How Ajmera Realty has managed to outperform the market

Ajmera Realty's secret sauce of constructing quickly and moving on to the next project has helped it post rapid growth in the realty upcycle

When the team at Ajmera Realty totalled sales numbers for fiscal 2024 they were in for a pleasant surprise. Ajmera Manhattan, a flagship building of the company in Wadala, had sold Rs 100 crore worth of apartments in a single month. Now, Wadala is not your usual luxury market and Ajmera, which has a 100 acre land bank there, has been working in the area for decades. Never before had they seen such numbers.

The company ended FY24 on a high with pre-sales reaching their highest ever at Rs 1,017 crore, a 21 percent jump over the previous year. In this booming market the Ajmera family, who own 74 percent of the company, were also conscious of pricing their projects reasonably and area sold rose faster than pre-sales at 28 percent in FY24 to 4,72,000 sq ft. It was followed up in the first half of FY25 with pre-sales rising 18 percent to Rs 560 crore.

The numbers show that after spending over five decades in the real estate market Ajmera has recently begun to hit its stride. The mid-sized developer has been a beneficiary of a market that has benefitted well capitalised developers post the implementation of the Real Estate (Regulation and Development) Act. While it has a land bank of 11.1 million sq ft the company views it as a raw material that has to be turned into apartments quickly. Compare this to the 1 million sq ft it is developing at present and the company has a long growth runway ahead.

Ajmera’s balance sheet has only Rs 808 crore of debt as against a net worth of Rs 865 crore, making interest payments manageable. “Our company is always conscious of over leveraging. We know it is important to ride out a down cycle," says Dhaval Ajmera, director, Ajmera Realty.

This caution has not gone unrewarded by the markets. As the real estate cycle has picked up analysts have started pricing in future growth—disproportionately rewarding companies that have started to deliver. In the last five years Ajmera’s market cap has compounded 49 percent a year to a total of Rs 2,855 crore. Their next aim: To get to a billion dollars in market cap.

With the complexities involved in buying land, the long gestation periods for projects and cyclical nature of the business, real estate companies in India tend to be family controlled. Ajmera is unique in that it has three generations of the family working in the business simultaneously. This provides for a level of control and cohesion not seen elsewhere. The business has 12 family members in active roles across three generations with another three under training.

Each family member is inducted into the business by being put in charge of a site. “It is only when you are within a construction ecosystem that you understand the moving parts involved," says Rushi Ajmera, director at Ajmera Realty. The learning curve is phenomenal—from dealing with engineers to contractors and from liaising for permissions to working with the sales team on crafting a strategy for the project. Once the family member has managed a few projects the learning curve is complete. “We are taught that financial discipline is important and that each site has to be run in a silo," says Yash Ajmera, director, Ajmera Realty.

Each family member is inducted into the business by being put in charge of a site. “It is only when you are within a construction ecosystem that you understand the moving parts involved," says Rushi Ajmera, director at Ajmera Realty. The learning curve is phenomenal—from dealing with engineers to contractors and from liaising for permissions to working with the sales team on crafting a strategy for the project. Once the family member has managed a few projects the learning curve is complete. “We are taught that financial discipline is important and that each site has to be run in a silo," says Yash Ajmera, director, Ajmera Realty.

At the same time it is the elders who provide counsel. They’ve seen multiple real estate cycles and know that not all developers survive a down cycle. All decisions on land acquisition and new projects flow to the managing director and chairman who are also family members. The brand strategy for the company is also laid down here. For now, Ajmera has decided to concentrate on four verticals—greenfield projects constructed on their land bank, joint development proposals where they tie up with a landowner, outright land purchases and slum redevelopment projects. This would give the group 11 million sq ft of saleable area.

One reason why Ajmera has managed to outperform the market is its emphasis on constructing quickly. They aim to finish projects within 3-4 years and move on to the next development. This also allows them to post good sales and collection numbers every quarter and keep investors happy. Second, the company is working on township-like projects especially in Mumbai’s Wadala area as it sees it can charge a premium from customers when facilities are bundled in.

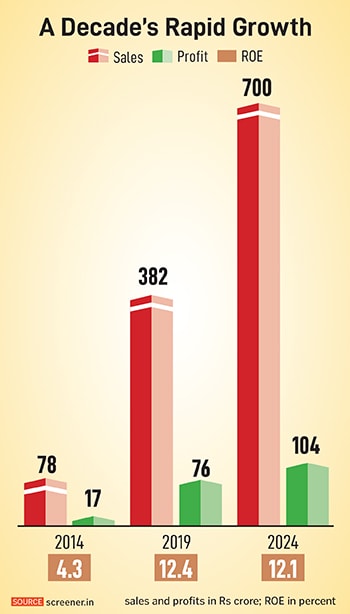

While doing so Ajmera has managed to post a consistency in margins that are at par with its larger listed players. Operating margin in 2013 stood at 27 percent and in 2024 it rose to 29 percent. Through the decade it has stayed in that range. This compares favourably with Macrotech Developers (Lodha) which also operates in Mumbai and has margins between 23 and 27 percent. In Ajmera’s case the margins have come with rising return on equity. In the last decade return on equity has increased from 4.3 percent to 12.1 percent pointing to an efficient use of capital. Also in the last decade its debt equity ratio has never gone north of 1.5 times and currently stands at under one time.

At Ajmera the target is to reach a billion dollars in market cap. For this the company plans to increase the size and scope of operations. It has already entered Bengaluru and has three projects under construction. In Mumbai, Kanjurmarg and Wadala are being developed as micro markets where it has a brand recall. Third, it will have to increase the scope of operations through joint development agreements.

According to KG Krishnamurthy, independent director of Ajmera Realty, a key missing link in their portfolio is the “absence of rent yielding commercial real estate assets". Krishnamurthy, who stepped down in September 2024 from the board, had been advising the company on how to build a more resilient portfolio. Long-term institutional investors like to see rent-yielding assets as it helps developers ride out a down cycle. As of now Ajmera’s stock has not found favour with large institutional investors or mutual funds. It has a shareholder base of 27,500 investors as of the June 2024 quarter.

What works in its favour is that the company has the building blocks to benefit from the current uptrend in real estate. Over the next 12 months potential launches of 1.7 million sq ft with a revenue potential of Rs 4,270 crore are expected. Sales in the year ended March 2025 should be in the Rs 1,300-1,350 crore range, a 27 percent jump from Rs 1,017 crore in FY24. Given that the company is still trading at a 30 price earnings multiple compared to the 50-60 multiple of its larger peers patient investors (and the family) could be in for a beneficial ride.

First Published: Oct 18, 2024, 15:07

Subscribe Now