The Thar, which bears a striking resemblance to the Jeep Wrangler, was launched in India last October. The hysteria had become obvious when the first unit of the SUV was sold in an auction ahead of the official launch for a staggering ₹1.1 crore, the proceeds of which went towards a Covid-19 relief fund.

Then, as bookings opened, Jejurikar, the man in charge of the automobile business at Mahindra Group, knew that the company could be in for some trouble. A veteran at the homegrown automaker, Jejurikar has led and lived through the launch and hype of some of the company’s iconic vehicles, ranging from the Scorpio to the XUV 500 over the past two decades. In 2002, when the Mumbai-headquartered company launched the Scorpio, Jejurikar was the man in charge of marketing at the automaker. In 2011, when it rolled out the XUV 500, he was the chief of operations for the automobile business.

In the next five years, Jejurikar, who took charge as the executive director for the auto and farm sectors at the Mahindra Group 15 months ago, plans to launch 23 new products across passenger and commercial vehicle segments. The company has lined up capital expenditure of ₹12,000 crore for the launch of new models, upgrades of existing ones and new variants. Of these, nine will be in the SUV segment, while 14 will be in the light commercial vehicle (LCV) category. Between July and September, the company will also launch two new models, including the Bolero Neo and XUV 700.

“I have lived through the hype of Scorpio, and I’ve lived through the hype of XUV 500," says Jejurikar. “But the hype over Thar is something I’ve never seen. It is eight months since the launch, and even today we are unable to deliver the vehicle to the finance minister of a state in which we have a large industrial activity. We are now quoting 10 months as the waiting period to customers."

![]() Much of the shortfall is a result of the second Covid-19 wave, and a shortage of semiconductors that has hit manufacturing businesses across the world. “It’s a mania that is unimaginable and this is not because we are making 1,500 units a month," Jejurikar adds. “We are still producing 3,000-plus units, but we are getting bookings of 6,000 a month." That means, for someone booking a Mahindra Thar in July, delivery isn’t expected until April 2022.

Much of the shortfall is a result of the second Covid-19 wave, and a shortage of semiconductors that has hit manufacturing businesses across the world. “It’s a mania that is unimaginable and this is not because we are making 1,500 units a month," Jejurikar adds. “We are still producing 3,000-plus units, but we are getting bookings of 6,000 a month." That means, for someone booking a Mahindra Thar in July, delivery isn’t expected until April 2022.

That’s a long wait in India’s highly competitive $104 billion automobile market, and most often, such delays put buyers off. For Mahindra, which is trying to stage a comeback and reclaim some lost turf over the past few years in its once impregnable stronghold of SUV business, delays such as these can be a death knell. But Jejurikar isn’t bothered. New orders continue to come in and he knows that it’s only a matter of time before the company can ramp up supply.

In many ways, Mahindra’s renewed sense of assurance stems from its faith in the Thar, and the lack of a rival in its category. The Thar, which gets its design from the jeeps Mahindra would assemble in 1947, is distinctive and, until recently, did not boast much of the sophistication that numerous other SUVs in the Indian market had.

Unlike compact SUVs such as the Hyundai Creta or the Kia Seltos, which have defined the segment, the Thar, Jejurikar says, is busy creating a category for itself, a philosophy he wants other Mahindra vehicles to follow. That means, over the next few years, as it looks at launching new models, Mahindra will not chase other carmakers and build rival of their offerings. Instead, it wants to build products that will redefine authentic SUVs to reclaim, what Jejurikar says, is a space that Mahindra continues to own.

“By picking on our capability and competence, we want to attract consumers who are looking at multiple other segments," Jejurikar says. “You can be a specialised position brand and still get volumes. To win in the SUV battle, you don’t have to make a product that’s similar to what somebody else is making. Because that’s what works for them. We must focus on our strengths. And that’s exactly the tweaking that we’ve done."

