How acquisitions turned out to be Sun Pharma's winning strategy

The country's top specialty generics company recently acquired US-based Checkpoint that will further its oncology portfolio

On Tuesday, India’s top specialty generics company Sun Pharma announced the acquisition of the US-based Checkpoint for $355 million to enhance its oncology portfolio.

Analysts view this acquisition as a gamechanger, enabling Sun Pharma to enter the high-growth PD-L1 inhibitor market and help bolster its innovation portfolio in onco-derm therapy.

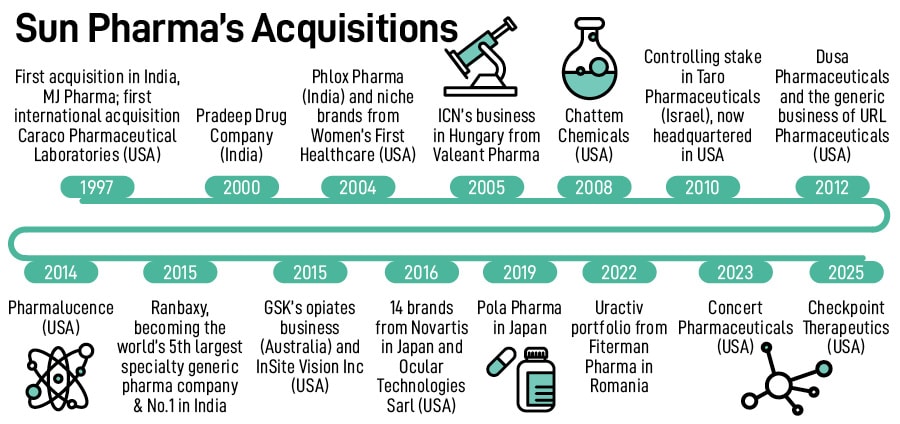

Over the years, Sun Pharma has executed several high-profile acquisitions that have helped it drive growth and establish presence in key international markets. Its first international acquisition of Caraco Pharmaceutical Laboratories in 1997 marked its entry into the North American generics market. The 2010 acquisition of research-based Israeli company Taro Pharmaceuticals effectively doubled its US business, while Pola Pharma in 2018 solidified its foothold in Japan.

One of the landmark acquisitions in Sun Pharma’s CV would be that of Ranbaxy Laboratories in 2014 that had made it the world’s fifth-largest, and India’s largest, specialty generic pharmaceutical company. Ever since, the company has done one better, by becoming the fourth-largest company globally while maintaining its pole position within the country.

In a recent exclusive interaction with Forbes India, Dilip Shanghvi, chairman & managing director of the company explained his acquisition philosophy: “First, [we see] whether the acquisition is strategic in nature and it helps you go further in the direction in which you wish to go. Second, whether you can run that business better than the present owners can. And last would be the issue of culture—whether the change or difference in culture can be managed." Given that acquisitions take up the time of senior management, there is likely to be a negative impact on your natural growth, so these need to be taken into consideration, he added.

On plans for future acquisitions, Shanghvi said: “We are always on a lookout, and we have the capacity to look at future opportunities."

Over the years, Sun Pharma has shifted its focus towards specialty pharmaceuticals and niche therapeutic areas. Reflecting this, acquisitions such as Dusa Pharmaceuticals in 2012, Concert Pharmaceuticals in 2023, and the recent announcement of Checkpoint Therapeutics underscore its commitment to advancing in oncology, dermatology, and immunotherapy.

"With a strong net cash position (approximately $2.6 billion by end of H1FY25 ) and an ongoing strong free cash flow generation enables them to successfully drive their ambitions around inorganically strengthening their specialty business globally," says Vishal Manchanda, senior vice president, Institutional Research, Systematix Group.

First Published: Mar 12, 2025, 09:47

Subscribe Now