Ironically, the dream of the young guns was a nightmare for the potential backers. Everybody greeted them with disbelief and skepticism. Eleven months of hustle, and Ather ran of money in September of 2014. The duo dragged the venture into the next month, October, on the back of some personal loans. “We had decided to close down in November," recounts Mehta, who had countless futile meetings with all kinds of investors. But in the dying moments, the founders spotted a spark of light.

Mehta had been in touch with a group of HNIs (high net-worth individuals), who evinced interest. The meeting was in Bengaluru. Mehta came from Chennai, and Ather was set for a new lease of life.

The meeting turned out to be a dud. They eventually called to inform that they would not invest. Mehta’s last hope had vanished into thin air. But just as death seemed evident, he had a fleeting thought. “Why don’t I drop a quick message to Sachin," Mehta thought, referring to Sachin Bansal of Flipkart. A few months ago. Mehta had sent cold mails to a bunch of founders in the hope of some connects with potential investors. Only two replied, Bansal was one of them, and he had liked the vision of the young boys. “So I thought of going back to Sachin," Mehta recalls. “He was my last shot."

At the time of the meeting in Bansal’s office, Mehta entered the room with modest expectations. “We are looking to raise funds. Would you like to put in around Rs30 lakh," he asked, as gingerly as possible. “How much are you raising," Bansal asked with poise. “Six crore," Mehta replied. Bansal agreed to invest on one condition. “I will put in the entire money," said Bansal, who also roped in his co-founder Binny Bansal. And so, Ather survived.

The funding deal was inked, paperwork was done, and the money was set to hit the bank in 30 days. But there was an unforeseen delay and Ather was about to run out of capital once again. This time, the company had taken a debt and it had to be serviced by March 31. “We needed Rs40 crore of emergency capital," recalls Mehta, who panicked on the prospect of defaulting on debt repayment. It was once again a near-death experience for Ather and Mehta had a sense of déjà vu.

Sachin Bansal came to their rescue once again. He roped in a bunch of friends, they pooled Rs40 crore, but due to financial year closing, the money could not be wired on March 31. Mehta was gripped with a feeling of helplessness. “I called up Sachin again," says Mehta. Bansal had a word with his bank, arranged for the money, and Ather was about to survive one more time.

![]()

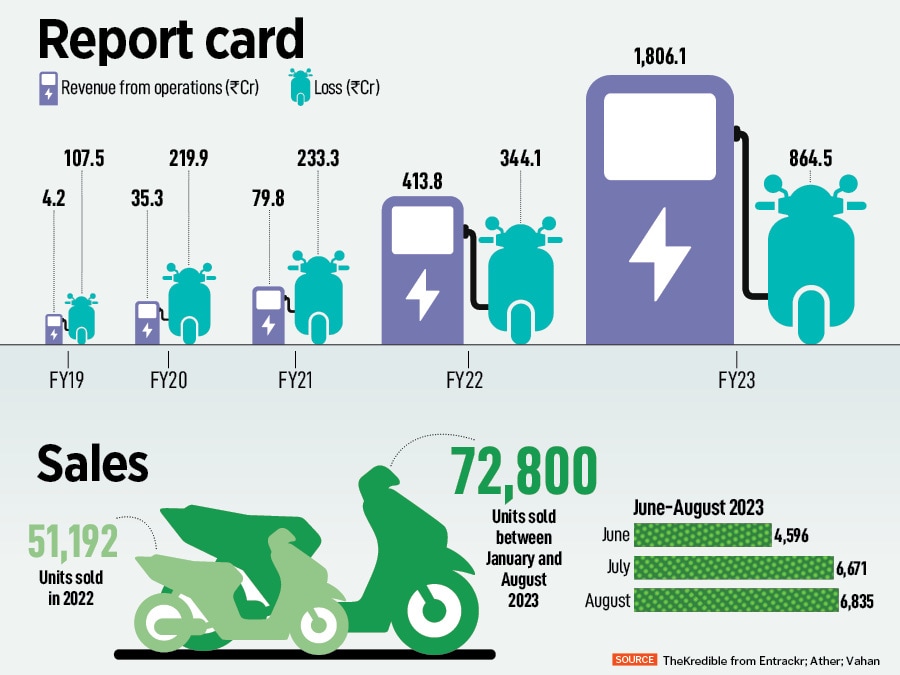

Ather spent the first few years in R&D and product development, and by FY19 it had an operating revenue of Rs4.2 crore and a loss of Rs107.5 crore. “Almost all of 2019 was a big low for us," recounts Mehta. This time, however, the crisis was not perpetrated by lack of money.

