How Cropin is using AI for better, more predictable harvests

Started 12 years ago by friends Krishna Kumar and Kunal Prasad, the agri-tech venture is becoming a global powerhouse by providing granular data on the farming ecosystem

Ask Krishna Kumar about the founding story of Cropin Technology Solutions and he likes to say it was more of an emotional decision than one grounded in business logic.

It started 12 years ago with Krishna—as everyone calls him in the company—and his childhood mate Kunal Prasad deciding that they couldn’t just sit by when Indian farmers were dumping their produce on the roadside or killing themselves for not being able to repay loans. The duo had been in school together in Ranchi, prepared together in Delhi for engineering college entrance tests, and went to different colleges. They kept in touch, with Prasad working at Tata Motors, in sales and marketing—he got an MBA as well, in between—and Krishna being a techie at General Electric. In 2009, Krishna called Prasad to say he’d quit his job, and the following year Cropin was born.

It was a time when ‘agri-tech’ wasn’t a term and ‘startup’ was common vocabulary. Although ahead of their time in India, they were onto something. They figured that technology could eliminate information disparity—and thus price disparity—between, for example, what a farmer growing tomato earns in Chikkaballapur and what a consumer in nearby Bengaluru pays for it. Consequently, farmers could earn more, and food businesses—such as Mother Dairy, one of their earliest customers—would get a more predictable supply.

More than a decade later, their effort is about to pay off—big time. Today, the rest of the world has come up to speed, not just with cloud computing and digital technologies, but also about the importance of data-driven agriculture amid a climate crisis and rising human populations. “In the recent past, we’ve seen a lot of scale in the business," Prasad says. In fact, he moved to Europe this March to lead the push into that market. He is also overseeing public and developmental alliances. “Digital is the new norm, and everyone now understands data-driven agriculture."

Krishna and Prasad are betting everything on building what they say will be the world’s first artificial intelligence (AI)-based cloud—everyone inside Cropin calls it ‘ag cloud’—for agriculture intelligence, by mapping land and crops on a third of the planet. They’ve already done that for 12 countries at the hyper-local level of 10 m sq. “We are very committed to marrying agricultural sciences with AI sciences," Krishna says.

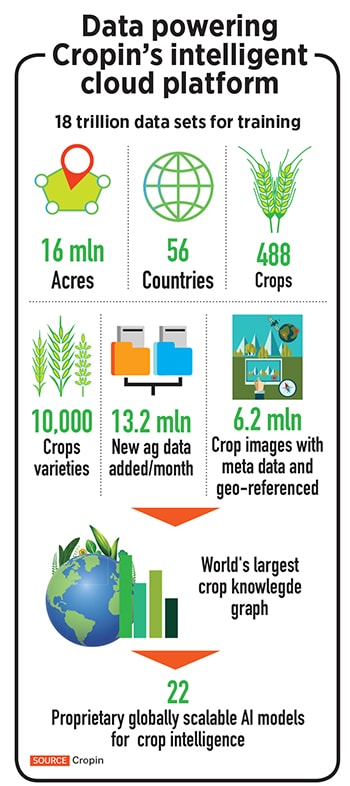

Cropin has 250 or so customers in 56 countries, including in India, Southeast Asia, Africa, Europe and Latin and North America. Clients include multinational businesses like McCain, Philip Morris, Syngenta, and Unilever, fertiliser companies, farm mechanisation equipment providers, banks and insurers, government agencies and developmental organisations.

The company’s platform helps customers manage close to 500 different crops covering horticulture, plantations, field crops and row crops and about 10,000 crops varieties. This information is captured in what are called ‘crop knowledge graphs’. Cropin helps customers improve per-acre yield and quality of the produce. It is building machine-learning (ML)-based models to predict farm outcomes much before the actual harvest, and trying to “make farms more ‘climate smart’ using AI sciences," Krishna says.

