How Brand WPL will be built over the long term

The early years would be loss-making, yet the league is expected to create phenomenal value for franchises and aspiring cricketers

When she was around eight, a cricket academy in Mumbai refused to admit Jemimah Rodrigues. “One of the reasons was I was a girl," the 22-year-old told Forbes India in an earlier interview. “That hurt me a lot because, till then, I didn’t know you had to be a boy to play cricket."

It’s a story that’s unlikely to repeat itself ever again. Because, if you cut to 2023, Rodrigues, the second-fastest Indian woman to reach 1,000 runs in T20Is, is not only a household name, but has been signed by the Delhi Capitals for a whopping Rs 2.2 crore to play in the inaugural edition of the Women’s Premier League (WPL), India’s first franchise cricket league for women.

Not just Rodrigues, but her colleagues from the national team have also commanded a premium at the recently-concluded players auction for the WPL. Opening batter Smriti Mandhana has emerged as the most expensive pick, earning a Rs 3.4 crore bid from Royal Challengers Bangalore, teenage opener Shafali Verma will play alongside Rodrigues for the Delhi Capitals for Rs 2 crore, while national captain Harmanpreet Kaur will turn out for Mumbai Indians for Rs 1.8 crore. Rodrigues, Mandhana and Kaur have all played in franchise cricket in the UK and Australia, but this is likely the biggest purse they would be carrying home.

Mandhana’s fees may pale in comparison to the Rs 15.25 crore that the Mumbai Indians paid for keeper-batter Ishan Kishan, the most expensive Indian pick in the 2022 mega auction of the men’s tournament, the Indian Premier League (IPL), but given the late blossoming of women’s cricket in the country–that gained wider recognition only in 2017, when India finished runners-up in the ODI World Cup–the figures are astounding. Especially since, till about six months ago, India’s centrally contracted players would earn Rs 1 lakh for an ODI and a T20I and Rs 2.5 lakh for a Test match. It was only in October the Board of Control for Cricket in India (BCCI) brought in pay parity among the men and women and hiked the salaries to Rs 15 lakh for a Test, Rs 6 lakh for an ODI and Rs 3 lakh for a T20I.

Its broadcasting rights, won by Viacom 18, have exceeded expectations as well, earning the BCCI Rs 951 crore in five years, with a per match value of Rs 7.09 crore. Says Anil Jayaraj, CEO, Viacom18 Sports: “Recent bilateral women"s series and ICC tournaments like the U19 World Cup and T20 World Cup have fired up conversations among fans. There"s a very strong business case here to build the league as the biggest women’s sporting property in the world and deliver significant value to the sporting ecosystem." Despite macro-economic headwinds, and talks of an advertising slowdown, the broadcaster has signed on 10 sponsors for the inaugural season, including the likes of Tata Motors, Bank of Baroda, Noise, H&M and JSW Paints.

While Viacom18 believes the WPL"s principal consumers will be the core fans of the game, it has taken certain steps to ensure that it digs deep into the untapped female cohort of the audience. “We are broadcasting the league on TV and streaming it on JioCinema in 4K (English & Hindi) for free, so this expands our audience base tremendously, making the WPL available to 700 million+ internet users," adds Jayaraj.

