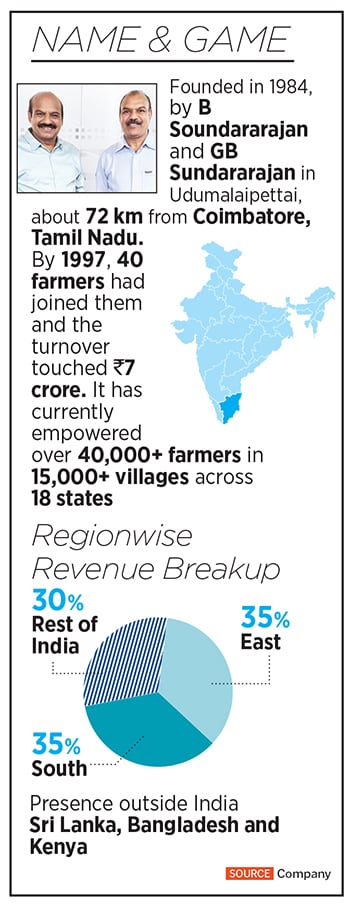

Suguna Foods, which is the flagship company of the larger group—Suguna Holdings—works with over 40,000 farmers, from more than 15,000 villages across 18 states. Soundararajan is now the chairman of the group company, his son Vignesh has recently taken charge of Suguna Foods India as managing director. The company is now focussing on four verticals: Farms and feed as B2B, and food and soya as B2C. Though it has a pan-India and international presence, the family-run business gets most of its revenue from South and East India. As per reports, Suguna Foods is a market leader, with a 15 percent market share in the ₹70,000-crore poultry broiler market in India. “The goal is to provide affordable quality protein to every household in the country, while being inclusive of small and marginal farmers," says Vignesh.

Soundararajan, after completion of his schooling, aimed to set up his own business.

He started with vegetable farming in his family’s ancestral agricultural land for about three years, which wasn’t profitable. To overcome the financial crisis, he started to work for an agricultural pump company in Hyderabad. The job allowed him to travel extensively and meet a lot of farmers. He returned to his native village to join the business started by his brother.

“This is when the idea of contract farming struck and we experimented with this model in 1990 with just three farmers," says Soundararajan. Contract farming was unheard of in India’s poultry sector, until Suguna.

“We provided farmers with everything they needed to hatch chicks—from feed to medications—and the farmers, in turn, gave the grown bird to us." Through this model, the cost centres for a farmer came down from 14 to four—a win-win situation for both the farmers and Suguna.

“Looking back, I think it was a risky bet.

But we did what we thought was right," reckons Soundararajan. When the model was introduced, farmers were resistant to the idea, but once they saw good results in the trial batches, the word spread. By 1997, 40 farmers had joined them and the turnover touched ₹7 crore.

Soon after, Suguna Chicken became a household name in Tamil Nadu. The company today provides farmers with end-to-end solutions, and has technical service executives who visit 10 to 15 farms daily. “I have been in the poultry business with Suguna for the past two years. Supervisors and staff are giving me the right guidance and advice it has helped in earning good growing charge and profits," says Abdul Jabbar, a farmer from Mannarkkad, a small village in Kerala. Suguna follows a ‘contract farming’ model where farmers are paid growing charges for raising the hens and are paid per kilogram. “There is a minimum growing charge as well. In case the farmer’s performance is very poor, the company pays them a minimum growing charge to take care of farm expenses," says Vignesh. This is a far more sustainable approach, as the farmer earns a fixed income—the minimum growing charge—every two months, in addition to performance incentives. Looking back, both father and son attribute this unique concept of contract farming to the company’s rapid success. At present, close to 80 percent of poultry in India is raised through contract farming.

![]() Focussing on the core

Focussing on the core

The largest contributor to its revenue—80 percent—is the farm business. This includes both the broiler and breeder: Products that are sold to the wet market, which sells fresh meat, fish, and produce. It also has over 70 feed mills across the country, where it produces animal feeds. Suguna Feeds makes both poultry and dairy feed. “Poultry feed includes broiler, layer, and country chicken. Dairy is all cattle feed, a vertical that we started only last year looking at the demand," explains Vignesh.

On the B2C side, Suguna Foods’ second largest revenue contributor is soya. “One of our protein sources for animal feed is soya, along with which we use maize. We have a soya processing plant in Nagpur, where the seed gets split into meal and oil. The soya meal goes to all our feed mills," says Vignesh. The oil was earlier sold wholesale. “We now refine it and sell it across Maharashtra and Madhya Pradesh under the brand name Mother’s Delight."

The third business vertical is processed food, which includes meat, eggs and its click-and-mortar stores. In 2021, it implemented a brand restructuring for this segment, with the launch of its new brand Delfrez, which has nearly 300 stores across India. The group has invested over ₹100 crore in Delfrez and plans to launch over 1,000 outlets by 2025. “Delfrez is now present in major online and offline channels, including platforms like Big Basket, Grofers, Swiggy, Zomato and Dunzo. Apart from diverse poultry products, the brand also includes ready-to-eat, ready-to-cook, and marinades," says Vignesh. Delfrez also retails in stores in metros like Chennai, Bengaluru, Gurgaon, Mumbai, and Cochin.