To do that, he has the unflinching support of his boss, Anish Shah, who took over as managing director and CEO of Mahindra & Mahindra Ltd in April. “Auto is a core business," says Shah. “It is an integral part of who we are and what we do. Over the decades, we have designed vehicles that have created a strong and loyal customer base. The latest example is the Thar. We have consistently performed well in our core: Authentic SUVs that are tough and sophisticated. Our strengths lie in our deep-rooted understanding of customer requirements and an ability to deliver outstanding products at a great value for our customers."

![]() New thinking, new philosophy

New thinking, new philosophy

Much of the recent tweaking, perhaps, is also a desperate need of the hour.

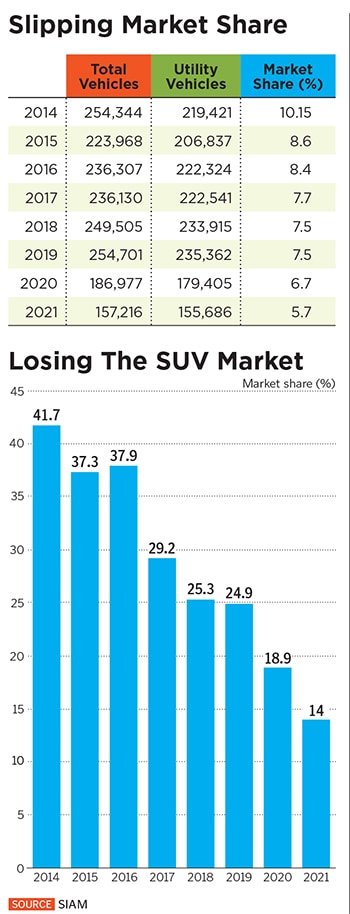

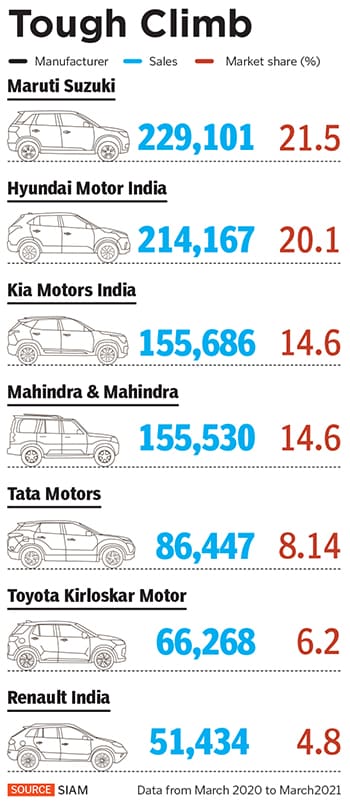

For a while now, Mahindra has been steadily losing turf, particularly its dominance in the SUV market. Its share in the utility vehicle category, according to the Society of Indian Automobile Manufacturers (SIAM), slipped from over 50 percent in 2012 to less than 15 percent in 2021. The company is now fourth, behind Maruti Suzuki, Hyundai Motors and Kia Motors in the category.

Mahindra’s overall share in the domestic passenger vehicle sector has slipped to less than 6 percent from nearly 12 percent in 2012, making it only the fifth-largest passenger vehicle maker. Just a year ago, it was the third-largest automaker, cornering over 7 percent. Rival Tata Motors, the other homegrown automaker, has made a stunning turnaround in its fortunes over the past five years, unleashing products that boast best-in-class features, design and safety, among others. In the process, it has become the third-largest carmaker, from the sixth position a few years ago.

One of the pioneers in the SUV business, Mahindra’s dip in fortunes also comes at a time when India’s automobile industry has seen a tectonic shift with auto makers making a beeline to launch SUVs and compact SUVs. Much of the shift had to do with changing customer preferences and global trends. The success of models such as the Kia Seltos and Sonnet, Hyundai Creta and Venue, MG Hector, Tata Harrier, Maruti Suzuki Brezza and Mahindra Scorpio is proof.

The trend towards bigger-looking SUVs had also tempted Mahindra to spread itself too thin in the SUV business, creating a plethora of products that it had hoped would win the market. From entry-level SUVs to compact sedans and MUVs, its vehicles included unsuccessful models such as the Quanto, a smaller version of the Xylo, the TUV300, the KUV100, and the Marazzo. “Market share is of importance to us as well," Jejurikar says. “How you get market share has to be a strategic call. In the desire to get market share, if you try and do things where you’re not going to succeed, then you’re barking up the wrong tree because you’re going to get into segments where you don’t have a right to be in."

