2023 was largely a year that the digital assets ecosystem could forget, barring that Bitcoin spot jumped 157 percent in 2023, fuelled on expectations of the regulatory approval for ETFs. For the rest of the year, fortunes waned for large crypto exchange Coinbase, NFT trading volumes fell and crypto exchanges in India adopted different business models and diversified products to stay afloat.

What the game-changing decision of the SEC does for Bitcoin is that it has now received official recognition as a store value. It is now into the mainstream market. Bitwise, Grayscale, BlackRock, Valkyrie, Hashdex, Franklin Templeton, BZX, Invesco, VanEck, WisdomTree and Fidelity are the 11 institutions that are rolling out these funds—based on the Bitcoin spot price—for US-based investors only.

But despite this positive news, global Bitcoin spot fell nearly 10 percent to $42,591 on January 15, since the SEC announcement. As with all market and investor-sensitive events, the price has corrected after factoring in the ETF news. Bitcoin is expected to continue to face some pressure on price over the next few weeks, analysts say.

While much of the demand towards Bitcoin ETFs will be seen from US-based investors, including pensioners, the debate over how this news will impact the Indian crypto ecosystem and domestic investors is yet undecided.

India is believed to have the largest number of crypto investors, estimated at 93 million (or 6.55 percent of the total population), in terms of crypto ownership, according to data from Singapore-based digital currency payment institution Triple-A.

No Bitcoin endorsement

The SEC has had a rough 2023. In mid-July, a Manhattan federal judge partially dismissed SEC’s case against the creators of XRP cryptocurrency, Ripple Labs. The SEC in 2020 sought action against Ripple, arguing it broke securities laws. But the judge ruled the XRP token were not securities.

In the Bitcoin ETF case, for over five years the SEC had disapproved 20 exchange rule filings, including one from Grayscale. The SEC faced a new set of filings similar to those it had disapproved in the past, chair Gary Gensler, a former investment banker, says in a statement on the SEC website. “The US Court of Appeals for the District of Columbia held that the Commission [SEC] failed to adequately explain its reasoning in disapproving the listing and trading of Grayscale’s proposed [exchange traded product] ETP (the Grayscale Order)," the statement says.

![]()

The court therefore vacated the Grayscale Order and remanded the matter to the SEC. Following the court verdict, it had no option but to approve the listing and trading of these spot Bitcoin ETFs. But the SEC clearly says it does not approve nor endorse Bitcoin nor signal “the willingness to approve listing standards for crypto asset securities. Nor does the approval signal anything about the Commission’s views as to the status of other crypto assets under the federal securities laws," Gensler says in the statement.

But the trading of Bitcoin ETFs will create a test case for the future. “ETFs will bring more stability to the price of Bitcoin, since the liquidity risks will be reduced with time. We also expect the demand for Bitcoin to go up exponentially," says Sidharth Sogani, founder and CEO of Crebaco Global, a crypto and blockchain market research and ratings firm.

Estimations of how much money could flow towards Bitcoin ETFs vary. Standard Chartered Bank’s head of digital assets analyst Geoff Kendrick has said the ETFs may attract $100 billion in institutional investments by December-end 2024. Experts also predict a sharp surge in prices over the short to medium term. Ajeet Khurana, crypto advisor and investor, and former CEO at ZebPay, says that Bitcoin could see an “extraordinary" jump in the price of spot Bitcoin, simply due to its low floating stock.

But some analysts prefer to predict a more conservative picture. “Bitcoin is a speculative investment. There is no fundamental reason why it is priced where it is today. It is at the whims of supply and demand, making future prices hard to predict," Bryan Armour, director of passive strategies research for North America at Morningstar Research Services, says in an article on Morningstar website.

“Investors don’t need to take a stance on Bitcoin. Fear of missing out [Fomo] is a poor investment strategy, and investors should only invest in these ETFs if they see value in doing so," he adds.

Slight shift of the needle

But what does this mean for investors in India who already own and hold Bitcoin purchased through an exchange, or those who have waited on the sidelines hoping for the froth to subside?

“There has always been a demand for cryptocurrency in India, and estimates suggest that 5 to 7 percent of the population had already invested in crypto before the recent taxation changes," Viram Shah, CEO, Vested Finance, tells Forbes India. “Bitcoin ETFs provide a regulated and tax-efficient way for people in India to invest in cryptocurrencies. This simplifies the process for those who want to add exposure to their portfolio. The ideal customer base for this would be those who want to diversify their portfolio by allocating 1 to 5 percent of it to cryptocurrencies. The Bitcoin ETFs are regulated, which means the bitcoins are in custody with a large institutional custodian, ensuring the safety of the cryptocurrency. Platforms like ours are also regulated, providing end-to-end clarity and safety regarding this investment route."

High net worth Indian individuals who already have exposure to buying international equities through brokerages such as INDmoney or Interactive Brokers could now opt for buying the Bitcoin ETF for their portfolio. But it will be within the cumulative limit set out of $250,000 of foreign exchange purchased from or remitted through all sources in India during a financial year.

