Fintech startups exult as RBI releases digital lending rules

They have widely welcomed the new rules for bringing clarity to the space, being 'customer centric' and 'encouraging innovation'

India’s fintech startups that had been in a bit of a quandary after the Reserve Bank of India’s (RBI) diktat on prepaid instruments and loans earlier this year, on Wednesday, welcomed the comprehensive rules on digital lending released by the central banker.

The RBI published the rules following the recommendations of a working committee on digital lending, divided into those that have been accepted for immediate implementation and those that have been accepted “in-principle, but require further examination".

“The RBI has demonstrated consumer centricity... we welcome the regulation," Gaurav Chopra, founder and CEO of IndiaLends, an online lending platform provider, said in an email.

“Most new customers today are borrowing for the first time and a growing share is coming through digital channels. That’s where we believe a framework ensures responsible players are rewarded for working in the interest of the consumer," Chopra added.

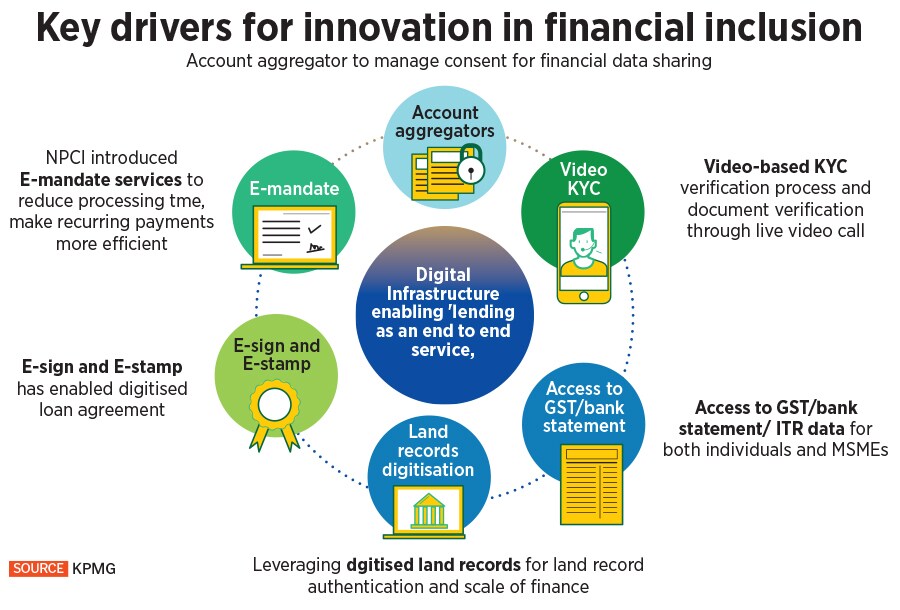

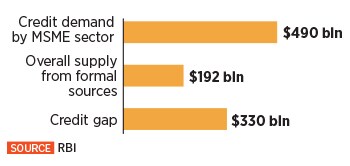

India’s fintech revolution is widely seen as a success at the scale of a billion people. Starting with UPI or the unified payments interface, India is adding financial infrastructure, including the accounts aggregator platform, and--in the broader, online commerce market--ONDC or the open network for digital commerce that has seen support from the world’s biggest tech companies, including Amazon and Microsoft.

India’s fintech revolution is widely seen as a success at the scale of a billion people. Starting with UPI or the unified payments interface, India is adding financial infrastructure, including the accounts aggregator platform, and--in the broader, online commerce market--ONDC or the open network for digital commerce that has seen support from the world’s biggest tech companies, including Amazon and Microsoft.

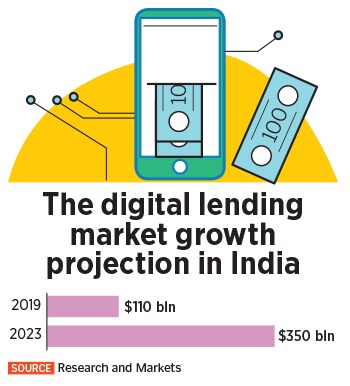

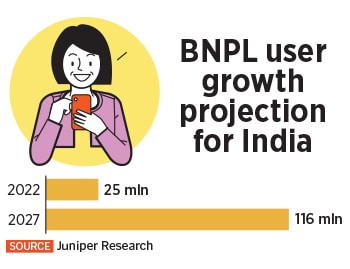

The subcontinent is also seen as one of the most promising markets for financial products such as BNPL or ‘buy now pay later".

Entrepreneurs like Chopra say the RBI working committee’s recommendations are a step forward in addressing issues related to lack of transparency, data protection, and privacy, as well as user consent.

The clarity on rules will “only boost consumer confidence and trust in the credit system and will allow players like us to continue our business without any changes to the business model," Chopra says.

Any lending sourced through any digital lending app–such as the many smartphone apps available today–is required to be reported to Credit Information Companies by the regulated entities irrespective of the nature or tenor of the loans.

All new digital lending products offered by regulated entities over merchant platforms involving short term credit or deferred payments are required to be reported to the credit information companies by the regulated entities.

Smartphone apps from fintech startups and banks have brought in innovation in the financial system, using data and tech to make the customer experience of borrowing simple, Saurabh Puri, chief business officer for credit cards at Zaggle, a fintech startup offering various financial services especially to corporate customers, said in an email.

Lenders and borrowers benefit from easy customer acquisition, credit assessment, loan approval, disbursement, repayment, and customer service. However, there are concerns that have emerged that include breach of data privacy, unfair business conduct, charging of exorbitant interest rates, and unethical recovery practices, Puri says.

Lenders and borrowers benefit from easy customer acquisition, credit assessment, loan approval, disbursement, repayment, and customer service. However, there are concerns that have emerged that include breach of data privacy, unfair business conduct, charging of exorbitant interest rates, and unethical recovery practices, Puri says.

The RBI’s rules will help mitigate these concerns, and bring in transparency and enhance customer confidence, he says.

First Published: Aug 11, 2022, 12:50

Subscribe Now