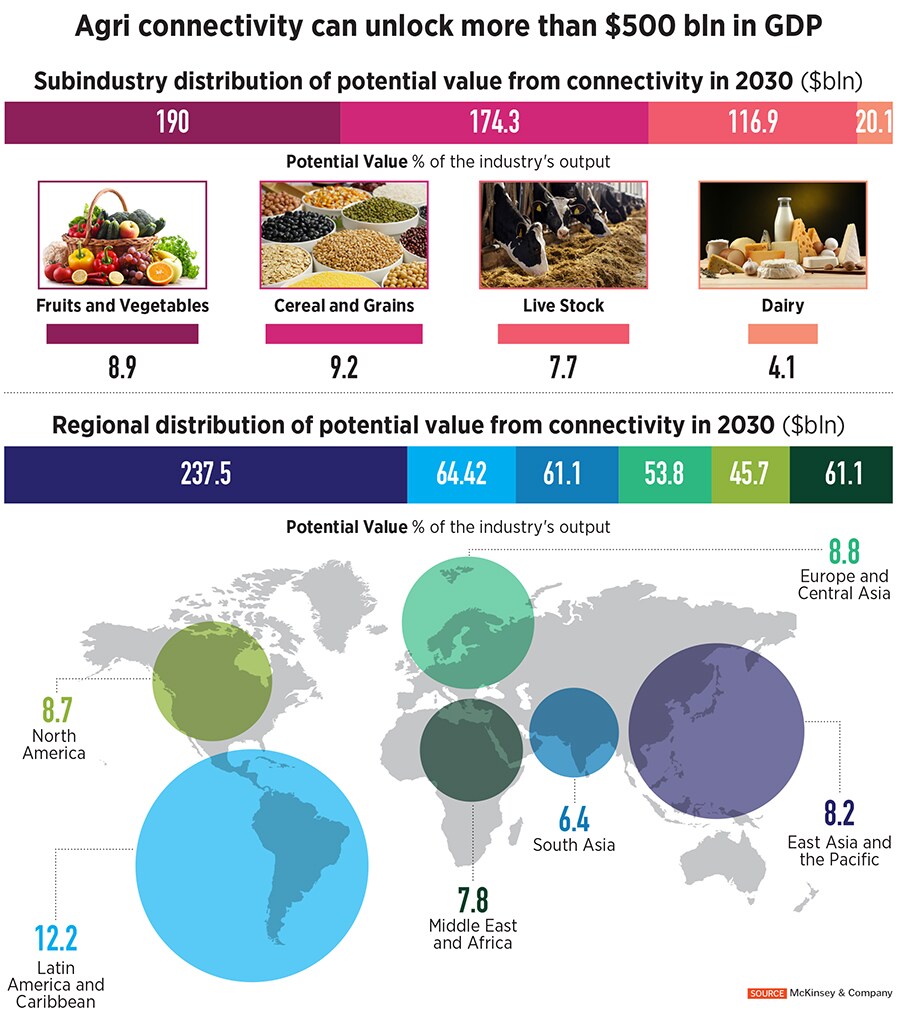

And the money is there. In the US alone, almost $1 trillion flow every year into the agriculture value chain, according to the US Farmers and Ranchers in Action, a network of farmer and rancher-led organisations and experts. Projections for the returns are massive too. Connectivity technologies in agriculture alone can add $500 billion to world GDP by 2030, consultancy McKinsey estimates.

Cropin’s solutions can accurately assess land health, locations and degree of water stress, levels of nitrogen and other nutrition, ‘disease pressures’ and other factors, all aimed at getting advance information about expected yield. For example, SmartFarm Plus is used by Unilever’s teams when they visit coconut farmers who supply coconut sugar, and update the app with information about the plantations. The app then provides location-specific advice that the teams share with the farmers.

“We can track how much coconut sugar we’ll likely be able to receive—strengthening the resilience of Unilever’s supply chain—and more importantly help smallholder farmers become more resilient, get good harvests and care for their land," Unilever said in a June blogpost.

Cropin also works with government agencies. For example, in India, it provides information on yield and acreage estimation to gram panchayats for the Pradhan Mantri Fasal Bima Yojana (Prime Minister’s Crop Insurance Scheme) to make pay outs to farmers at scale.

Be it small, fragmented farms in India or large ones in the US, the problems remain the same, Krishna says.

When Cropin started, “there was no digital in agriculture, and people could not even correlate how agriculture and data could marry, tomorrow," he says even in the US and Europe, there weren’t such startups, and the surge started after 2012.

The first challenge was a straightforward one: There was little or no data. Whatever information there was, was in the unstructured diaries of farmers or Excel sheets of large customers. One of Cropin’s first solutions was an application to help customers see data as an asset, which would become the foundation for an ‘intelligence’ solution. It was Cropin’s first phase, to build applications to digitalise every activity at the farm level.

