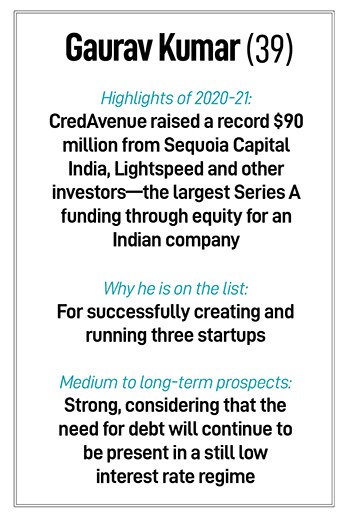

Gaurav Kumar and CredAvenue: Lending a helping hand to SMEs

With CredAvenue, Gaurav Kumar is enabling capital for the neediest and revolutionising the space

Gaurav Kumar, Founder and CEO, CredAvenue

Gaurav Kumar, Founder and CEO, CredAvenue

Image: Balaji Gangadharan for Forbes India

The pandemic has further exposed the failure of the debt financing ecosystem in servicing small and medium enterprises (SMEs). Most were, and remain, starved of capital. This has rarely been a problem for large (and often better rated) corporates, which have found it easier to raise debt from large banks and other financial institutions, besides also private placement of debt.

India’s debt market remains underdeveloped, being valued at 65 percent of GDP, much lower than the global average of 150 percent of GDP. The lack of finance, besides the irregularity of cash flows due to clients not paying up, has meant that SMEs have been unable to ride out of the crisis after the second wave of Covid. Non-food bank credit growth stood at ₹108 lakh crore in September, up 6.7 percent compared to a year earlier, according to RBI.

Union Minister for Electronics and Information Technology Ashwini Vaishnaw, in December, suggested the creation of a UPI-like digital platform to provide credit to micro- and SMEs.

Despite the obvious demand for debt by companies, this segment of the market failed to grow due to the lack of infrastructure. “A two-sided market place has to be present," says Gaurav Kumar, founder and CEO of CredAvenue, a technology platform that connects lenders and borrowers looking for term and working capital loans, supply chain financing, bond issuances, securitisation and co-lending.

CredAvenue has cumulatively facilitated transactions worth around $11.3 billion across all these verticals, to help around 2,200 institutional borrowers and over 1.1 million retail borrowers. In 2021, CredAvenue raised a record $90 million from Sequoia Capital India, Lightspeed, TVS Capital Funds and Lightrock. This is the largest Series A funding through equity for an Indian company this year, beating Ola Electric’s ($58 million), independent data shows.

In the eight months from April to November, the gross transaction value totalled $2.94 billion, with an aim to end FY22 at $5.5 billion value. CredAvenue’s revenues were at ₹47 crore in FY21 and are estimated to more than triple to ₹160 crore by March 2022, a source says.

In the eight months from April to November, the gross transaction value totalled $2.94 billion, with an aim to end FY22 at $5.5 billion value. CredAvenue’s revenues were at ₹47 crore in FY21 and are estimated to more than triple to ₹160 crore by March 2022, a source says.

CredAvenue’s Securities Infrastructure and Debt exchange (a trading platform for all primary/secondary bonds, government securities, pools and forex) has seen revenues of $2.5 billion in 2021. The second platform, the Unified Lending Infrastructure, for all types of loans, including co-lending, sees 75,000 loans being executed every day. The fixed income platform for retail investors has 3,000 users daily. Another platform, the Unified Collection Infrastructure, which enables faster, cheaper collections of all consumer/enterprise loans, is yet to commence operations.

Similar platforms/features are found on independent credit and digital lending platforms focussed on SMEs, but there is none which combines all types of debt offerings on one platform, with the availability of a ‘fulfilment’ factor. CredAvenue offers lenders and borrowers the ability to discover the price and execute the transaction after credit analysis, documentation and negotiation. Then there is fulfilment, where the investor can track the performance of the company, industry or portfolio of clients on the marketplace platform, to whom it has lent to.

Kumar, who set up CredAvenue in 2017, is also the co-founder of two other companies: Chennai-based fintech Vivriti Capital and Vivriti Asset Management. He has been in the credit space for 16 years, commencing with non-banking financial company Northern Arc, also a debt arranger.

Kumar has understood the need to build a debt servicing platform that will continue to grow. And he is clear that the team must be equally experienced and passionate about the journey. Vivriti Capital co-founder and former Northern Arc Capital colleague Vineet Sukumar is on CredAvenue’s board and the team also includes chief business officer Irfan Basha (formerly at Northern Arc), Harshwardhan Mittal who heads technology (former engineering leader at Facebook), chief marketing officer Karanpreet Bindra (formerly head-products at Marico) and Vibhor Mittal (head-product, formerly worked at ICRA Ratings).

“New entrepreneurs must be able to evaluate how large the need/problem is which they are trying to address, how transformative is the function and operation of the startup, and what is the culture of the organisation," Kumar adds.

Even as the lending environment continues to improve, Kumar is confident that there are many green shoots being seen. “Demand for debt is coming back due to the large infrastructure projects… we are also seeing demand across categories such as consumer durables, electronics and housing."

First Published: Dec 27, 2021, 12:32

Subscribe Now