Vodafone Idea: Still several moving pieces

A recent adverse court decision relating to adjusted gross revenue dues makes debt fund raising even more critical for Vi to meet its capex for 4G/5G technology expansion. It will need to continue to

Capital-starved Vodafone Idea (Vi) will continue to face uncertain times ahead, according to analysts, until it completes a proposed Rs35,000 crore debt fund raising plan in the next two months, as proposed by its top management. On September 22, Vi announced a $3.6 billion (Rs30,000 crore) deal with Nokia, Ericsson and Samsung for supply of network equipment over three years.

This comes five months after Vi had raised Rs18,000 crore through a follow-on public offer (FPO alongside issuing preferential shares to its promoters. After this fund raise, Vi’s cash on books is positive at Rs18,150 crore as of Q1FY25. But the positive news does not really push the needle too far for Vi’s financial security and competitive efficiency.

Vi needs to continue to raise significant capital to fund its capital expenditure towards expanding 4G coverage, augmenting capacity, rolling out 5G and enhancing enterprise capabilities. Its larger rivals Reliance Jio and Bharti Airtel have continued to expand their 5G technology network across India.

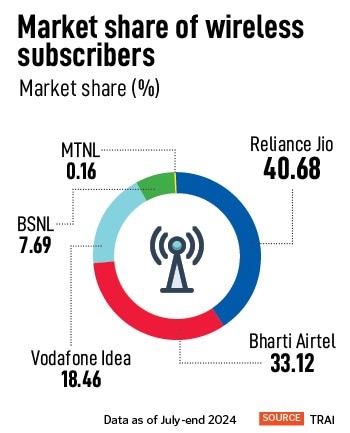

The worrisome part is that even as Vi will work towards boosting its capex, it will still run short of what Jio and Airtel have in place, which indicates a catch-up game and continuing loss of market share. Also, data shows that Vi has been losing market share and active subscribers even in its priority circles of Kerala, Mumbai, Gujarat, Kolkata and Haryana.

Vi, alongside Airtel, had pinned hopes on a possible relief of up to 50 percent reduction in total adjusted gross revenue (AGR) due to the government. Vi’s estimated liabilities include Rs1,33,110 crore in deferred spectrum payments and Rs70,320 crore in AGR dues.

Now, Vi admits that there is no further legal recourse available after the Supreme Court dismissed curative petitions from Vi and Bharti Airtel seeking corrections of computation of AGR dues. Vi, the distant third-largest telecom operator in India, has initiated fresh talks with the government—its second-largest shareholder after its promoters—to discuss future options and reduce the dues.

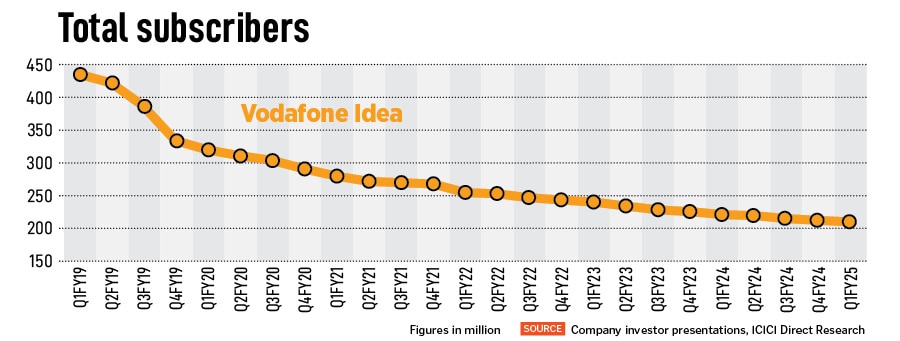

The scale of the capital raise to meet future capex, the option for the government to convert Vi’s dues into equity, sustained tariff hikes by telcos in the coming quarters and Vi’s ability to arrest the loss in subscribers (see chart) and market share to rivals are all moving pieces which will weigh down on every lender’s/investor’s decision relating to the telecom operator.

Vi has been losing subscribers for at least 25 successive quarters (since June 2018) and suffered losses for six straight financial years since the company was created through the merger of Vodafone India and Idea Cellular.

