Private capital chasing mid-sized Indian banks

Most opportunities for private equity firms and foreign institutional investors came when the banks needed capital urgently. Now SFBs and mid-sized banks might seek fresh capital avenues for growth

Earlier in September, US-based GQG Partners, a boutique investment firm, had through two separate deals hiked its stake in IDFC First Bank, one of the fast expanding mid-sized banks in India. IDFC First Bank, which had moved into the top 10 most valuable listed banks in India – has probably just slid out of that list amid weak market sentiment. But it is seeing enough interest from private and capital market investors, as a bank whose loan book and deposits growth is strong, while staying profitable.

The GQG deal, in some ways, is reflective of what private equity investors, family offices and foreign asset management companies, besides institutional investors are seeing in Indian private or public sector banks, large or mid-sized. It is a simple conviction that if you are long on India, you need to be long banks.

While FIIs have always found Indian banks attractive stocks to invest in over the past 2-3 decades betting on the India growth story as has also been the case with private equity investors, who are finding more value in mid-sized banks such as Yes Bank, RBL Bank and Federal Bank.

But unlike FIIs, private equity cannot simply go out and buy stake in these banks. “They have to wait for the right opportunities where they can take substantial stakes. Those opportunities come very infrequently," a senior partner with a private equity firm said, preferring to stay anonymous.

In the case if these mid-sized banks, the opportunities have typically arise due to some “dislocation" which could be when the bank is in some form of distress and is in need of recapitalisation.