That’s why after taking over as head of the automotive business, Jejurikar and his team spent time on defining the vehicles they were going to develop, and redefining the idea of SUVs for the Indian audience. The Thar is the first of those. “In the personal vehicle space, the battleground has intensified and there’s been a huge increase in competition, especially in the SUV space, where we primarily had a presence," Jejurikar admits.

The company has identified six pillars on which it wants to build future products, including turn-on design, unmissable presence, tough-yet-sophisticated, safe, and sci-fi products. “For each of these pillars, we created three or four parameters. For instance, we will not do a product that will not meet a certain ground clearance," Jejurikar says.

In addition, Mahindra is clear that it will not waste time making rivals for successful models. “We don’t want to create a Creta fighter. The minute you say I’m going to create a fighter for something, you’ve boxed yourself in," Jejurikar says. “When the designers created Scorpio, they never said we are creating a fighter for something. Somebody just created a design from their heart. XUV 500 was like that. It’s a segment that didn’t exist and, in a way, Thar is that. It is not a fighter of anything. It just created a segment of its own. People who compare the Hyundai Venue and Kia Sonnet come and buy the Thar. So, if you create a product that touches a sweet spot, you’re going to get consumers coming from everywhere."

This means the company will eventually phase out some of its unsuccessful models, including the Marazzo, and KUV 100. Mahindra’s pipeline for the next few years includes the new Scorpio, XUV 700, a five-door Thar, and an all-new Bolero. Then, there will be an electric option of the XUV700, new XUV300, and on SUVs code-named W620 and V201. There will also be two ‘born electric’ models debuting in FY26. “We’ve invested in platforms over the last few years, and we’ve built a strong portfolio of engines and aggregates," Jejurikar says. “Now we need to leverage that in a way that we deliver a brand idea and build products that are exciting."

“The time has gone where Mahindra needed to take small steps to win market share," says Puneet Gupta, director for automotive forecasting at consultancy firm IHS Markit. “The industry is in a transformational phase, and all automakers from Hyundai to Kia and Toyota are playing for global volumes. Mahindra has had a loyal customer base in India, but with India’s buyers now having global exposure and access to aspirational brands, it needs to give more weightage to products that can score well for themselves."

That’s why Mahindra’s new launches will be even more crucial. The Bolero Neo, a face-lifted version of the previous TUV 300, which is scheduled to be launched on July 15, will likely feature BS VI-compliant engines, redesigned headlamps and grille to bring it closer to the Bolero. The XUV700 is expected to boast best-in-class tech such as ADAS driver aids, level 2 autonomous driving, a fully digital infotainment system, and a turbo petrol engine.

“As long as Mahindra balances the price-value equation, delivers exceptional customer experience and works in harmony with its network partners, reclaiming lost ground and market share is absolutely doable," says Harshvardhan Sharma, head of auto retail practice at Nomura Research Institute. “Mahindra has been launching a bouquet of market initiatives, especially on customer journey enhancement via digitisation as well as connecting with millennials and Gen Z to deliver a holistic experience. With Thar and the upcoming XUV700, I am sure market domination is possible."

![]() Leading the change

Leading the change

Its renewed push in the SUV business means Mahindra intends to stay away from the fleet market, and focus on personal ownership. That strategy is akin to what Tata Motors, which had struggled for over a decade in the automobile business, followed in its comeback. Mahindra’s products such as the Xylo and the Marazzo had largely focussed on the fleet market in the past.

“All our offerings should have adventure capability," Jejurikar says. “We don’t want to be a mobility solution. And hence when we say we’ve now chosen to not play in shared mobility, it’s a conscious call. Our products are being designed with a specific target."

That’s a far cry from a decade ago, when Mahindra wanted to be an all-encompassing auto maker with UVs, tractors, two-wheelers, three-wheelers, sedans, pick-ups, light trucks, heavy trucks, electric cars, boats, and aircraft, among many others. In 2018, Mahindra had also picked up a 16 percent equity stake at ₹176 crore in car rental firm Zoomcar.

