In July 2014, over one lakh potential buyers scrambled to register for the flash sale on ecommerce platform Flipkart. And within five seconds, thousands of smartphones were scooped up by fervent consumers. A month later, in August, the frenzy erupted again when the same model—thousands of Xiaomi"s Mi3 phones—was sold out in two seconds. Even over thirty days later, the excitement persisted. This time, Xiaomi sold 40,000 units of Redmi 1S in four seconds. The Chinese smartphone maker had made its India debut in July 2014, and flash sales by the upstart set the market on fire. The euphoria was real, but the experience was surreal. In 2014, when handset brands were wooing buyers in shops, Xiaomi was engaged in an intense online romance.

The fairytale continued. “The first four-five years were like Midas touch for us," recalls Muralikrishnan B, who joined the Chinese brand as the chief operating officer in 2018 and four years later was elevated to president in July 2022.

A decade ago, the smartphone market was nascent, the competition was placid, and Xiaomi had something that others lacked: Budget phones for the masses. Muralikrishnan explains. “We had the right product for the right market, at the right price and at the right time."

India was warming up to 4G but homegrown mavericks like Micromax, Intex, Lava, and Karbonn were saddled with a massive 3G inventory. “We started with a clean slate, went aggressive with 4G handsets, and things changed over time," he underlines. In little over three years, Xiaomi became the biggest in India and grabbed a meaty 30 percent market share in 2018. In fact, the brand logged a record 31 percent share in the first quarter of 2018. “This is the stuff that fairy tales are made up of," smiles Muralikrishnan. “But every fairy tale has an element of drama."

![]()

The first existential crisis came in 2020, and it was not Covid. The India-China border clash in Galwan Valley triggered a clamour to boycott Chinese products. Xiaomi slipped into a fire-fighting mode and plastered its Mi Stores with ‘Made in India’ banners. As Chinese brands survived the crisis, Xiaomi too emerged unscathed, and Covid tailwinds—the pandemic ushered in a fairytale growth for smartphones and laptop makers—fanned the aggressive onward march of the Chinese biggie.

At a time when brands struggled to keep up with a raging demand, Xiaomi too had to rejig its supply blueprint. “We were bullish for two years as we couldn"t match supply. We kept pushing our supply chain," recounts Muralikrishnan. Aur maal do, aur maal do (give us more products) became a war cry, and the aggressive strategy was replicated in 2022.

![]()

Six months into 2022, Xiaomi had a tryst with an old-fashioned corporate villain: Miscalculation. Covid started waning, people started returning to work from offices, and schools reopened. “Suddenly, a big pent-up demand got sucked out of the market," says Muralikrishnan.

The smartphone business, he lets on, is like the vegetable, food, and fish business. If you fail to clear inventory on time, you are in trouble. Xiaomi—which had grabbed the biggest share of the smartphone market under Rs10,000—was in deep trouble. The rivals continued to launch new phones in the same price band, and Xiaomi was compelled to follow suit. To clear the stock, the brand started discounting. “After a point of time, you start selling below the cost price because you must get rid of inventory. And we had crores of inventory," he rues.

Unfortunately, over-estimation or miscalculation of the demand was not the only culprit. Covid’s impact on the supply chain and high inflationary pressure pushed the price of entry-level smartphones. A Rs6,000 handset now carried a tag of Rs7,500. Customers buying entry-level smartphones lacked a credit card or access to financing. NBFCs too shied away from offering loans. “A 25 percent price hike hurts," avers Muralikrishnan.

![]()

The result was disastrous for Xiaomi. The market for the under-Rs10,000 segment started shrinking as consumers shifted to cheaper, refurbished phones. At the same time, people who were upgrading from feature phones were not buying entry-level smartphones. They too opted for refurbished phones. This further hit the belly of the smartphone market. “And who was the market leader in this segment? Xiaomi," rues the president of the Chinese brand.

There was another anti-hero that inadvertently hit Xiaomi. One of the masterstrokes of the Chinese brand was its flanking strategy. To put it simply, it meant launching as many phones as possible to cast a wide net and cater to a broad section of the population.

![]()

Sample this. Between the price band of Rs8,500 and Rs14,000, Xiaomi had five models in 2022. Redmi 10A was from Rs8,499 onward, Redmi 10 started from Rs10,999, Redmi 11 Prime carried a tag of Rs12,999, Redmi Note 11 came for Rs13,499, and Redmi 11 Prime 5G was priced at Rs13,999. The result was utter confusion. “We had a portfolio bloat," confesses Muralikrishnan. There is a Redmi 10, Redmi 10A, Redmi 10 C…and all came in the same price band. “We just created the recipe for complications," he says.

Unfortunately, more ingredients whipped up a perfect storm for Xiaomi. The mass budget smartphone segment—between Rs10,000 and Rs20,000—too notched a lukewarm growth. Reason? The consumers were yet to make up their minds. ‘Should I stick with a 4G handset or should I upgrade to 5G’ was the big dilemma. Xiaomi was again the biggest player in this segment. “The only segment that grew was the above Rs20,000, and we were not strong there," says Muralikrishnan.

The premium smartphone market—including entry, mid, and super premium that goes up to $800 (Rs66,616+)--has been the big bright spot for smartphone makers in India. So as Samsung, Vivo, and Apple flourished, Xiaomi started languishing.

