Jio bags fifth investment, from KKR

In the last month, Mukesh Ambani-owned Jio Platforms has raised $10.3 billion or Rs 78,562 crore

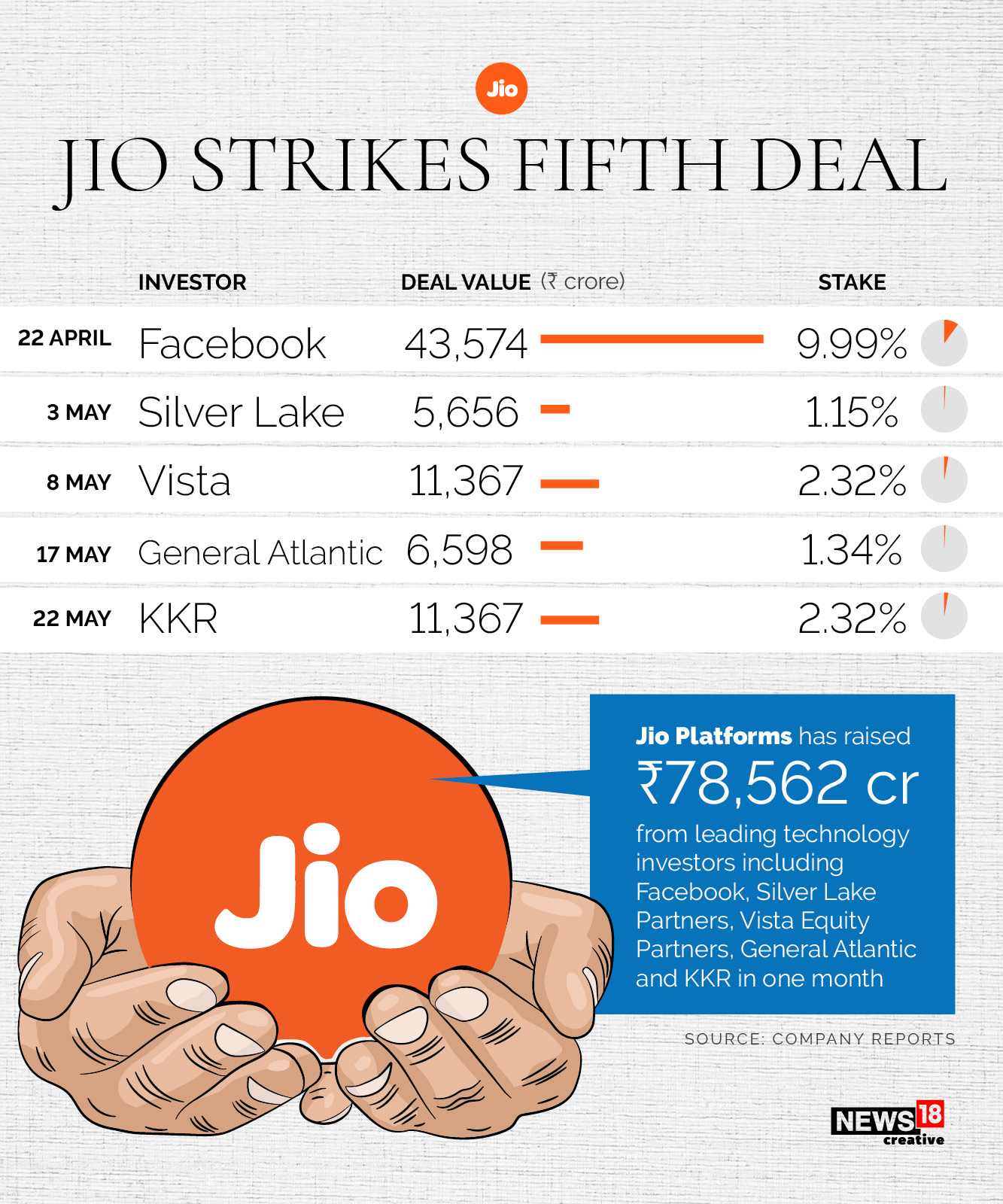

Photo Illustration by Avishek Das/SOPA Images/LightRocket via Getty ImagesExactly a month after it received an investment from Facebook, Jio Platforms signed on private equity group KKR as a partner. The deal marks the fifth investment in a month for the company, after Silver Lake, Vista Equity Partners and General Atlantic, and takes the parent Reliance Industries a step closer to its stated aim of being a zero net debt company by March 2021.

Photo Illustration by Avishek Das/SOPA Images/LightRocket via Getty ImagesExactly a month after it received an investment from Facebook, Jio Platforms signed on private equity group KKR as a partner. The deal marks the fifth investment in a month for the company, after Silver Lake, Vista Equity Partners and General Atlantic, and takes the parent Reliance Industries a step closer to its stated aim of being a zero net debt company by March 2021.

KKR plans to invest Rs 1,1376 crore for a 2.32 percent stake in Jio Platforms at an equity value of Rs4,91,000 crore. The investment was made from KKR’s Asia private equity and growth technology funds. With this deal, Jio Platforms has raised a total of Rs 78,562 crore from investors as it prepares to position itself as a platform company with a presence in telecom, retail and payments.

In previous announcements, Jio has indicated that retail, along with telecom, will power growth for Jio Platforms. It plans to accelerate the rollout of JioMart, which facilitates orders to local merchants. This would allow the business to grow a lot faster as it would remove the need to set up new stores across the country. The service has been launched in Thane, Kalyan and Navi Mumbai. With the Facebook partnership, the aim is to put out an ordering platform on Whatsapp and eventually integrate with it with a payments solution on the same app.

The last month has seen India’s telecom companies being rerated as analysts expect Reliance Jio and Bharti Airtel to benefit from rising average revenue per user (ARPU) as well as lower network investments (till the 5G auctions are announced). In the fourth quarter results announced, Jio had an ARPU of Rs 130.6 and Airtel registered Rs 154 per user. Jio’s deals have been done at an enterprise value of Rs 5,16,000 crore while Airtel is valued at an enterprise value of Rs 4,09,000 crore.

Over the last month since the Facebook deal was announced, Reliance Industries has gained 17.8 percent to Rs 1,442 a share, adding Rs 132,000 crore to its present market capitalisation of Rs 915,000 crore. This compares to a 0.4 percent gain in the Sensex during the same period. In the same period, Bharti Airtel has also gained 17.8 percent, taking its market cap to Rs 3,21,600 crore.

Disclaimer: Network18, the publisher of Forbes India, is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.

First Published: May 22, 2020, 10:52

Subscribe Now