“As an OEM we had two paths. We could say, ‘I’m going to make a product like Ertiga because that’s the only way I can get market share and by playing in every segment’. We’re taking a step back and saying, ‘that’s not going to work because that’s going to take us into a territory where we don’t have a competitive advantage’. We will be clear about where opportunities are and where we can have a distinctive offering," says Jejurikar.

Mahindra is expanding this strategy to its other focus areas, including two-wheelers, where it has turned its attention to the legendary Java motorcycles and France-based Peugeot Motocycles. In July, Peugeot appointed tennis legend Novak Djokovic as the brand ambassador for its EV business. “Our right to win has to come out of creating distinctive products that are true to our story," Jejurikar adds. “But we are not going to play in the mass-market of two-wheelers. We have realised it’s not wise to play in the two-wheeler market only to say we are in the mobility space."

This new direction has also begun to deliver financial results, according to Jejurikar. Over the past couple of years, strict cost management has helped reduce manufacturing fixed expenses by 40 percent, and sales and marketing expenses by 70 percent. “Overall, we have reduced our fixed expenses—₹900 crore over FY19—resulting in a much fitter, leaner and agile organisation," Jejurikar says. The company also walked away from businesses that it wasn’t finding much merit in.

“Our capital allocation actions over the past year are delivering results," says Shah. “Despite the challenges of the pandemic, we generated operating cash of over ₹10,000 crore and delivered strong revenue and profit growth." Mahindra & Mahindra’s consolidated revenue stood at ₹21,456 crore in the January-March quarter, up by 32 percent, while consolidated profit after tax stood at ₹1,635 crore during the same period.

The company is in the midst of selling its Korean subsidiary SsangYong, in which it owns a 75 percent stake. It had acquired it a decade ago to further its international presence. SsangYong is under court receivership after Mahindra failed to bring in a buyer over the last year after announcing it would make no further investments in SsangYong.

Early this year, Mahindra also announced that a joint venture with Michigan-based Ford has been put off, after being under works for over two years. “Apart from India, Mahindra is looking at making itself appealing to a global audience," says Vinay Piparsania, former executive director at Ford India and former consulting director for automotive at Counterpoint Technology Market Research. “The company will definitely want to hedge against the India cycles and has a significant business to go after in Asia and Africa, among others. This means there shouldn’t be any confusion about who owns what in the minds of consumers. In India, Mahindra has a dominating market presence and as long as it can offer products that are accessible and aspirational, the brand will only get stronger."

[qt]As long as Mahindra balances the price-value equation, delivers exceptional customer experience and works in harmony with its partners, reclaiming lost ground and market share is doable."

Harshvardhan Sharma, Head of auto retail practice, Nomura Research Institute[/qt]

Gearing up

Mahindra is also laying out elaborate plans to ramp up its electric offerings. In May, it approved the merger of the EV subsidiary Mahindra Electric Mobility Ltd (MEML) with the company to consolidate operations, development, sourcing and manufacturing. It also set aside ₹3,000 crore for its EV plans, six of which will be launched by 2026.

The company was among the earliest entrants in the EV category, buying a stake in Bengaluru-based Reva Electric in 2010. Despite that, Mahindra didn’t make significant inroads in the segment. In 2017, it was one of the companies chosen by the government agency, Energy Efficiency Services Ltd, to provide 10,000 electric cars for government use. But concerns over poor range and performance led to the government shelving the plan.

“Mahindra is bullish on EVs and rightly so," adds Sharma of Nomura. “Given their prowess in product development and R&D, it’s the right way to go. India is at an inflection point for EVs, and Mahindra, which has been a pioneer with EVs is surely pacing well."

The company has hired Uli Stuhec, an EV veteran and a former vice president of vehicle engineering at May Mobility, a Michigan-based autonomous vehicle startup, to kick-start its ‘Born Electric’ programme, based out of its North American Technical Centre in Detroit. It has also created two verticals: One focusing on last-mile mobility and the other on technology. “Right now, we’re building a team in Detroit for Born Electric," Jejurikar says. “It will leverage the UK Design Centre for the design, but core platform architecture work will happen out of Detroit."