Here’s what went wrong. In 2018, they had unveiled Ather 340 and 450. A few months down the line, towards early 2019, they realised that the cost of the vehicle was three-four times higher than what the co-founders had anticipated. “The vehicle was a mistake. It was a stupid idea. We should have never built it," rued Mehta, who was staring at the improbability of bringing down the cost to make it affordable for the consumers. He half-heartedly tried to redraw the blueprint over the next few months and thought of Plan B.

The new plan was to dump the original vehicle and build something from scratch, but a few months down the line, Ather did not have money to finish a new vehicle. “Going down the new plan meant only one thing: Sure-shot bankruptcy," he recalls. Out of panic, the co-founding team thought of Plan C. “Can we just become an IP (intellectual property) company," wondered Mehta. Ather had a product. So it could sell the IP, and earn royalty.

Mehta went to the US, pitched the idea to a bunch of investors and attempted to raise funding for the new business model. Nothing worked. He came back, and towards the end of 2019, realised his mistake. This time, Mehta wanted to go back to his roots. “Let’s stick to our guns. Let’s not give up on what we built for years," he conveyed the message to his team. What Ather needed badly was not a new start but a renewed laser-sharp focus. There was a lot of distraction in 2019: Low-cost scooter, bike and international operations. Mehta wanted to reboot. “Let"s give our engineering team 12 months to fix this," he underlined.

![]()

