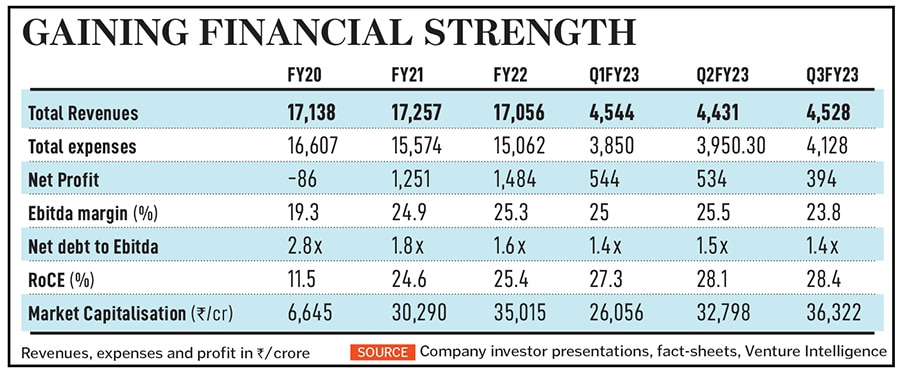

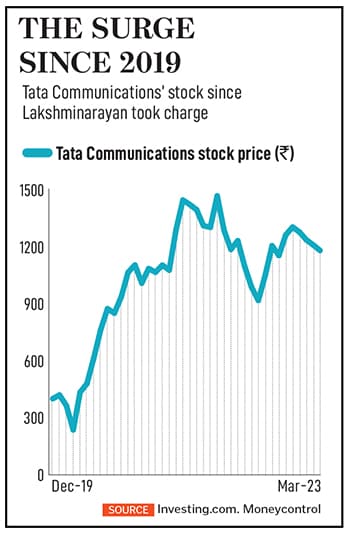

But now, investors cannot ignore the company. Almost every financial parameter in recent quarters has been “the best in its recorded history", Shakir tells Forbes India. The company has recorded 11 successive quarters of net profit, and Ebitda margins, which hovered around 14 to 15 percent, are now 24 to 25 percent. Return on capital employed (RoCE), which was 8.3 percent in 2019, is now at 28 percent. Improved earnings have seen retail investor confidence return, with the stock up by nearly 200 percent or 3x at ₹1,177 at the stock exchanges, since Lakshminarayanan’s taking charge.

Before Lakshminarayanan and Shakir joined, Tata Communications was trying to shrug off several negatives, including a weakening balance sheet, inability to raise fresh equity due to government presence in the company and selling commoditised-type products with voice telephony contributing 37 percent to revenues in 2017. This was, after all, the sleepy, erstwhile Videsh Sanchar Nigam Ltd (VSNL)—it became Tata Communications in 2007—which had a large range of products, but could not channelise them to generate revenues.

By the time Lakshminarayanan’s predecessor Vinod Kumar left in 2019, two of the big hurdles had been dealt with: The demerger of surplus land held by VSNL to a new entity, and the selling of the South African Neotel unit and a 74 percent stake in its data centre business to a unit of Singapore’s Temasek Holdings. After the land sale, the government, by March 2021 exited Tata Communications completely.

This meant that Lakshminarayanan could focus only on business without any distractions. There was no time wasted, and after a string of meetings with strategic investors and several customers, he launched the ‘Reimagine Strategy’, which was approved by the board and officially launched when the pandemic broke in India in 2020.

![]() Lakshminarayanan explains the contours of the strategy, all in a page. “Earlier, customers operated in silos and they would then go scouting for different products with other companies. The mindset of providing a holistic digital solution to customers was missing," he tells Forbes India.

Lakshminarayanan explains the contours of the strategy, all in a page. “Earlier, customers operated in silos and they would then go scouting for different products with other companies. The mindset of providing a holistic digital solution to customers was missing," he tells Forbes India.

Tata Communications provides a range of products from network services, cloud hosting and cyber security to media and entertainment services and mobility and IoT (Internet of Things) services.

