The rationale to resign, the billionaire banker said, was “with a view to sequencing this process from a transition and stability perspective", considering that the financial year and the AGM for FY23 were behind the bank. Uday Kotak will continue as a non-independent, non-executive director of the bank for five years and as a promoter with the largest single shareholding of 25.72 percent, as of June. He also cited personal matters, including his elder son’s marriage, which would keep him occupied in the coming months.

But the pieces do not add up if you consider that the two most likely candidates believed to be frontrunners to take charge from Uday Kotak, if either is approved by the Reserve Bank of India (RBI)—KVS Manian or Shanti Ekambaram—have both led and worked with teams to create some of the most critical business units and functions in Kotak Mahindra Bank, over the last two decades. Manian, who has worked with the group since 1994, leads corporate, institutional andinvestment banking at Kotak Mahindra Bank since April 2014. Ekambaram, also a veteran within the group, leads consumer banking, prior to which she was heading corporate andinvestment banking for 11 years.

What Uday Kotak might have done through his departure is hasten the decision-making process within the RBI. “He is probably putting pressure on the RBI to make known their decision quicker. After all, how long could you have a prominent bank without a designated CEO?" a banker tells Forbes India, on condition of anonymity.

There are two most likely options which Kotak Mahindra Bank may be faced with, awaiting approval from RBI. The first is the assumption that Manian and Ekambaram are the names likely suggested by the Nomination and Remuneration Committee of the bank and the RBI needs to decide between the two.

But this might create a bit of an impasse between the regulator and the bank. “Someone that internal seems like the continuity of Kotak’s term," the banker said. One is not sure if the RBI would want an ‘internal’ candidate and the bank is unlikely to voluntarily suggest the name of a complete outsider. Kotak Mahindra Bank was yet to respond to an email seeking participation.

The RBI, in an April 2021 note on corporate governance in banks, promoters who are managing directors and chief executives or whole-time directors (WTDs), has mentioned that they cannot continue for more than 12 years. But the tenure could be extended to 15 years at the discretion of the RBI.

![]() The second option extends from the first. The RBI may decide to reject the candidatures offered by Kotak Mahindra Bank and want the bank to come back with fresh options of external candidates.

The second option extends from the first. The RBI may decide to reject the candidatures offered by Kotak Mahindra Bank and want the bank to come back with fresh options of external candidates.

The RBI had, in the case of RBL Bank, approved the appointment of an outsider, R Subramaniakumar—a former public-sector banker, he was administrator of Dewan Housing Finance Corp Ltd (DHFL)—to lead the bank as managing director and CEO in June 2022, for a three-year term.

This came months after RBL’s long-standing CEO VishwavirAhuja had gone on medical leave and did not return to the post. The RBL board had appointed executive director Rajeev Ahujaas interim MD and CEO. But the bank’s leadership had been under pressure facing high NPAs and low profitability between 2019 and 2021, and the decision to bring in Subramaniakumarprobably signalled the lack of confidence the RBI had in the-then leadership team.

In the case of the then-troubled Yes Bank, RBI approved the appointment of Prashant Kumar as the bank’s MD & CEO in October 2022, after Kumar, a former SBI veteran and earlier administrator to Yes Bank, had successfully led a turnaround of Yes Bank from near-collapse in early 2020.

There is, of course, no such crisis at Kotak Mahindra Bank. The bank has no third succession option at the moment. The name of Jay Kotak, Uday Kotak’s son, was speculated upon in the media in 2022 as a future successor, after he was introduced at an analyst meet, co-heading the bank’s 811 digital banking initiative. But he holds no management position at the moment and is expected to prove his merit to the bank’s board by rising up the ranks. This discussion might, however, start again after a few years, after Manian or Ekambaram decide to step off.

“The RBI does not like superstar CEOs. It’s a bit like Sashidhar Jagdishan replacing Aditya Puri at HDFC Bank… a below-the-radar ruler, but who has risen from the ranks, guided by the bank and who can take it forward with minimal disruption," the private sector banker said.

There is a debate on whether Uday Kotak can attend board meetings being a non-executive director. Emkay Global Financial Services’ senior research analyst (banking) Anand Dama believes it will need an RBI approval, considering that the regulator does not want a long-serving promoter to be involved in any day-to-day activity or any board decision. If he attends the board meetings, and if the RBI says nothing, then it is an implicit permission.

Kotak is, after all, the single-largest shareholder of the bank. In his letter to shareholders in the FY23 annual report, Uday Kotak had spoken about his future role as a “strategic shareholder with a long-term perspective of nurturing a world class institution". But it is rare for an outgoing CEO to be the largest shareholder of the bank he had founded. So, one will have to wait and see how this plays out. The board, we believe, will have no objection.

Uday Kotak has had a frosty relationship with the RBI in previous decades. It turned bitter when the bank—in an unprecedented move—took RBI to court in 2018 over a matter relating to dilution of promoter shareholding in private banks. The RBI wanted it to be brought to 15 percent of the paid-up capital, for a promoter shareholder, but Uday Kotak was opposed to this. Both parties yielded ground and Kotak Mahindra Bank withdrew their case, after the regulator raised the promoters’ stake in private banks to 26 percent.

No abandoning Kotak’s success mantras

There is no doubting the success of Uday Kotak, the institutional builder. He is admired for building institutions—from an NBFC to a successful financial services group, including a bank, asset management company and insurance—in recent decades. Investors have shown that confidence in the leadership. Today, Kotak is India’s 10th richest Indian—and Asia’s richest banker—according to the Forbes 2023 Billionaires list, with a net worth of $13.3 billion.