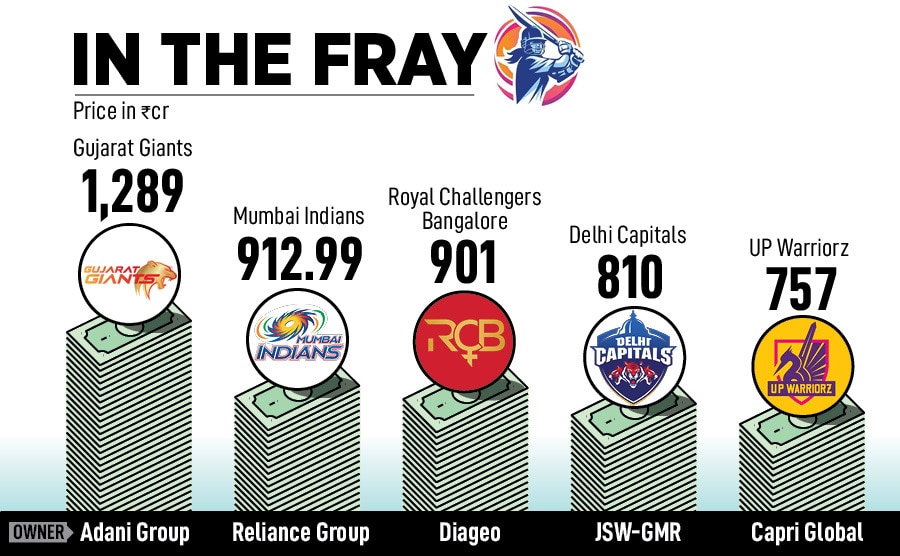

While the astronomical numbers make for great headlines, what sort of business rationale are the franchises driven by? Not the near-term, say most. “It isn’t exactly a business decision, as much as it is a conscious decision. We knew there would be losses," says Dhiraj Malhotra, CEO, Delhi Capitals. “I think it will take at least 5-10 years for the women’s franchises to turn profitable."

It’s not an anomaly given that’s how the financials of the IPL teams had panned out in the early years as well. According to media reports, the eight franchises had reported a cumulative loss of Rs 315 crore in FY10. Kolkata Knight Riders (KKR) was the first team to register a profit, and the first time all franchises went in the black was in 2018, buoyed by a steep rise in the media rights.

A large part of the annual costs of a WPL franchise for the first 10 years will go towards paying a tenth of the franchise fee, as was the case with IPL too. Which means for Delhi Capitals, for instance, a fixed annual cost of Rs 81 crore, having bought the team for Rs 810 crore. “Add to that the fixed player purses–Rs 12 crore for the first year with an increase of Rs 1.5 crore thereon each season. These two would constitute over 75 percent of the costs," says Bhairav Shanth, co-founder of ITW Consulting, a leading sports management and consulting company.

Once that’s paid out, the franchises will only have to share 20 percent of their revenues with the BCCI. “That’s when your outflow reduces and inflow rises," says Malhotra of DC.

The franchises, on the other hand, are entitled to a share from the central pool of media and sponsorship rights–80 percent in the first five years, 60 percent in the next five, and 50 percent thereafter. But the fixed costs are expected to be higher, at least in the first few years. “You can manage your operations from individual sponsorship, mainly by selling space on the jersey," says Rajesh Sharma, managing director and chief financial officer of Capri Global, the owners of UP Warriorz. “But, in the initial years, you cannot cover the franchise fee. When you buy a franchise, that’s an investment one has to make."

Menon won’t put a timeline to when the WPL team can turn profitable. “Maybe in the next 8-10 years. It all depends on the next rights cycle," he says. “But we’ve crunched our data and feel that if women’s cricket becomes even 50 percent of men’s cricket in 10-15 years, we would have done pretty good from a business point of view."

Till that happens, the WPL is a category-builder and one has to start from ground up to build the game and the league. The cornerstone of building a brand is to first establish an ethos among the stakeholders that gives the team a shared vision. This is where the WPL franchises can take a leaf out of their IPL counterparts.

“Forty years ago, sports teams just came and played, and won and lost. Not anymore," says Bhattacharjya. “Now you need to define how your team should be structured, how they would play, how they would recruit."

“If you take examples from an IPL franchise, look at the cultures established by RCB and CSK, the values they are known for," he adds. “RCB, for example, has been a star-driven franchise. They"ve had the biggest names–Chris Gayle, AB de Villiers, Virat Kohli. And while they haven"t won the cup yet, they have always been an exciting franchise that plays bold cricket. CSK, on the other hand, is not bothered about a brand of cricket, no flash and dash, all they want is to bring the cup back."

This is where new teams like Gujarat Giants and UP Warriorz, first-time owners of a cricket team, have a blank canvas to play with. “Our culture will be to play aggressive cricket, win or lose," says Sharma of UP Warriorz. “We want to be recognised for playing that brand of cricket." The franchise has used the idea as the leitmotif across its name (warriors), jersey (that has an imprint of Rani Laxmibai, the firebrand queen from Jhansi), and the team (led by explosive Aussie keeper-batter Alyssa Healy).

First Published: Mar 03, 2023, 13:27

Subscribe Now