Besides, many individuals who wanted to take exposure but did not have capability could opt to buy Bitcoin ETF through a domestic or international brokerage.

“Regarding taxation, there is a 1 percent tax deducted at source [TDS] and a 30 percent capital gains tax. If you"re investing in an ETF, the taxation is as per your income tax slab for short-term investments, while for long-term investments beyond 36 months, it is 20 percent with indexation. This means if you hold your cryptocurrency longer, the taxation substantially reduces. Both these factors make this investment route a good option for those who want to invest in Bitcoin or cryptocurrency in an easy and safe manner," says Shah. But a foreign remittance of over Rs 7 lakh will face a one-time tax collected at source (TCS), which was increased to 20 percent in October 2023.

“For someone who does intraday trading, direct Bitcoin on India exchanges is highly relevant because it cannot be traded intraday in the US markets. Also, there is no 24/7 access to the cryptocurrency. For traders, spot exchanges or local exchanges are the best options for purchasing Spot Bitcoin. For long-term investors, the ETF might provide an easier option to get started," he adds.

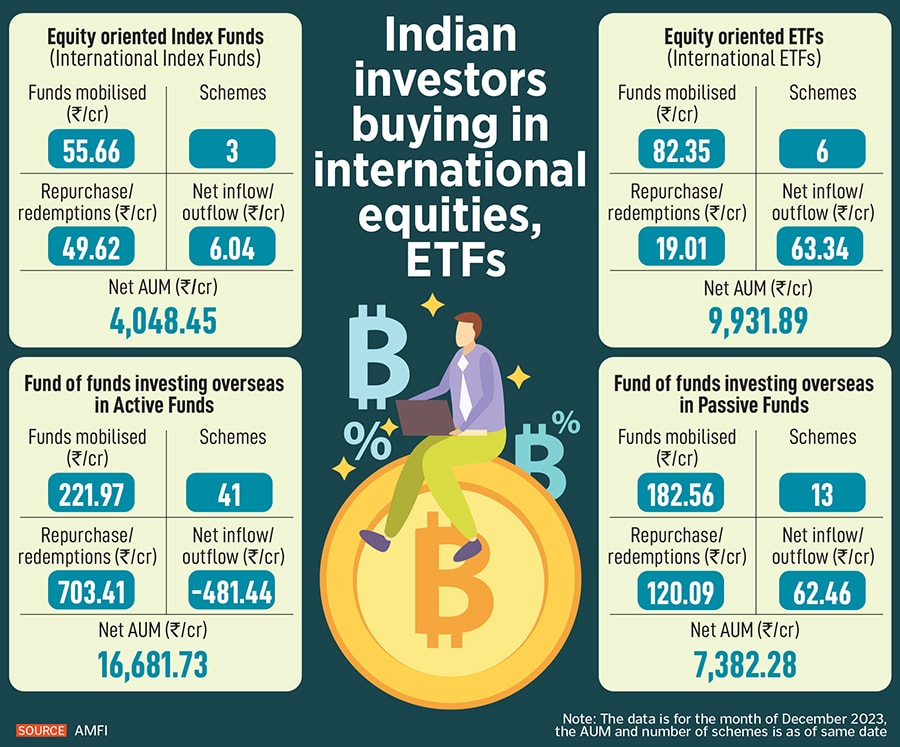

Indians have already been buying international stocks and other international ETFs through their local brokerages (see table). Sogani and Khurana say it is only a matter of time before the Bitcoin ETF starts to get marketed as an additional investment tool to investors here.

Crypto exchange official Rajagopal Menon, vice president of WazirX, is confident that demand for Bitcoin will continue to increase. “The regulatory uncertainty around Bitcoin has gone. It is now an investment grade product," he tells Forbes India. But he feels that investors in India may not opt for a slightly intricate route of buying through international brokerages, considering that spot Bitcoin can be bought through exchanges locally.

This is being reflected in the rise in trading volumes and market depth at WazirX in recent months. In the period November 2023 to January 2024 , WazirX saw a 42.3 percent rise in peer-to-peer (P2P) transactions, a 253 percent jump in spot trading volumes and a 114 percent rise in deposits (crypto and rupee), compared to the previous three months.

Crypto exchanges in India still seek some form of relief from the sharp taxes levied on cryptocurrencies, but it unlikely to happen anytime soon, with the government in the election year. Banks in India are not encouraged to allow crypto trades and the Reserve Bank of India Governor Shaktikanta Das has an unchanged view on the risk that cryptos could cause to the financial ecosystem.

The G20 has formally adopted the roadmap for governance of crypto assets and India will eye developments and talks emerging from the upcoming 2024 G20 Rio de Janerio talks, to get more clarity on the matter, by the end of 2024. India has blocked the websites of some global crypto exchanges including Binance, KuCoin, OKX and others, for not complying with the existing money laundering norms.

In the US, the chatter has already started on whether the SEC will approve the case for Ethereum ETFs, which seems unlikely in the near term, as election fever will start to heat up there soon. For now Indian investors might enjoy greater opportunities to invest into the spot and Bitcoin ETFs.