Even now, India’s poultry sector remains largely unorganised. “Slowly it is becoming organised, with more and more people moving to contract farming. The market is moving a lot more towards processing, many large players are investing in chicken processing plants now," explains Vignesh.

![]() Margins for the poultry business are thin and fluctuate based on consumption patterns and seasons, especially in India. As the industry moves towards processing, margins are expected to improve.

Margins for the poultry business are thin and fluctuate based on consumption patterns and seasons, especially in India. As the industry moves towards processing, margins are expected to improve.

Back in 2016, the group diversified into the dairy business by focussing on milk and curd. As part of Suguna Dairy Products, it had a unit near Coimbatore, serving western Tamil Nadu and Kerala. “We thought dairy definitely has the potential to grow as big as the poultry market, and is closely aligned with farmers we worked with," says Vignesh. “But margins are thin in dairy as well, and you have to depend on wholesalers and retailers, and share margins with them." Last year, the group decided to sell that business to Hyderabad-based Heritage Foods, and focus on poultry as a core. “Rather than looking at new verticals," says the 29-year-old, “we decided to focus on geographical diversification, instead."

Tech-focussed

Since 1997, the founders decided to start leveraging technology to help professionalise Suguna Foods. They introduced the Oracle ERP, which helped create a central database in Coimbatore. “For most manufacturing units or FMCG companies, inventory is sitting in a few warehouses, so it is easy to control those. But our inventory—every bird across every farm—is sitting in 45,000 locations across the country. This is why ERP was necessary for us, and we were the first ones to introduce this technology in the poultry space."

More recently, the company has introduced its mobile application, through which customers can see which farms are available for selling live chicken. “They can pick the farm on the application, locate it and find the exact route," he adds.

![]() B Soundararajan (centre), who started the Suguna Group in 1984

B Soundararajan (centre), who started the Suguna Group in 1984

The pandemic effect

Due to a lot of misinformation during the first few months of Covid-19, the poultry industry reportedly ran into losses of over ₹26,000 crore in just three months of 2020. Vignesh recalls, “We’re dealing with a live product that you cannot keep in a warehouse you will have to sell it, so the prices crashed at the time." Wholesale prices of broiler chicken crashed to a low of around ₹50 per kg in March 2020 from ₹90 per kg that January. “Even after the misconceptions were cleared by the government and ICMR, hotels were shut for a brief period of time. Close to 30-40 percent of meat consumption comes from that segment. We did suffer, but now things are back to normal," he adds.

In FY21, the company clocked in a turnover of ₹9,155.04 crore, an increase of ₹415.28 crore from its FY20 turnover of ₹8,739.76 crore. Profit after tax for FY21 was ₹358.89 crore, against a loss of ₹382.51 crore in the previous financial year, due to the pandemic.

Soundararajan says, “The pandemic has been a great learning opportunity for every industry and today we are happy to see one of our biggest takeaways from the pandemic take shape with a very innovative approach to our poultry format. The rebranding [Delfrez] exercise was a major initiative that we have undertaken to be relevant in today’s digital world."

Expanding globally

In 2010, the company expanded to Sri Lanka, followed by Bangladesh in 2011 and Kenya in 2017. In 2020, the International Finance Corporation (IFC), the multilateral lending arm of the World Bank, announced an investment of $54 million in Suguna Holdings, for the company’s expansion projects in Bangladesh and Kenya. Suguna invested $15.9 million in Suguna Food and Feeds Bangladesh and $8.4 million in Suguna Poultry Kenya, to capitalise on both these growing economies. The group also has another subsidiary company, Globion, an animal health care company manufacturing poultry vaccines.The turnover from the company’s exports is ₹18.41 crore in FY21.

Vignesh has set up a leadership team for each of the four verticals. “Gradually, I would like to move the business from a family-led organisation to a professional institution," he says. Apart from Suguna Foods, all other subsidiaries of the group company are being run by CEOs who report to Soundararajan.

Do they have plans to expand to more countries and new verticals? “We want to stay focussed on our four main strategic business units, and be an inch-wide and mile-deep player," says Vignesh. For a company at such a stage, an IPO is presumed to be the next big step. The managing director says, “We’ve not closed our eyes to the idea. But, frst, we are building the business that is ready for an IPO in the future."

They would buy chicken feed and sell them to farmers, becoming one of the many vendors that farmers would interact with in order to raise chicken. There were specific vendors for every small requirement, such as rice husk, medicines or feed, adding margins for every purchase. Consequently, costs escalated and farmers could not pay the vendors on time.

They would buy chicken feed and sell them to farmers, becoming one of the many vendors that farmers would interact with in order to raise chicken. There were specific vendors for every small requirement, such as rice husk, medicines or feed, adding margins for every purchase. Consequently, costs escalated and farmers could not pay the vendors on time. Focussing on the core

Focussing on the core Margins for the poultry business are thin and fluctuate based on consumption patterns and seasons, especially in India. As the industry moves towards processing, margins are expected to improve.

Margins for the poultry business are thin and fluctuate based on consumption patterns and seasons, especially in India. As the industry moves towards processing, margins are expected to improve.