The rising popularity of gold bonds

Since they were launched in 2015, gold bonds have come to be seen as an investible asset class

Almost a decade after the government launched the sovereign gold bond scheme, data shows how successful the offering has become among a class of buyers that would otherwise have been forced to buy the physical metal.

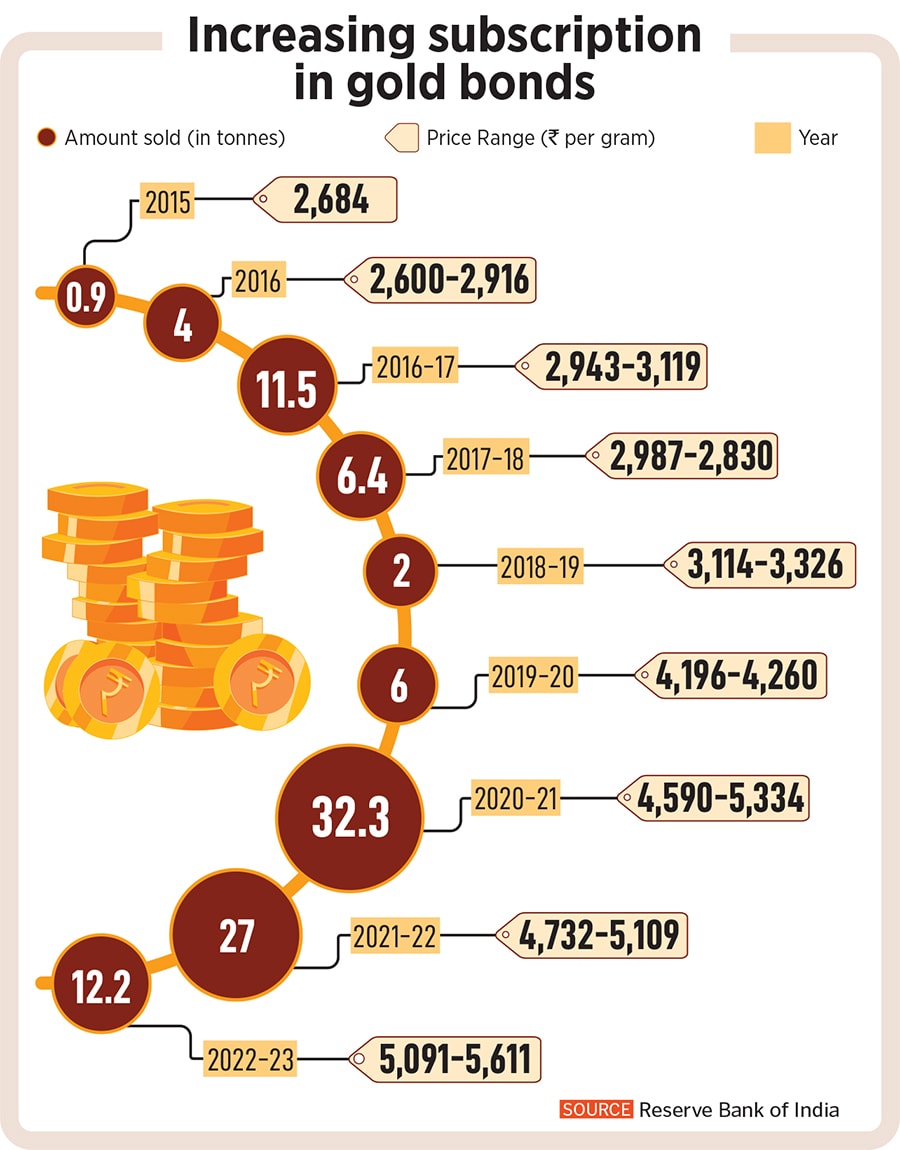

While data from the first tranche of 2023-24 is still awaited, sovereign gold bonds have now become an acceptable investment class. Sample this: In 2020-21, a total of 32.29 tonnes was sold by the Reserve Bank of India (RBI) in 10 tranches as demand for the yellow metal had spiked during the Covid-19 pandemic. A year later in 2021-22, a total of 26.98 tonnes was sold to investors at prices between Rs 4,732 and Rs 5,109 per gram. Since the scheme was launched in 2015, a total of 102 tonnes have been sold.

“This is a product that is suited to the average retail investor and we have seen people in their 30s buy, starting from 1 gram, to diversify their portfolio," says Abhijit Roy, chief executive of Goldenpi, an online bond buying platform. According to Roy, the last three years have seen sovereign gold bonds being bought increasingly by retail investors as opposed to HNIs as the tax advantages have sunk in.

Here’s how the scheme works. Investors can buy as little as one gram at a price fixed by the government and receive a fixed interest of 2.5 percent a year. “This interest is a crucial difference between gold bonds and ETFs. If not, investors would not choose this scheme," says Vijay Kuppa, chief executive officer of InCred Money. Add to this that the purity of the gold is guaranteed by the government. With physical gold there is always the risk of the purity not being accepted when it is sold.

According to Roy of Goldenpi a big disadvantage of gold bonds is the fact that they have a tenure of eight years. This makes them illiquid. Investors have the option of redeeming them with the RBI after the expiry of five years or they could sell them on the secondary market. Roy does acknowledge that liquidity is a challenge in the secondary market as both sellers and buyers would lose their tax advantages.

Data from the RBI shows that investors do redeem after the five-year lock-in period ends but this is no more than 2-3 percent of the outstanding bonds issued in that tranche. Usually investors who have seen significant gains between the price they bought at and the redemption price are the ones who sell.

Data from the RBI shows that investors do redeem after the five-year lock-in period ends but this is no more than 2-3 percent of the outstanding bonds issued in that tranche. Usually investors who have seen significant gains between the price they bought at and the redemption price are the ones who sell.

For now, the RBI has come out with two tranche offerings in 2023-24 and it remains to be seen how investors react if the price of gold doesn’t move up as most of the pandemic related gains have been sucked out. Investors in gold have used the precious metal as, variously, an inflation hedge, a store of value and as an ornament. But during this time cryptocurrencies, with Bitcoin being the most prominent, have also emerged as effective stores of value.

“Gold responds to uncertainty and with most of [uncertainty] out of the way we may not see buying by central banks for some time," says Anand James, chief market strategist at Geojit Financial Services. In such a situation it would be interesting to see how investors respond to the next few gold bond tranches.

First Published: Jun 28, 2023, 09:59

Subscribe Now