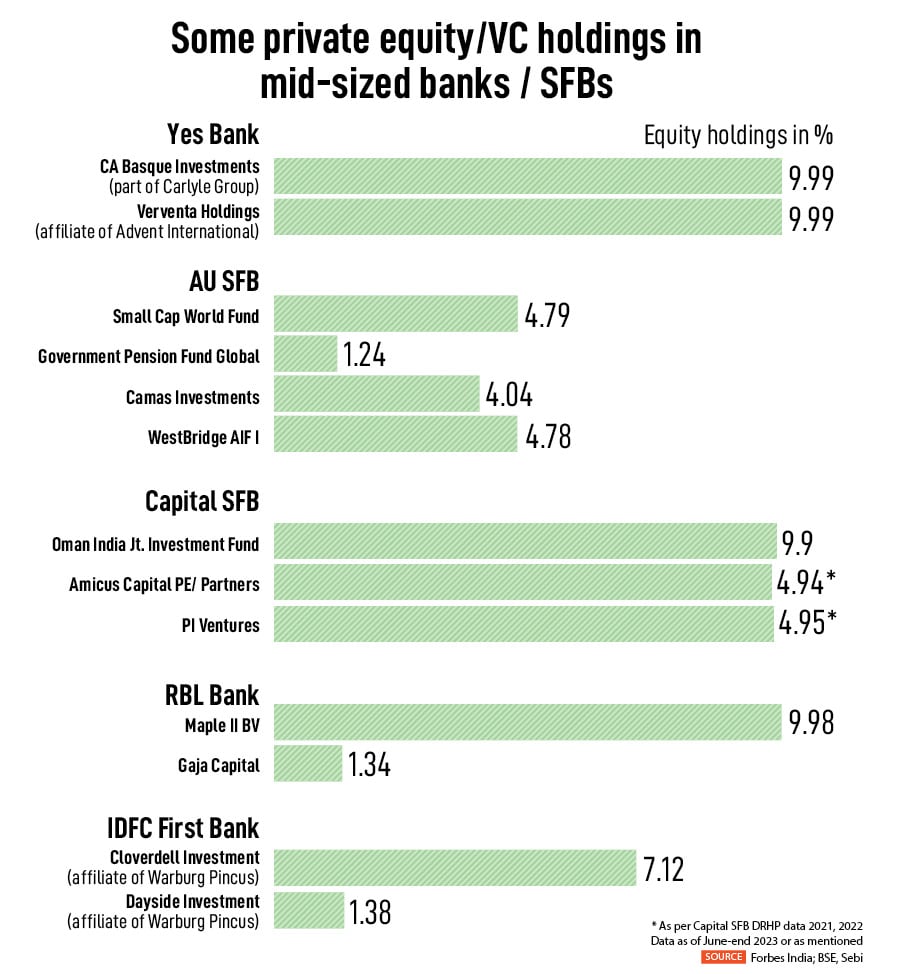

This was seen with Yes Bank in March 2020, when the regulator imposed a 30-day moratorium, fearing a deeper run on deposits. To prevent a collapse, the bank received capital infusion from the State Bank of India, ICICI Bank, Axis Bank and others. There was a need to raise more capital, and $1.1 billion was brought in from funds affiliated with global private equity investors, Carlyle and Advent International. Both the investors own 9.99 percent stake each of the post-issue paid-up share capital of Yes Bank, as of June-end shareholding data.

This helped raise confidence amongst all stakeholders in the bank, which has since been able to ride out of the crisis and transfer bad loans to asset reconstruction company JC Flowers.

Obviously, in the case of Yes Bank and even RBL Bank, they, in previous years, offered opportunities for private equity investors to get an entry into the banking space. Banks see private capital as a good source of capital, as it is patient capital. “Often these distressed banks might be going through a clean-up of books, a need to invest in technology, rebrand the bank or be challenged by leadership exits. In these phases, stable capital is critical," the private equity partner said.

The private equity investor not only provides the ‘patient capital’ and can assist the bank management through hand holding. These would also be a great signal to the financial markets, with investors aware of the medium-term commitment of a private equity investor with the bank, who has expectations of high returns. “Even the regulator would want long term investors to come in and help capitalise the bank," he said.

Nitin Aggarwal, head of BFSI research at Motilal Oswal Institutional Equities says mid-sized banks are expected to, and can, grow by a faster run rate. “IDFC First Bank is growing at 25 percent, RBL is growing in the 20s (percent) and valuations for some banks look attractive," he told Forbes India. In the case of IDFC First Bank, analysts are betting on a RoA expansion to 1.5 percent [1.26 percent currently] and with 75 percent of its book retail-focussed and steady growth in deposits, a re-rating of the bank can take place.

In July-end, M&M which picked up a 3.53 percent stake in RBL Bank, has indicated that it eyes this investment for a long-term of 7-10 years, according to media reports. Attractive valuations and exploring synergies with its NBFC arm Mahindra Finance were the other factors seen for the Rs 417 crore investment. M&M can, at best, under current norms, raise its stake in RBL to 9.9 percent.

The RBI has always been reluctant to offer a banking licence to a corporate house.

Besides these banks, smaller banks such as DCB and federal Bank need to start getting ready for a change in top leadership. This could be considered a dislocating factor, but positive factor, for investors to look at. In DCB’s case its managing director and CEO Murli Natarajan will complete his term of 15 years in April 2024. Global consultancy Korn Ferry has been appointed to identify a new leader.

Federal Bank will also need to get ready for a change of guard, as its MD and CEO Shyam Srinivasan is set to complete his second term at the top in September 2024. The stocks of both these banks are likely to see fresh interest from investors, analysts said. The IFC Group, though a developmental institution and not a private equity investor, has become a significant shareholder in Federal Bank, with a 4.46 percent stake.

Oswal’s Aggarwal is of the view that small finance banks could also emerge as potential investment opportunities for private capital to flow in. AU Small Finance Bank (SFB) has already taken the lead here, with private equity firms Motilal Oswal’s India Business Excellence Fund (IBEF) and IFC having pumped in capital into AU SFB in 2010, when it was still an NBFC called AU Financiers. Warburg Pincus and Kedaara Capital had also invested into AU, before partially exiting in 2017-18. Most of the private equity funding had helped the SFB build scale and enhance technology in its early period of expansion.