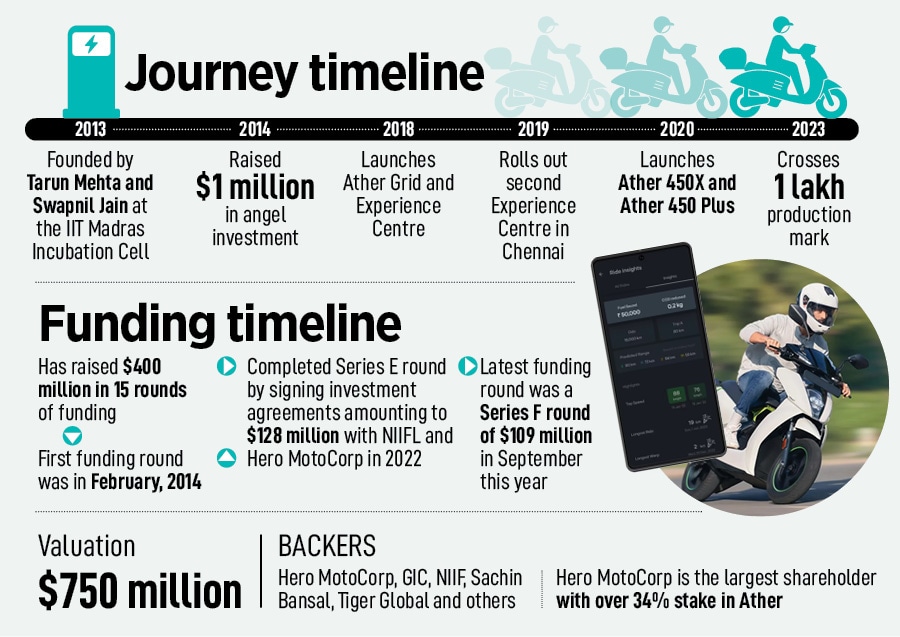

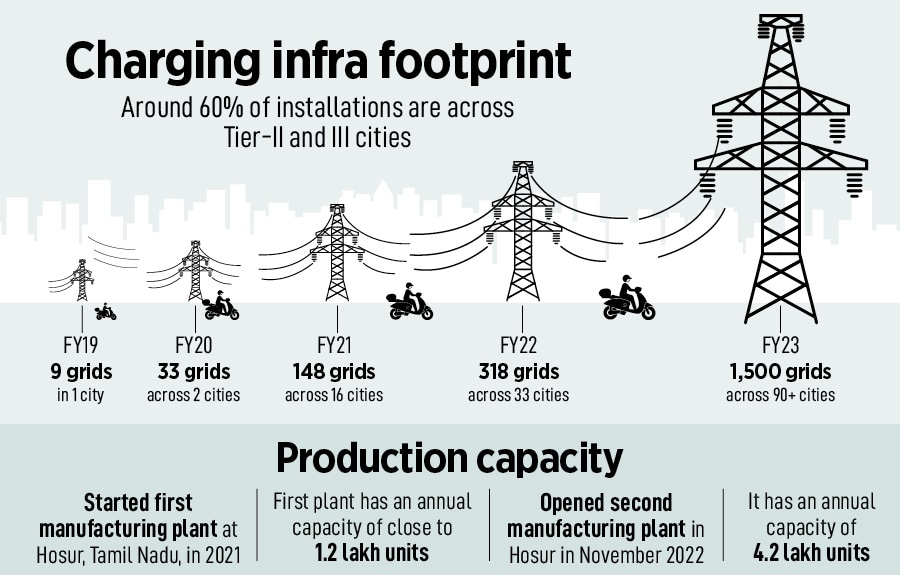

Cut to September 2023. Ather has emerged as the third biggest two-wheeler EV maker in India by volume. While in 12 months of 2022, the brand sold 51,192 units, it has overhauled the numbers during the first eight months of 2023 by selling 72,800 units. What it means in terms of revenue from operations is equally startling. From a low of Rs4.2 crore in FY19, it jumped over eight times to Rs35.3 crore in FY20. While the next fiscal it doubled, the curve pole-vaulted over the next two years: Rs 79.8 crore, Rs 413.8 crore and Rs 1,806 crore in FY21, FY22 and FY23, respectively.

In terms of strategic backing, Hero MotoCorp has steadily increased its stake in the EV maker. “It is the largest shareholder with over 34 percent stake in Ather," says Jai Vardhan, co-founder at Entrackr, a media venture tracking startups and internet economy in India.

Hero, reckon auto analysts, is evolving its EV play in a smart way. On one hand, it has been increasing its stake in Ather, which helps it cover the premium end of the EV market, points out Amit Kaushik, managing director at Urban Science India. On the other hand, Hero MotoCorp has been beefing up its organic play via its brand Vida. Mehta declined to comment on Hero MotoCorp’s stake.

![]()

Ather’s backers, meanwhile, are elated with the performance. “NIIF’s investing journey so far has seen Ather scale its revenues and volumes almost 4x in the last fiscal year alone," says Padmanabh Sinha, executive director and chief investment officer (growth equity) at National Investment & Infrastructure Fund (NIIF). Performance EV scooters, he says, would gain higher market share relative to other EVs with the advent of higher quality electric options. “We have seen this play out in Ather’s growth trajectory as customers upgraded from ICE (internal combustion engine) to electric scooters."

Mehta explains how Ather has played a differentiated game. When Ather launched, Honda Activa—India’s largest selling scooter—had a price tag of around Rs70,000. “Our first product was for Rs1.24 lakh," he says. Today, while an Activa is around Rs95,000, Ather’s products start from Rs1.3 lakh and go up to Rs1.7 lakh. Most startups, Mehta underlines, start their product journey by discounting. “We started by saying that we will charge a premium," he says.

![]()

“It’s not that there are no takers for low-end electric scooters. There are many. But our value proposition comes by upgrading the users," Mehta adds, and explains his logic. There are crores of people who own a two-wheeler in India. When they buy their next vehicle, they should have a better option. In mobiles, people upgrade to from feature phones to smartphones. Even within smartphones, the people at the low-end of the spectrum upgrade to a better phone when they move to their second or third handset. “We want to build something that people would love to own, and not just be able to own," Mehta underlines, adding that Ather never wanted to build yet-another EV, and a me-too product.

If not playing price warrior was a big edge, then staying away from getting sucked in rivalry was another smart move. “I think those are inefficient companies who have to fight each other," he reckons. Companies in intense competition, he lets on, don"t create a lot of value because profits go away, margins go for a toss and they end up becoming copycats. “You don"t have the space to zoom out and build something different," he says. “But when you are doing something entirely different and magical, there is no competition," he adds.

But what about another aspect of magic, which is posting profits and growing sustainably? Mehta says that it’s a work in progress and the company is on the right track. Ather was planning to turn profitable next year, but it might take a little longer. “But we will get there because we are building it correctly, pricing the product correctly, and upgrading with magic," he smiles.