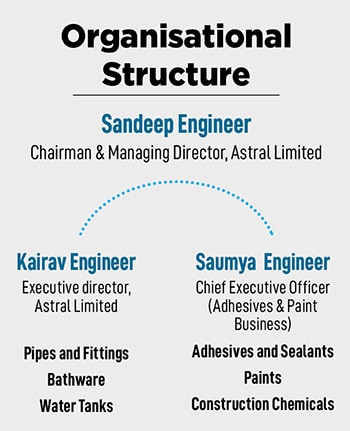

He continues to lead the mammoth company that Astral is today, but it’s his sons—Kairav and Saumya Engineer—who are running the show on ground. Sitting in a boardroom at Astral’s head office in Ahmedabad, Engineer says with a laugh, “Sometimes we have arguments, but 90 percent of the time we are in the safe zone. Over the years, I have learnt how to delegate. It is tough for me because I started and then grew the business and every nitty-gritty was handled by me."

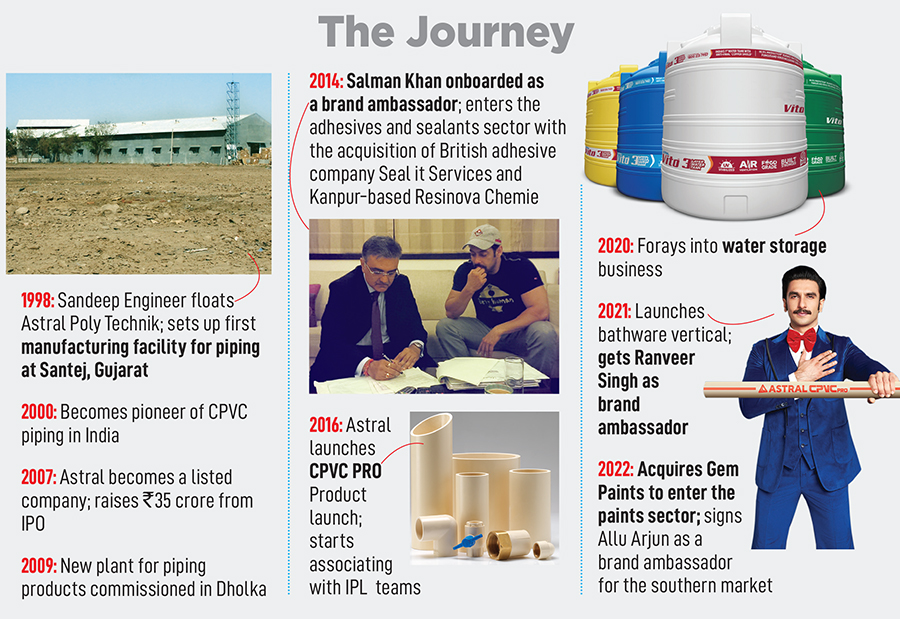

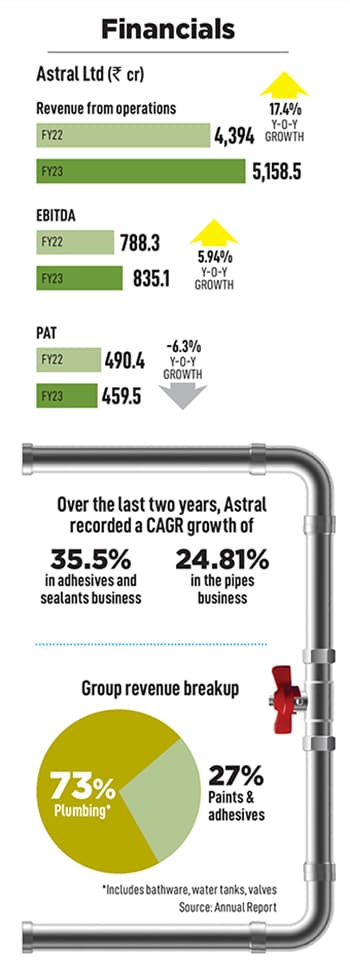

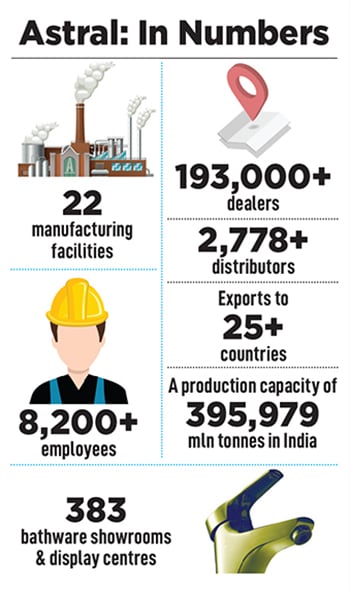

Astral Limited has expanded from Astral Pipes to now include multiple new verticals such as water tanks and valves, bathware and paints in its portfolio. Revenue from operations has grown by close to 106 percent—from Rs 2,507.3 crore in FY19 to Rs 5,185.5 crore in FY23. Along with the company, Engineer’s net worth has shot up from $1.1 billion in 2019 to $2.5 billion in 2023, according to Forbes.

