Five months back, in May 2017, the Indian-origin entrepreneur had made his first bold bet in the country when he bought 80 percent in ItzCash, a leading payment solutions exchange and a leader in the prepaid cards and bill payments space, reportedly for Rs 800 crore. With a retail distribution network of over 75,000 outlets spread across 3,000 cities, 1,500 corporate partners and 75 million customers, ItzCash was processing over 6 lakh transactions per day. The acquisition, Raina underlines, made sense. “Its network and reach meant that we could dominate from day one," he says.

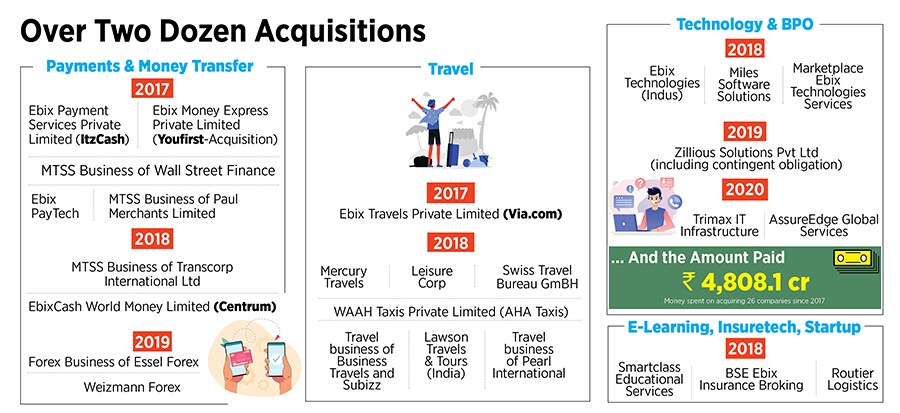

The acquisition of Via.com would have provided an opportunity to dominate the travel space too. The company had 14,700 agents in Indonesia, 9,900 in Philippines, 600 in Singapore and 350 in the UAE and Oman. It was in India, though, where Via had its biggest assets: 85,000 agents. Buying Via.com also meant adding over a lakh retail outlets to EbixCash, a wholly-owned subsidiary of Ebix. The master of buyouts—Raina had snapped up over two dozen companies across the world to add heft to Ebix’s global play, knew that to take care of the plateauing growth, India was the land of salvation. “It was not just an opportunity. I knew it would be a life-changing one," he recounts.

By 2017, Ebix—Delphi changed its name to Ebix in 2003—had emerged as a strong global player by providing software and ecommerce services to insurance, financial, e-governance and health care industries. Raina could not afford to let go any interesting buyout opportunity in India. He called up Kola—the managing director at Kalaari Capital was one of the backers of Via—at 3.30 am US time. “I don’t think the deal is likely to happen," he said. “Even if it happens, it may take months," Raina continued, requesting for an update on the company financials.

The next day, Raina made an offer. “If you like it, I will close the deal in 30 days," he underlined. On the last day of the deadline in October, Ebix announced that it had bought Via for $75 million. “Almost all my acquisitions have happened like this," he says, alluding to the speed at which he closed the deal. It’s not only the speed, though, which is unique. “I set a price. I don’t negotiate. It’s take it or leave it," he says.

In over four-and-a-half years since May 2017, Raina has acquired a staggering 27 companies in India, and has furiously expanded his B2B and B2C fintech empire. “I buy to dominate," he says. “Overall, I have acquired 13 companies in distress and have turned then around," he claims, dishing out an example of Trimax which Raina bought in May 2020.

![]() The Mumbai-based infrastructure solutions company provided IT and integration services to state-owned transport corporations, and operated data centres. The company reportedly owed over Rs 1,918 crore to its lenders, including about Rs 1,700 crore to financial creditors. “It was in heavy distress and landed up in the National Company Law Tribunal (NCLT)," says Raina, who acquired it reportedly for Rs 75 crore. Over one-and-a-half years later, in December 2021, Trimax’s new owner claims that the company is firing on all cylinders. “I’m doing a revenue run rate of close to $20 million, and the Ebitda (earnings before interest, taxes, depreciation and amortisation) margin is 31 percent," he says, bragging about one more achievement. All acquired companies, he lets on, end up having an Ebitda of 40 percent.

