. But he says its ecommerce and cloud business is not likely to be impacted in a major way. Within this segment, merchants offer discounts, deals, gift vouchers, and other digital goods such as tickets.

Yes Securities is amongst the few research firms to have upgraded One97 (Paytm) to a ‘buy’ rating, with the belief that the market is currently pricing in an even more acute scenario for Paytm, which will not transpire.

According to media, Paytm has restarted its lending activities in a tie-up with its existing lending partners SMFG India Credit and Shriram Finance.

![]()

Yes Securities analysts Shivaji Thapliyal and Siddharth Rajpurohit say the TPAT licence has meant that Paytm’s UPI business will not collapse.

“One97 Communications is now communicating energetically to ensure client loss remains well contained and will also look to recoup clients that may have departed to other app platforms," they said in the note to clients.

Over the medium term the real test for Paytm will be whether it can recover lost business and get on to a clear growth trajectory, possibly in 2025-26. Only then would it merit a re-rating for the stock.

“At present, the fintech ecosystem in India may seem in turmoil, but is essentially stable. Nobody is in a hurry for acquisitions or scaling with aggression. In any case, aggression has occurred only when there is strong external funding," says SALT’s Kumar.

Organic demand for credit should pick up in a growth economy and given low distribution bandwidth of large players like banks, fintech collaborations with banks will continue to take place, she says.

The good news for RBI governor Shaktikanta Das is that India’s lending ecosystem is robust, the credit cost to balance sheets is low and the retail lending demand is good, being still under-leveraged, despite concerns over aggressive unsecured lending. It reads good news for banks and their collaborative partners fintechs.