SpiceJet, a 19-year-old airline that had been struggling to stay afloat for many months, often finding itself being dragged to courts over unpaid dues, announced an interest in purchasing the now-defunct Go First. Go First, the Mumbai-headquartered low-cost airline owned by the Wadia Family, went belly up last April.

The decision to throw its hat in the ring came soon after SpiceJet announced that its board had approved a proposal to raise over Rs2,200 crore from 63 entities, including financial institutions, foreign institutional investors, high-net-worth individuals, and private investors, through the issuance of equity shares and warrants. Of them, half of the investment is to come from the little-known husband duo of Harihara and Preeti Mahapatra. The idea of the fundraiser, SpiceJet said, was to build a strong and viable airline.

The announcement sent the aviation world into a frenzy. “It’s a strange bid given the situation SpiceJet is in," Alok Anand, chairman & CEO of Bengaluru-based Acumen Aviation, an aircraft asset management and leasing company, says. “They had also bid for the Air India stake sale, so I am not sure how serious this one is. It seems more like an exercise to gather information or perhaps to bolster the SpiceJet stock."

Not surprisingly, SpiceJet’s stock has jumped over 18 percent since the announcement, with the stock price going up by a staggering 168 percent since June last year. In contrast, the benchmark Sensex has risen by some 16 percent since last June, while SpiceJet’s rival, and India’s only other publicly traded airline, IndiGo’s share prices have grown by only about 33 percent.

![]() SpiceJet’s interest in Go First, even though an acquisition might be far-fetched, stems from a mix of reasons. The acquisition could give the Ajay Singh-led airline access to slots at 27 domestic and seven international airports in addition to traffic rights held by Go First. Go First, which shut down due to operational troubles caused by faulty engines supplied by Pratt & Whitney on its Airbus aircraft, has some 53 aircraft in its fleet. These aircraft, all of them leased, are currently grounded as the airline undergoes insolvency proceedings.

SpiceJet’s interest in Go First, even though an acquisition might be far-fetched, stems from a mix of reasons. The acquisition could give the Ajay Singh-led airline access to slots at 27 domestic and seven international airports in addition to traffic rights held by Go First. Go First, which shut down due to operational troubles caused by faulty engines supplied by Pratt & Whitney on its Airbus aircraft, has some 53 aircraft in its fleet. These aircraft, all of them leased, are currently grounded as the airline undergoes insolvency proceedings.

“SpiceJet may be the most appropriate bidder for Go First if it can raise the funding," aviation consultancy firm CAPA India writes in a report. “If successful, it would provide access to over 50 aircraft on the ground in India and an order book for 72 aircraft. In contrast, to expand organically through OEM orders would take two to three years. Although contemplating such a scenario may be premature at present, if they are successful, it may lead to SpiceJet transitioning to an all-Airbus fleet in the near term."

SpiceJet has had a troubled few years with Boeing—the American aircraft maker that contributes to a significant chunk of its fleet. SpiceJet’s Boeing Max aircraft were grounded for over 20 months during which the airline struggled with capacity addition, thereby losing market share, and a recent incident with the aircraft door has once again raised uncertainties regarding Boeing’s 737 variant.

The Go First Plan

For now, a spokesperson for SpiceJet says the company has expressed interest with the Resolution Professional of Go First, and wish to submit an offer post diligence, to create a strong and viable airline in a possible combination with SpiceJet. Apart from SpiceJet, Sharjah-based aviation company Sky One, and a mysterious entity, Busy Bee, are the three companies to have expressed a formal expression of interest in acquiring Go First.

Insolvency proceedings in India often lead to significant haircuts on dues, allowing SpiceJet to mop up Go First quite cheaply. But the integration may not be as easy as it sounds. “The aircraft types are entirely different, have the engine issues going on (GTF) and the lessors are waiting to take back the assets. So, I am not sure how the mixed fleet makes sense," Anand adds. “I understand even the Go First slots would have been auctioned by now, so what’s the assets to be acquired except passenger revenue seats to be sold under the assumption that the aircraft stay and are serviceable."

