Gaming and interactive media: Lumikai, the kingmakers

Lumikai is betting big on the upside of being the only dedicated fund for games and interactive media in India. Will the gambit pay off?

The investor began the conversation by looking at the downside. “Oh, so you are building games for women!" exclaimed the venture capitalist (VC) as he welcomed Salone Sehgal to his office. “What is a woman doing in the big boys’ world of gaming?" he said grinning. “Are you the only one doing it?" he continued with his set of questions. His colleagues, too, looked stunned. There was an awkward silence. Sehgal, who happened to be the only woman in the room, was not bemused. “Around 60 percent of casual gamers in the world are women," she stressed. Sadly, she continued, less than 20 percent of games and companies are built for them. “There is a huge upside in building games for women," she underlined. “And it’s great to be the odd one out."

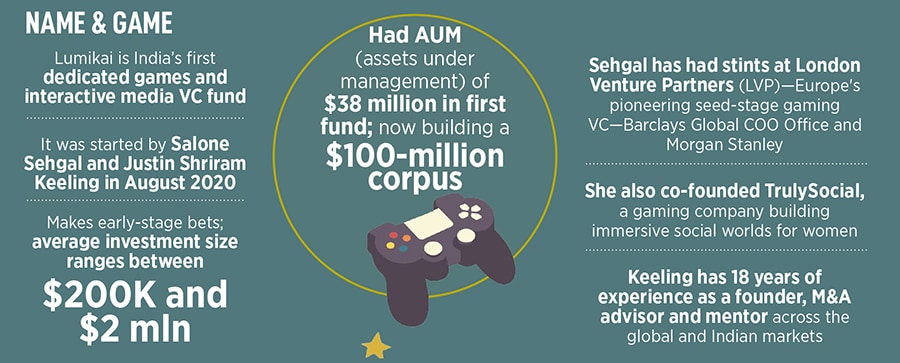

Sehgal, for sure, had a one-of-its-kind track record. The founder of TrulySocial, a mobile gaming company co-founded by her in December 2013 to build an immersive, narrative-based social world for global female audiences, had built a formidable reputation in her stints as M&A banker and PE (private equity) specialist with Barclays, Morgan Stanley and KPMG. Now, Sehgal, who had executed over $10 billion of M&A transactions, was taking her maiden plunge into entrepreneurship. Despite her famed background, she had to do what any rookie entrepreneur would do passionately: Pitch for VC money. “The conversation didn’t go well. We didn’t get the money," she recounts.

What Sehgal did get in plenty though, were rejections. One of the VCs, interestingly, evinced interest in taking the bet. His strategy of validating the idea, however, was ridiculous. “I’m going to get my wife to try the product," he remarked. An outraged Sehgal responded in kind. “If I am building a blockchain industry," she asked, “would you still ask your wife to try or understand yourself?" Understandably, the miffed investor declined to back the venture. Sehgal eventually managed to get the backing of biggies such as Nazara Games and London Venture Partners (LVP). The gritty founder scaled the venture, ran it for three-and-a-half years, and then had to shut it down after a buyout deal went south.

The founder now turned funder. Sehgal joined NVP, an early-stage London-based fund focussed on interactive gaming and entertainment segments. What didn’t change was a constant jibe of reminding why she might be the odd one out. “She looks like a diversity hire," was a common taunt. By now, Sehgal knew how to block the outside noise. “I’ve had enough detractors. It’s helped me develop a very thick skin," she says, adding that after working for close to two years she came back to India in 2019.