The Mumbai-based infrastructure solutions company provided IT and integration services to state-owned transport corporations, and operated data centres. The company reportedly owed over Rs 1,918 crore to its lenders, including about Rs 1,700 crore to financial creditors. “It was in heavy distress and landed up in the National Company Law Tribunal (NCLT)," says Raina, who acquired it reportedly for Rs 75 crore. Over one-and-a-half years later, in December 2021, Trimax’s new owner claims that the company is firing on all cylinders. “I’m doing a revenue run rate of close to $20 million, and the Ebitda (earnings before interest, taxes, depreciation and amortisation) margin is 31 percent," he says, bragging about one more achievement. All acquired companies, he lets on, end up having an Ebitda of 40 percent.

Well, the detractors scoff at the ‘turnaround magic’. “Some people might say that I have sucked out cost and made it profitable," says Raina, trying to answer one of the allegations. “They criticise me," he says. The founder, though, is not pained. He explains his ruthless strategy of downsizing and taking brutal financial steps to make the companies stand on their feet. “I call it a band-aid strategy," he says. When you remove the band-aid in one go, he explains, it might be painful. “But that’s the

best approach," he says. Sucking out costs, he lets on, might put finances on track for the first year, but you can’t do it every year and grow. “Everybody would be a successful entrepreneur if one just sucks the cost out and reports profit," he smiles. The basics of fiscal discipline, growth-oriented mindset and razor-sharp focus on Ebitda, he underlines, have to be right.

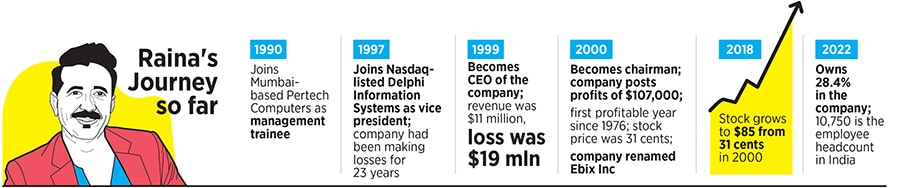

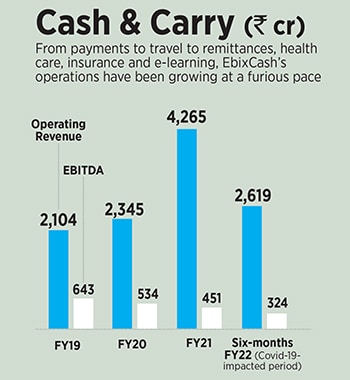

The man might seem to be fixated with Ebitda, but his track record in India substantiates his claims. Look at the financials of EbixCash. An operating revenue of Rs 2,104 crore in FY19 doubled to Rs 4,265 crore in FY21. Ebitda during the same period dipped, though, from Rs 643 crore to Rs 451 crore, respectively. And for the six-months-ended FY22, the corresponding numbers are Rs 2,619 crore and Rs 324 crore. And his global report card is nothing less than astonishing. In 1997, he joined Delphi. Till then, the US company had been making losses for 23 years. Three years later, 2000, happened to be the first profitable year of the company, but the stock was languishing at 31 cents. Eighteen years later, in 2018, the stock jumped to an all-time high of $85 (on January 24, 2022, it was trading at $29.74 at 11 am IST). “I have 21 successful years, 84 quarters of sequential results behind me," says Raina. “I’m not going to hype my future."

![]()

But if the India story is fundamentally strong, and the overall revenues of the Nasdaq-listed parent company too have been steadily growing during 2021—revenue for Q1 increased by 110 percent year-over-year to $290 million Q2 increased by 121 percent to $246.3 million and Q3 increased by 24 percent to $191.7 million—then what is the need to get EbixCash listed in India?

Raina explains India’s magnetic power. The country now, he underlines, has the power of having a bigger enterprise than what he has built in the US. “An Indian company listed in the US doesn’t ever work," he reckons. “Even if it does, it’s a rare example." Reason: People in the US don’t understand the India story. “India could be bigger than anything I have done," he says, adding that India will remain the centre of global business action over the next few years. “If the action is here, then why get it listed in the US?" he asks. Ebix has over 11,000 employees in India. “I want to build an MNC brand out of India," he avers.