Growing verticals

The idea to go beyond pipes and include water tanks, valves and bathware was to have products across their “water or plumbing portfolio", according to Kairav. “Earlier, plumbers were only focussed on plumbing, but now they are becoming plumbing contractors. This means they will also install sanitaryware, faucets, shower cubicles, tile cement, sealants and a lot more—the idea was to have a presence across these products," adds the executive director.

![]() Though a late entrant in the bathware category, the Engineers are bullish about the potential in this space, despite it being a consumer-facing segment. Since getting into the category in 2021, Astral already has 383 bathware showrooms and display centres. “The vision was to expand the brand. End-users never saw the Astral brand name. Now, with bathware in place, they do… so we are moving closer to our consumer and getting connected," says Sandeep Engineer, chairman & managing director, Astral Limited.

Though a late entrant in the bathware category, the Engineers are bullish about the potential in this space, despite it being a consumer-facing segment. Since getting into the category in 2021, Astral already has 383 bathware showrooms and display centres. “The vision was to expand the brand. End-users never saw the Astral brand name. Now, with bathware in place, they do… so we are moving closer to our consumer and getting connected," says Sandeep Engineer, chairman & managing director, Astral Limited.

Even with ball valves—used to control flow in water and chemical lines—the Engineers found a glaring gap in the market. “India does not have a dedicated ball valve manufacturer. Most of the good quality ball valves were imported till last year," adds Kairav. Astral claims to be the first Indian company to have a major focus on ball valves. “The manufacturing process is challenging, and the chances of failure are quite high if not made properly. Now we have an in-house manufacturing unit dedicated only for valves," he says.

How did the idea to move into the paints segment come about? Saumya looks at the senior Engineer and laughs. “Dad really wanted to go into paints," he says.

In April 2022, Astral acquired a controlling stake in Karnataka-based Gems Paints for Rs 194 crore to enter the paints market. Engineer chimes in, “My father was a trader in paints, so I always wanted Astral to have a paints sector. To add to that, we came across the right-sized company, with good quality products. They are market leaders in industrial paints for Southern India, and entered decorative paints much later." Saumya, who is chief executive officer (Adhesives & Paint Business) adds, “India has the capacity to absorb two more massive brands. We are in no hurry, we will go at our pace, understand the market and focus on creating good, quality products." That’s the formula that has worked for the company for years, and the Engineers plan to stick to it. The company plans to relaunch the paints under the Astral brand soon.

The existing hero segment—pipes—which got Astral the brand name it has today has only been growing. “We are constantly innovating and adding technologically advanced products to remain ahead of the curve," says Kairav. There is still potential for a lot more growth in this sector. The market is expected to grow at an impressive CAGR of 10.3 percent from 2022 to 2027, reaching a valuation of $10.9 billion. It has also roped in two brand ambassadors—actors Ranveer Singh and Allu Arjun—and their association with IPL teams continues.

![]()

On the other hand, the other major vertical, of adhesives and sealants, has recorded a 35.5 percent CAGR over the last two years. In 2014, Astral acquired an 80 percent stake for Rs 44 crore in the British adhesive company Seal it Services. It followed it up with a buyout of a 76 percent equity stake in the Kanpur-based Resinova Chemie for Rs 212.8 crore, which gave it the brand ResiQuick, an instant adhesive. During a conversation with Forbes India in 2019, Engineer said: “Moving into adhesives has helped us distribute the risks and we realised there was no No 2 player in the segment (after Pidilite’s Fevicol)."

