Why the RBI mustn't take its eyes off inflation yet

Retail and wholesale inflation as well as global commodity prices may have declined, but a likely shortfall in the balance of payments and a weakening rupee could add to MPC's woes

In its July bulletin, the Reserve Bank of India suggested that inflation may be peaking, and will align with the tolerance band of 2 to 6 percent by the fourth quarter of the current fiscal year. That’s the central bank’s baseline scenario. On a more optimistic note, the RBI doesn’t rule out the possibility that the “easing of inflation could be even sooner and faster". The key is the direction of change in inflation—not its level—in these extraordinary times, it said.

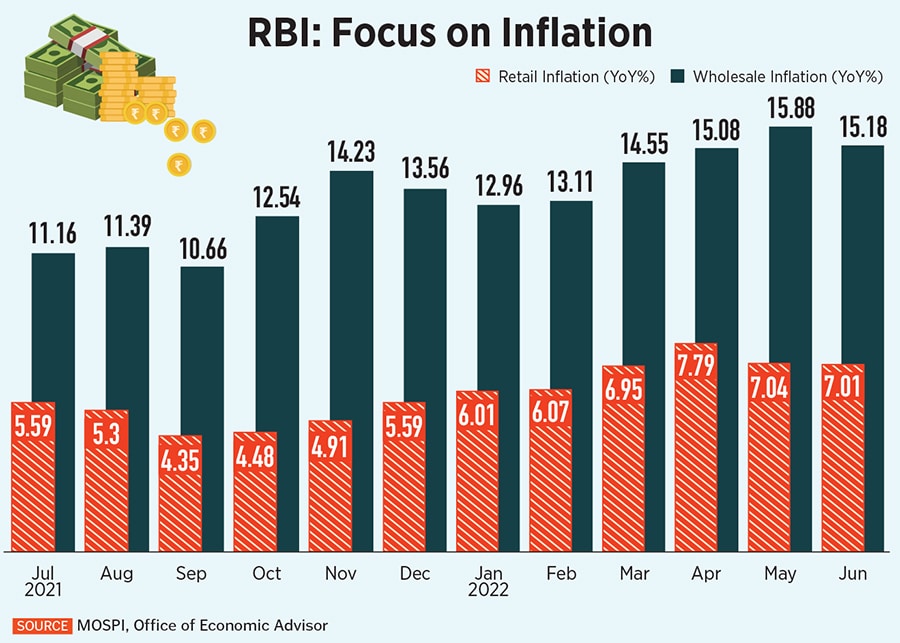

However, economists caution that inflationary risks cannot be downplayed at this juncture. The central bank must focus on steps to rein in inflation, despite the month-on-month decline in CPI and WPI inflation prints (see table) and a 20-40 percent decrease in global commodity prices. Rather, the recent cool-off in input prices can help the RBI pull inflation down to 6 percent levels by March next year, if it continues to tighten rates.

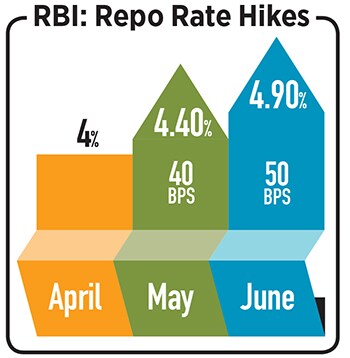

After watching inflation surge from the sidelines for many months, India’s central bank sprung into action to increase rates and tame rampant inflation. Over two tightening moves in May and June, the Reserve Bank of India raised the benchmark rate by a cumulative 90 basis points to 4.9 percent. As the Reserve Bank’s rate-setting panel readies to meet on August 3 to mull interest rates, most economists are expecting the repo rate to go up by 25 to 50 basis points.