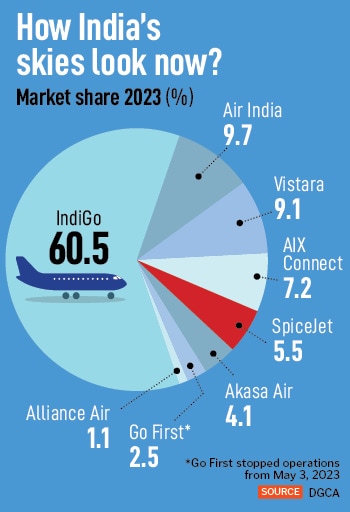

Despite that, SpiceJet sees enormous potential in the purchase, especially as India’s aviation emerges into a duopoly with heavyweights IndiGo and Air India cornering nearly 90 percent of the market. “The inclusion of Go First positions the combined entity to target a market share of 22 to 25 percent, making it a formidable player in the Indian aviation market," a senior executive at SpiceJet says on condition of anonymity. The airline currently has a market share of about 5.5 percent, a minuscule number compared to IndiGo that has a market share of over 60 percent. Coincidentally, IndiGo and SpiceJet started operations around the same time.

The recent plan to raise Rs2,250 crore is part of a larger plan that will see SpiceJet raise another Rs700 crore—Rs500 crore from Singh and Rs200 crore through the Emergency Credit Line Guarantee Scheme (ECLGS). The Indian government launched the ECLGS in May 2020 to support companies during Covid-19 and tweaked the policy in 2022.

“The capital infusion will result in a stronger balance sheet, enabling SpiceJet to access fresh funding at more favourable rates, supporting its growth initiatives," the senior executive at SpiceJet adds. “These points highlight the transformative potential of SpiceJet"s bid for Go First and the strategic moves that could reshape the landscape of the Indian aviation sector."

India is currently the world’s third-largest aviation market, and is expected to see 300 million flyers take to the skies annually in six years. “The resurgence of SpiceJet (with or without acquiring Go First), once new funding is in place, may be the most watched development in the industry in 2024, given that it has the potential to disrupt the market," CAPA says. “Though we believe that the tranche structure of the funding may be a possible downside."

![]() India’s aviation industry is emerging into a duopoly making it challenging for the likes of SpiceJet. Image: Indranil Mukherjee / AFP

India’s aviation industry is emerging into a duopoly making it challenging for the likes of SpiceJet. Image: Indranil Mukherjee / AFP

Who is putting in the money?

Of its plan to raise over Rs2,240 crore from external investors, half, or Rs1,100 crore is to come from Mumbai-based couple Preeti and Harihara Mahapatra. In all, SpiceJet will raise funds in two tranches. In the first, the company will issue 31.83 shares as fresh allotment worth Rs1,590 crore, with another 13 crore shares worth Rs650 crore being issued as warrants that are convertible into shares in the second tranche. A total of 63 new shareholders will come onboard the airline.

The Mahapatras will be allotted 22 crore shares. Other investors include Elara India Opportunities Fund, Aries Opportunities Fund, Nexus Global Fund, Prabhudas

Lilladher, and Resonance Opportunities Fund. Notably, Elara India Opportunities Fund had been linked to the Adani Group in the Hindenburg Research report published last year, which sent the Adani Group into a debacle.

“Given the fragile financial position of the airline, equity is the need of the hour," says Satyendra Pandey, managing partner for aviation services firm AT-TV. “Such fundraising is a welcome measure. However, as with any capital raise, till the funds are remitted, the on-ground reality remains the same."

That’s where the curious case of the Mahapatras raises eyebrows. They are promoters of Mahapatra Universal, a global enterprise, headquartered in India, according to the company’s website, with five subsidiaries across 11 verticals. The company claims to operate in more than seven countries across three continents and its verticals include manufacturing, engineering, infrastructure, information & technology, consumer and retail, financial services, health care, sports, media and entertainment.