The so-called ‘Big 4’ of Indian private banks – HDFC Bank, ICICI Bank, Axis Bank and Kotak Mahindra Bank – are unlikely to start to sell large enough equity to a PE player, unless an existing player partially sells-off.

The hope with some of the mid-sized banks is that they will thrive as standalone banks and continue to grow or eventually when consolidation happens they can be bought over by a larger player, as when DBS Bank bought over Lakshmi Vilas Bank (LVB).

On September 24, S&P Global Market Intelligence said “Indian banks are likely to attract increasing global investment from investors looking for better returns as higher credit growth, improved margins and stable asset quality boost lenders".

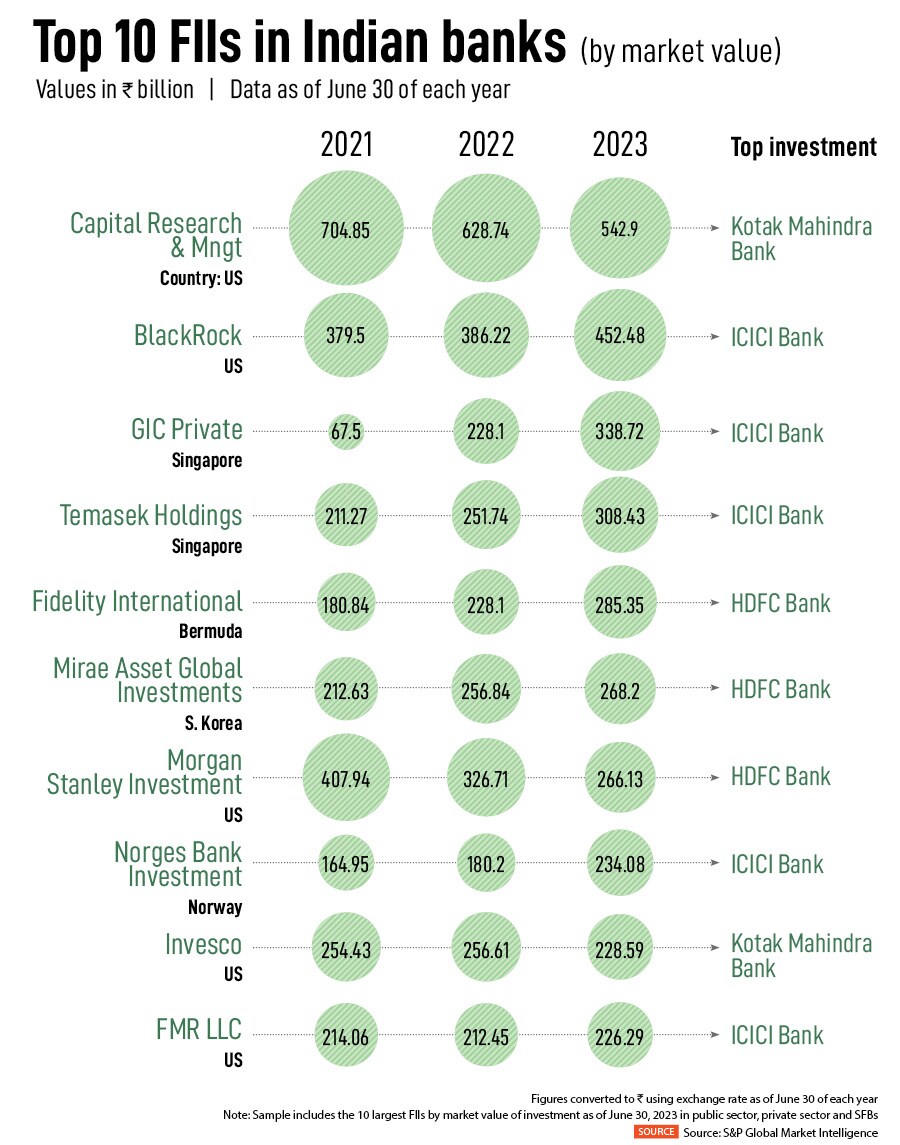

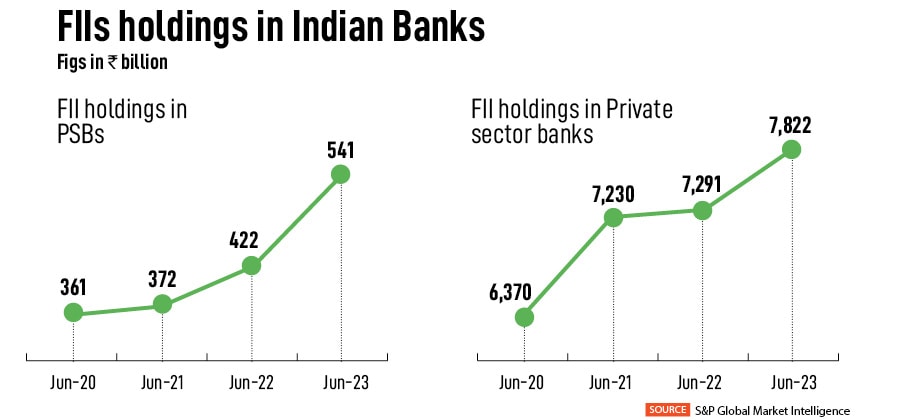

The total market value of foreign institutional investors" holdings in Indian banks has risen in recent years, climbing to Rs 8.36 lakh crore as of June 30, from Rs 7.71 lakh crore a year prior, according to data compiled by S&P Global Market Intelligence. This is a significant rise from Rs 6.73 lakh crore levels in June 2020.

“Indian banks have improved both profitability and asset quality in recent years, benefitting from higher credit growth and margins in a fast-growing economy," analysts Aditya Saroha, Zia Khan and Mohammad Taqi said in the report. The economy is expected to expand 6 to7 percent annually until 2026 at least, making it the fastest-growing major global economy, S&P Global Research said.

The majority of foreign institutional investors" holdings — 93.5 percent of the value as of June 30 — is concentrated in India"s biggest private-sector banks, market Intelligence data shows. Top banks for FIIs include HDFC Bank, ICICI Bank, and Kotak Mahindra Bank.

The top FIIs in Indian banks include Capital Research, BlackRock, Singapore’s GIC Private, Temasek Holdings and Fidelity International (see table).