Besides this, both Lakshminarayanan and Shakir decided to take tough decisions, if Tata Communications was to improve efficiencies and fortunes were to be turned around. “I realised that we were operating in India with an international cost base while overseas we were operating without the advantage of an India cost base. This was like the worst of both worlds that one can think of," says Lakshminarayanan. It meant getting the operating model right and needing to realign job locations, by shifting customer-facing jobs back to India.

Another important element in the turnaround strategy is how the sales team has changed the sales and product pitches. “Five years back we were a very product-driven, single-point solutions company. We used to measure our success by product penetration ratio, but this has now shifted to variable consumption from the customer, which we now call a relevancy quotient [to the customer]," says Sumeet Walia, chief sales and marketing officer at Tata Communications.

Walia says the relevancy quotient is determined by three elements: The share of engagement with CXOs to solve business problems a net promoter score—pre-sales to post sales—and the share of wallet. Walia explains the relevancy quotient scores were internal data, but adds that digital platform revenues have outpaced core connectivity revenues.

In the past four years, 70 percent of Tata Communications’ revenues came from core connectivity solutions and the balance from digital platforms. Now about 40 percent revenues come from digital solutions and 60 percent from core connectivity. It is clear then that Tata Communications has already positioned itself as a digital ecosystem enabler, compared to just a telco, from previous years.

![]() Ensuring financial fitness is another important element of growth. Then there were elements to address ‘the who, what and how’ while facing the customer. The company created customer-centric teams to assess and started to offer platforms and solutions rather than just commoditised products such as ‘connectivity’ to customers. The ‘how’ related to creating the right operational model so that cost-efficiencies were managed.

Ensuring financial fitness is another important element of growth. Then there were elements to address ‘the who, what and how’ while facing the customer. The company created customer-centric teams to assess and started to offer platforms and solutions rather than just commoditised products such as ‘connectivity’ to customers. The ‘how’ related to creating the right operational model so that cost-efficiencies were managed.

Shakir also talks about the ‘Fit to Compete and Fit to Grow’ pillars to improve financial efficiencies. The ‘Fit to Compete’ relates to a company being agile and dynamic to a changing ecosystem. “If a competitor can churn out a price revision proposal to a customer in a few hours instead of a few weeks by us, that is unacceptable," he says. Tata Communications has now introduced dynamic pricing frameworks that are updated every month. This would also help in reducing time to respond to dynamic situations.

Also, earlier the company would stop at ‘deal profitability’, but now it thinks about ‘deal cash flow’—which means how soon will the company start seeing capital flows from the deal. “Fit to Grow is a financial model to drive double-digit profitable growth. When the company gets double-digit profitable growth, it will get operating leverage and better efficiencies and then, finally, margin expansion. This margin money is then redeployed back into infrastructure and innovations," Shakir says.

Switch Acquisition Impact

Shakir cites the recent ₹485 crore ($58.8 million) all-cash acquisition of Switch Enterprises, a live production and video transmission company. “The deal will strengthen our position in the American market. The geographies and product portfolios are complementary," Lakshminarayanan says. The entire funding for the deal was through internal cash accruals, Shakir says, adding that he is confident that in the future, Tata Communications should be able to fund $50-100 million-sized acquisitions from within.

Sanjesh Jain and Akash Kumar, ICICI Securities’ analysts, in a post Q3FY23 earnings report on Tata Communications say: “The Switch TV deal adds to Tata Communications’ production capabilities which it can cross-sell to existing global customers. Switch has production facilities at a large number of locations which will act as an entry barrier and Tata Communications’ global cloud-based delivery solutions will add value to Switch customers."

The analysts say Tata Communications anticipates “Switch to be margin-dilutive initially, but should improve on realisation of synergy benefits". In an interaction with analysts on January 24, post Q3FY23 earnings, Shakir had said: “We do see that the overall margin portfolio for media business will definitely be held by Switch and be able to sell more. We’re able to give more value to our customers, and in the medium term, Ebitda will pick up."

![]()

The Switch Enterprises deal will definitely help the media and entertainment segment to grow over the medium term. Tata Communications in 2022 announced a multi-year strategic collaboration with Formula 1 (F1) as their official broadcast connectivity provider.

As part of the agreement, Tata Communications will bring to F1 global end-to-end managed network services for video contribution. The company will facilitate the transfer of more than 100 video feeds and over 250 audio channels to be transmitted between the Grand Prix venue and F1’s media and technology centre in the UK every race weekend in under 200 milliseconds, enabling F1 to broadcast to over 500 million fans in over 180 territories globally.

