This year is very much a write-off. All economies will be witnessing negative growth. But we can look forward to a big recovery in calendar year 2021, simply as the economies open up and we move from negative to relative stability. The equity markets are telling us that we are going to have a great year ahead. We are in a situation where people and economies are getting ready for the recoveries. Some of this will depend on whether US President Donald Trump gets re-elected. But if Trump does not get re-elected, the US markets probably will not fare well. The US public is looking forward to a comprehensive tax cut policy under Trump and will be disappointed if he fails to come back to power.

It will be even more negative if the election result is a hung one. The markets do not like uncertainty, so if Trump does not come back, the situation could get worse. If this happens, in terms of size, we could see a correction of 15 to 20 percent. It is a real concern. One must remember that Trump did not win the popular vote in the 2016 elections.

Investors will not give him a fair chance if they do not believe that he can get the economy moving. The good news for Trump is that he recovered quickly from Covid-19. Fresh Covid lockdowns are getting the markets nervous, which is why Trump demands a wider opening up of the economy. Unless the markets (sectors) are open and we do away with lockdowns, economies are not going to fare well. Oddly, the Democrats want stricter mandates, restrictions and lockdowns, which the man on the street does not want.

India’s experience has not been good: One of the harshest lockdowns which unlocked as Covid cases rose and economy collapsed…

Governments around the world have made major policy mistakes relating to the pandemic lockdowns. Take South Africa—which, like several countries, reacted fast to rising panic with one of the severest lockdowns. In April, I was stuck in Durban and was not allowed to walk on the streets. I was later in Germany, cycling along the river bank in Munich each day, visiting museums and dining at restaurants. I am now in Athens and waiting to head back home to Singapore, where I have not gone back since January.

What I am implying is that South Africa has a young population—a majority of whom would not be violently ill from the virus. Like India, its population depends on daily wage incomes… it is quite tragic that young suicide and child abuse cases in some countries are starting to rise. Unfortunately, all governments moved to do the same thing though their domestic situation was different.

You forecast a global recovery from recession in 2021. What shape could it take? Which sectors are likely to bounce back?

Recovery, as seen already, will be led by services growth. The sectors which have been deepest hit such as tourism, travel, hospitality and cruise liners will see a dramatic recovery. Look at the state of Singapore Airlines, which suffered a $1 billion loss in the June-ended quarter, due to the near shutdown in international aviation routes. The digital and telecom sectors will also continue to grow, but the biggest recovery will be in the services sector.

And it will depend entirely on each government’s lockdown policy, not on vaccine availability. Of course, governments need to continue to focus on hospital bed availability and caregivers for the elderly. But let children go back to school and services open. If the scenario I am outlining happens, we will see a sharp V-shaped recovery.

Global GDP growth could then be as high as 5 percent in 2021. (The World Bank forecasts a contraction of 5.2 percent in global GDP in 2020.) Some emerging markets could see a 10 to 15 percent recovery for their economies, led by China and India.

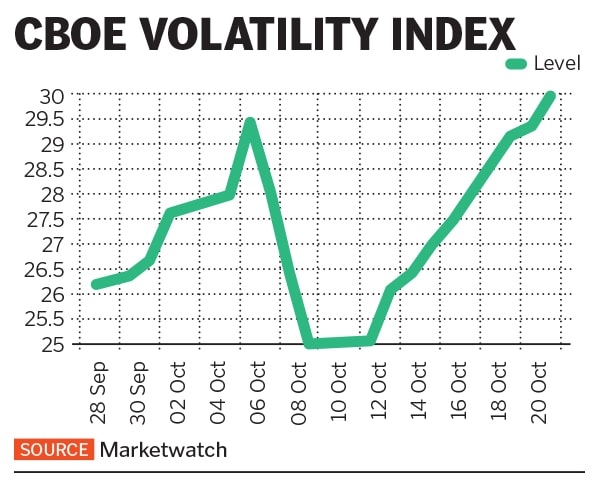

You expect market volatility to reduce? How will emerging markets and India be impacted by the fallout of the US markets?

Market volatility is going to stay with us for a long time, well into 2021. Even if we find a solution to Covid, it could be some other global concerns, There is a realisation that humankind is vulnerable to so many things. Over the next two months, if there is a severe downturn (assuming a Joe Biden victory), it will hurt all emerging markets with varying degrees and in coming months, these emerging markets will bounce back. If Trump comes back, everybody will have a party.

![mobius graphic -- us volatility index mobius graphic -- us volatility index]()

You have remained bullish on India. What weightage does India have in your overall portfolio, in terms of specific allocations?

India has the largest—19.8 percent—weightage in the [Mobius] Emerging Markets Fund (MEMF) followed by Brazil (15 percent), South Korea (13.2 percent) and China (13 percent). I remain hugely positive on the continuing reform programme of the Narendra Modi-led government and the entire move towards more diversity in manufacturing base. The US-China trade war has pushed the focus towards India—where India is offering incentives to companies moving out of China and wanting to set up manufacturing facilities in India. The trickle-down effect will be enormous, beyond just offering jobs. The Chinese are seeing supply chains and manufacturing moving out of their country due to high labour… India is the place for mass labour force.

Could you talk about specific India investments? Do you plan to invest more at these levels?

Our investments are in mid- and small-cap companies, particularly in medical care, electric equipment/cables and software. The top three investments in India are APL Apollo Tubes, Polycab and Persistent Systems. We also have a holding in Metropolis Healthcare. The weight in the portfolio for some of these stocks is as high as 6 percent. We have seen gains in India from our investments, but I would not want to comment on individual stock investment strategy. [As of June 30, MEMF had invested 93.9 percent of capital, according to its fact sheet data.]

In China, we see the point-of-care testing devices market as a key growth engine. We are getting more interested in that space.

Do you expect India to follow an aggressive protectionist policy? Which areas need more focus?

India’s protectionist policy indicates that it does not want products to be dumped there. But for companies such as Oppo, for whom India is a huge market, it is not going to miss out on this market. It will only grow. India is missing out on the integrated circuit design market, where countries such as Taiwan (fabless companies) and the US have strength in. India will eventually need and want to establish a position in that kind of industry.

India’s GDP showed a massive contraction in Q1FY21, with a slowdown expected to continue into Q2. Where do you see demand coming back from and how soon?

India’s economy could see more contraction in the September-ended quarter. But sequentially India could expect a recovery in demand and business activity in Q3 and Q4FY21. The services industry will continue to drive this. New leadership sectors are starting to emerge which include the technology and digital space.

With interest rates the way they are, how will gold play out as an asset class? Prices continue to be high globally and domestically.

Gold as an asset will continue to do well, but I do not expect prices to see the gains we saw in 2019, when demand continued to rise with price. Interest rates will stay the way they are… the US Fed is unlikely to raise rates into the next year. The Reserve Bank of India will also take its cue from the US Fed. We expect India to coordinate its efforts and movements at the policy levels, with that of the US Fed.

The Chinese government is trying to attract US capital back. It will be interesting to see how this pans out in the coming months, but Trump will not have much control over this. Look at the recent bond issue which China came out with—its $6 billion bond offering drew strong demand from US investors. India is just not raising enough capital from the international markets it’s just too conservative at this stage. It should come out with a “century bond offering”, capital raised which can be put towards infrastructure needs.

The US-China trade war has pushed the focus towards India where India is offering incentives – to companies moving out of China – and wanting to set up manufacturing facilities in India.

The US-China trade war has pushed the focus towards India where India is offering incentives – to companies moving out of China – and wanting to set up manufacturing facilities in India.