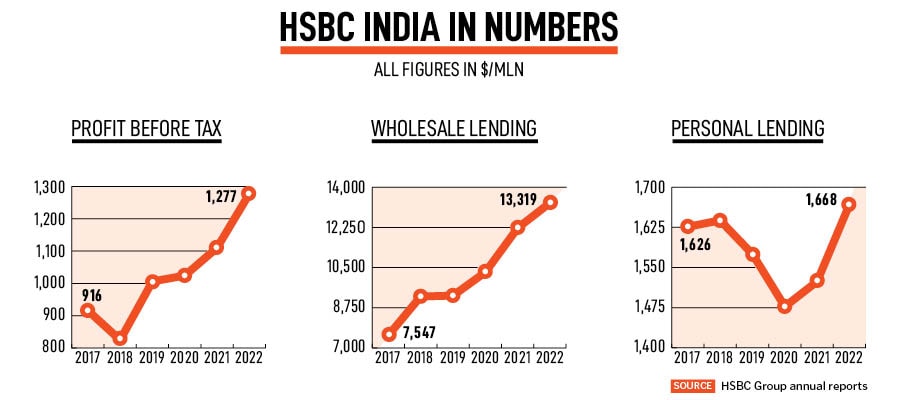

All of this makes sense for HSBC, which has long identified India as one of its priority markets. Nearly 80 percent of HSBC’s 2022 profit comes from Asia, where Hong Kong is its biggest market by profit and India operations, with a profit of $1.27 billion, is the fourth largest contributor (7.2 percent) to the 2022 profit for HSBC globally. The London-headquartered bank’s presence in India dates back 170 years and India is also HSBC’s largest employment market with 39,000 people (about 17 percent of the total workforce for HSBC), as of December-end 2022. In terms of revenue, corporate banking (64 percent) and treasury operations (22 percent) are the main contributors to its India revenues, according to India filings for the financial year ended March 2022.

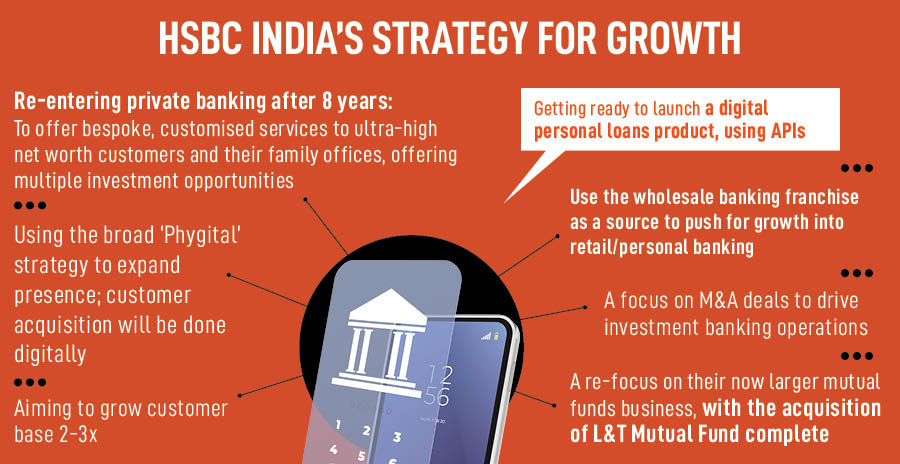

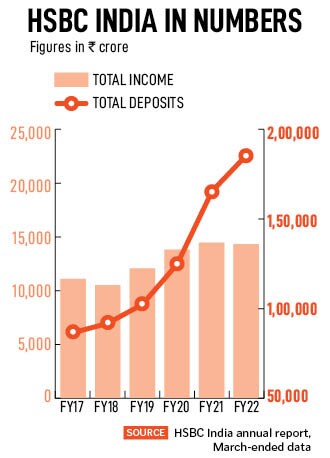

Thus, for HSBC India’s CEO Hitendra Dave, the aggression is part of the strategy to not just be a full-service foreign bank in India but also bolster its retail banking activity in India, which has lagged the bank’s traditionally strong wholesale lending activity. Retail banking contributed around 13 percent to HSBC India’s total revenues of Rs 14,301 crore (see table) and personal loans formed just 10 percent of total advances of Rs 82,339 crore in FY22, according to India filings for the financial year ended March 2022.

HSBC, which operates in India through a branch model (and not a wholly-owned subsidiary), reported a 15 percent rise in pre-tax profit (see table) for the year 2022. Earnings data for full FY23 is likely to be disclosed mid-year.