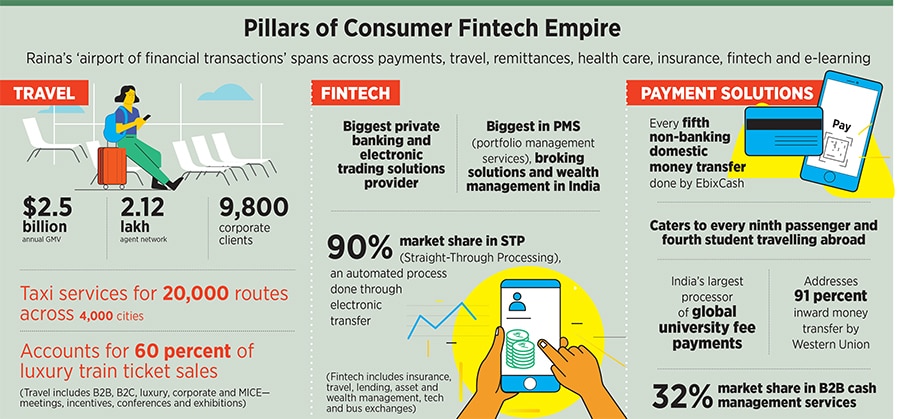

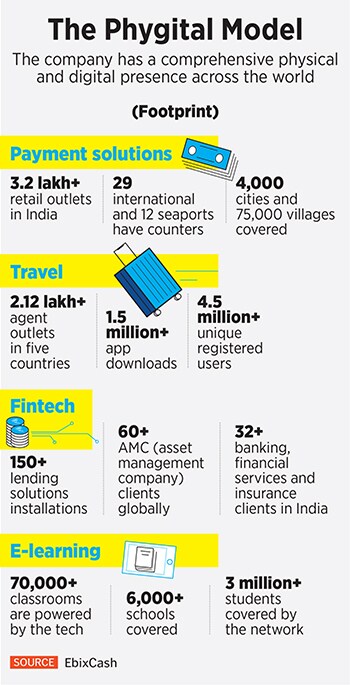

The strategy to do so is simple: Overwhelming domination. “Barring B2C travel, we are only the leader in almost every business [In most verticals that the company operates in, it claims to have the biggest market share, except in travel]," he claims, giving a peek into how he has been operating in the country. Payment solutions, one of the four pillars of EbixCash, has three components: International remittances, which is money coming into India then there is foreign exchange and the card business. “In foreign exchange, we are the undisputed leader," he claims.

The thumping domination was acquired. Raina snapped up the number one, number three and number four companies in the pecking order—Centrum, Weizmann and Essel Forex. Pre-Covid, the company was handling around $7 billion in transactions in India. “We are there in almost every airport in India," he says. “In fact, we are exclusive in 21 airports out of 31." In remittance, the company does around six-and-a-half billion dollar transactions and has over 320,000 agents in India, he claims. In bus exchange technology, 14 state roadways do business with the company. Over 38,000 buses in Maharashtra use the tech provided by Raina. “Every ticket that is sold, we make a few pennies on it," he says.

![]() Ebix’s meteoric rise in India is staggering. But so is the stratospheric story of the man behind it. Raina started his career in 1990 when he joined Mumbai-based Pertech Computers (PCL) as management trainee. In the first year, he emerged as the second best sales person in the organisation by clocking a hardware sales of Rs 31 crore. People started taking note. “I was one of those very cocky guys who felt that I could succeed at anything," he recalls.

Ebix’s meteoric rise in India is staggering. But so is the stratospheric story of the man behind it. Raina started his career in 1990 when he joined Mumbai-based Pertech Computers (PCL) as management trainee. In the first year, he emerged as the second best sales person in the organisation by clocking a hardware sales of Rs 31 crore. People started taking note. “I was one of those very cocky guys who felt that I could succeed at anything," he recalls.

A year later, Raina moved to Delhi. The reason looked ‘ridiculous’ to his colleagues. The best salesman was from Delhi and Raina wanted to work under the man who trained the winner. Over two years, he not only topped the chart but got six promotions. Seven years later, in October 1997, when he joined Delphi as vice president, Raina kept galloping. In four months, he got promoted to senior vice president (sales and marketing). In December 1998, he became executive vice president and chief operating officer. Next year, in August, he was appointed president, and a month later, promoted as chief executive officer. “In Atlanta, my employees call me Sultan," he smiles, alluding to his flashy lifestyle.

