Government equity conversion only a short lifeline for Vodafone Idea

Though the move will help improve Vi's cash flows, it needs to halt its subscriber base erosion, raise debt funding quickly and resolve the payment of AGR dues

L

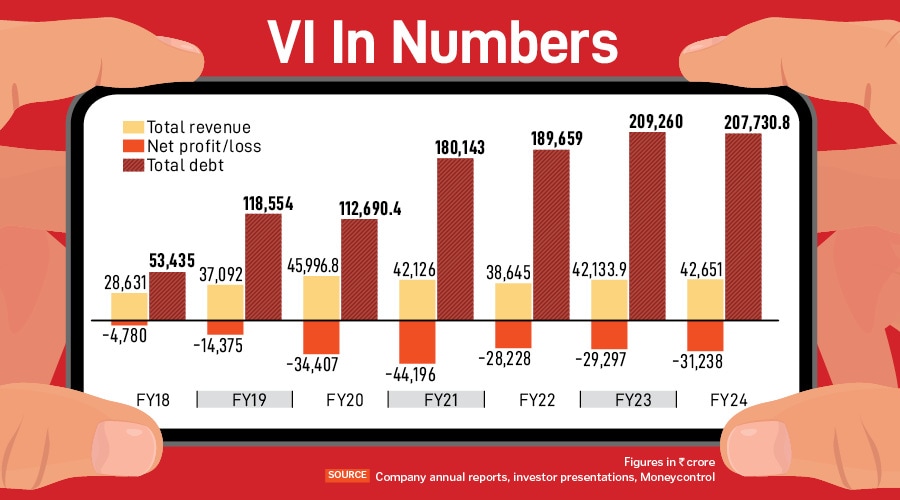

oss-making Vodafone Idea (Vi) will be able to breathe easy, but only just and not for long. The government has approved Vi’s request to convert Rs 36,950 crore spectrum liability into equity. It means the government’s stake in Vi rises to nearly 49 percent—without operational control—from 22.6 percent.

It will reduce Vi’s cumulative government payouts over the next three fiscal years (FY26-28) to around Rs 75,300 crore. The possibility of cash flows increasing for Vi and higher degree of government backing raises the prospects of completion of Vi’s pending debt-raising plan. The news brought cheer to Vi investors, with the stock closing 20.1 percent higher, or up Rs 1.37 at Rs 8.17 on the BSE on Tuesday.

But there are still some real concerns that Vi must face: Its revenues have risen only around 6 percent to Rs 11,360 crore in Q3FY25 from September 2023 levels, despite average revenue per user (ARPU) from tariff hikes rising 16 percent in the same period. Its customers are too price sensitive—the churn continues as it upgrades to 4G from 2G—and Vi has not been able to arrest its falling subscriber base for the past 26 consecutive quarters (see chart). Vi has been busy upgrading its subscriber base from 2G to 4G, providing more bundled offerings and higher value products to these subscribers.

Vi has a pending plan to raise debt of Rs 25,000 crore, which got stalled after a curative plea on AGR dues from telecom operators (including Vi), was rejected by the Supreme Court in September 2024. At its recent February 12, 2025 analysts meet, Vi CEO Akshaya Moondra said they remain “actively engaged" with banks to tie up for the debt funding programme, towards long-term network expansion. All these factors—arresting the declining subscriber base, a debt fund raise, any relief on AGR dues and improving revenues, operating efficiency and cash flows—are vital to Vi’s long-term survival.

There are, however, some positives from the lowering of Vi’s liabilities, as it is expected to improve free cash flow (FCF). Balaji Subramanian, telecom analyst at IIFL Securities, estimates Vi’s underlying FCF in FY26 to be around -Rs 21,500 crore in FY26 and a positive Rs 1,800 crore in FY28, after equity conversion.

Moondra, at the analysts’ meet, highlighted what the telco has been busy with. During the quarter it has expanded its network footprint, adding over 4,000 unique broadband towers, the largest quarterly addition since its 2018 merger. “Our network enhancement efforts included the deployment of 4G on the sub-GHz 900 MHz band across approximately 15,000 sites, improving both coverage and indoor network experience," he said.

The company also expanded its network capacity by adding about 10,400 sites in the 1,800 MHz and 2,100 MHz bands, which have resulted in faster data speeds of nearly 28 percent. Moondra said Vi was at “the start" of its larger investment cycle. “We plan to take 4G count to approximately 215,000 to 220,000, ie an increase of over 45,000 4G towers since the start of this investment cycle. Our immediate plan is to add another 13,000 towers till the middle of next quarter [April to June 2025]".

Last December, Vi launched Easy+, a corporate postpaid plan through which subscribers got an option to select and purchase services like international roaming, OTT subscriptions and others for their personal needs on their existing corporate plans.

Motilal Oswal Financial Services research analysts Aditya Bansal and Siddhesh Chaudhari say this government stake conversion will ease Vi’s cash constraints “considerably till 1HFY28".

But there are concerns going ahead for Vi. “Despite the spectrum due conversion into equity, Vi would continue to require more relief from the government on AGR dues as well as spectrum payments beyond 1HFY28," Bansal and Chaudhari add. “With GoI’s stake rising to 49 percent after the latest equity conversion, any further equity conversion of dues could lead to the government’s stake crossing 50 percent, which could turn Vi into a public sector undertaking (PSU)."

Analysts said Vi has not seen any significant operational improvement, as tariff hike benefits have been offset by continued subscriber losses. “We believe stabilisation of Vi’s subscriber base, along with further relief measures from the government, remain imperative for Vi’s long-term survival," say Bansal and Chaudhari. “Despite the likely acceleration in capex over the medium term, we believe gaining back subscribers would be a tall ask for Vi, given its peers’ superior free cash flow generation and deeper pockets. Vi remains a high-risk high-reward play."

Analysts said Vi has not seen any significant operational improvement, as tariff hike benefits have been offset by continued subscriber losses. “We believe stabilisation of Vi’s subscriber base, along with further relief measures from the government, remain imperative for Vi’s long-term survival," say Bansal and Chaudhari. “Despite the likely acceleration in capex over the medium term, we believe gaining back subscribers would be a tall ask for Vi, given its peers’ superior free cash flow generation and deeper pockets. Vi remains a high-risk high-reward play."

Subramanian assesses that continued government support is likely to keep Vi afloat even in the medium-term, albeit as a distant No 3 player, behind Reliance Jio and Bharti Airtel. “This is positive for Indus Towers in the medium-term, unless Vi’s revenue market share falls meaningfully below its current 15 percent, warranting a reduction in equipment intensity," he says.

The positive element of the government-backing Vi has to be taken into perspective of its operational efficiency. The ecosystem does not also need a situation where the third largest telecom operator needs lifelines to survive. It will need to show operational efficiency and growth, before a strategic investor decides to pump in fresh capital to make it viable.

First Published: Apr 02, 2025, 10:41

Subscribe Now