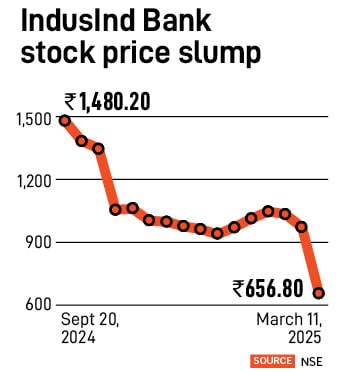

IndusInd Bank stock tanks 27 percent after derivatives markdown hurts creditabil

Concerns over slowing future earnings growth and challenges in transitioning to a new leadership weigh in on the bank and its valuations

IndusInd Bank, which in the December-ended quarter saw a fall in interest income, profitability and asset quality, is in the midst of yet another negative event. The bank has reported discrepancies and a markdown in its derivative portfolio, resulting in a post-tax impact of 2.35 percent of its net worth.

This has triggered a 27.8 percent intra-day fall in IndusInd Bank (IIB) shares to Rs 649.5 at the stock exchanges on Tuesday, after several analysts’ firms downgraded the investment rating for the stock. The bank told analysts in a call late on Monday that the financial hit will be absorbed as a one-time charge in the current March-ending quarter of FY25, routed through the P&L statement.

A deeper concern for the Ashok Hinduja-promoted IndusInd Bank is that near-term visibility for the bank’s earnings is likely to be impacted. The regulator Reserve Bank of India (RBI) last week approved the reappointment of incumbent CEO Sumant Kathpalia for only a year—against a proposal for three years—which indicates the bank will need to transition to a new leader sooner than expected.

The forex discrepancies arose from internal trades with low liquidity (3 to 5-year yen, 8 to 10-year dollar borrowings) that were on swap contracts and not mark-to-market (MTM). The transactions were carried out 5 to 7 years ago, but the discrepancies were discovered after the bank began reviewing its derivative book, following a new RBI circular in September 2023. The bank has informed the RBI of the same and hired an agency to carry out an external audit in Q3FY25.

“The timeline is discomforting: The CFO [Gobind Jain] resigned just before the Q3 earnings, the CEO recently got a one-year extension instead of three, and now a derivatives-induced dislocation. We believe IIB’s credibility and earnings shall be impacted," wrote Mahrukh Adajania and Madhukar Ladha, institutional equities analysts at Nuvama’s, in a report released on Tuesday morning.

Nitin Aggarwal, head-BFSI (institutional equities) at Motilal Oswal Securities wrote in a note to clients, “The recent accounting discrepancies related to derivative transactions have further dampened sentiments and are likely to drive losses in Q4FY25 as the bank absorbs the impact through its P&L."

Aggarwal tells Forbes India that the IndusInd board will expedite the evaluation of both internal and external candidates for a suitable successor. This should help alleviate concerns and improve confidence in the bank’s operations. But the near-term concerns mean that Motilal Oswal Financial Services has downgraded IndusInd Bank’s stock to ‘neutral’ with a revised target price of Rs 925.

Aggarwal says once the audit is completed, its detailed findings will be shared, “although the final impact is not expected to differ materially from the current estimates," he wrote in his note.

However, there will be more pain lined up for IndusInd Bank, analysts warn. “We think IIB will likely use the one year to transition to a new CEO. The bank already has a deputy CEO who can also be a contender should a new CEO have to be appointed in the next nine to 12 months. But, given the RBI’s preference for an outsider in case of other recent appointments, the probability of an external candidate for CEO of IndusInd Bank to succeed Kathpalia is high. Should this happen, near-term visibility, which is already impacted by a weak microfinance cycle, will become lower," the Nuvama analysts said.

Kathpalia on Tuesday attempted to allay investor concerns, stating that this event was a “one-time event" and will not impact the bank’s fundamental strengths. IndusInd Bank, however, saw a 1.2 percent year-on-year dip in Q3FY25 net interest income at Rs 5,228 crore and profitability is down 39 percent at Rs 1,402 crore, from levels a year earlier.

First Published: Mar 11, 2025, 16:32

Subscribe Now Nuvama reduced IIB’s investment rating to an ‘underperformer’ and the target price to Rs 750.

Nuvama reduced IIB’s investment rating to an ‘underperformer’ and the target price to Rs 750.