Back in India, Raina has stayed true to his billing. His home—call it a grand palace—in Greater Noida in Uttar Pradesh—looks like a wonderland. Sprawling lawns, a battery of security guards, and a bunch of swanky luxurious cars and bikes catch your eyes. Enter inside and you will get dazzled by the majestic grandeur—big portraits hung on the imposing walls, a golden chair where Raina sits like a Maharaj, and pin-drop silence. “My employees say I have a style quotient attached to everything I do," he beams, offering kahwah, a traditional tea popular in Kashmir.

A few kilometres from his residence, EbixCash’s office too mirrors the opulence. Built in the form of a palace, a car is safely perched on the roof once one enters the office. Glass stairs, a movie theatre, expansive gym, and a confluence of blue and white lights make the ambience look ultra-rich. Offering another cup of steaming masala tea, Raina gets back to business. “I inherited a company which had no cash and had huge losses," he says. “Before I stepped into India, we were essentially debt free," he says, adding that all his life he never used a banker to raise money.

![]()

Over the last few decades, Raina has religiously followed three thumb rules of doing business. First is fiscal discipline then comes posting consistent profits, and the last is growing aggressively. “Your selling price has to be more than the cost price," he says. For an entrepreneur who keeps talking about cash flow, bottom line and Ebitda, how does it feel to be in India at a time when most of the startups have been burning cash, when raising money looks like a drop-hat act, losses are the name of the game, and now even loss-making companies are getting listed? Raina stays mum for a minute. “I don’t believe cows can fly," he laughs.

In India, cows have been flying. Raina explains. When private companies—many of them without a business model or nil chances of posting profit—get big backers, they come with loads of dollars and start chanting that ‘cows can fly’. That’s how the story starts. Then a consumer walks in and he too believes that cows can’t fly. Once the company gets listed, the shareholders now want to see cows fly. “When are they flying?" they ask. Talking about the subprime crisis in the US, Raina reckons that a lot of Americans bought the story that cows can fly. When they got to know that it doesn’t happen, the industry collapsed. Back in India, he maintains, the country is in the midst of some sort of bubble. “I still believe cows don’t fly, and can’t fly," he says.

For Raina, though, the challenge in India is not to worry about cows flying, but the flip side of his business model. “He seems to be all over the place," reckons Navin Honagudi, partner at Kae Capital. Thought the maverick founder has been posting revenue and sustainable growth, the long-term challenge could be the absence of a strong playbook. “Look at Flipkart or Amazon. They have a playbook. You can tell what are they doing," he says. Having a stake in too many business operations brings with it the complexity and the challenge of staying focussed.

Raina, for his part, stays optimistic. “I have built a sustainable company which offers value," he says, adding that he has never chased valuation. There is a strong convergence in all the businesses, verticals and acquired assets, he adds. Ask him if cash is the king, then can he be the Sultan? He smiles. “I just want to be Sultan of my mind," he signs off.

Robin Raina, Chairman & CEO of Ebix Inc. and founder of the Robin Raina Foundation at his office in Greater Noida, UP, India. Image: Amit Verma

Robin Raina, Chairman & CEO of Ebix Inc. and founder of the Robin Raina Foundation at his office in Greater Noida, UP, India. Image: Amit Verma

The Mumbai-based infrastructure solutions company provided IT and integration services to state-owned transport corporations, and operated data centres. The company reportedly owed over Rs 1,918 crore to its lenders, including about Rs 1,700 crore to financial creditors. “It was in heavy distress and landed up in the

The Mumbai-based infrastructure solutions company provided IT and integration services to state-owned transport corporations, and operated data centres. The company reportedly owed over Rs 1,918 crore to its lenders, including about Rs 1,700 crore to financial creditors. “It was in heavy distress and landed up in the

Ebix’s meteoric rise in India is staggering. But so is the stratospheric story of the man behind it. Raina started his career in 1990 when he joined Mumbai-based Pertech Computers (PCL) as management trainee. In the first year, he emerged as the second best sales person in the organisation by clocking a hardware sales of Rs 31 crore. People started taking note. “I was one of those very cocky guys who felt that I could succeed at anything," he recalls.

Ebix’s meteoric rise in India is staggering. But so is the stratospheric story of the man behind it. Raina started his career in 1990 when he joined Mumbai-based Pertech Computers (PCL) as management trainee. In the first year, he emerged as the second best sales person in the organisation by clocking a hardware sales of Rs 31 crore. People started taking note. “I was one of those very cocky guys who felt that I could succeed at anything," he recalls.