Why debt is juicier than equity investments today

Investing in debt is more lucrative now. Alternative Investment Funds and Do-It-Yourself platforms are the key beneficiaries

Imagine being able to make double-digit returns with lower levels of risk and volatility than equity investments. That’s a deal few would spurn.

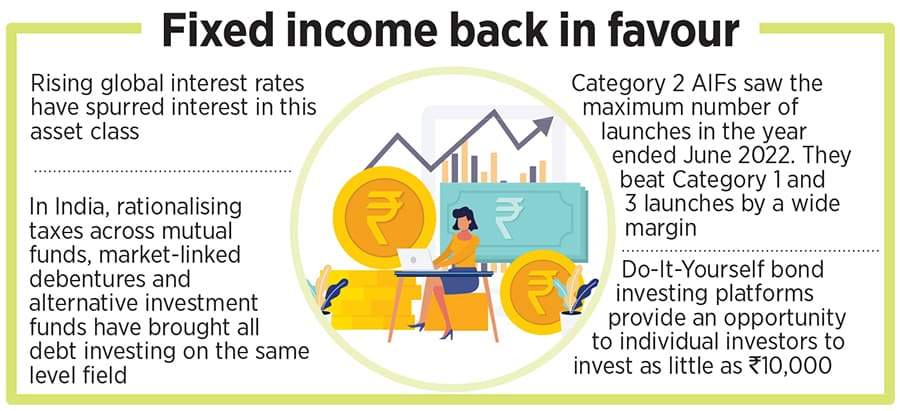

That is also the promise that debt funds hold. In the last 18 months, as interest rates globally have headed north so have investments into this asset class. The US 10-year government bond, considered a proxy for the global risk-free rate, now trades at 3.6 percent—up 250 basis points in the last 18 months. As a result, all debt investments globally are offering higher yields. The consensus on interest rates remaining higher for longer means that these investments should stay in favour for quite some time.

The situation is no different in India on account of both higher yields as well as a recent change in tax laws. Investors are increasingly allocating a larger portion of their portfolios—which remain heavily skewed towards equities, real estate and gold—to debt. With markets at nearly-all-time highs and earnings growth in the high teens, they have toned down their expectations of future returns from equities.

For Indian investors on the debt front, there is plenty to choose from. The total outstanding stock of bonds in India stands at $2.3 trillion of which corporate bonds make up $509 billion, according to data from the Clearing Corporation of India and the Securities and Exchange Board of India. “Globally, the size of the bond markets is 1.2 to 1.4 times the GDP," according to Vishal Goenka, co-founder of Indiabonds.com, a bond buying platform.

Changes to tax laws have also brought all forms of debt investing at par. In February, the Budget removed the favourable tax treatment accorded to market-linked debentures In late March, the Finance Bill brought debt mutual funds also under the slab rate.

This meant that in effect all classes of debt—from fixed deposits to government bonds and mutual funds to alternative investment funds (AIFs)—are now taxed similarly. It removed the tax arbitrage that some investors used when putting money to work. (The only exception remains for hybrid funds that invest in both debt and equity.) Bhavin Jatania, Head of products at 360 ONE Asset (formerly IIFL Wealth), says: “We are just seeing the start of this trend. On account of a change in regulations, a lot of people over-allocated to debt in February and March." He expects the rise in investments to continue.

With only 2 percent of demat accounts having some form of debt securities, according to data from Central Depository Services, there is plenty of room for investors to allocate larger amounts to debt. “In the last year, people have shifted their investments on account of (uncertainty) in the equity markets. And they want to tap into rising rates," says Mahavir Lunawat, founder of Pantomath Financial Services.

For now, there are three ways in which investors can make allocations. There is the tried-and-tested mutual fund route. There are Do-It-Yourself bond investment platforms like Indiabonds.com and Zerodha-backed GoldenPi. And there are AIFs—Category 2 funds cater to debt investments and unlisted equity, and most large-ticket debt investing is expected to happen here.