Media and Entertainment services has a 14.5 percent share of the company’s digital platforms and services (DPS) revenues, according to YTD FY23 data.

As with most transformational journeys, the Reimagine Strategy is work-in-progress. “No element of the strategy has changed," Lakshminarayanan says.

Staying Agile

Tata Communications’ solutions have assisted various companies stay agile in a rapidly challenging technology-driven world. One such company is Baroda BNP Paribas Asset Management India, where both partners in the joint venture (JV)—Bank of Baroda and BNP Paribas—have their core strength in asset management and distribution.

“We were looking to contract a one-cheque vendor who could manage all immediate and future requirements of scalability end-to-end, including compliance to regulatory requirements," says Vivek Kudal, COO and CFO at Baroda BNP Paribas Asset Management India.

“Tata Communications helped us set up our JV that was a greenfield project wherein it was responsible for managed hosting services (MHS), network connectivity, managed security services (MSS) and facility management services (FMS), thus ensuring that the solution architecture was robust, optimised and regulatory compliant," Kudal adds. “With Tata Communications as our partner, we are more agile and can now focus on our core competency of asset management and continual servicing to our stakeholders."

![]() It is not just the customers who need to stay agile. Shakir is likely to stay agile to interest rate decisions from central banks, not just due to sustained inflationary pressures but also the possible fallout of news surrounding weakening banks across Europe. While borrowing costs for the company are likely to go up further, it may need to explore more sources of capital. Shakir declined to comment on the matter.

It is not just the customers who need to stay agile. Shakir is likely to stay agile to interest rate decisions from central banks, not just due to sustained inflationary pressures but also the possible fallout of news surrounding weakening banks across Europe. While borrowing costs for the company are likely to go up further, it may need to explore more sources of capital. Shakir declined to comment on the matter.

“The pandemic taught us that it is not the most profitable companies that survive… it’s the liquid ones," Shakir says. He is confident the company will increase capital spend in the coming year, which could touch between $400 million and $500 million for FY24. If you have to drive growth, you need capital. If you need capital, there should be comfort to shareholders that the company can generate return on capital," he adds.

Tata Communications’ next strategy for growth could well focus more on the international market, where it has massive untapped opportunities to increase its revenue pie, compared to other global players. Lakshminarayanan is likely to keep all future strategies simple and on a page. “Communicate things in simple terms," he says.

Lakshminarayanan explains the contours of the strategy, all in a page. “Earlier, customers operated in silos and they would then go scouting for different products with other companies. The mindset of providing a holistic digital solution to customers was missing," he tells Forbes India.

Lakshminarayanan explains the contours of the strategy, all in a page. “Earlier, customers operated in silos and they would then go scouting for different products with other companies. The mindset of providing a holistic digital solution to customers was missing," he tells Forbes India. Ensuring financial fitness is another important element of growth. Then there were elements to address ‘the who, what and how’ while facing the customer. The company created customer-centric teams to assess and started to offer platforms and solutions rather than just commoditised products such as ‘connectivity’ to customers. The ‘how’ related to creating the right operational model so that cost-efficiencies were managed.

Ensuring financial fitness is another important element of growth. Then there were elements to address ‘the who, what and how’ while facing the customer. The company created customer-centric teams to assess and started to offer platforms and solutions rather than just commoditised products such as ‘connectivity’ to customers. The ‘how’ related to creating the right operational model so that cost-efficiencies were managed.

It is not just the customers who need to stay agile. Shakir is likely to stay agile to interest rate decisions from central banks, not just due to sustained inflationary pressures but also the possible fallout of news surrounding weakening banks across Europe. While borrowing costs for the company are likely to go up further, it may need to explore more sources of capital. Shakir declined to comment on the matter.

It is not just the customers who need to stay agile. Shakir is likely to stay agile to interest rate decisions from central banks, not just due to sustained inflationary pressures but also the possible fallout of news surrounding weakening banks across Europe. While borrowing costs for the company are likely to go up further, it may need to explore more sources of capital. Shakir declined to comment on the matter.