“I would like to wait and see how much of this is posturing and how much is an actual development. It is prudent to wait till the funding comes in," an analyst at an equity research firm tells Forbes India, declining to be named. Any further delay in raising debt will hurt Vi’s overall capex expansion plan, he adds.

The Vi stock has reacted to news flows in recent months, but remains 37.29 percent or Rs6.34 down year-to-date at Rs10.66 at the BSE.

Opinions are mixed within the analyst community on Vi’s financial performance from here. Vi will have no alternative but to exercise the option of converting the dues owned to the government into equity. Hemang Khanna of Nomura India research estimates that in FY26, Vi will generate Rs22,400 crore of Ebitda, and its Ebitda generation will be used to partly meet government dues [according to Vi’s calculation] of Rs29,000 crore.

“However, as indicated by Vi in the past, it is likely to use the option to convert government dues into equity—to this end, Vi will be able to convert Rs12,000 crore of dues into equity and manage to repay the balance through its Ebitda generation," he says in a note to clients. “Despite its large debt burden (but manageable with government support) in the coming years, Vi will be able to steadily repair and rebuild its business and partake in the robust outlook for the Indian telecom industry—which is underpinned by clarity on significant tariff hikes for the next two years and 5G monetisation," Khanna adds.

Other telecom analysts, however, emphasise that there are hurdles which Vi is likely to face in the coming years. Goldman Sachs analysts Manish Adukia, Harshita Wadher and Anisha Narayan see a further 300 basis points (3 percent) revenue share loss for Vi over the next three to four years. Their report sees a direct correlation between capex and revenue market share.

The analysts say even without the payment of dues till FY27, Vi’s cumulative five-year-capex (FY23 to FY27E) could be $7 billion to $8 billion, way below Airtel’s estimate of $18 billion and $20 billion for Jio.

Vi’s balance sheet is expected to remain stretched [even after the potential conversion of government dues into equity]. The Goldman Sachs analysts have concluded that with its current valuations at a premium to peers such as Airtel, the Vi stock is on a sell-rating on a discounted cash flow basis, the 12-month target is Rs2.5.

Vi’s balance sheet is expected to remain stretched [even after the potential conversion of government dues into equity]. The Goldman Sachs analysts have concluded that with its current valuations at a premium to peers such as Airtel, the Vi stock is on a sell-rating on a discounted cash flow basis, the 12-month target is Rs2.5.

IIFL Securities’ telecom analyst Balaji Subramanian tells Forbes India that while determining the fair value for Vi, there are different variables which could play out for the company. These relate to its raising of debt, the execution of its capex plan over the next three years and the number of tariff hikes which all telcos will carry out in the coming quarters.

Balaji says he does not see a solvency risk for Vi and that despite uncertain scenarios which are yet to play out, “the government has been keen on ensuring a three-player market structure". “It could provide cash flow relief by extending the moratorium on regulatory payouts by a few more years," Balaji says in a report. The moratorium is set to end by September 30, 2025. Balaji has placed a lower target price of Rs10 for Vi, with a downgrade ‘Reduce’ investment rating.

Motilal Oswal Financial Services analysts Tanmay Gupta and Siddhesh Chaudhari say that “the significant amount of cash required to service debt leaves limited upside opportunities for equity holders, despite the high operating leverage opportunity from any source of ARPU improvement".

At the time of announcing the network equipment deal, Vi’s CEO Akshaya Moondra said they had kickstarted the investment cycle. “We are on our journey of VIL 2.0 and from hereon, Vi will stage a smart turnaround to effectively participate in industry growth opportunities," he said in a press release.

Moondra had clarified that the capex is currently being funded out of the recent equity raise. “For the long-term capex, Vi is in advanced stages of discussions with its existing and new lenders to tie up Rs250 billion (Rs25,000 crore) of funded and Rs100 billion (Rs10,000 crore) of non-fund-based facilities," the release said.

The debt fund raising is the single most influential variable for Vi at this moment. If Vi can pull it off as planned, it would be better placed to arrest the subscriber loss. The extent of the liabilities it owes to the government continues to loom and even though it can be extended, in the later years, the payments could be exorbitant. The coming weeks will also bring clarity to the ongoing nature of talks with the government. The wait is on.

First Published: Sep 30, 2024, 11:21

Subscribe Now