![]() Mahapatra Universal says it has three brands under operations, Sceniuz, an IT company that claims to be a Microsoft Partner specialising in data analytics, data engineering and data advisory, while Preeti’s is a one-stop retail chain. Another brand, Happy Hours, claims to be a fun mobile app for all promotional offers related to food, drinks, bars, movies, sports, adventures, gym, hotels, travel and health care.

Mahapatra Universal says it has three brands under operations, Sceniuz, an IT company that claims to be a Microsoft Partner specialising in data analytics, data engineering and data advisory, while Preeti’s is a one-stop retail chain. Another brand, Happy Hours, claims to be a fun mobile app for all promotional offers related to food, drinks, bars, movies, sports, adventures, gym, hotels, travel and health care.

Preeti is listed as the founder and mentor of Mahapatra Universal, while husband Harihara is the managing director. “Under her leadership, the group integrated six acquired companies into a single division that outpaced competitors, maximised share of strategic markets, and elevated earnings," Preeti’s profile reads on the Mahapatra Universal website. Harihara, the company claims, spent the last 16 years building and leading investments as an entrepreneur from manufacturing to financial services.

Despite all the tall claims about a globally diversified empire, a closer look at Mahapatra Universal’s financials raises serious concerns about how the couple is raising Rs1,100 crore. Mahapatra Universal, the parent company, had total revenues of Rs4 lakh in FY23, down by 81 percent from FY22, according to the company’s independent auditors report sourced from market research firm Tofler. In 2022, the company did not make any revenues, according to the report, instead receiving Rs22 lakh as other income. Net loss for the financial year ended March 2023 stood at Rs1.5 crore, compared to Rs17 lakh in 2022.

In 2014, Harihara, then identified as a real estate builder, announced plans to build India"s tallest building in Khajod, Gujarat, according to a report in The Times of India. However, the plan did not materialise. Preeti and he were also accused of cheating a doctor couple in 2015, according to another report in The Times of India in January 2015, promising them flats in Mumbai worth some Rs5.5 crore, that never came up. In an interview with the Hindustan Times in 2016, Preeti claimed that the High Court had quashed those charges. Emails and WhatsApp messages sent to Mahapatra Universal and Preeti remained unanswered.

In 2016, Preeti stood as a candidate against noted lawyer-turned-politician, Kapil Sibal in the elections to the Rajya Sabha, India’s upper house, backed by the Bharatiya Janata Party (BJP). It was a closely contested battle, with Sibal eventually emerging winner. In the process, though, Preeti grabbed public attention, particularly for the support from leaders across the BJP.

Meanwhile, with SpiceJet having to complete the allotment of shares within 15 days of receiving shareholders’ approval, the airline has already sought an extension after it managed to complete only half of its proposed fundraised amount of Rs1,590 crore. On January 26, the airline said it had allotted shares and warrants totalling Rs744 crore. The money from the Mahapatras is reportedly stuck at the moment.

“The preferential issue is the first tranche of our fund infusion exercise," a spokesperson for SpiceJet says. “Due to limited banking days during the intervening period of 15 days from the date of stock exchange approval, we have sought an extension of time to complete the same. We remain committed to our capital-raising objectives and the process is ongoing. The fundraising exercise has elicited an enormous positive response."

The other prominent investors include Aries Opportunities Fund, Raghav Investments Ltd, Monika Garware and Saloni Jesal Shah. “The current fundraising should help tide over the current challenges and get the airline to a position where it can start to address liabilities, most notably TDS, PF, and other critical payments," says Pandey of AT-TV. “This will also help pave the path for repairing the balance sheet which, in turn, will have impacts on credit standing, fleet financing, and the ability to induct capacity."

Can it help SpiceJet?

![]()

With as many as 63 new investors on board, the message from Singh is clear. He has no plans of letting go of the airline and is ready to tug it out. “Singh"s ability to attract a diverse group of investors, including prominent names like Elara Capital, Aries Fund, and others, reflects his strong reputation in the business world and the confidence investors have in SpiceJet"s potential," the airline spokesperson adds.