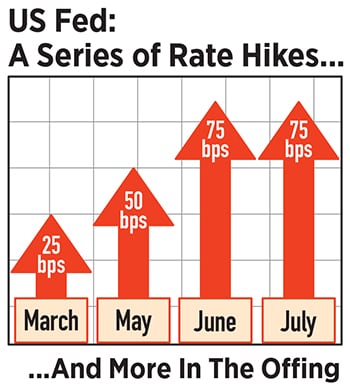

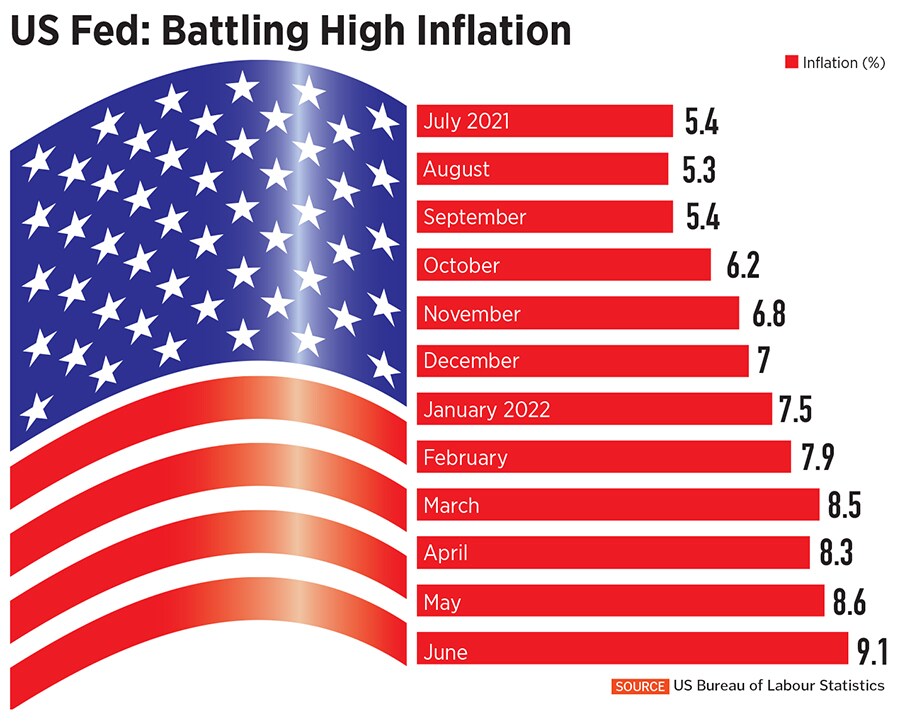

In its July meeting, the US Federal Reserve has hiked rates by 75 basis points for the second straight time (see table). The policy rate is now perched close to its long-run estimate of 2.5 percent. It admitted that recent indicators of spending and production had softened, but with inflation at 9.1 percent (see table) the US Federal Reserve has its task cut out as it seeks to get inflation back to 2 percent. In its own words, the risk of tightening too much in the short run is less than the risk of tightening too little.

“The RBI will remain focused on clamping down domestic inflation in the August policy. With no surprises from the Fed, we expect the RBI to remain on track to hike repo rate by 35 bps while maintaining a hawkish stance," says Suvodeep Rakshit, senior economist, Kotak Institutional Equities.

“The RBI will remain focused on clamping down domestic inflation in the August policy. With no surprises from the Fed, we expect the RBI to remain on track to hike repo rate by 35 bps while maintaining a hawkish stance," says Suvodeep Rakshit, senior economist, Kotak Institutional Equities.

Economists and analysts expect the US Fed to raise rates by 50 basis points in September, followed by a 25-basis points rate hike in November and December. Most economists forecast the US economy will slip into a mild recession later this year. The Fed’s strong focus on the inflation mandate with a series of rate hikes in the offing pose concerns for the domestic economy too.

On the face of it, inflation has moderated with a downtrend in retail and wholesale price inflation over the past two months. Yet, core inflation (excludes food and fuel) remains sticky at over 6 percent, suggesting that it may be challenging to rein headline inflation below 6 percent given the volatility in food and fuel supply. Extreme weather conditions and the change in sowing and seasonal patterns due to climate change are making it more difficult to predict food and energy prices and hence accurate inflation forecasts are tough.

Besides, economists say inflation in India tends to be sticky and since the pandemic large firms have gained pricing power and may begin to pass on higher input costs to consumers. HSBC India’s chief economist Pranjul Bhandari says the RBI may have to do more to anchor inflation expectations. “For instance, it may have to experiment with new techniques like raising rates earlier rather than later in the cycle, as a way of keeping inflation expectations anchored without too much cumulative tightening," she notes.

Besides, economists say inflation in India tends to be sticky and since the pandemic large firms have gained pricing power and may begin to pass on higher input costs to consumers. HSBC India’s chief economist Pranjul Bhandari says the RBI may have to do more to anchor inflation expectations. “For instance, it may have to experiment with new techniques like raising rates earlier rather than later in the cycle, as a way of keeping inflation expectations anchored without too much cumulative tightening," she notes.

Multi-decade high inflation levels in developed economies coupled with steep rate hikes by central banks are stoking fears of a global recession. This has contributed to the fall in commodity prices which has eased the import bill for India, but also heightens the likelihood of a fall in demand from other countries for India’s exports.

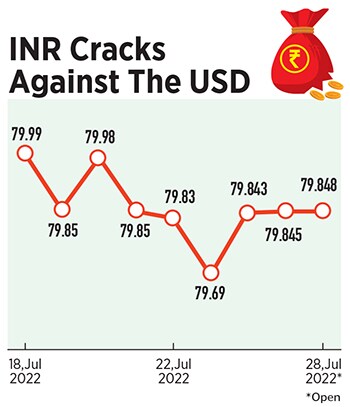

Economists expect India’s balance of payments to slip into deficit this year. This will weaken the Indian rupee further, which recently hit a fresh low of beyond 80 against the greenback. RBI intervention has cushioned the impact, but the central bank’s forex reserves have plummeted to a 20-month low of over $572 billion.

In a situation wherein the balance of payments is in deficit and the US dollar continues to climb against the Indian rupee, the RBI estimates that CPI inflation could potentially rise by 20 basis points for every 5 percent INR depreciation.

