The revival of L&T Finance Holdings

MD & CEO Dinanath Dubhashi is looking to turn around L&T Finance Holdings with his exacting methods and standards

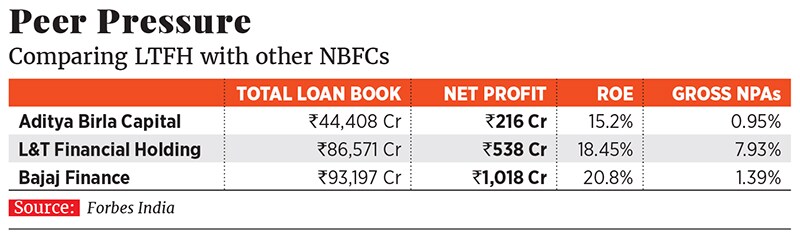

Dinanath Dubhashi: "All the tough calls were made and no one questioned them." In June 2016, when Dinanath Dubhashi took charge as the managing director and CEO of L&T Finance Holdings (LTFH), succeeding Yashwant Deosthalee who took over as its chairman, the going wasn’t great for the NBFC. Its return on equity (ROE) had fallen to 9 percent after costs had surged int the process of operating a string of businesses that were not generating better returns. And the crowded space it was operating in was pulling the company down: Diversified NBFC rivals such as Bajaj Finance, Aditya Birla Capital, Tata Capital and HDFC had already secured a firm footing and others like Piramal Capital and Housing Finance, IndiaInfoline Finance, ECL Finance (from Edelweiss Group) were vying for business.

One of the reasons behind LTFH’s tough journey was that, over the past decade, NBFCs in India grew at a hectic pace, expanding lending activity as several banks, crippled by non-performing assets (NPAs), were unable to lend to segments that needed capital.

These segments included housing finance (particularly in the affordable segment) amid still low home ownership levels, vehicle finance (new and used vehicles), micro, small and medium enterprises (MSMEs) finance (an underpenetrated market where less than 50 percent of the credit requirements are being met today by formal financial channels like banks and NBFCs) and wholesale financing (which includes large ticket loans towards segments like real estate, mid-market promoter financing, infrastructure financing that involves a significant quantum of structured debt).

LTFH, in which the parent company L&T holds a 64.01 percent stake, tried to have a finger in each pie between 2011 and 2015. After it became a listed company in 2011, macro-economic conditions in India weakened, thus impacting its lending activity. The company, too, lost its focus after it applied for a banking licence in 2013. “We had started thinking like a bank, when we were not one, and our cost of funds and customers were like an NBFC's,” admits Dubhashi. This led to excess products in which they had no leadership position and a surge in costs as the company expanded.

Top among Dubhashi’s strategies for getting into shape was trimming down businesses from 21 to just five “right” ones, particularly those businesses where shareholder returns were maximum and the company had a chance to climb to the top five in growth and top two in profitability. As a result, LTFH now operates in five verticals—rural, housing and wholesale (infrastructure) lending, and non-loan businesses such as mutual funds and wealth management, through five separate subsidiaries. “All the tough calls were made and no one questioned them,” says Dubhashi, who previously worked at BNP Paribas and SBI Caps.

Dubhashi also introduced the 'Results not reason' programme, where the focus was to achieve milestones. Some of the projects, which were part of their centres of excellence, are now headed by 30- to 35-year-old mid-level employees with leadership potential. “They have been given three- to four-year objectives in terms of targets, but with milestones that they have to achieve every three months,” says Dubhashi, who monitors their performance every quarter.

Besides, the new plan involved focussing on “retailisation” of the lending book, shifting focus to high-growth areas of retail finance, including auto and home loans. At present, rural lending accounts for 22 percent, housing 24 percent, wholesale finance 53 percent, and 1 percent for de-focussed business.

Dubhashi aspires to have all lending businesses (rural, housing and wholesale) at 33 percent each of the book in the next three to four years. Its September 5 sale of its supply chain finance business (loan book of ₹800 crore) to Centrum Financial Services for an undisclosed amount is seen as a step in that direction.

He has also given a renewed thrust to fee-based income through underwriting and down selling in the lending businesses. The NBFC has seen three-fold rise in its fee income to ₹359 crore, making it less vulnerable to tough business cycles.

The outcome of the course correction? There has been a tangible improvement in the key ratios: Its total loan book is at ₹86,571 crore, its return on equity has doubled to 18.45 percent as of Q1FY19 and market cap at ₹33,979 crore (on a stock price of ₹170 on September 4, 2018).

In Q1FY19, it also calculated its stressed assets (Stage 3 under expected credit losses) at ₹6,480 crore (or 7.93 percent) and provisioning of 62 percent at a consolidated level. Bad loans were at 11.7 percent and provisioning lower at 51 percent for the corresponding quarter a year earlier.