The UK Design Centre, known as the Mahindra Advanced Design Europe (MADE) centre, was set up in May and will be headed by Pratap Bose, until recently vice president, design, at Tata Motors. Bose was instrumental in turning around Tata Motors’ fortune, and in designing bestselling models such as the Altroz, Harrier, and Nexon. Bose’s appointment is likely to help Mahindra in newer areas and SUVs. “Everything starts with design," adds Goenka of IHS Markit. “With EVs becoming a core of their strategy and a renewed focus on the SUV space, people like Bose will be able to deliver results."

India sold over 21 million vehicles, including 17 million two-wheelers, that run fossil fuels in FY20. China, where EVs have seen traction in recent times, sold 1.3 million EVs in 2020, according to Singapore-based market research firm Canalys it accounted for over 40 percent of the global EV sales. Over the past few months, everyone from General Motors to Ford Motor Company, Volkswagen and Honda have been making commitments to shift their entire fleet to EVs.

“One foresees a bright future for Mahindra in the mid-to-long term," adds Sharma of Nomura. “Despite having a broad portfolio, Mahindra Group has continued to build value, and remains relevant in the market across sectors. By announcing nine new products across an assortment of segments and powertrains, it reasserts its pole position as far as the SUV space is concerned. What’s also interesting is the decision to have electric powertrains for its whole PV range except Bolero, Thar, and Scorpio.

Apart from Bose, Mahindra has hired several senior executives, including Jogindra Shetti, a veteran at Ford who has joined as vice president for EV Tech business, Harish Lalchandani to drive strategy, and Binoy Paul, who will lead all the electrical and electronics engineering activities for vehicles.

“Mahindra is planning the new product lineup in sync with current mobility themes such as connected, autonomous driving, and electrification, as well as revamping its design language to cater to legacy and millennial customers… these are all positive steps and will definitely bear fruit in the coming years," adds Sharma. It has helped that the company has shifted from its rugged nature to appeal to a wider, younger customer base that prefers automatic and petrol variants.

Mahindra is gearing up for the long haul and wants to reclaim its status as leader of the lucrative SUV market, which Jejurikar reckons is between 50 and 60 percent of the SUV market in India. But does focusing on a niche curtail growth? “We do have volume ambitions," adds Jejurikar. “We do have strong growth aspirations, but all we are saying is we should do it in a way that we have a strong right to win and not do it by getting into segments where we are not going to be competitive enough, either on costs or on the way our product is perceived."

The drive may be bumpy, and Jejurikar knows that well. But like the Thar, who better than Mahindra to handle the rough terrain.

To win in the SUV battle, you don’t have to make a product that’s similar to what somebody else is making. We must focus on our strengths: Rajesh Jejurikar, executive director (auto & farm sectors), Mahindra & Mahindra

To win in the SUV battle, you don’t have to make a product that’s similar to what somebody else is making. We must focus on our strengths: Rajesh Jejurikar, executive director (auto & farm sectors), Mahindra & Mahindra Much of the shortfall is a result of the second Covid-19 wave, and a shortage of semiconductors that has hit manufacturing businesses across the world. “It’s a mania that is unimaginable and this is not because we are making 1,500 units a month," Jejurikar adds. “We are still producing 3,000-plus units, but we are getting bookings of 6,000 a month." That means, for someone booking a Mahindra Thar in July, delivery isn’t expected until April 2022.

Much of the shortfall is a result of the second Covid-19 wave, and a shortage of semiconductors that has hit manufacturing businesses across the world. “It’s a mania that is unimaginable and this is not because we are making 1,500 units a month," Jejurikar adds. “We are still producing 3,000-plus units, but we are getting bookings of 6,000 a month." That means, for someone booking a Mahindra Thar in July, delivery isn’t expected until April 2022. New thinking, new philosophy

New thinking, new philosophy Leading the change

Leading the change