56% of banks say DLT, not a priority in the near future: Fed report

According to many responders from major banks, the technology would probably not be significant for the practice of liquidity management until 2027

Prefer us on Google

Image: Shutterstock

Image: Shutterstock

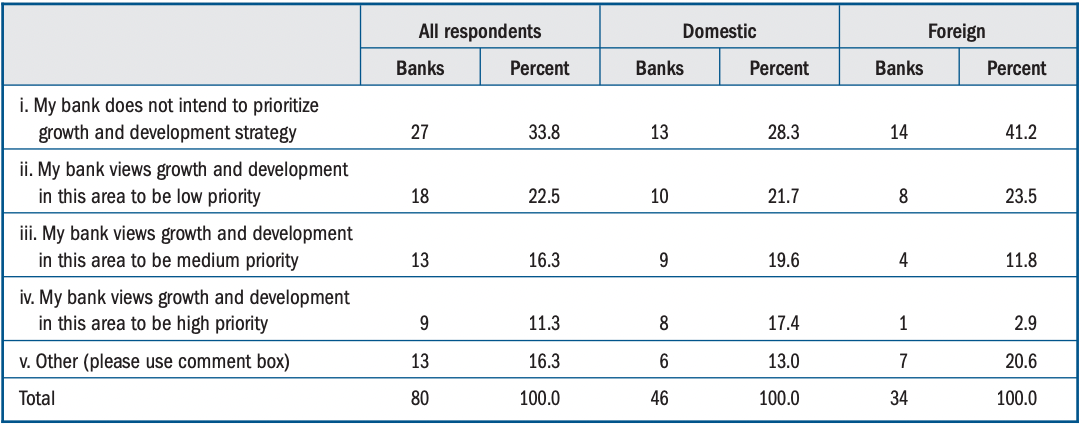

A survey by the US Federal Reserve stated that most executives at major banks do not prioritise crypto-related goods and services as crucial for the banking system in the near future. Over 56 percent of senior financial officers from 80 banks responded to a Fed study that was made public on Friday, stating that they didn’t contemplate distributed ledger technology and crypto products and services as a priority in the near future.

For the next two years, their growth and development strategy ranks cryptos and DLT as "not a priority" or "a low priority," while about 27 percent stated they considered cryptos carrying a medium or high priority. However, almost 40 percent of poll participants stated that their banks would prioritise the DLT technology at a medium or high level in the next two to five years.

Bank executives responded similarly when questioned about the effect of crypto on liquidity management practices, with many claiming that the technology won"t matter in the next two to five years. The banks were "actively watching the situation and would react to the landscape as needed," according to several of the officials.

As of May 2022, the senior financial officials of examined banks held almost 75 percent of the entire reserve balances in the banking system. Of those surveyed, 46 were domestic banks, and 34 were foreign banking organisations.

If politicians or regulators approve, the Federal Reserve, which serves as the country"s central bank, will probably be the organisation to issue a digital dollar. Many of the laws governing digital assets and financial institutions in the nation are also overseen by the Securities and Exchange Commission and the Commodity Futures Trading Commission. The Senate confirmed Michael Barr, a former advisor to Ripple, on Wednesday to be the Fed"s next vice chair for guidance, guaranteeing that the board of governors will have seven members in total in 2022.

Shashank is the founder of yMedia. He ventured into crypto in 2013 and is an ETH maximalist. Twitter: @bhardwajshash

First Published: Jul 18, 2022, 16:59

Subscribe Now