Not shying to put his family name to an institution, on the lines of JP Morgan, Goldman Sachs and Morgan Stanley, Uday Kotak had done the same with NBFC Kotak Mahindra Finance, which in 2003 got a banking licence to then be converted into a bank, Kotak Mahindra Bank. It is the only Indian private sector lender which retains the family names of its promoters.

But Uday Kotak’s masterstroke was after he successfully completed a $2.4 billion all-stock acquisition of ING Vysya Bank in 2015. It gave the bank the geographical banking reach to South India, which it needed.

![]() Uday Kotak’s leadership was also well-recognised when he led a newly structured board of debt-ridden IL&FS, which, in 2018, heightened the risk of a systemic crisis of the country’s financial sector, after it went bankrupt for failing to honour debt it owed to banks and other lenders.

Uday Kotak’s leadership was also well-recognised when he led a newly structured board of debt-ridden IL&FS, which, in 2018, heightened the risk of a systemic crisis of the country’s financial sector, after it went bankrupt for failing to honour debt it owed to banks and other lenders.

Uday Kotak had been parachuted by the government to help clean up the books of IL&FS. In 2022, about Rs56,000 crore (or 55 percent) of the IL&FS Group’s outstanding debt of Rs99,000 crore had been resolved. In June 2023, reports said IL&FS had paid a total debt of Rs28,848 crore, as of FY23.

Some of Uday Kotak’s mantras, which he spoke to us about in 2016, stand hugely relevant even today:

- When money-making looks very easy, watch out

- Always practice total transparency, don’t shove anything below the carpet

- Return of capital is more important than return on capital

- If you torture data, it will confess to anything

- Go by your conviction, don’t follow the herd

Dipak Gupta, the joint MD and now interim chief, has more to add: “When the marketplace is in trouble, bullets will fly around, some will even hit you. You just have to ensure that not too many do… and that the few that hit you do not kill you."

Emkay’s Dama says: “The management premium which it enjoyed when Uday Kotak was around will come off."

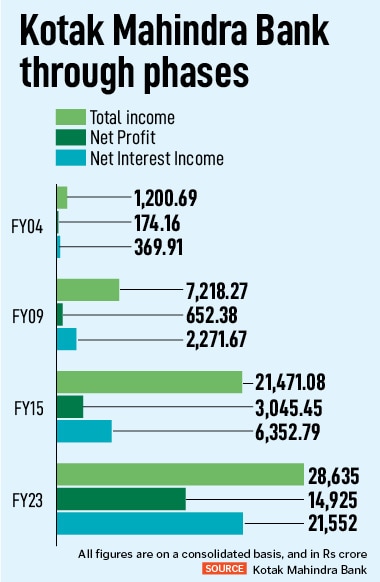

But it is unlikely that Kotak Mahindra Bank’s new leadership will abandon Uday Kotak’s mantras of success. The bank has grown loans at 21 percent CAGR over FY13-23 (including ING acquisition), besides building strong CASA (current and savings account) growth with a CASA ratio of 49 percent. Net non-performing assets (NPAs) for the bank have fallen to 0.4 percent in the June-ended quarter from 1.3 percent in March 2017.

Ratings stand unchanged

Like most banks, the focus on retail banking—with a focus on home loans, consumer loans, personal and credit cards besides small-business loans—is likely to be maintained by Kotak Mahindra Bank. TransUnion CIBIL"s Credit Market Indicator (CMI) report reached 102 in March, compared to 94 for the corresponding period in 2022, indicating an upward trend.

Emkay’s Dama says the bank will have to scale up and continue to grow, with a focus on retail and wholesale banking both.

Some of the brokerages have kept their investment ratings unchanged. Nitin Aggarwal, head of BFSI Research at Motilal Oswal Financial Services, says they maintain their neutral rating with a target price of Rs2,000 (2.7x FY25 estimates). Jefferies analysts in their September 4 note said they value Kotak Mahindra Bank at Rs2,400 based on sum-of-the-parts (SOTP) valuation, with the core banking business valued at 3.3x adjusted P/ABV (June 2025 estimates).

Dama, however, does not expect the stock to escalate from here. It has lagged in recent times, down 8.2 percent for the past 12 months to Rs1,779 at the BSE on September 5, and has returned flat just 0.67 percent up in two years. A smooth takeover by the new leadership will be the key.

“The stock had not moved in recent times, but I believe positivity will come through. The potential successors, Manian and Shanti, are both well-respected in the industry and among the investor community," says Nachiket Naik, head of corporate lending at Arka Fincap, a Mumbai-based NBFC.

Kotak had a tinge of emotion in his exit note. “I stand in a lonely place of being a founder, promoter and significant shareholder of this great institution. It also bears our family name and carries that as its brand. I am committed as a stakeholder to see this institution sustain and grow."

His goal has not been to create personal wealth, but to build an institution and a legacy which will outlive the individual. That he has already done.

The second option extends from the first. The RBI may decide to reject the candidatures offered by Kotak Mahindra Bank and want the bank to come back with fresh options of external candidates.

The second option extends from the first. The RBI may decide to reject the candidatures offered by Kotak Mahindra Bank and want the bank to come back with fresh options of external candidates. Uday Kotak’s leadership was also well-recognised when he led a newly structured board of debt-ridden IL&FS, which, in 2018, heightened the risk of a systemic crisis of the country’s financial sector, after it went bankrupt for failing to honour debt it owed to banks and other lenders.

Uday Kotak’s leadership was also well-recognised when he led a newly structured board of debt-ridden IL&FS, which, in 2018, heightened the risk of a systemic crisis of the country’s financial sector, after it went bankrupt for failing to honour debt it owed to banks and other lenders.