For a few years now, SpiceJet has been in the midst of turbulence. Ahead of the Covid-19 pandemic, that threw air travel into a tailspin, it had to do with a significantly reduced fleet size. The airline had operated the Boeing Max aircraft that were globally grounded. With Covid-19 adding to woes, and financial difficulties as a result, lessors had been knocking on SpiceJet’s doors to take back aircraft. SpiceJet has a fleet size of 91 aircraft, of which 32 are Bombardier, with the remaining Boeing 737 ones.

“AT-TV estimates that SpiceJet is operating a fleet of approximately 31to 35 aircraft which is a large variance from the planned capacity based on filed DGCA schedules," says Pandey of AT-TV. “The financial position of the company also remains fragile. The balance sheet is weak, and the cash position is evidenced by delays in TDS payments, delays in the deposit of provident funds, auditors" note of material uncertainty, and payment deferrals—all disclosed by the company itself in the financial filings. Legal issues only add to this overall challenge, including costs."

A spokesperson for SpiceJet, meanwhile, says the company is in the process of getting its grounded aircraft back to the skies. “The impact of the grounding of aircraft was minimal for SpiceJet, as the airline supplemented its fleet by inducting 10 737s on wet lease in September-October 2023, ensuring the operation of all flights as per the filed schedule," the spokesperson says. “Currently, nine grounded planes have been ungrounded and returned to operations. With the recent fund infusion, we anticipate a swifter process for ungrounding the remaining aircraft which will enhance our revenue significantly."

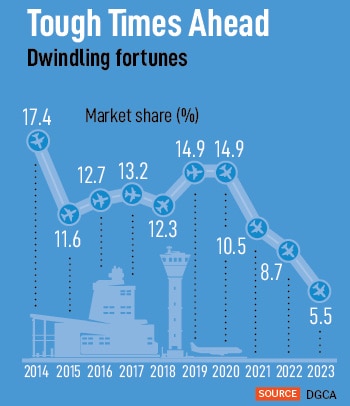

Still, the airline’s market share for 2023 fell to 5.5 percent, from 8.7 percent in 2022 and 10.5 percent in 2021. “Continuous losses, too many aircraft types (mixed fleet), rapidly changing strategy (routes, narrow body, turboprops, widebody, seaplanes, cargo, services), apart from the challenges faced due to MAX issues and thereafter the pandemic-related challenges," says Anand about the issues plaguing the airline currently.

That’s why deep pockets become extremely crucial, and essential, as India remains something of a graveyard for airlines. In the last five years, two airlines have folded operations in the country. Only those flush with funds—IndiGo, Air India and Akasa Air—have been able to expand rapidly over the last few years, as post-Covid-19 travel peaks in the country. Of this, IndiGo has a market share of over 60 percent, while Air India Group has another 26 percent.

Air India, since the Tata acquisition, is also the midst of a transformation, setting up two arms, Air India, a full-service carrier comprising Vistara, and a low-cost airline, Air India Express, comprising AirAsia India and Air India Express. India’s domestic aviation market is currently led by low-cost carriers that control as much as 80 percent of the market. The Tata group’s total fleet size stands at 260, including Air India’s 130 aircraft, Vistara’s 67, and Air India Express’ 63 jets.

“This move to bring multiple new shareholders on board is part of our strategic initiative to broaden the company"s investor base, enhance corporate governance, and foster long-term growth," says the SpiceJet spokesperson. “Singh"s business acumen is evident in his skillful navigation of the aviation industry, fostering partnerships, and positioning SpiceJet for sustained success."

But even then, Singh has serious work to undertake, once the funds are in the kitty, especially in addressing under-investments the past few years. “At its core, the airline has to address balance sheet issues, stabilise and scale operations, and to a point where revenues are consistently covering for costs incurred," says Pandey. “That is, each seat flown must contribute to the bottom line and not take away from it. This requires a clear strategy, executed by a strong team with a laser-like focus."

The latest fundraise, though, will likely reduce Singh’s grip over the airline, with shareholding significantly reduced from about 56 percent to 38 percent. SpiceJet says Singh will continue to lead the airline with the same commitment and success that has “been evident in his past leadership".