In a situation wherein the balance of payments is in deficit and the US dollar continues to climb against the Indian rupee, the RBI estimates that CPI inflation could potentially rise by 20 basis points for every 5 percent INR depreciation.

“While the Fed’s moves have been feeding into the INR weakness against the dollar, the RBI has been using its FX reserves to address the resultant volatility. We believe that a 35 basis points hike with a hawkish guidance will be appropriate. Arguably, the choice is finely balanced between a 35 basis points hike and a 50 basis points hike in the August policy," says Rakshit.

The Reserve Bank’s best strategy, against this backdrop, would be to take measures to keep the Indian rupee competitive. More importantly, the MPC must adhere to raising rates to tackle inflation.

“We believe the RBI should take the repo rate to 6 percent by December this year, by raising rates in each of the three policy meetings remaining in 2022. And hike again by up to 50 basis points in 2023 depending on the inflation situation," Bhandari adds.

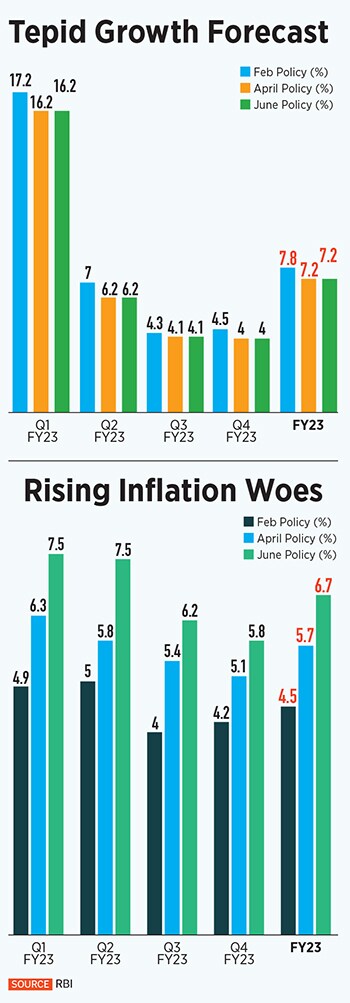

The RBI MPC’s strict mandate is to control inflation within 2 to 6 percent. However, for the past many months inflation has been outside this band. Until April, RBI Governor Shaktikanta Das had been clear on the central bank’s motive to support durable recovery in the economy. Over the past couple of months, growth has admittedly taken a backseat as the MPC scurries to douse the flames of raging inflation. In its last meeting the MPC cut its GDP estimate and raised its inflation projection (see table) for the current fiscal year.

In the August meeting, analysts and economists do not expect a revision in growth and inflation forecasts. Most economists see a 35 basis points rate hike as a base case scenario, but do not rule out the possibility of a smaller rate cut of 25 basis points or a steeper rate cut of 50 basis points.

In the August meeting, analysts and economists do not expect a revision in growth and inflation forecasts. Most economists see a 35 basis points rate hike as a base case scenario, but do not rule out the possibility of a smaller rate cut of 25 basis points or a steeper rate cut of 50 basis points.

Bank of America has revised up its previous rate hike call from 25 basis points to 35 basis points, and the global brokerage expects a change in stance from withdrawal of accommodation to calibrated tightening. The call for a higher rate hike is driven by the steep rupee depreciation of 2.6 percent and negative developments in balance of payments. Persistent high trade deficit and the relentless FII equity outflows suggest the rupee may weaken further to 82 to the dollar by December. Plus, the US Fed’s aggressive rate hike of 75 basis points for the second time adds pressure on the MPC to raise rates.

India economist Aastha Gudwani says, “If the RBI MPC decides to send a more decisive signal, then it can continue with sharp rate hikes, raising the policy repo rate by 50 basis points in August. In this case the stance could change to tightening and the repo could be raised to 5.9 percent by March."

Explaining the other possible scenario of a 25 basis points rate hike, Gudwani adds, “If the RBI MPC decides to resort to a more measured hike of 25 basis points, citing downside risks to their CPI inflation forecast of 6.7 percent y-o-y, then the repo rate could go to 5.65 percent by March. In this case, we see the stance change to calibrated tightening."

Pankaj Pathak, fund manager, Quantum Mutual Fund, expects the RBI’s commentary to soften a bit with an acknowledgement of receding inflationary risks. In the August policy, investors will look for cues on future rate hikes in this cycle.

“From the bond market’s perspective, much of this is already priced in as bond yields have fallen by over 25 basis points from their recent peak. Indian bond yields will likely trade in a tight range in the coming months," Pathak adds.

All in all, economists are unanimous that RBI’s inflation forecast of 6.7 percent for the current fiscal year is an underestimate. Aurodeep Nandi, VP and India economist, Nomura says, “RBI strategy should be governed by inflation trajectory. We believe RBI’s current projection of 6.7 percent for FY23 inflation is still an underestimate. We see inflation around 7.5 percent. Inflation in India is a problem, and this means RBI will have to hike more. Our terminal rate projection is 6.25 percent."

First Published: Jul 29, 2022, 16:20

Subscribe Now