Wholesale banking for HSBC in India includes Global Banking and Markets, offering treasury, investment banking, advisory, market and forex solutions for large Indian and global companies. Wholesale banking also includes commercial banking for mid-sized Indian and global companies, including small- and medium-sized businesses. Retail banking includes personal banking and wealth management solutions.

“The intention is to use wholesale banking and make it a source of strength for retail [personal] banking," Dave told Forbes India. This could mean providing a promoter of a firm the option to upscale to private banking, offering the HSBC Premier product to senior corporate executives or employee banking services for individuals. This would be a more effective way of generating income while generating the maximum number of clients through corporate channels. Dave reiterated the bank will double-triple its customer base in the next 3-5 years, from the current near one million.

Customised solutions for the super-rich

In the third quarter of year 2023 HSBC India should be ready for a mega launch of its private banking business, a space it will re-enter after eight years—it exited India due to a global strategy at that time. The thinking in 2015 was to simplify businesses across regions and since it was not a leader in the wealth management business, the bank decided on the closure, even when India’s economy was continuing to expand.

In this period it continued to operate HSBC Premier, a retail banking and wealth management service for individuals and their families. Premier will co-exist with the private bank.

![]()

India now has a record number of billionaires—169, according to Forbes 2023 data, though their wealth has fallen due to weakening equity markets and lower investment returns across most global markets. Experts have forecast India’s wealth management industry to grow at a 10-12 percent compound annual growth rate (CAGR) up to 2025, driven by factors such as increasing wealth, a growing middle class, and a rise in digital adoption. Julius Baer, a pure foreign private wealth manager, is one of the few with a meaningful franchise, with global assets under management of CHF 428 billion ($472 bln).

The HSBC private bank would offer customised, curated solutions, including alternative investments, to about 10,000 families and their offices, by invitation only. Dave did not disclose the differential with rivals but said the private bank would “offer the best of products and propositions to customers".

HSBC India will stack up against some foreign banks such as Barclays India, Deutsche Bank India, private wealth managers like Julius Baer and local giants such as IIFL Wealth and Kotak Private. “This space offers opportunities, but it is very competitive. How they will differentiate from others will be key to their success," a senior executive at a private wealth management firm said, on condition of anonymity.

India, Hong Kong and Australia were amongst the few regions that reported a growth in wholesale lending for HSBC in 2022. Like leading domestic banks, it is seeing favourable tailwinds where corporates are less leveraged and asset quality has improved. It now banks with 40 percent of multinationals in India, most of the top corporate groups, about 1,000 startups and 44 percent of the unicorns in India, Dave says. He said the favourable tailwinds will keep driving M&A activity and cross-border trade financing.

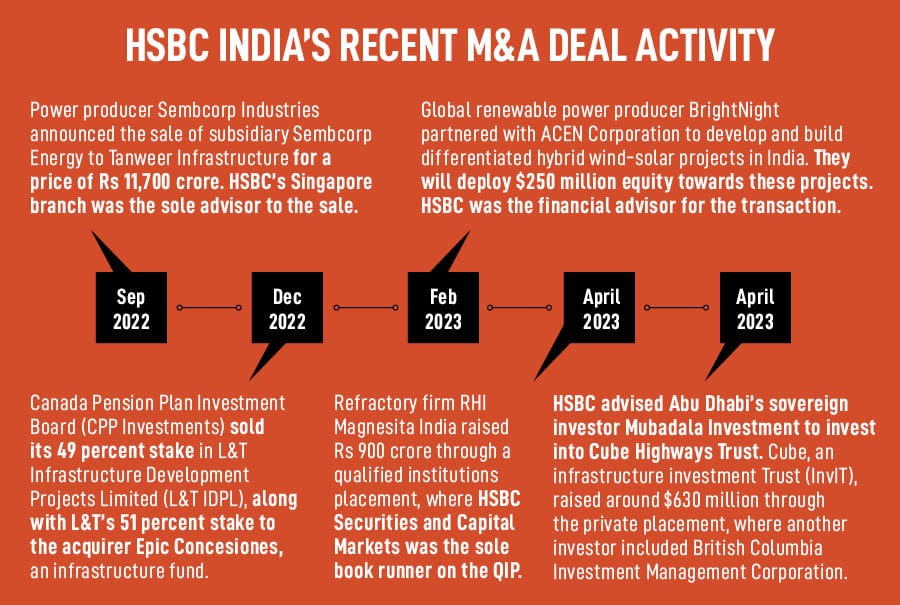

M&A deals picking up again

The turbulence of corporate business cycles, supply chain disruptions, the ongoing Russia-Ukraine war and central banks’ hiking rates to curb rising inflation had led to global M&A activity falling 36 percent in 2022 in value terms to $3.8 trillion, according to Bain & Company. But India has not seen that great an impact and most banks have reported improved activity in the last 4-5 months.