![]() Interestingly, outside of product innovation and expanding the portfolio, Astral decided to club all its adhesives and sealant products under a single brand name: Bondtite. “It has been quite a learning curve for us, moving from a piping company to also learning about adhesives, sealants and construction chemicals. But we have grown well—from Rs 190 crore to Rs 925 crore in the adhesives space, domestically," claims Saumya. The burgeoning Indian adhesives and sealants market is poised for impressive growth, with an estimated valuation of over $2,400 million by the end of FY23. It is expected to grow at a CAGR of over 7 percent between 2023 and 2028. “I think with adhesives, we are only at the tip of the iceberg, there is a lot more scope for growth. But for that we need to educate the market and bring that awareness," adds Saumya. The company hopes to announce its brand ambassador for Bondtite soon to help build the brand in India. Globally, though, in more mature markets such as the UK and the US, Astral’s adhesives portfolio has been doing well.

Interestingly, outside of product innovation and expanding the portfolio, Astral decided to club all its adhesives and sealant products under a single brand name: Bondtite. “It has been quite a learning curve for us, moving from a piping company to also learning about adhesives, sealants and construction chemicals. But we have grown well—from Rs 190 crore to Rs 925 crore in the adhesives space, domestically," claims Saumya. The burgeoning Indian adhesives and sealants market is poised for impressive growth, with an estimated valuation of over $2,400 million by the end of FY23. It is expected to grow at a CAGR of over 7 percent between 2023 and 2028. “I think with adhesives, we are only at the tip of the iceberg, there is a lot more scope for growth. But for that we need to educate the market and bring that awareness," adds Saumya. The company hopes to announce its brand ambassador for Bondtite soon to help build the brand in India. Globally, though, in more mature markets such as the UK and the US, Astral’s adhesives portfolio has been doing well.

“We continue to like Astral for its comprehensive portfolio, wide distribution reach and strong brand presence, along with net-debt-free balance sheet and high return ratios," stated research analysts Arun Baid and Sohil Kaura in an ICICI Securities results review report.

![]() For most of their products, apart from bathware, the distribution strategy remains the same. “We have a very robust dealer network. Of all the building materials he sells, 10 percent might be Astral goods... why not provide him with the balance 90 percent as well? Even if he sells 10 percent more of Astral goods, that’s still doubling my share at his counter," explains Kairav. The distributor network, though, continues to be fragmented, “…which is why Indian building material companies have much healthier Ebitdas compared to their global counterparts. If large players enter the market, we will get squeezed for margins," adds the 34-year-old.

For most of their products, apart from bathware, the distribution strategy remains the same. “We have a very robust dealer network. Of all the building materials he sells, 10 percent might be Astral goods... why not provide him with the balance 90 percent as well? Even if he sells 10 percent more of Astral goods, that’s still doubling my share at his counter," explains Kairav. The distributor network, though, continues to be fragmented, “…which is why Indian building material companies have much healthier Ebitdas compared to their global counterparts. If large players enter the market, we will get squeezed for margins," adds the 34-year-old.

“The challenge," says Engineer, “is that we’ve brought all these changes in a very short span of time. First the paint acquisition and then bathware." Earlier bathware was to have a low-capex model. Engineer explains, “We were going to tie up with companies who have spare capacities to manufacture our products. But soon we realised, given how design- and quality-focussed we hoped to be, depending on a third-party would kill our brand." Additionally, expansion of manufacturing plants across India means large investments. The company has also onboarded new professionals across the board to help grow these verticals further.

Constant reinvention

At 23, Engineer started as a distributor of Isabgol, a popular home remedy for constipation. Later he went on to manufacture active pharmaceuticals ingredients (APIs), but the business didn’t scale as he’d hoped. Despite multiple failed attempts at entrepreneurship, Engineer refused to give up. Finally, he found his calling in CPVC or chlorinated polyvinyl chloride pipes that were very popular in the US. Engineer saw potential in this sector, and in 1998 he started Astral Poly Technik.

“Everything is like [a game of] snakes and ladders, you reach the top and then you are at zero," says Engineer about the challenges he faced, particularly during the first few years. But these have taught him the lesson of resilience. “If you adhere to your vision… keep working hard towards that goal and stay grounded, success will definitely follow," he says. Despite years of experience, Engineer continues to have an urge for constant learning. He is pursuing an Executive Owner/President Management Programme from Harvard Business School. “I have one module left, and then I will also have a Harvard degree," he says laughing. And he has also taken on the role of senior vice president in Gujarat Chamber of Commerce to stay in touch with industry members.

![]()

Though Kairav and Saumya are hands-on, bringing in a lot of changes, Engineer continues to remain the people-person he always was—be it with his staff or distributors. “I have been a distributor for Bengaluru with Astral since 1999. Sandeep Engineer is a chemical engineer, and knows how to maintain the quality of all his products. In all these years, Sandeep sir has been extremely accessible for any issues I face, and now his sons are taking that legacy forward," says K Srinivas, distributor, Astral.