Of the consolidated figure, bad loans in wholesale lending stood at ₹5,058 crore, on which a provisioning of ₹3,200 has been made. Dubhashi is confident that, with aggressive provisioning when its business is faring well, the bad loan concern is behind them.

[qt]We had started thinking like a bank, when we were not one, and our cost of funds and customers were like an NBFC's.”

Dinanath Dubhashi, MD & CEO, LTFH[/qt]

In any organisation, it is usually after the cycle of tough decisions that extraneous, non-important things start coming to the fore. But there has been no pulling back. To prevent employees from slackening, Dubhashi launched a campaign towards the end of 2017, which said '7 quarters is not 10 years'. This has been followed by another one in April 2018, which said 'Basecamp to Mt Everest', a signal to employees that the company is not only far from the summit but is yet to reach base camp. “Base camp targets have been set out for each vertical, which are to be met by March 30, 2019,” Dubhashi says.

There could not have been a more apt time for Dubhashi to launch his latest campaign with an eye on the long term. For, despite businesses being in a better shape than what they were two years ago, there are real concerns that need to be addressed. And LTHF hasn’t been able to build a firewall yet.

All NBFCs in the country offer pretty much the same suite of products to customers. Bajaj Finance, one of the fastest growing ones, has a focus on consumer durables and SME lending, and follows a strategy of profit share and not market share, which means the bottom line, rather than just aiming for revenue growth. LTFH, barring infrastructure financing, is still looking to improve its market share.

Krishnan Sitaraman, senior director (financial sector), Crisil, says: “NBFCs have raised ₹40,000 crore of capital in the last five fiscals that has resulted in gearing levels [a company’s debt compared to equity capital] coming down despite the growth. The challenge in the current fiscal for NBFCs is on the liability side.” As interest rates are rising again, so are borrowing costs of NBFCs. But lending rates for some NBFCs have not kept pace, particularly in segments like new vehicle loans and home loans where competition from private banks is high.

LTFH’s largest business is towards wholesale lending, which, including its infrastructure debt fund, has a 53 percent share of the total book. “Wholesale loans are relatively chunkier and carry higher concentration risk with infrastructure lending representing additional construction and execution risk,” says ratings agency ICRA in its August 28 note on LTFH.

While some of these risks could be lessened, considering that the company has shifted towards renewable energy projects and they have a strong legacy experience of infrastructure lending, the ability of the group to manage asset quality—with early warning signals—through different business cycles will need to be watched.

High NPAs for LTFH—these are lower for other NBFCs—are due to its existing legacy business. Umang Shah, financial analyst at HSBC Securities and Capital Markets, says, “The delay in resolution of stressed assets can keep LTFH’s credit costs elevated for a period longer than expected.” LTFH’s consolidated NPAs stand at 7.93 percent, much higher than peers such as Aditya Birla Capital.  On the non-loan side, LTFH has diversified by offering mutual funds and wealth management services to help retain customers and capture a larger share of their wallets. This will help reduce the company's customer acquisition cost. But each of these businesses will need more time to grow.

On the non-loan side, LTFH has diversified by offering mutual funds and wealth management services to help retain customers and capture a larger share of their wallets. This will help reduce the company's customer acquisition cost. But each of these businesses will need more time to grow.

Aditya Birla Capital is already the third largest by average assets under management of ₹2,67,176 crore, while LTHF’s is ₹69,773 crore.

At this stage, LTFH has a leadership position only in the renewables sector lending, while it ranks second to Mahindra Finance in farm equipment finance (which forms part of rural lending). In micro loans, it stands third to Bandhan Bank and Bharat Financial Inclusion Ltd.

“L&T Finance does not need to have a competitive advantage at this stage. They may not be market leaders in any segment, but it is fine if they can manage to improve cost of funds. But the problem will emerge later where, if they are not a market leader in sub-segments, they could find it tougher to maintain a stable ROE in individual businesses, not at a consolidated level,” said another analyst with a foreign brokerage said. (LTFH’s cost of funds improved to 8.20 percent in FY18 from 9.20 percent in FY16.)

A top management source at a rival NBFC said LTFH will need to diversify further to start to have pricing power [as a market leader] in segments. “It needs to be in at least 10 diversified businesses with market leadership in at least three of these, going ahead.”

Dubhashi understands much of this. He has set out two more goals that form part of his Vision 2020 plan. The first is that LTFH’s ROE will not dip below 18 percent. The second is a 'Never again' campaign that he spoke of at an analysts' meet this July, highlighting that the company will never again go through the loss of confidence and credibility it saw in earlier years.

Tough words these. The next several quarters will decide how far LTFH goes.

First Published: Oct 10, 2018, 15:07

Subscribe Now