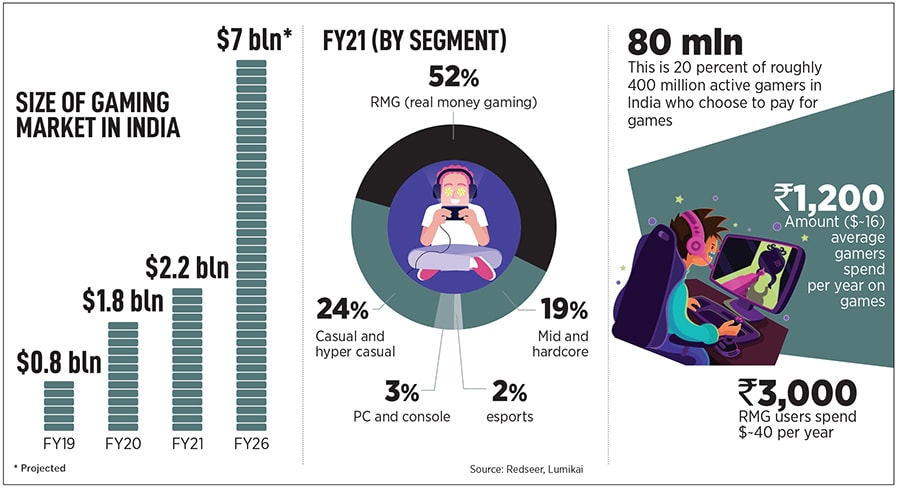

Back home, Sehgal wanted to start a VC fund focusing solely on the gaming space. The idea was compelling. India was at the cusp of a gaming boom due to the explosive growth in smartphones and cheap data. In 2018, there were an estimated 250 million gamers in India and by FY19, gaming was a little under a billion dollar opportunity, according to data by Redseer. Sehgal partnered with Justin Keeling and started Lumikai, an early-stage VC fund for games and interactive media, in August 2020, a few months after the pandemic-induced lockdown.

Lumikai, though, zeroed in on an odd game plan. “When life gives you lemons, you make lemonade," Sehgal says with a laugh. The co-founders decided to build a portfolio of gaming assets which looked beyond fantasy gaming. Lumikai, Sehgal explains, decided to look at content, platforms, tools, tech and infrastructure. “For us, the breadth of the gaming [sector] was much wider than just fantasy gaming," she adds, underlining that the focus was on making category-leading bets.

Fast forward to October 2022. Lumikai finds itself well-placed with over half-a-dozen differentiated bets. Let’s start with Loco, a mobile-first live game streaming platform. It has bagged over 52 million users over the last two years, claims Keeling. Over the last year, he underlines, daily active users (DAUs) on the platform have increased 15x, monthly active users (MAUs) have jumped 8x, and monthly active streamers have scaled 5x. Loco, he points out, has raised $51 million from Lumikai and a host of marquee investors such as Makers Fund, Krafton and Hiro Capital.

Another interesting bet is Cloudfeather Games. The gaming infrastructure company, which provides plug-and-play real money gaming solutions to developers, has raised $1.25 million in a pre-seed round from Lumikai, Venture Highway, and a clutch of angels such as Manish Agarwal of Nazara. Yet another portfolio startup is Studio Sirah, a game development studio building cross-platform, midcore games with Indian themes. Their first game happens to be a digital CCG (card collectible game) called Kurukshetra: Ascension. It leverages themes and characters from epics such as the Ramayana and Mahabharata.

What’s most fascinating, though, is Lumikai’s latest bet on Supernova. A startup that makes live quizzes and interactive gamified formats on CBSE math topics for kids aged between four and 12, Supernova raised pre-seed funding of $1.1 million this October. The round was led by Lumikai, and saw participation from Kae Capital, All In Capital, Goodwater Capital and a slew of angels. Keeling explains the logic behind the bet. “We believe that the system of play and gaming best practices have the potential to unlock massive disruption in edtech," he reckons. Supernova, he underlines, is taking a first principle approach to a massive opportunity with a new platform that reimagines kids’ education by leveraging the power of experiential, game-based ‘learning by doing’.

Sehgal, for her part, points out another big opportunity for her gaming fund. Last year, users in India downloaded games 15 billion times. The corresponding numbers during the first six months of this year, she points out, are encouraging: Seven billion new game downloads. “Games account for a third of all app downloads in India, which is the most for any category," she says, adding that India has higher game downloads than any other country in the world. Users in India, Sehgal continues to flash out data points, spend an average of 40 minutes daily playing casual games. Indians are spending 30 percent more time on mobile games post-Covid as compared to pre-Covid. “There were 450 million gamers in India in 2021 and the numbers are likely to touch 600 million in 2022," she adds.

Okay, there is enough headroom for growth. But what about monetisation? There is money in RMG, but what about the rest? Sehgal points out another set of positive data from a joint study by Lumikai and Redseer on the gaming industry in India. Around 20 percent of roughly 400 million active gamers in India choose to pay for games, she says. While average gamers spend ₹1,200 per year on games, RMG users shell out ₹3,000 per year. In FY21, around 40 percent of the revenues for the gaming industry came from in-app purchases. “It’s a story that’s not talked about much," she says with a smile.

A point high on the talking list is the exit for VCs. Sehgal knows about the potential challenge. “Around 93 percent of exits in gaming happen via strategic acquisitions, and not through IPOs," she says. India, she lets on, is still at a nascent stage in the gaming industry. For early-stage investors like Lumikai, it has to be a long and patient game. The second big challenge for VCs in the gaming space is boredom. “The startups need to be agile to keep churning interesting stuff," she says, adding that user stickiness is the key. While conceding that some odd bets would go wrong—well, that’s the law of investment—Sehgal contends that India is poised to touch $7 billion in the gaming market by 2026. “The next billion gamers are going to come from India," she smiles. “Let’s play."

First Published: Nov 14, 2022, 11:32

Subscribe Now