When it comes to leadership styles, there is a huge difference between the first and second generation’s approach to talent. “We are more task-focussed, and he has a more human-centric approach. Even if we have an underperforming talent, dad will want to give second/third chances, especially for our legacy talent who have been around since years. He has more empathy towards them, and sometimes you need that," says Kairav.

![]()

There is a company-wise digital transformation that Astral is undergoing to help with transparency and efficiency. One such initiative is an application for their entire distribution network, with a strong loyalty programme.

Eventually, the goal is for Astral to become a complete building materials player. “With four major verticals, we have enough on our plate to focus on for now," says Engineer. But at the same time, they are always on the lookout for any backward integration, to reduce dependency on third parties and improve margins. While Engineer is open to taking risks, he says, “I always judge the risk at a value that is within our reach."

Though a late entrant in the bathware category, the Engineers are bullish about the potential in this space, despite it being a consumer-facing segment. Since getting into the category in 2021, Astral already has 383 bathware showrooms and display centres. “The vision was to expand the brand. End-users never saw the Astral brand name. Now, with bathware in place, they do… so we are moving closer to our consumer and getting connected," says Sandeep Engineer, chairman & managing director, Astral Limited.

Though a late entrant in the bathware category, the Engineers are bullish about the potential in this space, despite it being a consumer-facing segment. Since getting into the category in 2021, Astral already has 383 bathware showrooms and display centres. “The vision was to expand the brand. End-users never saw the Astral brand name. Now, with bathware in place, they do… so we are moving closer to our consumer and getting connected," says Sandeep Engineer, chairman & managing director, Astral Limited.

Interestingly, outside of product innovation and expanding the portfolio, Astral decided to club all its adhesives and sealant products under a single brand name: Bondtite. “It has been quite a learning curve for us, moving from a piping company to also learning about adhesives, sealants and construction chemicals. But we have grown well—from Rs 190 crore to Rs 925 crore in the adhesives space, domestically," claims Saumya. The burgeoning Indian adhesives and sealants market is poised for impressive growth, with an estimated valuation of over $2,400 million by the end of FY23. It is expected to grow at a CAGR of over 7 percent between 2023 and 2028. “I think with adhesives, we are only at the tip of the iceberg, there is a lot more scope for growth. But for that we need to educate the market and bring that awareness," adds Saumya. The company hopes to announce its brand ambassador for Bondtite soon to help build the brand in India. Globally, though, in more mature markets such as the UK and the US, Astral’s adhesives portfolio has been doing well.

Interestingly, outside of product innovation and expanding the portfolio, Astral decided to club all its adhesives and sealant products under a single brand name: Bondtite. “It has been quite a learning curve for us, moving from a piping company to also learning about adhesives, sealants and construction chemicals. But we have grown well—from Rs 190 crore to Rs 925 crore in the adhesives space, domestically," claims Saumya. The burgeoning Indian adhesives and sealants market is poised for impressive growth, with an estimated valuation of over $2,400 million by the end of FY23. It is expected to grow at a CAGR of over 7 percent between 2023 and 2028. “I think with adhesives, we are only at the tip of the iceberg, there is a lot more scope for growth. But for that we need to educate the market and bring that awareness," adds Saumya. The company hopes to announce its brand ambassador for Bondtite soon to help build the brand in India. Globally, though, in more mature markets such as the UK and the US, Astral’s adhesives portfolio has been doing well. For most of their products, apart from bathware, the distribution strategy remains the same. “We have a very robust dealer network. Of all the building materials he sells, 10 percent might be Astral goods... why not provide him with the balance 90 percent as well? Even if he sells 10 percent more of Astral goods, that’s still doubling my share at his counter," explains Kairav. The distributor network, though, continues to be fragmented, “…which is why Indian building material companies have much healthier Ebitdas compared to their global counterparts. If large players enter the market, we will get squeezed for margins," adds the 34-year-old.

For most of their products, apart from bathware, the distribution strategy remains the same. “We have a very robust dealer network. Of all the building materials he sells, 10 percent might be Astral goods... why not provide him with the balance 90 percent as well? Even if he sells 10 percent more of Astral goods, that’s still doubling my share at his counter," explains Kairav. The distributor network, though, continues to be fragmented, “…which is why Indian building material companies have much healthier Ebitdas compared to their global counterparts. If large players enter the market, we will get squeezed for margins," adds the 34-year-old.