Amit Thawani, Nomura India managing director echoes the optimism for India’s banks. “Financials are entering a strong credit cycle, driven by stronger balance sheets, robust economic outlook, technological enablement and product innovation," Thawani told Forbes India.

The entire range of banks from public to private, large and mid-cap banks, are going to benefit. If credit quality remains robust, the cycle can last even longer. “Given the Indian economy’s strong growth prospects and the increase in regulatory vigilance, Indian financials could potentially be in for a long haul credit cycle if they play the cycle well," Thawani adds.

Capex is currently being led by the government coupled with private capex linked to areas where the government is investing. “Capex in large manufacturing sectors is moving in the right direction and while announcements are happening, it will take some time for it to fructify on the ground," Thawani adds.

The RBI, in its June Financial Stability Report had noted that the gross non-performing assets (GNPA) ratio for all commercial banks continues to improve, falling to a ten-year low of 3.9 percent in March 2023, with the net NPA ratio declining to 1.0 percent. “Macro stress tests for credit risk reveal that SCBs (scheduled commercial banks) are well-capitalised," the report says.

Nomura, which in its September 26 Asia ex-Japan equity strategy, has upgraded India to an ‘Overweight’ from ‘Neutral’ rating, said that it continues to “prefer banks from domestic-oriented economies such as from India, Indonesia, Philippines, but are cautious on banks from more developed parts of Asia (Korea, Singapore, HK).

An exciting phase of investments, either through private equity or foreign institutional investors into Indian banks, whether mid-sized, SFBs or select NBFCs is expected to continue. Critical will be the opportunities and the attractive pricing which could attract private capital.

First Published: Oct 03, 2023, 14:13

Subscribe Now