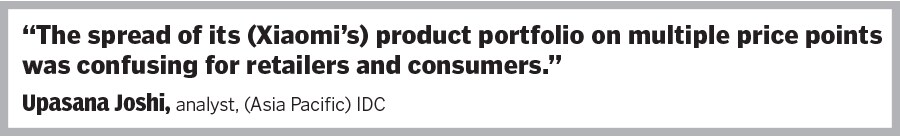

![]() From a record 31 percent volume market share in the first quarter of 2018, Xiaomi slipped to 16 percent in the corresponding quarter of 2023. A year later, it inched to 19 percent. The annual report card too reflected the grim reality. From a 30 percent market share in 2018, Xiaomi tumbled to 17 percent in 2023. A player that occupied the top slot for 20 consecutive quarters, made way for Samsung in the third quarter of 2022.

From a record 31 percent volume market share in the first quarter of 2018, Xiaomi slipped to 16 percent in the corresponding quarter of 2023. A year later, it inched to 19 percent. The annual report card too reflected the grim reality. From a 30 percent market share in 2018, Xiaomi tumbled to 17 percent in 2023. A player that occupied the top slot for 20 consecutive quarters, made way for Samsung in the third quarter of 2022.

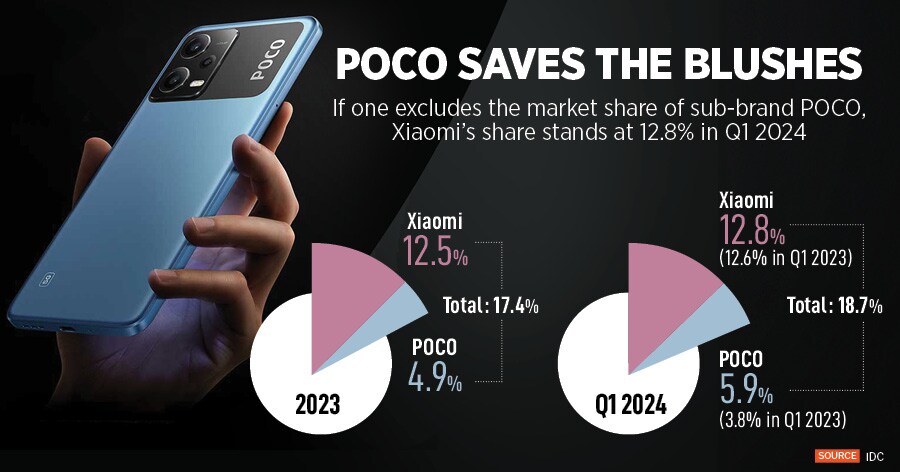

Xiaomi, say market experts and analysts, fell victim to its obsession with online-heavy strategy. "Too many variants, too many models, an aggressive flanking strategy, and a fledgling offline plan added to its woes," believes Faisal Kawoosa, founder of techARC, a technology analytics, research, and consulting firm. If one excludes the market share of sub-brand POCO, Xiaomi"s share stands at 12.8 percent in Q1 2024. “POCO has salvaged the situation," he underlines.

Upasana Joshi, an analyst with IDC, says that Xiaomi was also hit by top management rejig and intense scrutiny by the government over alleged tax issues. “These factors led to a slowdown in the operations," she says.

Meanwhile, Muralikrishnan maintains that the brand has had a reboot over the last few quarters. Achieving a cleaner and leaner portfolio, democratising 5G handsets, and growing offline capabilities became the mantra from 2023. “We exited 2022 as the No 4 smartphone brand. In Q4 2023, we became No 2 and clawed back the market share," he says, adding that the brand is now plugging a gaping hole in its armoury: Premium smartphones.

![]()

This year, Xiaomi has rolled out three products: Xiaomi 14 Civi starts at Rs42,999, Xiaomi 14 starts at Rs69,999, and Xiaomi 14 Ultra carries a tag of Rs99,999. If you look at the Rs40,000 to Rs50,000 price band, explains Muralikrishnan, there is a big opportunity. “We don"t just have a right to play but a right to make a significant impact with premium phones," he says.

There is a small problem, though. Can Xiaomi, which has made a mark with its mass play and has always positioned itself as a price warrior, morph into an aspirational brand and take on the likes of Samsung and Apple? Brand experts have a contrarian take.

“It’s relatively easier to downgrade from premium to budget, but tough to upgrade," reckons Ashita Aggarwal, professor of marketing at SP Jain Institute of Management and Research. The premium play, she explains, should have been under a different brand rather than the mother brand. Xiaomi, Mi, and Redmi have a strong connotation with mass and budget phones. “That’s the reason why Maruti had to come up with a premium Nexa," she adds.

Muralikrishnan, for his part, sounds confident. “We will continue on the premiumisation journey," he signs off.

From a record 31 percent volume market share in the first quarter of 2018, Xiaomi slipped to 16 percent in the corresponding quarter of 2023. A year later, it inched to 19 percent. The annual report card too reflected the grim reality. From a 30 percent market share in 2018, Xiaomi tumbled to 17 percent in 2023. A player that occupied the top slot for 20 consecutive quarters, made way for Samsung in the third quarter of 2022.

From a record 31 percent volume market share in the first quarter of 2018, Xiaomi slipped to 16 percent in the corresponding quarter of 2023. A year later, it inched to 19 percent. The annual report card too reflected the grim reality. From a 30 percent market share in 2018, Xiaomi tumbled to 17 percent in 2023. A player that occupied the top slot for 20 consecutive quarters, made way for Samsung in the third quarter of 2022.