Vijay Nelson, chief product officer, points out how the simplicity of these apps helped them succeed. For example, with one app, gathering data is as simple as walking around a plot with the app running. The data is fed into dashboards for agronomists, with calendar views for current and historical snapshots. Auto detection for on-field images is a feature that’s coming.

Then there is a data hub, a pipeline that feeds the models. This phase was about expanding data acquisition to different parts of the world, different crops, and different climatic conditions. Cropin did this through applications that were crop- and location-agnostic, and it helped the company generate 18 trillion datasets to build its AI models with. Taking these applications to customers in different countries helped Krishna and Prasad bring millions of farms to Cropin.

The third phase was to invest in the AI capability. Work on this started five to six years ago, and over time Cropin developed 22 ML models built on the 18 trillion datasets from farms. These models are at level 5 of technology readiness (TRL 5, where the tech is validated in simulations or real-world environments) and Krishna aims to get them to TRL 7, where they would be ready for much larger-scale commercialisation. This gradation, with nine levels, was made by America’s space agency Nasa and is widely used by innovators.

“We can divide a country into a grid of 10 sq m, and layer this intelligence on it, from the last six seasons to what’s happening today and the forecasted view," Krishna says. “And we can refresh this every month." Cropin has done this mapping for India, wheat in Nigeria and paddy in Bangladesh. The AI models have been commercially rolled out in 13 countries, tracking about 32 commodities.

The plan is to take tech and knowhow developed in India to markets around the world. To do this, Krishna and Prasad are setting their sights on a much more ambitious project. “We are calling it the industry’s first cloud for intelligent agriculture, where we have brought all the digital apps and tools in a box," Krishna says. This ‘Ag Cloud’ is to be launched in a matter of weeks.

The plan is to take tech and knowhow developed in India to markets around the world. To do this, Krishna and Prasad are setting their sights on a much more ambitious project. “We are calling it the industry’s first cloud for intelligent agriculture, where we have brought all the digital apps and tools in a box," Krishna says. This ‘Ag Cloud’ is to be launched in a matter of weeks.

“Our audacious goal is to compute crop intelligence for one-third of the planet and let the whole world plug in," he says. The idea is to offer this cloud to every business that touches agriculture or is touched by agriculture, so that “industry folks can use it in their business processes".

Customers use Cropin in a modular fashion, tapping individual products such as SmartFarm or tools for traceability and so on. Some customers have asked for tailored dashboards.

With Cropin’s top, strategic, accounts, customers tend to have their own experts, including data scientists, agronomists, and analysts, says Nelson. These experts are looking to bring in their own data as well, in addition to Cropin’s, into solutions that can give useful insights. These experts may also want to build their own applications on top of Cropin’s data hub. This is what Cropin is beginning to make possible, Nelson says.

The data hub is also a moat for Cropin it is structured agri information that would take years for competitors to replicate. While SmartFarm is being refreshed to gather more rich data and offer a new dashboard that gives a holistic view of what’s happening on a farm. Nelson expects it to go live soon. “This is how we’re productising the AI platform, so that any person in our customer organisation can use them," without having to call on an agronomist, he says, adding that depending on the maturity of their own tech and data systems, Ag Cloud customers can plug into any level of Cropin’s platform. This platform is now ‘fungible’ because of this flexibility and the features that if offers to customers, he says.

Today an agronomist might get to see four villages at a time or in a day, says Rajesh Jalan, CTO Digitalisation, remote sensing and on-ground data increase the expert’s bandwidth manifold. In the US, for instance, it’s common for a farmer to have 500-1,000 acres. If, say, the sprinklers aren’t working in a few acres somewhere, Cropin’s platform can figure it out, he says. “So, we show where the problem is, what it is, why and what I can do about it."

Today if a customer wants to open a Jupyter notebook (a web app to create and share computational documents) and see how a new variety of seed is performing in two different plots in two different climatic zones, it’s possible on Cropin’s platform, Krishna says.

A real-world problem that a customer recently posed Cropin was, can the company detect a particular crop around the country, and further, a specific variety of that crop. “We did that for the whole of Bangladesh and we also measured the performance of that particular variety against other varieties in different climatic conditions," Krishna says.

His point is that for several use cases, Cropin has solved the part of the data effort that involves building the pipeline, which most data scientists spend 80 percent of their time on, Kumar says. Therefore, they may now be free to spend more of their time in the actual modelling and analyses.

