More pain for Paytm till business model transition complete: Experts

Paytm reported a widening of losses and flattish revenue growth for its March-ended quarter. It has, however, forecast recovery to commence in the Q2FY25 period

One97 Communications Limited, which owns payments and financial services distribution company Paytm, is seeing the initial impact of disruptions to its business operations, following regulatory action. The company on Wednesday reported a widening of consolidated loss for the March-ended quarter, even as revenues edged down 3 percent for the same period.

Losses in the Q4FY24 quarter came to Rs 549.6 crore, against Rs 220 crore for the December-ended quarter and Rs 168 crore for the January-to-March quarter a year earlier. Revenues edged down 3 percent for the March-ended quarter to Rs 2,267 crore.

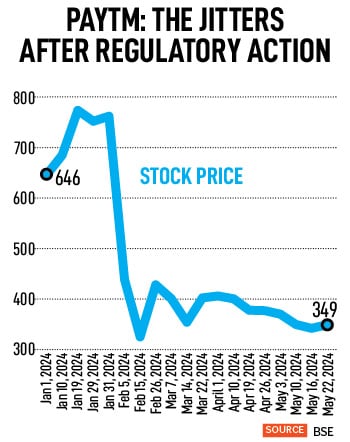

Post its earnings release, the Paytm stock fell as much as 2.04 percent intraday to Rs 344.5 before recovering marginally to Rs 349.6 levels at the BSE, still down 0.64 percent from its previous close of Rs 351.7 levels.

Paytm is trying to transition its core payments business from its subsidiary bank, Paytm Payments India Ltd (PPBL) to four other banks (Axis Bank, HDFC Bank, SBI and Yes Bank). This comes after the regulator Reserve Bank of India, this February, accused the company of persistent non-compliances and continued material supervisory concerns in the bank, warranting further supervisory action.

Paytm is trying to transition its core payments business from its subsidiary bank, Paytm Payments India Ltd (PPBL) to four other banks (Axis Bank, HDFC Bank, SBI and Yes Bank). This comes after the regulator Reserve Bank of India, this February, accused the company of persistent non-compliances and continued material supervisory concerns in the bank, warranting further supervisory action.

In Q4FY24, payments revenue was down by 9 percent from the previous quarter due to the disruption of PPBL products and a temporary impact on account of a conservative approach taken for certain businesses and temporary disruptions in operating metrics (MTU, merchant base, GMV). But for the full year payments revenue grew by 7 percent year-on-year to Rs 1,568 crore.

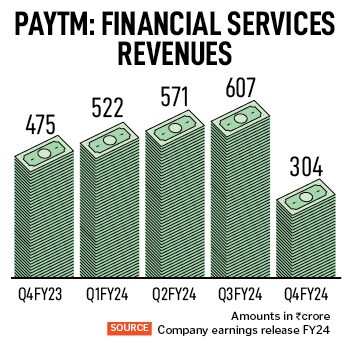

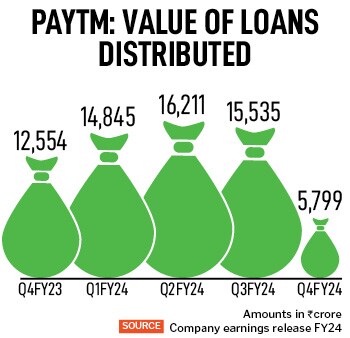

The pure lending business also saw a decline in revenues. In Q4FY24, revenue from financial services and others fell 36 percent year-on-year to Rs 304 crore, on account of lower loan distribution (see charts).

The pure lending business also saw a decline in revenues. In Q4FY24, revenue from financial services and others fell 36 percent year-on-year to Rs 304 crore, on account of lower loan distribution (see charts).

The Paytm management in its earnings release issued on Wednesday said: “While we experienced financial impact in Q4 due to the above disruptions, the full financial impact will be seen in Q1FY25. We expect Q1FY 2025 revenue of Rs1,500–Rs1,600 crore and Ebitda before ESOP of Rs 500–Rs600."

The fintech is confident of seeing “meaningful improvement starting from Q2FY25", based on restarting certain paused products and achieving steady growth in operating metrics. In FY25, company will focus on embedded insurance and wealth product distribution and credit growth led by distribution-only disbursement model.

One97 Communications has recently been given permission by the National Payments Corporation of India (NPCI) to operate as a third-party application provider (TPAP) and migrate its UPI-based payments business to other banks (now Axis Bank, HDFC Bank, SBI and Yes Bank) from PPBL.

Paytm says in Q1FY25, its focus will be on acquiring new merchants, reactivation of inactive merchants, and redeployment of devices from inactive merchants to new merchants. “While there will be a smaller net addition of device merchants in Q1FY2025, we expect net additions to improve from thereon and recover to past trendlines by Q3FY2025," the company earnings update said.

Analysts, however, continue to be conservative in their outlook towards the growth trajectory for Paytm and the stock itself. “I thought the earnings data numbers were dismal and that was expected. Till the management does not go in for a big change in its attitude and streamlining its processes—and other fintechs are eating into their market share—the Paytm stock is an avoid for us for the time being," says Sanjiv Bhasin, director, IIFL Securities. He added that the “stock was on a weak wicket" and any rise could be seen by retail investors as an opportunity to exit.

Analysts, however, continue to be conservative in their outlook towards the growth trajectory for Paytm and the stock itself. “I thought the earnings data numbers were dismal and that was expected. Till the management does not go in for a big change in its attitude and streamlining its processes—and other fintechs are eating into their market share—the Paytm stock is an avoid for us for the time being," says Sanjiv Bhasin, director, IIFL Securities. He added that the “stock was on a weak wicket" and any rise could be seen by retail investors as an opportunity to exit.

Emkay Global analysts Anand Dama, Kunaal N and Marazbaan Dastur in a note to clients on May 16 said they believed Paytm was still in the disruption phase amid ongoing customer, key management personnel and lending partner attrition. “Business normalisation and growth re-acceleration are likely to be long drawn-out processes. Thus, we expect Paytm to turn Ebitda-positive only in FY28E and net profit-positive not before FY29E. This thus derails the company’s plans of turning PAT positive in the near future. Also, regulatory risks remain high, with its payment aggregator license in abeyance," he says.

First Published: May 22, 2024, 14:46

Subscribe Now