Marketed to sophisticated investors who can invest a minimum Rs1 crore, AIFs offer a variety of debt choices. “Investors are asking whether private credit markets can offer the same return as public markets," says Karthik Athreya, head, product and strategy private credit at Sundaram Alternates. What AIFs do is work towards getting those higher returns by taking advantage of a wide array of investments available in the debt space. According to data from the Securities and Exchange Board of India, Category 2 funds have also seen the highest growth over the last decade. In the year ending June 2022, 93 Category 2 AIFs were launched compared to 30 Category 1 and 14 Category 3 funds.

These funds have taken advantage of the fact that post 2010, the banks have increasingly moved to lending to larger companies as well as for working capital requirements. This leaves a large swathe of companies with revenues between Rs100 crore and Rs2,000 crore in search of credit. “We believe this opportunity to be Rs50,000 crore in annual demand," says Athreya of Sundaram Alternates. “A host of scenarios—acquisitions, corporate reorganisations, last-mile working capital mismatches, refinancing, bridge to liquidity events like IPOs typically do not fall within bank credit appraisal systems."

In addition, there are distress situations like when a business goes through insolvency proceedings where banks may not lend to or venture debt. A vast majority of debt money is being raised in these areas. According to estimates, $50 billion (Rs400,000 crore) is already invested in Category 2 AIFs and this market is growing by 25 to 30 percent a year.

Now, as a result to changes in tax laws, the AIF structure has become more attractive to HNIs for two reasons. One, the tax rate is the same. And second, as a consequence of this, AIFs can make their investments more broad based.

This is how it plays out. Earlier AIFs would not want to invest in government bonds as post tax, they would be no better off than mutual funds. (AIFs were taxed at the slab rate while mutual fund investors had the benefit of indexation, which in effect reduced the tax to about 15 percent.) As a result, AIFs would only buy bonds that yielded in excess of 10 percent. “Now the entire field from 8 percent to 20 percent yielding instruments is open to us," says Jatania of 360 ONE. That brings in more flexibility and makes investors more willing to put in the higher ticket sizes that AIFs require. As the equity risk premium declines, expect more Category 2 AIF launches this year as investors seek higher returns with less volatility.

For the average investor, bond platforms offer the best path. Over the last year, the Reserve Bank of India (RBI) has tried to deepen investing avenues for bonds. The launch of the RBI direct scheme is one such avenue. Citizens can go and buy RBI bonds directly.

Others who expected a higher rate of return than fixed deposits had in the past found opportunities shut out to them. “Previously high yield bonds were accessible only to HNIs and institutions," says Vijay Kuppa, CEO at InCred Money. At best they could go through the mutual fund route. But buying bonds of state governments, state companies, non-banking finance companies were opportunities.

Individual investors still needed a platform to view quotes as well as to be made aware that there are options that give higher returns than fixed deposits. Over the last five years, options like GoldenPi, Indiabonds.com and InCred offer bond quotes to investors. Goenka of Indiabonds.com says, “The two biggest problems were the lack of awareness and the technological access to make investments easy." While KYC is a lot easier now—bonds get credited directly to the demat account—the awareness bit is an ongoing process.

Suku Thomas Samuel, 37, who started investing in bonds post Covid, came to GoldenPi as he wanted a higher return than fixed deposits. He invests mostly in non-convertible debentures that yield 9 percent and above. Over the years, he has moved 10 percent of his investments to bonds. He finds the platform transparent and as he is able to research himself, he is comfortable with the additional risk that results in the higher yields. An added advantage is that his investments can be as low as Rs10,000. Abhijit Roy, CEO, GoldenPi, says: “People under 30 usually go for higher yields, of say 9 percent. It is those above 40 who go for more stable yields and invest higher amounts," he says. GoldenPi has Rs6,000 crore worth of bonds listed on any given day.

One aspect that investors pay less heed to is the liquidity risk with bonds. With a mutual fund, they will be able to redeem at a time of their choosing, but a bond has to find a buyer. Here platforms say they will help the holder look for buyers, but this is done on a best-effort basis. Individual investors Forbes India spoke to say they hadn’t had an opportunity to sell their bonds before expiry.

So while a large part of the promise of debt investing is fixed returns with low volatility, it is also true that rising interest rates globally is what has spurred interest in this asset class. A decline in global interest rates could hamper growth as investors once again tilt towards equity to generate higher returns. How inflows rise in a falling rate environment will be key to track.

First Published: Jun 08, 2023, 12:37

Subscribe Now