“I think more than a ‘global’ airline, SpiceJet needs to be a safe, reliable and profitable airline," says Anand. “The focus areas should be a clear strategy of fleet and routes to begin with. Perhaps, one aircraft type, even if it means staying domestic or regional for a few years to come back to profitability. Then, a clear debt repayment plan, and cutting down ruthlessly on anything which is a diversion."

Tough times ahead

![]() All that means the year ahead isn’t likely an easy one, especially as the Indian aviation sector will see Air India and IndiGo flex their muscles, and the market tilts further into a duopoly.

All that means the year ahead isn’t likely an easy one, especially as the Indian aviation sector will see Air India and IndiGo flex their muscles, and the market tilts further into a duopoly.

But Singh, who founded the airline in 2005, is no stranger to seeing through tough times. In 2014, a few years after he had left the airline, he returned to take control of the airline after it ran into turbulent skies and near bankruptcy. The airline soon turned in 18 consecutive months of profits. Then, as Covid-19 hit, SpiceJet turned to set up a cargo division that remained the company’s mainstay during the pandemic, offsetting losses from the passenger airline business. Last year, SpiceJet hived off the business into a separate subsidiary.

“On one hand, SpiceJet is struggling, but on the other, he [Singh] has saved SpiceJet from near-death experiences multiple times," Anand says. “Only time will tell depending on how the recent fundraise pans out."

Singh, though, has strong reasons to fight it out. India’s domestic air passenger traffic is expected to grow between 8 percent and 13 percent in the current fiscal, taking the total number of passengers to nearly 155 million, surpassing the pre-Covid levels of 141.2 million, according to ratings agency ICRA. The momentum is expected to continue next year, with a similar growth. International passenger traffic for Indian carriers is expected at between 25 million and 27 million passengers.

So what"s SpiceJet planning to do this year? “As our grounded planes return to service, our market share is bound to increase," says the SpiceJet spokesperson. “However, SpiceJet’s focus is to grow profitably, achieve operational efficiency, provide customer-centric services, and implement prudent financial management."

All that might be easier said than done. But if there is anything, Ajay Singh is a tough cookie, and a difficult one to write off.

SpiceJet’s interest in Go First, even though an acquisition might be far-fetched, stems from a mix of reasons. The acquisition could give the Ajay Singh-led airline access to slots at 27 domestic and seven international airports in addition to traffic rights held by Go First. Go First, which shut down due to operational troubles caused by faulty engines supplied by Pratt & Whitney on its Airbus aircraft, has some 53 aircraft in its fleet. These aircraft, all of them leased, are currently grounded as the airline undergoes insolvency proceedings.

SpiceJet’s interest in Go First, even though an acquisition might be far-fetched, stems from a mix of reasons. The acquisition could give the Ajay Singh-led airline access to slots at 27 domestic and seven international airports in addition to traffic rights held by Go First. Go First, which shut down due to operational troubles caused by faulty engines supplied by Pratt & Whitney on its Airbus aircraft, has some 53 aircraft in its fleet. These aircraft, all of them leased, are currently grounded as the airline undergoes insolvency proceedings.

Mahapatra Universal says it has three brands under operations, Sceniuz, an IT company that claims to be a Microsoft Partner specialising in data analytics, data engineering and data advisory, while Preeti’s is a one-stop retail chain. Another brand, Happy Hours, claims to be a fun mobile app for all promotional offers related to food, drinks, bars, movies, sports, adventures, gym, hotels, travel and health care.

Mahapatra Universal says it has three brands under operations, Sceniuz, an IT company that claims to be a Microsoft Partner specialising in data analytics, data engineering and data advisory, while Preeti’s is a one-stop retail chain. Another brand, Happy Hours, claims to be a fun mobile app for all promotional offers related to food, drinks, bars, movies, sports, adventures, gym, hotels, travel and health care.

All that means the year ahead isn’t likely an easy one, especially as the Indian aviation sector will see Air India and IndiGo flex their muscles, and the market tilts further into a duopoly.

All that means the year ahead isn’t likely an easy one, especially as the Indian aviation sector will see Air India and IndiGo flex their muscles, and the market tilts further into a duopoly.