Cropin’s six-year AI effort is now formally structured as Cropin AI Lab because it will increasingly work with the industry, Krishna says. To lead this, industry expert Praveen Pankajakshan has been roped in as vice president of data science and AI. He has more than 20 years of experience in signal and image processing, pattern recognition, and ML in a variety of domains.

Cropin has 25 to 30 customers, considered ‘strategic accounts’ with who “we want to build an over $100 million business over the next three years," Krishna says. Prasad says the company’s ‘committed annual recurring revenue’ is in the range of $15-25 million, while declining to give a specific number. In 2018, the company was a $1.5 million business, according to Nathan Latka, who interviewed Krishna and who publishes a SaaS industry focussed podcast and information service. In 2021, Latka said Cropin’s revenue was $18 million.

The company grew its business 2.5x last fiscal year and the AI product has seen 6-8x growth in customer adoption, Krishna says. This year too, the company will grow 2.5-3x, he says. And that means a $100 million ARR target over the next three years could become a reality, if the AI cloud takes off, especially with strategic customers, but also, over time, with the broader customer base.

The company is also closing a pre-series D investment round and will very soon begin talks to raise between $50 million and $100 million in series D funding, the founders say. They have also, in parallel, put together a crack team of executives to lead the company’s next phase of growth.

Nelson, Jalan and Pankajakshan are among five or six senior figures who’ve joined Cropin in the last 12 months, and Krishna and Prasad hope they will take the company to $100 million in annual revenue over the next three years or so.

Nelson works closely with Jalan. While the former envisions the product roadmap, the latter leads its execution. Both previously spent many years at Microsoft, working on multiple technologies and products. If Nelson built a large team working on Outlook, Jalan was there at Azure before it was Azure.

Mohit Pande, chief business officer, and Sujit Janardanan, chief marketing officer, both are from Google. Pande, an entrepreneur who saw a successful exit, oversees the expansion and deepening of Cropin’s strategic accounts. “The agri space is on the upswing today, and in the next 18 months you will see the emergence of some large agri-tech startups around the world," he says. “We don’t have an agri-tech unicorn yet in India, and probably not elsewhere in the world," but that will change sooner rather than later.

“Sustainable food and agriculture are a core investment theme for ABC World Asia," said David Heng, founder and CEO of ABC World Asia, in a statement in June last year, when his firm invested in Cropin’s $20 million series C funding. Existing investors of Cropin include BeeNext and the Bill & Melinda Gates Foundation’s Strategic Investment Fund. Cropin has $33.1 million in funding so far.

Cropin has a formal advisory board, comprising Barrett Mooney, chairman of board at AgEagle, Ranveer Chandra, chief scientist at Microsoft, TVG Krishnamurthy, member of the board of directors at Ola, and Iya Khalil, global head of the AI Innovation Center at Novartis.

Karan Mohla, partner at Chiratae Ventures India Advisors, at the time of the series C funding, says “We are truly excited about the innovative models that Cropin is building… for multiple participants in the agriculture ecosystem." Cropin is “on the precipice of achieving massive scale as a global company."

The founders haven’t ignored industry partnerships either. Cropin has established a close relationship with Amazon Web Services, for example. “We partner with AWS globally to deliver solutions to large enterprises in the US" that own thousands of hectares of farms, manage multiple crops and use complex ML solutions, Pande says.

For data, Cropin has tie-ups with IBM Weather, six satellite services and various mechanisation providers. It has also partnered other hi-tech companies such as Teralytic, which can detect soil moisture and health 10 feet down, Jalan says, and enterprise system integrators such as True Digital in Southeast Asia, Nokia in Europe, and Eco BCG in the US.

Thus far, Cropin’s SmartFarm has helped customers get farm-level information in digital formats. “What we are now seeing explode are the intelligence-related products," Pande says, including SmartRisk, for regional crop intelligence, and PlotRisk, for information at the plot level.

Janardanan is focusing on getting the word out on Cropin’s deep capabilities and positioning it as an AI technology leader in the agriculture space. There is also an opportunity to create a community of agri experts and professionals because this is a nascent market, he says.

The size and scope of the problems in the sector are such that it will require everyone in the ecosystem to come together. For example, “if I don’t have a marketplace, can I get a marketplace partner to integrate with my platform," for mutual benefit, Janardanan says. “Or can I get a John Deere or a Mahindra to integrate the Internet of Things sensors from their farming equipment into my data pipelines. That’s the big shift, and that’s the direction we are pushing towards."

First Published: Aug 02, 2022, 18:09

Subscribe Now