“We definitely feel that M&A activity has been picking up in the last six months in a strong way," Amitabh Malhotra, head of global banking at HSBC India told Forbes India. Pharmaceuticals, manufacturing and infrastructure have seen the most activity. Malhotra is hopeful that technology companies which had got re-rated downwards “could get sorted out" in 2023.

![]()

Malhotra said the equity capital markets (ECM) capital raising activity was “not open yet" but is likely to improve later in the year. Over 50 companies, already with Sebi approval, are waiting to list their IPOs. This includes six—Nexus Select Trust REIT, IndiaFirst Life Insurance, Lohia Corp, Pristine Logistics and Infraprojects, Biba Fashion and Bharat FIH Limited—where HSBC has been named in the DRHP. “The pipeline is rich for the second half of 2023," Malhotra says.

HSBC has found its mojo being the preferred book-runner in India for debut issuers as well as regular issuers with numerous repeat mandates. Starting January 2021, the bank took five debut issuers to the market and helped them raise over $2.5 billion through foreign currency bonds.

In the crowded MF space

In the mutual funds space, HSBC India was, prior to the L&T Mutual Fund acquisition, a niche player in the vastly crowded space of 44 asset management companies. This includes heavyweights such as SBI Funds Management, HDFC AMC, ICICI Prudential AMC and Kotak Mahindra AMC.

The rationale for the L&T acquisition, Dave says, was to “be part of the [India investment growth] journey" and aim to get into the top 5-6 fund houses (by asset size), as the investing population in India is forecasted to explode. According to a 2022 Jefferies report, around 4.8 percent of Indian household assets are in equities, as of FY22.

HSBC has now acquired 2.2 million customers of L&T Mutual Fund. Dave admits that at this stage HSBC AMC is part of the large pool of ‘other’ asset management companies—and far away from the leaders of the pack—trying to stay relevant, grow in size and emerge profitable.

![]()

Dave also plans for a digital brokerage firm to boost retail banking and add to the full-service offerings. “Customers will want to use money in whichever way, and we have to provide that. We are exploring the possibility." But once again in the vastly competitive landscape led by fintechs and banks, any such plan will not be towards revenue generation but more to ensure customer stickiness.

Dave and Malhotra are confident that there could have been no better time for the bank to get aggressive.

Since the year 2020, it has been a period of two halves for India, led by record foreign portfolio investments of $26.76 between 2020 and 2021 and then outflows of $18.28 billion in 2022 and the first four months of 2023. The Nifty 50 index has gained 49 percent to 18,255.8 levels since January 2020 and 5.19 percent since January last year—supported by strong domestic institutional buying—and despite the absence of foreign funds, as they exited to invest into their home markets.

![]() It is rare to see that Indian equities are still in the positive despite growth slowing across several economies and the sharpest interest rates in the US in 16 years. Now with interest rates in the US and India closer to their peak and global oil prices stable, Dave believes that the “next 10-15 years will all be about India. HSBC will do whatever it takes to make sure we play a meaningful role as India continues to grow".

It is rare to see that Indian equities are still in the positive despite growth slowing across several economies and the sharpest interest rates in the US in 16 years. Now with interest rates in the US and India closer to their peak and global oil prices stable, Dave believes that the “next 10-15 years will all be about India. HSBC will do whatever it takes to make sure we play a meaningful role as India continues to grow".

Dave admits that there is scope to improve “between proposition, technology and service". With a presence of 26 branches across 14 cities, HSBC India is likely to take the ‘phygital’ route to expansion but where customer acquisition and servicing will be more digital.

The challenge will be to grow at the right pace and yet not lose the trust factor that the bank preserves. “I hope we don’t end up doing something that breaks the trust in a quest for fast growth. We cannot lose our core mooring, because in the period of fast-paced growth is when maximum mistakes take place." Some rival Indian private sector banks would agree.

It is rare to see that Indian equities are still in the positive despite growth slowing across several economies and the sharpest interest rates in the US in 16 years. Now with interest rates in the US and India closer to their peak and global oil prices stable, Dave believes that the “next 10-15 years will all be about India. HSBC will do whatever it takes to make sure we play a meaningful role as India continues to grow".

It is rare to see that Indian equities are still in the positive despite growth slowing across several economies and the sharpest interest rates in the US in 16 years. Now with interest rates in the US and India closer to their peak and global oil prices stable, Dave believes that the “next 10-15 years will all be about India. HSBC will do whatever it takes to make sure we play a meaningful role as India continues to grow".